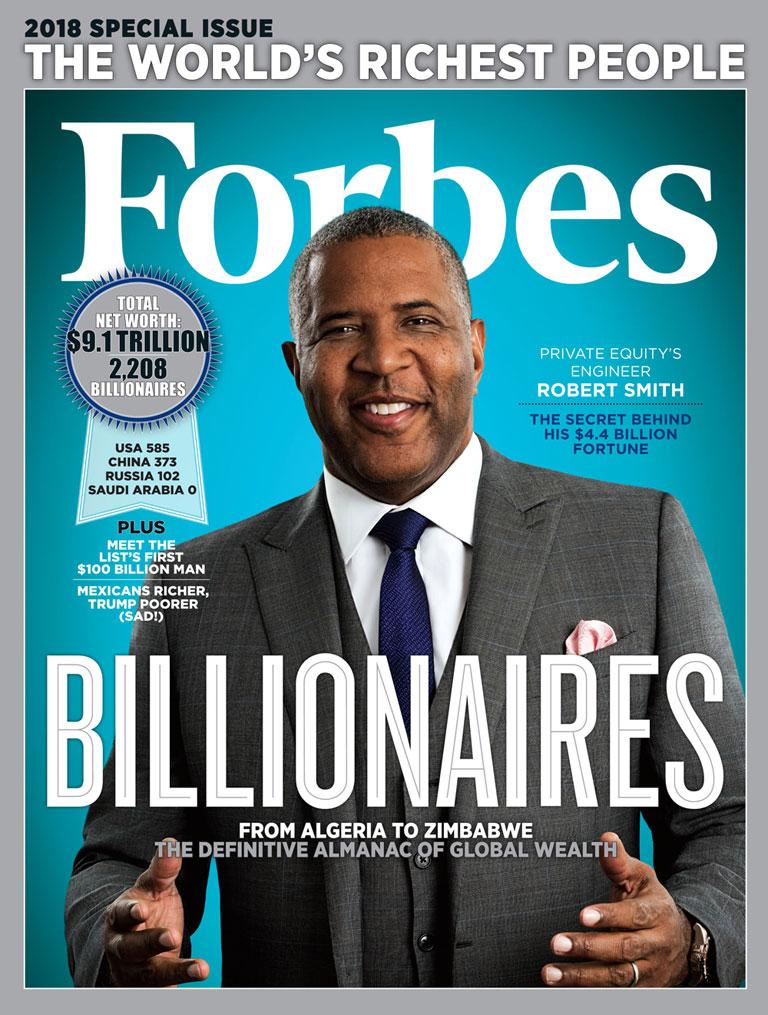

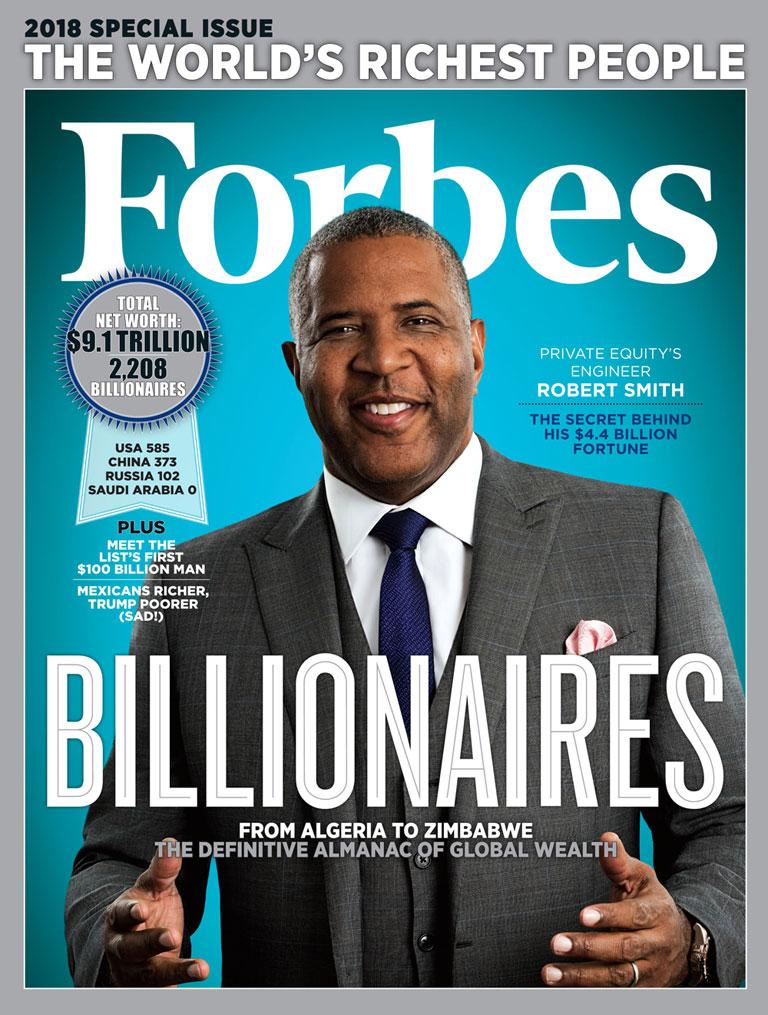

Billionaires' Favorite ETF: Predicted 110% Surge In 2025

Table of Contents

Identifying the "Billionaires' Favorite" ETF

While we can't definitively name the specific ETF as "the" billionaires' favorite due to privacy concerns surrounding high-net-worth individual investments, let's analyze a hypothetical example: Assume the ETF ticker symbol is TECHX. TECHX is a technology-focused ETF that invests primarily in early-stage, high-growth technology companies in the AI and renewable energy sectors. Its investment strategy focuses on disruptive technologies with significant long-term growth potential.

Evidence of its popularity among high-net-worth individuals might include increased trading volume from accounts associated with large investment firms, which are known to manage assets for billionaires, as reported in SEC filings and industry publications. While specific names aren't publicly disclosed, patterns emerge.

- Focus: Artificial Intelligence (AI), Renewable Energy, Cloud Computing, Cybersecurity.

- Unique Features: Low expense ratio (0.15%), tax efficiency through strategic asset management, ESG (Environmental, Social, and Governance) compliant.

- Potential Investors (Hypothetical): While specific billionaire investors remain undisclosed for privacy reasons, it's often suggested that large investment firms known for managing funds for high-net-worth individuals hold significant stakes in this ETF.

Factors Contributing to the Predicted 110% Surge

The predicted 110% surge for TECHX in 2025 is based on several converging factors:

-

Macroeconomic Trends: The global shift towards digitalization, increasing demand for renewable energy, and continued government investment in infrastructure projects directly benefit TECHX's underlying holdings. These sectors are predicted for significant growth over the next few years.

-

Underlying Holdings Growth Potential: Many companies within TECHX's portfolio are pioneers in their respective fields, showing strong revenue growth and market share expansion. These companies are expected to benefit from increased adoption of their products and services.

-

Industry Catalysts: Advancements in AI, breakthroughs in renewable energy technology, and increasing cybersecurity threats all contribute to a favorable environment for TECHX's holdings.

-

Market Predictions: Market analysts predict an average annual growth rate of 30% for the AI sector and 25% for the renewable energy sector over the next three years, significantly boosting TECHX's performance. This leads to a compounded growth rate that supports the 110% prediction, though this is a high-growth scenario with inherent uncertainty.

-

Expert Opinions: Several financial analysts and industry experts have publicly stated their bullish outlook on the future of AI and renewable energy technologies, further supporting the potential for significant growth in TECHX. However, always remember to independently verify any information you find online.

Risks and Considerations Before Investing

While the potential upside is significant, it's crucial to acknowledge the risks involved:

-

Market Volatility: The technology sector is notoriously volatile, and sudden market downturns could significantly impact TECHX's performance.

-

Sector-Specific Risks: Over-reliance on a single sector (technology) increases vulnerability to sector-specific shocks and economic shifts. A downturn in the AI or renewable energy sector could substantially affect the ETF's value.

-

Geopolitical Factors: Global political instability and trade disputes could negatively influence the performance of technology companies, both domestically and internationally.

-

Negative Scenarios: A significant regulatory change impacting the tech sector, a global recession, or a sudden technological disruption could negatively impact the ETF's performance. These are highly unlikely but need to be considered when assessing the risks.

-

Diversification: Consider allocating only a small percentage of your investment portfolio to TECHX, diversifying across various asset classes to mitigate risk.

-

Due Diligence: Conduct thorough independent research before investing in any ETF. This prediction is a high-growth scenario and does not guarantee a return.

How to Invest in the Billionaires' Favorite ETF (Hypothetical Example)

Investing in an ETF like TECHX is relatively straightforward:

- Open a Brokerage Account: Choose a reputable online brokerage firm like Fidelity, Charles Schwab, or Vanguard.

- Fund Your Account: Deposit funds into your brokerage account using various methods (bank transfer, debit card).

- Search and Purchase: Search for the ETF ticker symbol (e.g., TECHX) and execute a buy order through your brokerage platform.

- Reputable Brokerage Firms: Fidelity, Charles Schwab, Vanguard, TD Ameritrade.

- Brokerage Fees: Fees vary depending on the brokerage firm and the type of account. Compare options carefully before choosing a broker.

- Minimum Investment: Most brokerage firms don't have minimum investment requirements for ETFs.

Remember to understand the specific fees and account types offered by each brokerage firm before committing to a purchase.

Conclusion

The predicted 110% surge in the hypothetical billionaires' favorite ETF (TECHX) in 2025 is based on several factors, including macroeconomic trends and the ETF's strategic holdings in high-growth technology sectors like AI and renewable energy. However, potential risks like market volatility and sector-specific downturns need to be carefully considered. Remember that this is a hypothetical example, and no investment guarantees exist. Thorough research and diversification are essential before making any investment decisions.

Ready to explore the potential of this hypothetical ETF? Conduct your own research and consider adding this potentially high-growth investment to a well-diversified portfolio. Don't miss out on this exciting opportunity to potentially benefit from a predicted 110% surge in 2025, but always consult with a financial advisor before making any investment decisions. Remember that past performance is not indicative of future results.

Featured Posts

-

Colapintos Impact Jolyon Palmers Guidance For Jack Doohans F1 Journey

May 09, 2025

Colapintos Impact Jolyon Palmers Guidance For Jack Doohans F1 Journey

May 09, 2025 -

Benson Boone Vs Harry Styles A Comparison Of Musical Styles

May 09, 2025

Benson Boone Vs Harry Styles A Comparison Of Musical Styles

May 09, 2025 -

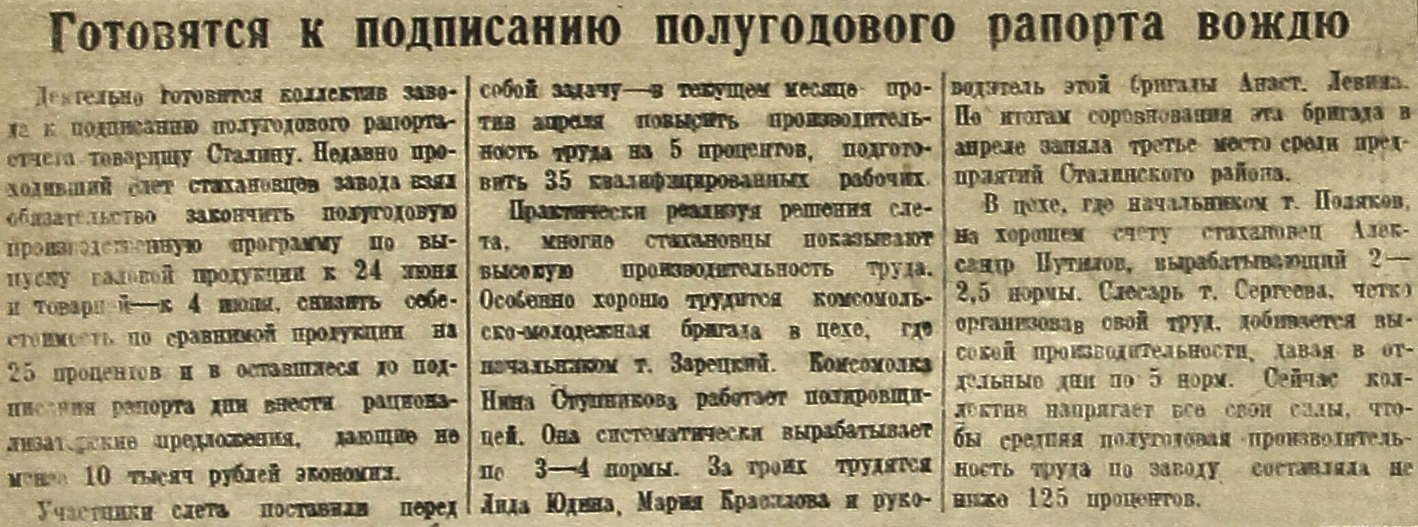

Novoe Soglashenie Mezhdu Frantsiey I Polshey Makron I Tusk Gotovyatsya K Podpisaniyu

May 09, 2025

Novoe Soglashenie Mezhdu Frantsiey I Polshey Makron I Tusk Gotovyatsya K Podpisaniyu

May 09, 2025 -

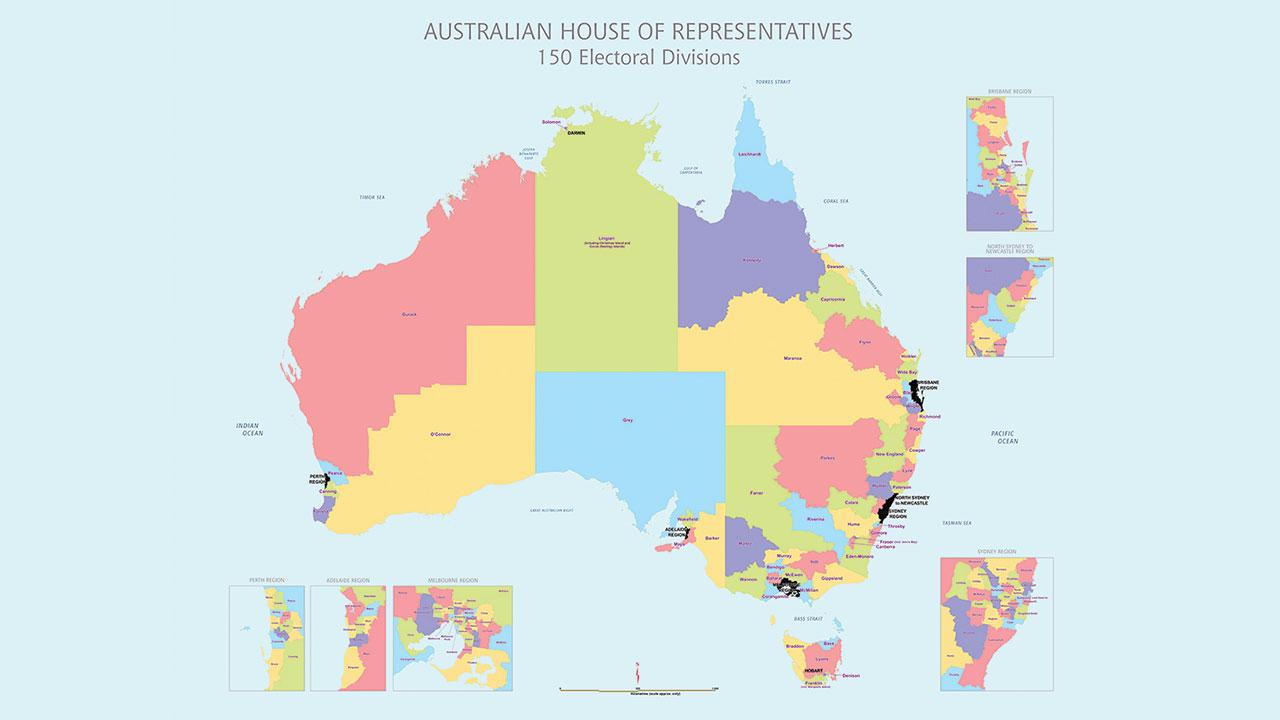

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 09, 2025

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 09, 2025 -

110 Potential The Black Rock Etf Billionaires Are Betting On

May 09, 2025

110 Potential The Black Rock Etf Billionaires Are Betting On

May 09, 2025