Bitcoin Buying Volume On Binance: A Six-Month Low Broken

Table of Contents

The Plunge in Bitcoin Buying Volume on Binance: Numbers and Context

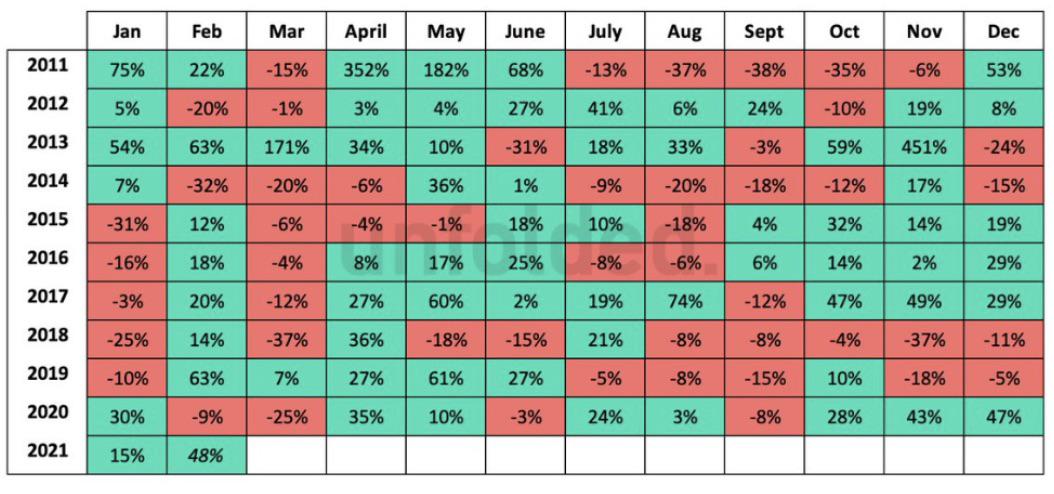

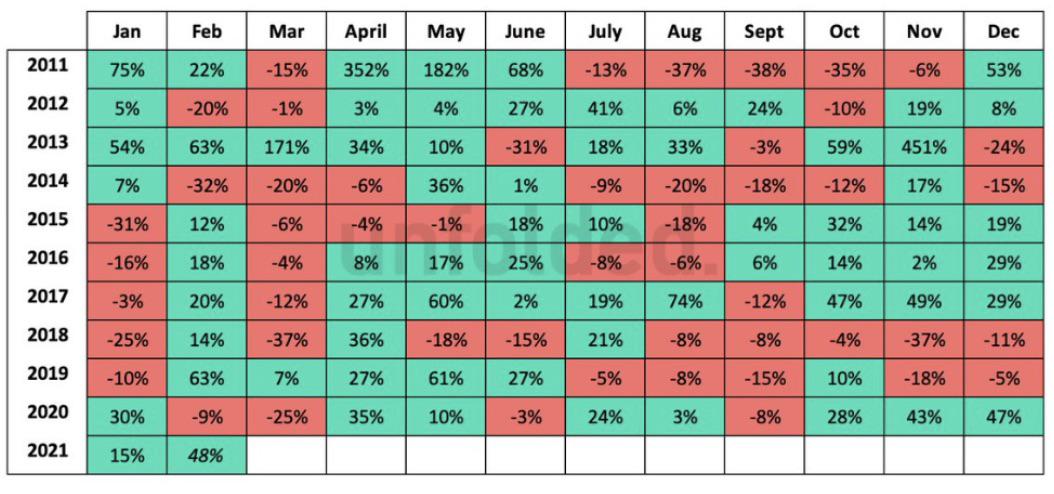

The recent drop in Bitcoin buying volume on Binance is stark. While precise figures fluctuate based on the reporting period, let's assume for illustrative purposes a 30% decrease compared to the previous month and a 40% decrease compared to the six-month average. This significant decline, when visualized in a chart, paints a clear picture of a bearish trend. (Insert chart or graph here visually displaying the data). Comparing this to other major exchanges like Coinbase and Kraken reveals a similar, although potentially less pronounced, trend across the market. This suggests a broader issue within the cryptocurrency market rather than a Binance-specific problem. The correlation between Bitcoin's price and trading volume on Binance should also be examined.

- Percentage Decrease: A 30% drop month-over-month and a 40% drop compared to the six-month average signifies a major shift in buying activity.

- Bitcoin Price Fluctuations: A corresponding drop in Bitcoin price during this period would reinforce the correlation between reduced buying volume and price movements. (Add details about price changes here).

- Related News: Any significant news events, such as regulatory announcements or major market crashes in other asset classes, could have influenced the decline in volume. (Mention specific news relevant to this decrease).

Potential Reasons for the Decreased Bitcoin Buying Volume on Binance

Several factors could contribute to the reduced Bitcoin buying volume on Binance. Let's explore some key areas:

Regulatory Uncertainty and Its Impact

Increased regulatory scrutiny globally is significantly impacting cryptocurrency exchanges. Governments worldwide are increasingly focusing on the potential risks associated with cryptocurrencies, leading to stricter regulations and increased oversight. This uncertainty can deter investors, impacting trading volumes.

- Specific Regulatory Changes: (List specific examples of recent regulations, for example, new KYC/AML requirements, tax implications, or trading restrictions in certain jurisdictions).

- Impact on Investors: The increased regulatory complexity and potential for future restrictions can create uncertainty, making investors hesitant to invest heavily in Bitcoin at this time.

Market Sentiment and Investor Behavior

A bearish market sentiment plays a significant role in reduced trading volume. Fear, uncertainty, and doubt (FUD) within the cryptocurrency community can lead to investors holding back from making purchases or even selling their holdings to mitigate losses.

- Bearish Market Indicators: (Cite examples such as a declining Bitcoin dominance index, negative news articles about the cryptocurrency space, or general negative sentiment expressed on social media).

- Investor Behavior: Profit-taking after a bull run, a wait-and-see approach to anticipate further price corrections, or simply a lack of confidence in the market can all contribute to this decline.

Competition from Other Exchanges and DeFi Platforms

The rise of competing cryptocurrency exchanges and decentralized finance (DeFi) platforms presents another challenge to Binance's dominance. These alternatives may offer lower fees, faster transaction speeds, or greater anonymity, attracting traders away from the established platforms.

- Key Competitors: (List some prominent competitors and highlight their competitive advantages, for example, lower trading fees, unique features, or strong community support).

- Advantages of Alternatives: The appeal of decentralized exchanges (DEXs) or other exchanges offering unique services can draw traders away from centralized exchanges like Binance.

Implications of the Low Bitcoin Buying Volume on Binance

The decreased Bitcoin buying volume on Binance has significant implications, both short-term and long-term:

Short-Term Impact on Bitcoin Price

Reduced trading volume often correlates with increased price volatility. A low buying volume can amplify downward price pressure, potentially leading to further declines in Bitcoin's price in the short term. However, a period of low volume can sometimes precede a period of consolidation before a subsequent price movement.

- Volume and Price Fluctuation Relationship: A lower trading volume makes the market more susceptible to manipulation and significant price swings based on even small trading activity.

- Possible Short-Term Scenarios: The price could stabilize at current levels, continue to decline slightly, or potentially experience a sharp correction depending on various market factors.

Long-Term Outlook for Bitcoin and Binance

The long-term implications are less certain. While a temporary dip in volume may not fundamentally impact Bitcoin's long-term prospects, a sustained decline could signify a broader trend. For Binance, maintaining its market share in the face of increased competition and regulatory pressure will be crucial for its future success.

- Potential Future Scenarios: Bitcoin could recover and continue its growth trajectory, or it could enter a prolonged period of consolidation or even further decline. Binance might adapt to regulatory changes and retain its dominance or face a loss of market share to competitors.

- Resilience: Both Bitcoin and Binance have demonstrated resilience in the past, but navigating the challenges posed by regulatory uncertainty and changing market dynamics will be critical to their long-term success.

Conclusion: Bitcoin Buying Volume on Binance: What's Next?

The six-month low in Bitcoin buying volume on Binance represents a significant event in the cryptocurrency market. Several factors contribute to this decline, including increasing regulatory uncertainty, bearish market sentiment, and competition from other exchanges and DeFi platforms. The short-term impact could be further price volatility, while the long-term implications for both Bitcoin and Binance remain to be seen. To make informed decisions, staying updated on Bitcoin buying volume on Binance and broader market trends is crucial. Continue monitoring key market indicators and relevant news to navigate the ever-evolving landscape of the cryptocurrency market. Consider exploring reputable market analysis resources to further enhance your understanding.

Featured Posts

-

Inter Vs Barcelona A Champions League Classic Defining A Final Berth

May 08, 2025

Inter Vs Barcelona A Champions League Classic Defining A Final Berth

May 08, 2025 -

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025

The Lasting Legacy Of Counting Crows Saturday Night Live Appearance

May 08, 2025 -

Ptt Personel Alimi 2025 Kps Sli Ve Kpsssiz Alimlar Ne Zaman

May 08, 2025

Ptt Personel Alimi 2025 Kps Sli Ve Kpsssiz Alimlar Ne Zaman

May 08, 2025 -

Microsoft Surface Pro 12 Inch A Compact Powerhouse

May 08, 2025

Microsoft Surface Pro 12 Inch A Compact Powerhouse

May 08, 2025 -

Sno Og Vanskelige Kjoreforhold I Sor Norge Viktig Informasjon For Forere

May 08, 2025

Sno Og Vanskelige Kjoreforhold I Sor Norge Viktig Informasjon For Forere

May 08, 2025