Bitcoin Bullish: How Trade Negotiations Impact Crypto Market

Table of Contents

Trade Wars and Global Uncertainty: Bitcoin as a Safe Haven?

Periods of global economic uncertainty, frequently triggered by trade tensions, often lead investors to seek alternative assets perceived as safer havens. This "risk-off" behavior significantly impacts the cryptocurrency market, driving demand for Bitcoin and other cryptocurrencies. The keywords here are Bitcoin safe haven, volatility, market uncertainty, and risk-off asset.

-

Increased volatility in traditional markets (stocks, bonds): When traditional markets experience heightened volatility due to trade wars or other geopolitical events, investors often look to diversify their portfolios. Bitcoin, with its decentralized nature, can become an attractive option.

-

Bitcoin's decentralized nature: Unlike fiat currencies, which are subject to government control and inflation, Bitcoin operates on a decentralized blockchain, making it less vulnerable to the risks associated with geopolitical instability and trade disputes.

-

Risk-off asset: Bitcoin increasingly functions as a risk-off asset. During times of uncertainty, investors move away from riskier assets and towards those perceived as safer stores of value. Bitcoin's limited supply and increasing adoption contribute to this perception.

-

Historical examples: Examining past instances of major trade events and their correlation with Bitcoin price movements reveals a clear trend. For example, periods of heightened trade tensions between major economic powers have often been followed by increased Bitcoin prices as investors sought a safe haven.

Positive Trade Outcomes and Their Impact on Bitcoin

Conversely, successful trade agreements and improved global economic outlooks can have a significantly positive impact on Bitcoin's price. Positive trade news frequently correlates with increased market confidence and investor sentiment.

-

Increased investor confidence: Successful trade negotiations often lead to increased investor confidence, resulting in a greater appetite for riskier assets, including cryptocurrencies like Bitcoin.

-

Economic growth: Trade deals that stimulate economic growth typically translate into a larger overall market capitalization for cryptocurrencies, driving up Bitcoin's price.

-

Reduced market volatility: Improved international relations, resulting from constructive trade agreements, contribute to a less volatile market environment, creating a more favorable climate for Bitcoin investments.

-

Examples: Analyzing historical data reveals that positive trade agreements have often been followed by periods of Bitcoin price increases. The successful conclusion of significant trade negotiations can inject significant optimism into the global economy, positively impacting investor sentiment toward crypto assets.

The Role of Government Regulation in Shaping Bitcoin's Trajectory

Government regulation plays a pivotal role in shaping Bitcoin's trajectory. Clarity in regulatory frameworks is crucial for fostering market confidence and encouraging institutional investment. The keywords here are crypto regulation, government policy, Bitcoin adoption, and legal frameworks.

-

Clearer regulations: Well-defined regulatory frameworks reduce uncertainty for investors and businesses, making it easier for institutional investors to enter the crypto market. This influx of capital can significantly boost Bitcoin's price.

-

Regulatory uncertainty: Conversely, unclear or hostile regulatory environments can suppress Bitcoin's price and hinder its adoption. Uncertainty discourages investment and creates a climate of fear and hesitation.

-

Global regulatory differences: Different regulatory landscapes across the globe can significantly impact Bitcoin's price and trading activity. Regions with favorable regulatory environments often become hotspots for Bitcoin trading and adoption.

Analyzing Market Sentiment and Predicting Bitcoin’s Response

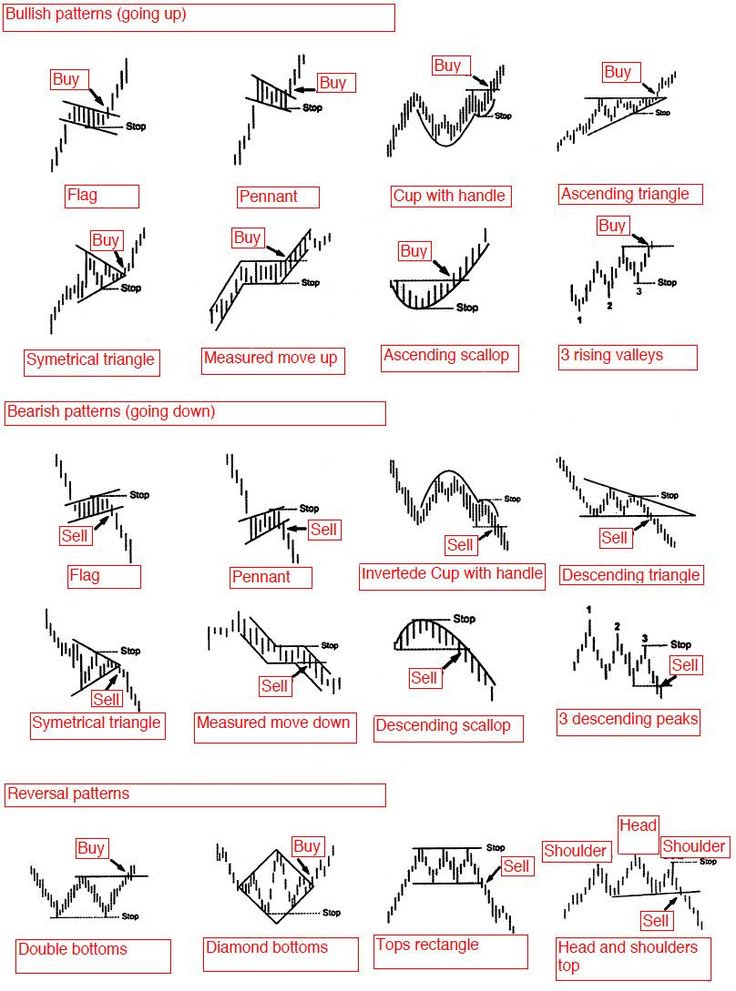

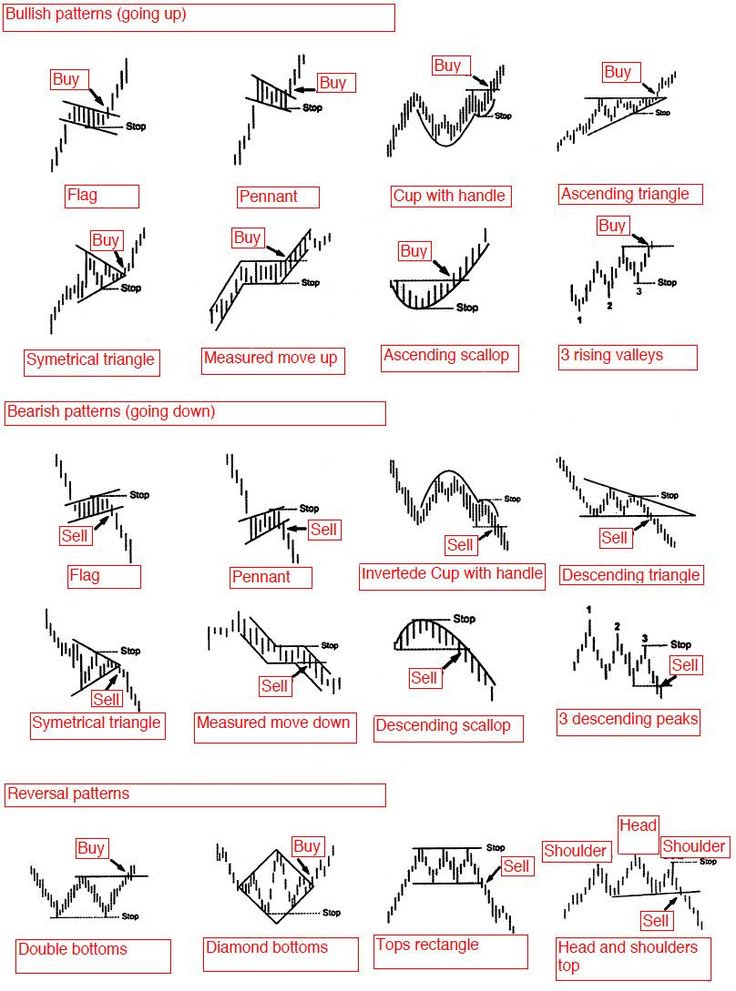

Predicting Bitcoin's response to trade negotiations requires a multi-faceted approach, combining market sentiment analysis with technical and fundamental analysis. Keywords include Bitcoin sentiment analysis, market prediction, technical analysis, fundamental analysis, and crypto trading strategies.

-

Social media sentiment: Monitoring social media sentiment and news headlines can provide valuable insights into shifting investor confidence. A surge in positive sentiment often precedes price increases.

-

Technical indicators: Employing technical indicators like moving averages and RSI (Relative Strength Index) can help identify potential price trends and predict short-term fluctuations in response to trade news.

-

Fundamental analysis: Fundamental analysis, considering factors beyond short-term price fluctuations, provides a longer-term perspective. This includes assessing the overall health of the global economy and the impact of trade agreements on Bitcoin's underlying value proposition.

Conclusion

Trade negotiations significantly impact Bitcoin's price and the broader cryptocurrency market. Understanding the interplay between global trade dynamics and Bitcoin's performance is crucial for navigating this complex landscape. By monitoring market sentiment, employing technical and fundamental analysis, and staying informed about global trade developments, investors can make more informed decisions.

Stay ahead of the curve in the ever-evolving world of Bitcoin and trade negotiations. Learn to navigate the Bitcoin market effectively by understanding its correlation to global trade dynamics. Subscribe to our newsletter for updates on Bitcoin and the global economy to stay informed and make savvy investment choices.

Featured Posts

-

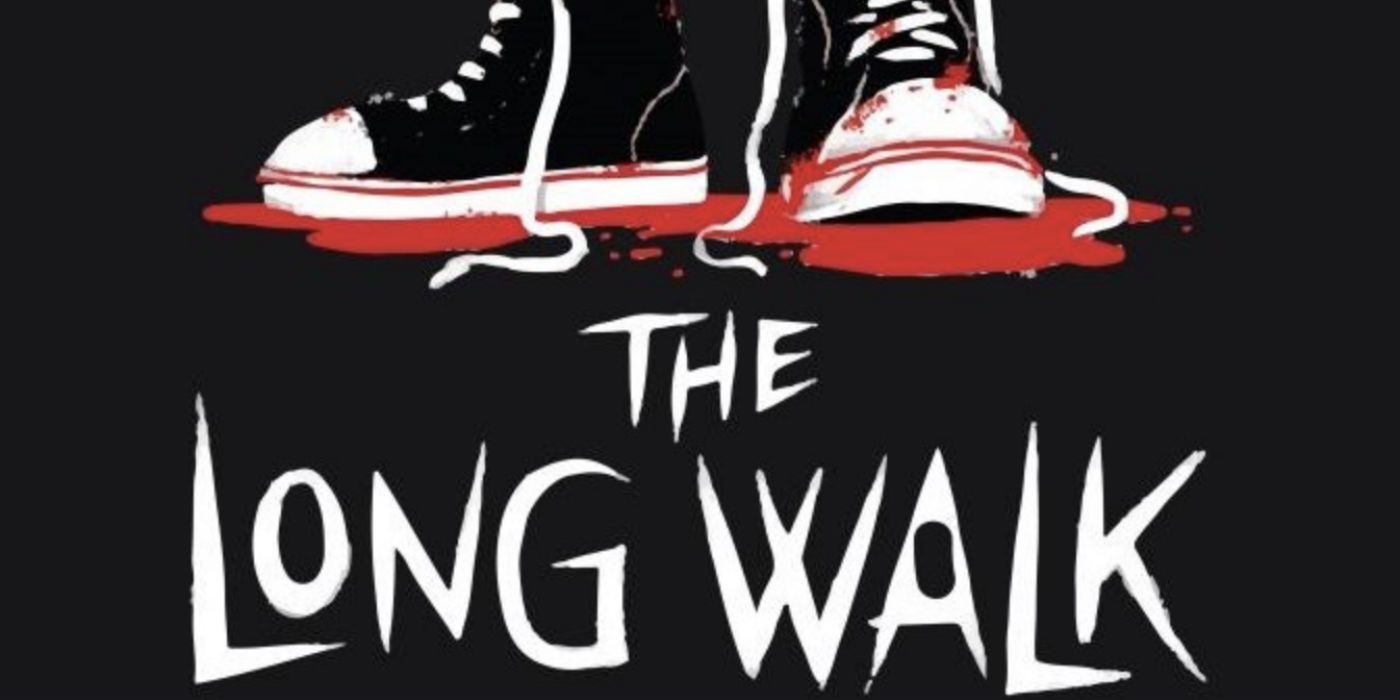

Stephen Kings The Long Walk Gets A Chilling New Trailer

May 08, 2025

Stephen Kings The Long Walk Gets A Chilling New Trailer

May 08, 2025 -

Lahwr Ky Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Ahm Qdm

May 08, 2025

Lahwr Ky Ahtsab Edaltyn Khtm Wfaqy Hkwmt Ka Ahm Qdm

May 08, 2025 -

Beyond Saving Private Ryan Top Realistic Wwii Films

May 08, 2025

Beyond Saving Private Ryan Top Realistic Wwii Films

May 08, 2025 -

Andor Cast A Behind The Scenes Look At The Rogue One Prequels Final Season

May 08, 2025

Andor Cast A Behind The Scenes Look At The Rogue One Prequels Final Season

May 08, 2025 -

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025