Bitcoin At A Critical Juncture: Key Price Levels To Watch

Table of Contents

The $26,000 Support Level: A Crucial Bastion

The $26,000 level represents a major support level for Bitcoin. This price point has acted as a significant floor on several occasions in the past, and a break below it could signal a more significant downturn. Its importance stems from both technical analysis and the psychological impact it holds for investors.

-

Breakdown of past price performance around $26,000: Historically, when Bitcoin's price has dropped to around $26,000, buying pressure has often emerged, preventing further substantial declines. This suggests a significant accumulation of Bitcoin by long-term holders at this price point.

-

Analysis of on-chain metrics suggesting support or resistance at this level: On-chain data, such as the distribution of Bitcoin across different wallets, can provide insights into the strength of this support level. High accumulation by large holders at this price point would strengthen the case for it acting as robust support. Conversely, a lack of accumulation could suggest a weaker support level.

-

Potential consequences of a break below $26,000: A decisive break below $26,000 could trigger a cascade of sell-offs, potentially leading to further downward pressure. This could push the Bitcoin price lower, potentially towards the next significant support level. This scenario emphasizes the importance of monitoring this key Bitcoin support level.

The $30,000 Resistance Level: A Test of Strength

Conversely, $30,000 acts as a key resistance level for Bitcoin. This round number often presents a psychological barrier for investors, making it challenging for Bitcoin to break through. Overcoming this resistance would be a strong bullish signal.

-

Past instances of Bitcoin struggling to overcome the $30,000 barrier: Bitcoin has repeatedly attempted to surpass $30,000 in the past, often encountering selling pressure that pushes the price back down. This indicates the significance of this level as a resistance point.

-

Market sentiment and its impact on price movement around this level: Positive market sentiment, driven by factors such as positive regulatory developments or increased institutional adoption, could help Bitcoin break through the $30,000 resistance. Conversely, negative sentiment could reinforce this level as a strong resistance.

-

Potential catalysts that could help Bitcoin surpass $30,000: Positive regulatory news, increased institutional Bitcoin investment, and widespread adoption of Bitcoin as a payment method are potential catalysts that could help Bitcoin overcome this resistance.

The Psychological Importance of Round Numbers in Bitcoin Pricing

The influence of psychology on Bitcoin price fluctuations cannot be overstated. Round numbers like $25,000, $30,000, and $40,000 act as significant psychological barriers. These levels often trigger either buying or selling pressure, impacting price movement.

-

The impact of investor psychology and herd behavior on price movements: Fear and greed often drive investor decisions, leading to herd behavior around these key psychological levels. When the price approaches a round number, investors may react based on their perceived risk, leading to either buying or selling pressure.

-

Examples of past price reactions to these psychological barriers: Historically, Bitcoin's price has often stalled or reversed direction at these round numbers, highlighting their significance as support or resistance levels. These past reactions offer valuable insights for predicting future price movements.

-

How these psychological levels can create both support and resistance: A round number can act as support when investors believe the price is undervalued and buy at that level, driving the price higher. Conversely, it can act as resistance if investors believe the price is overvalued and sell at that level, preventing further price increases.

Moving Averages and Technical Indicators: A Deeper Dive

Technical analysis tools such as moving averages (e.g., 50-day, 200-day) and indicators like RSI and MACD can provide further insights into potential price direction. However, it's crucial to remember that technical analysis is not a foolproof method.

-

Explanation of a few key indicators and their application to Bitcoin price analysis: Moving averages smooth out price fluctuations, helping identify trends. Indicators like RSI and MACD provide signals regarding momentum and potential overbought or oversold conditions.

-

Cautionary note about the limitations of technical analysis: Technical indicators should be used in conjunction with fundamental analysis and an understanding of market sentiment. They are not predictive tools and should be interpreted cautiously.

Conclusion

Bitcoin currently sits at a crucial juncture, with the $26,000 support and $30,000 resistance levels acting as significant indicators of its short-term direction. Monitoring these key Bitcoin price levels, coupled with an understanding of psychological factors and technical indicators, is vital for navigating this volatile market. By closely observing these factors, investors can make more informed decisions about their Bitcoin holdings. Remember to always conduct thorough research and consider your risk tolerance before investing in any cryptocurrency, including Bitcoin. Stay informed about these critical Bitcoin price levels to optimize your investment strategy.

Featured Posts

-

Trumps Warning On Greenland Justified Fear Or Political Maneuver

May 08, 2025

Trumps Warning On Greenland Justified Fear Or Political Maneuver

May 08, 2025 -

Expanded Uber Pet Service Delhi And Mumbai Launches

May 08, 2025

Expanded Uber Pet Service Delhi And Mumbai Launches

May 08, 2025 -

Exclusive Ex Goldman Partner Targeted In Malaysias 1 Mdb Extradition Push

May 08, 2025

Exclusive Ex Goldman Partner Targeted In Malaysias 1 Mdb Extradition Push

May 08, 2025 -

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025

Thunder Vs Trail Blazers Game Time Tv Schedule And Streaming Options March 7th

May 08, 2025 -

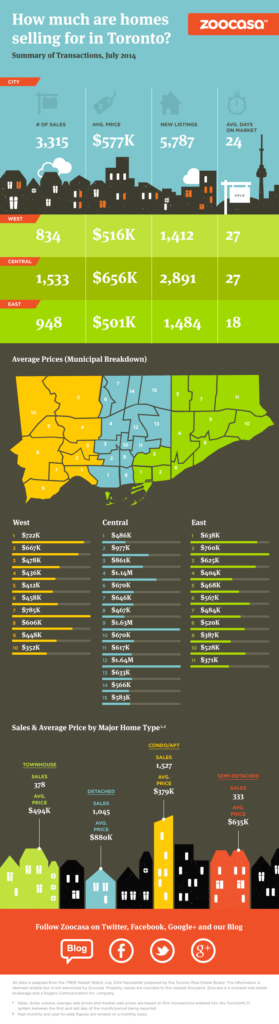

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025

Significant Drop In Toronto Home Sales And Prices 23 And 4 Respectively

May 08, 2025