Bitcoin Golden Cross: A Once-Per-Cycle Event And Its Implications

Table of Contents

Understanding the Bitcoin Golden Cross

The Bitcoin Golden Cross is a technical indicator derived from the intersection of two crucial moving averages: the 50-day MA and the 200-day MA. Understanding these averages is key to interpreting the Golden Cross.

-

50-day Moving Average (MA): This represents the average closing price of Bitcoin over the past 50 days. It's considered a shorter-term indicator, reflecting recent price trends and momentum. A rising 50-day MA suggests short-term bullish sentiment.

-

200-day Moving Average (MA): This is a longer-term indicator, representing the average closing price over the past 200 days. It provides a better understanding of the prevailing long-term trend. A rising 200-day MA signifies a strong long-term uptrend.

-

The Golden Cross: The Golden Cross occurs when the 50-day MA crosses above the 200-day MA. This crossover is interpreted as a bullish signal, suggesting a potential shift from a bearish to a bullish trend. [Insert a clear visual chart here showing a Bitcoin Golden Cross]. This signifies that the short-term momentum is now exceeding the long-term trend, potentially indicating a sustained upward price movement.

Historical Significance of Bitcoin Golden Crosses

Examining Bitcoin's price history reveals instances where the Golden Cross has preceded significant price increases. However, it's crucial to avoid oversimplification. The Golden Cross is not a guarantee of a bull market.

-

Past Occurrences and Impact: Historical data shows that past Golden Cross events have, in several instances, been followed by periods of increased Bitcoin price. [Insert a table or chart here showing historical data on past Golden Crosses and subsequent price movements].

-

Correlation, Not Causation: While a correlation exists between Golden Crosses and subsequent bull runs, it's vital to understand that correlation does not equal causation. Other market factors significantly influence Bitcoin's price.

-

Instances of Inaccuracy: There have been cases where the Golden Cross did not lead to a sustained bull market. Understanding these instances is critical for avoiding overly optimistic interpretations. [Provide specific examples of instances where the Golden Cross failed to predict a sustained price increase]. This highlights the importance of considering additional factors before making investment decisions.

Factors Influencing the Reliability of the Golden Cross

While the Golden Cross provides valuable insight, its reliability can be affected by several external factors. Relying solely on this indicator for investment decisions is risky.

-

Regulatory Changes: Government regulations and legal frameworks surrounding cryptocurrencies significantly influence market sentiment and price volatility. Stringent regulations can dampen enthusiasm, while favorable regulations can boost investor confidence.

-

Macroeconomic Factors: Global economic conditions, including inflation rates, interest rates, and overall economic growth, impact Bitcoin's price. Economic downturns can lead to risk aversion, impacting Bitcoin's value.

-

Market Sentiment and Investor Psychology: Fear, uncertainty, and doubt (FUD) can drive down prices, while positive news and investor optimism can fuel price increases. The Golden Cross needs to be interpreted within the context of overall market sentiment.

-

Limitations of Technical Analysis: Technical analysis, including the Golden Cross, is just one piece of the puzzle. It's crucial to complement technical analysis with fundamental analysis, examining factors like Bitcoin adoption rates and technological advancements.

Considering Other Technical Indicators Alongside the Golden Cross

For a more holistic analysis, incorporating additional technical indicators alongside the Golden Cross is crucial. Relying solely on one indicator can be misleading.

-

RSI (Relative Strength Index): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions.

-

MACD (Moving Average Convergence Divergence): This indicator identifies changes in the strength, direction, momentum, and duration of a trend in a price series.

-

Volume Analysis: Examining trading volume alongside price movements provides crucial context. A Golden Cross accompanied by high trading volume often suggests stronger bullish momentum than a Golden Cross with low volume.

-

Support and Resistance Levels: Identifying key support and resistance levels on the Bitcoin price chart can help determine potential price targets and areas where the price might consolidate or reverse. A Golden Cross breaking through significant resistance levels is a stronger bullish signal.

Conclusion

The Bitcoin Golden Cross is a valuable tool for technical analysis, potentially signaling a shift towards a bullish trend. However, it's crucial to remember that it's not a foolproof predictor of future price movements. Its reliability is influenced by numerous external factors, including regulatory changes, macroeconomic conditions, market sentiment, and overall investor psychology. Therefore, it's essential to utilize a comprehensive approach, incorporating other technical indicators like RSI and MACD, along with fundamental analysis, for a more informed investment decision.

While the Bitcoin Golden Cross can be a helpful component of your cryptocurrency investment strategy, remember to conduct thorough research, understand the inherent risks, and consider seeking advice from a qualified financial advisor before making any investment decisions based solely on the Bitcoin Golden Cross or any single indicator. Stay updated on the latest developments in the Bitcoin market to make well-informed choices. Learn more about the Bitcoin Golden Cross and its implications for your portfolio today!

Featured Posts

-

Veteran Wide Receiver Joins Browns Report Confirms Signing And Return Specialist Role

May 08, 2025

Veteran Wide Receiver Joins Browns Report Confirms Signing And Return Specialist Role

May 08, 2025 -

Thunder Media Feud Players Fire Shots At National Reporters

May 08, 2025

Thunder Media Feud Players Fire Shots At National Reporters

May 08, 2025 -

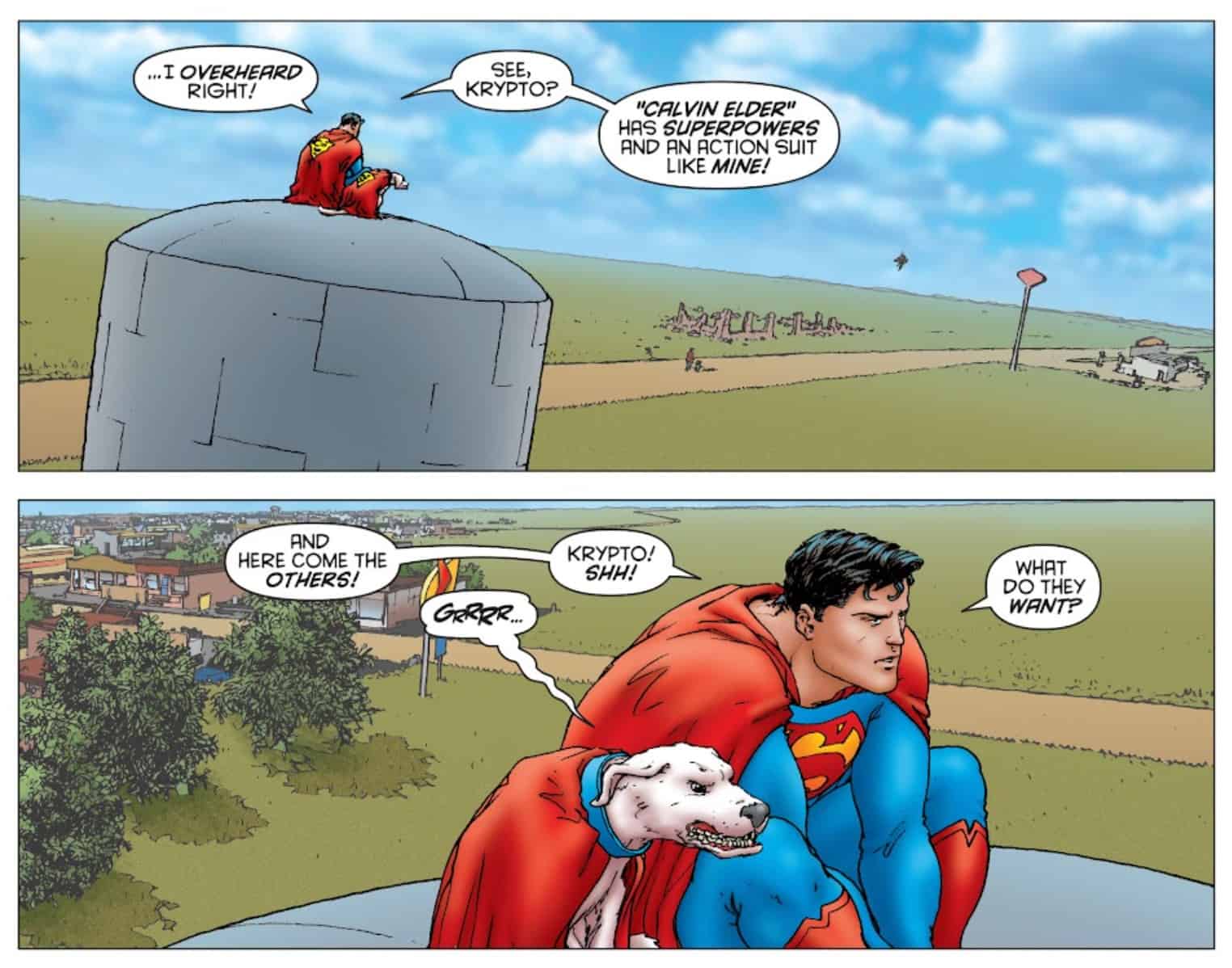

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025

Superman And Krypto Next Weeks Summer Of Superman Special

May 08, 2025 -

Andors Final Season Cast Offers Bts Glimpse Into Rogue One Prequel

May 08, 2025

Andors Final Season Cast Offers Bts Glimpse Into Rogue One Prequel

May 08, 2025 -

Zherson I Zenit Kontrakt Na E500 000 Podtverzhdenie Ot Zhurnalista

May 08, 2025

Zherson I Zenit Kontrakt Na E500 000 Podtverzhdenie Ot Zhurnalista

May 08, 2025