Bitcoin Buying Volume Surges Past Selling On Binance After Six Months

Table of Contents

Analyzing the Surge in Bitcoin Buying Volume on Binance

The increase in Bitcoin buying volume on Binance is substantial. While precise figures require access to Binance's internal data, anecdotal evidence from various market analysts and tracking websites points to a significant disparity between buying and selling pressure. This shift appears to have begun around [Insert Date], with the gap widening considerably over the following [Number] days. The magnitude of this increase, compared to the previous six months of relatively balanced or even selling-dominant volume, is unprecedented.

Several factors likely contributed to this surge in Bitcoin buying volume:

- Increased Institutional Investment: Recent reports suggest a renewed interest from institutional investors in Bitcoin. Several large financial firms have publicly expressed a more bullish outlook on Bitcoin, potentially driving significant institutional buying on platforms like Binance. [Cite source if available].

- Retail Investor Confidence: Positive news regarding Bitcoin's regulatory landscape, along with positive price action, might have boosted retail investor confidence, leading to increased buying activity among smaller investors. [Cite relevant news articles or reports].

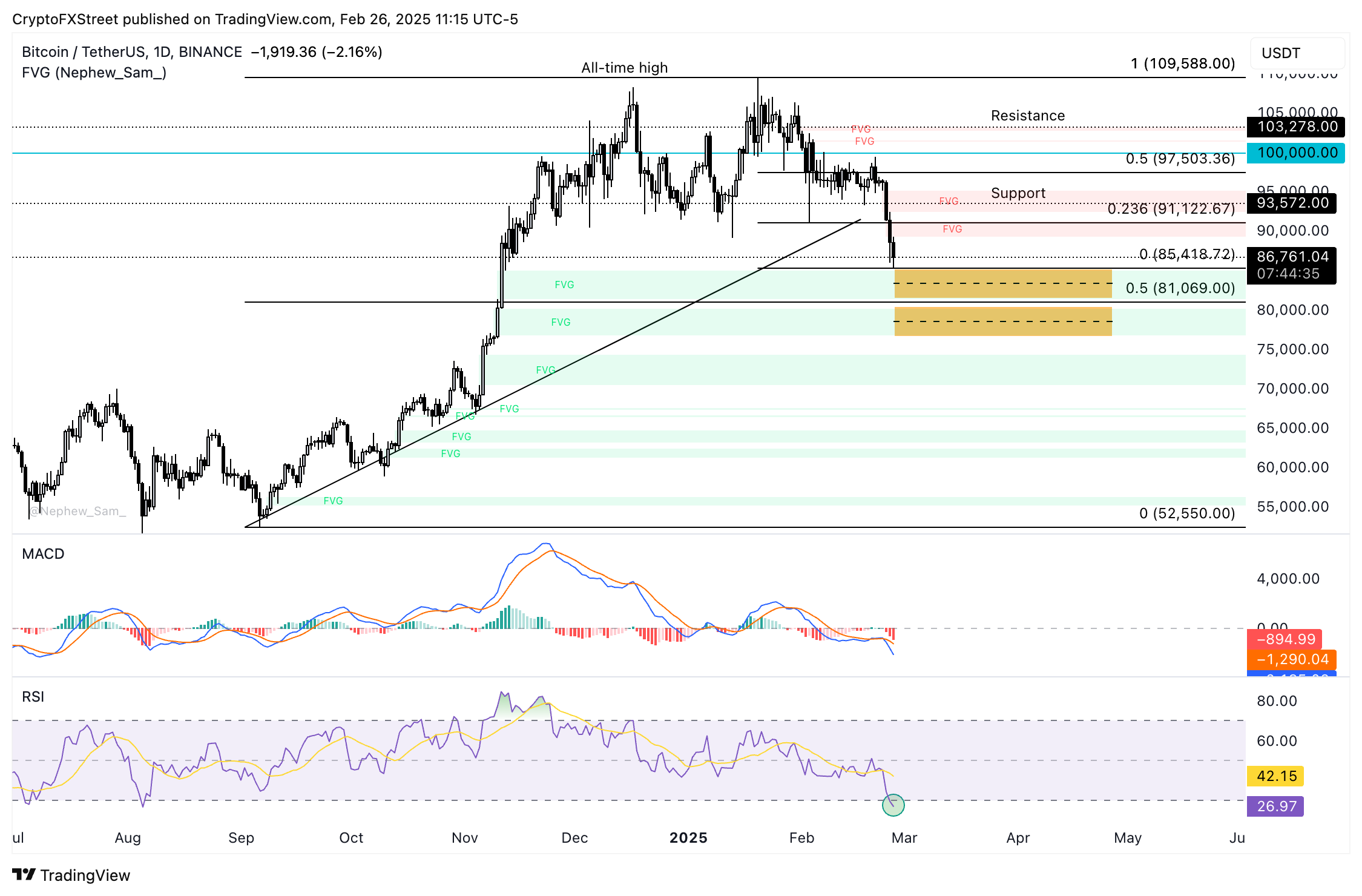

- Price Action and Technical Analysis: A breakout above a key resistance level ([mention specific price level]) could have triggered buy orders from traders employing technical analysis strategies. This positive price movement might have fueled further buying, creating a self-reinforcing cycle.

- Altcoin Market Performance: The relative underperformance of many altcoins compared to Bitcoin could have led some investors to shift their portfolios towards Bitcoin, further contributing to the increased buying volume on Binance.

Implications of the Shift in Bitcoin Trading Volume on Binance

This shift in Bitcoin trading volume on Binance has significant short-term and long-term implications:

- Impact on Bitcoin Price: The increased buying pressure could potentially lead to a sustained price increase for Bitcoin. However, various factors, including macroeconomic conditions and regulatory developments, will influence the extent and duration of any price appreciation.

- Implications for Other Cryptocurrencies: The increased flow of capital into Bitcoin could potentially negatively impact the altcoin market, as investors reallocate funds from altcoins to Bitcoin. This shift could lead to further price corrections in some altcoins.

- Broader Implications for the Cryptocurrency Market: This trend on Binance could signal a broader shift in market sentiment towards Bitcoin, potentially leading to increased overall market capitalization for the cryptocurrency sector.

Comparing Binance's Bitcoin Volume with Other Exchanges

While Binance's dominance in Bitcoin trading volume is well-established, it's crucial to compare its recent surge with other major exchanges like Coinbase and Kraken. [Include data comparisons if available. For example: "While Binance experienced a [Percentage]% increase in the buy/sell ratio, Coinbase showed a more modest [Percentage]% increase."]. Understanding whether this trend is unique to Binance or reflective of a broader market shift is essential for a comprehensive analysis. Any discrepancies might stem from differences in user demographics, trading fees, or regulatory environments across various exchanges.

Potential Risks and Considerations

Despite the positive signs, it's crucial to acknowledge potential risks:

- Short-Term Price Corrections: The surge in buying volume could be followed by a period of short-term price correction or increased market volatility as profit-taking occurs.

- Market Manipulation: The possibility of market manipulation, although difficult to prove, should always be considered when analyzing significant price movements.

- Regulatory Uncertainty: Changes in regulatory frameworks could significantly impact Bitcoin's price and trading volume.

Conclusion: The Future of Bitcoin Buying Volume on Binance and Beyond

The significant increase in Bitcoin buying volume on Binance over the past [Time period] represents a noteworthy development in the cryptocurrency market. This surge, driven by a confluence of factors including institutional investment and potentially improved retail investor sentiment, suggests a potential shift towards a more bullish outlook on Bitcoin. However, it's essential to remain cautious and aware of potential risks. Monitoring Bitcoin trading volume on Binance and other major exchanges remains crucial for making informed investment decisions. Stay informed about the latest developments in Bitcoin buying volume on Binance and other major exchanges to make informed investment decisions. Track Bitcoin's trading activity to capitalize on market trends.

Featured Posts

-

Inter Milan Upsets Bayern Munich In Champions League Thriller

May 08, 2025

Inter Milan Upsets Bayern Munich In Champions League Thriller

May 08, 2025 -

Fqdan Alasnan Fy Merkt Marakana Qst Barbwza Almrwet

May 08, 2025

Fqdan Alasnan Fy Merkt Marakana Qst Barbwza Almrwet

May 08, 2025 -

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Revealed

May 08, 2025

Hot Toys Japan Exclusive 1 6 Scale Galen Erso Rogue One Figure Revealed

May 08, 2025 -

Ethereum Price Prediction Buy Signal Flashes On Weekly Chart

May 08, 2025

Ethereum Price Prediction Buy Signal Flashes On Weekly Chart

May 08, 2025 -

Counting Crows Las Vegas Strip Concert Announced

May 08, 2025

Counting Crows Las Vegas Strip Concert Announced

May 08, 2025