Bitcoin Hits All-Time High Amidst Positive US Regulatory Outlook

Table of Contents

Positive US Regulatory Signals Boost Bitcoin Confidence

The recent surge in Bitcoin price is significantly linked to a more favorable US regulatory outlook. A gradual shift in the stance of key regulatory bodies is boosting investor confidence and fueling institutional adoption.

Gradual Shift in Regulatory Stance

The US Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have recently adopted a more nuanced approach to cryptocurrency regulation. This shift away from outright bans and towards a framework for responsible innovation is significantly impacting the market.

- Examples of positive regulatory developments: The SEC's approval of Bitcoin futures ETFs, the CFTC's increased engagement with cryptocurrency exchanges, and the introduction of several bipartisan bills aiming to clarify the regulatory landscape for digital assets.

- Details: This reduced regulatory uncertainty encourages institutional investors, who previously hesitated due to the unclear legal framework, to enter the market, driving up demand and consequently the Bitcoin price. Clearer guidelines reduce the perceived risk, making Bitcoin a more attractive investment option for large players.

Increased Institutional Adoption

Institutional investors, including hedge funds and asset managers, are increasingly allocating a portion of their portfolios to Bitcoin. This large-scale adoption is a key factor contributing to the recent all-time high.

- Examples of major institutional investments in Bitcoin: Several major financial institutions have publicly announced significant Bitcoin holdings, including MicroStrategy and Tesla. Investment firms are also actively launching Bitcoin-focused funds.

- Details: The impact of large-scale institutional buying is substantial. These large purchases significantly increase market liquidity and provide a strong support level for the Bitcoin price, limiting potential downside corrections.

Growing Demand and Scarcity Fuel Bitcoin's Rise

Beyond regulatory shifts, fundamental factors are driving Bitcoin's upward trajectory. Increasing global adoption and the inherent scarcity of Bitcoin are key contributors to its rising value.

Increased Global Adoption

Bitcoin is increasingly adopted globally as a store of value and a payment method. This growing adoption, fueled by economic instability in several regions and a desire for decentralized finance, leads to a natural increase in demand.

- Examples of countries or regions showing increased Bitcoin adoption: El Salvador's adoption of Bitcoin as legal tender, increasing adoption in developing countries with unstable fiat currencies, and the growing usage of Bitcoin for international remittances.

- Details: As more people and businesses use Bitcoin, the demand increases, pushing the price higher. This increased global usage reflects a growing recognition of Bitcoin’s potential as a hedge against inflation and economic uncertainty.

Limited Supply and Halving Events

Bitcoin's fixed supply of 21 million coins is a crucial factor underpinning its value. The halving events, which reduce the rate of new Bitcoin creation, further contribute to its scarcity.

- Explanation of the halving mechanism and its impact on the Bitcoin supply: Approximately every four years, the reward for Bitcoin miners is halved, reducing the rate at which new Bitcoins enter circulation.

- Details: This controlled supply, coupled with increasing demand, creates a classic scenario of scarcity driving value. As the supply remains fixed, and demand continues to rise, the price of Bitcoin naturally increases.

Potential Risks and Future Outlook for Bitcoin

While the current outlook is positive, it's essential to acknowledge the inherent risks associated with Bitcoin investment.

Regulatory Uncertainty Remains

Despite positive regulatory signals, uncertainty remains. Future regulations could significantly impact the Bitcoin market.

- Potential regulatory risks and challenges: Increased scrutiny of cryptocurrency exchanges, potential taxation policies, and the ongoing debate surrounding stablecoins are all potential challenges.

- Details: While current trends are positive, investors must remain aware that future regulatory decisions could negatively impact the Bitcoin price. It's crucial to monitor regulatory developments closely.

Market Volatility and Price Corrections

The cryptocurrency market is inherently volatile. Significant price corrections are possible, even with a positive long-term outlook.

- Importance of risk management in Bitcoin investment: Diversification, only investing what you can afford to lose, and employing appropriate risk management strategies are crucial.

- Details: Bitcoin investment carries significant risk. Responsible investors should conduct thorough research, diversify their portfolio, and understand the inherent volatility of the cryptocurrency market before investing.

Conclusion

Bitcoin's recent all-time high is a result of a confluence of factors: positive US regulatory signals, increased institutional adoption, growing global demand, and the inherent scarcity of Bitcoin. These factors present significant opportunities, but it's crucial to remember that investing in Bitcoin carries substantial risks. The potential for both high rewards and significant losses exists.

Bitcoin's future remains dynamic, and understanding the interplay between regulatory developments, market forces, and technological advancements is crucial for navigating this evolving landscape. Stay informed about the latest developments in the Bitcoin market and consider consulting with a financial advisor before making any investment decisions. Learn more about Bitcoin and its potential by [link to relevant resource].

Featured Posts

-

Sylvester Stallone Tulsa King Season 2 Blu Ray Release Exclusive Preview

May 23, 2025

Sylvester Stallone Tulsa King Season 2 Blu Ray Release Exclusive Preview

May 23, 2025 -

Nisan Da Servet Sansli Burclar

May 23, 2025

Nisan Da Servet Sansli Burclar

May 23, 2025 -

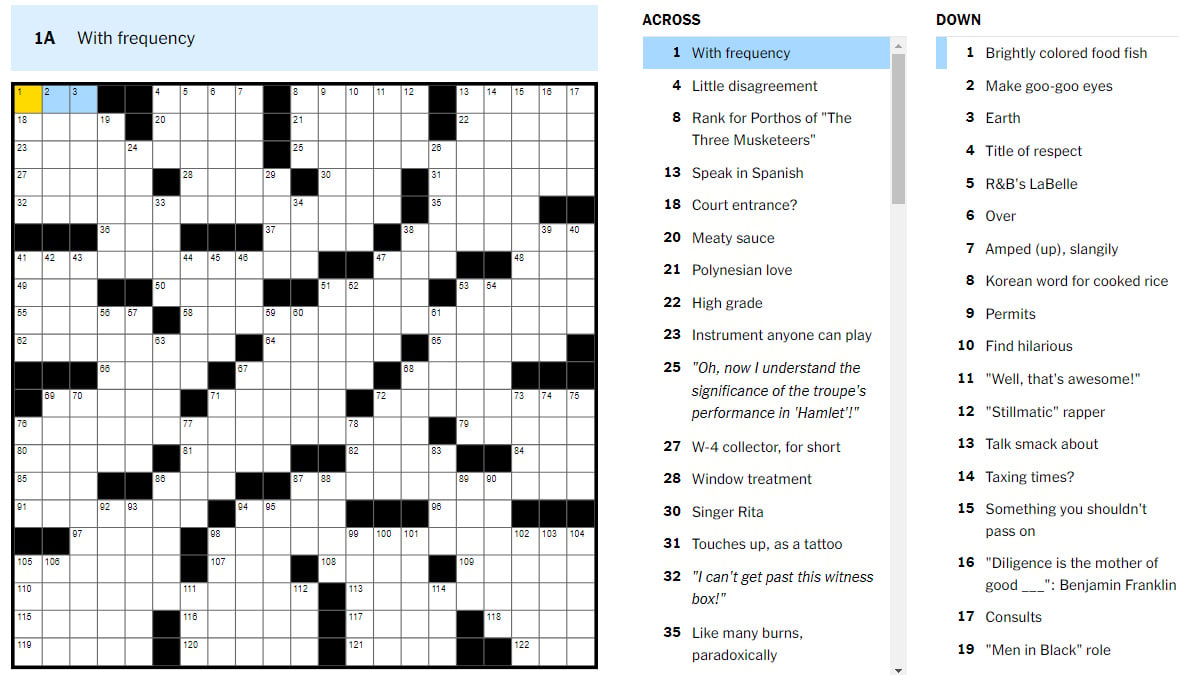

Solve The Nyt Mini Crossword March 24 2025 Answers And Hints

May 23, 2025

Solve The Nyt Mini Crossword March 24 2025 Answers And Hints

May 23, 2025 -

Kazakhstan Defeats Australia In Billie Jean King Cup Qualifying Tie

May 23, 2025

Kazakhstan Defeats Australia In Billie Jean King Cup Qualifying Tie

May 23, 2025 -

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 23, 2025

The Price Of Anonymity Attending Trumps Memecoin Dinner

May 23, 2025

Latest Posts

-

Grossfeuer In Essen Heisingen Polizeimeldung Und Feuerwehr Einsatz Am 07 04 2025

May 23, 2025

Grossfeuer In Essen Heisingen Polizeimeldung Und Feuerwehr Einsatz Am 07 04 2025

May 23, 2025 -

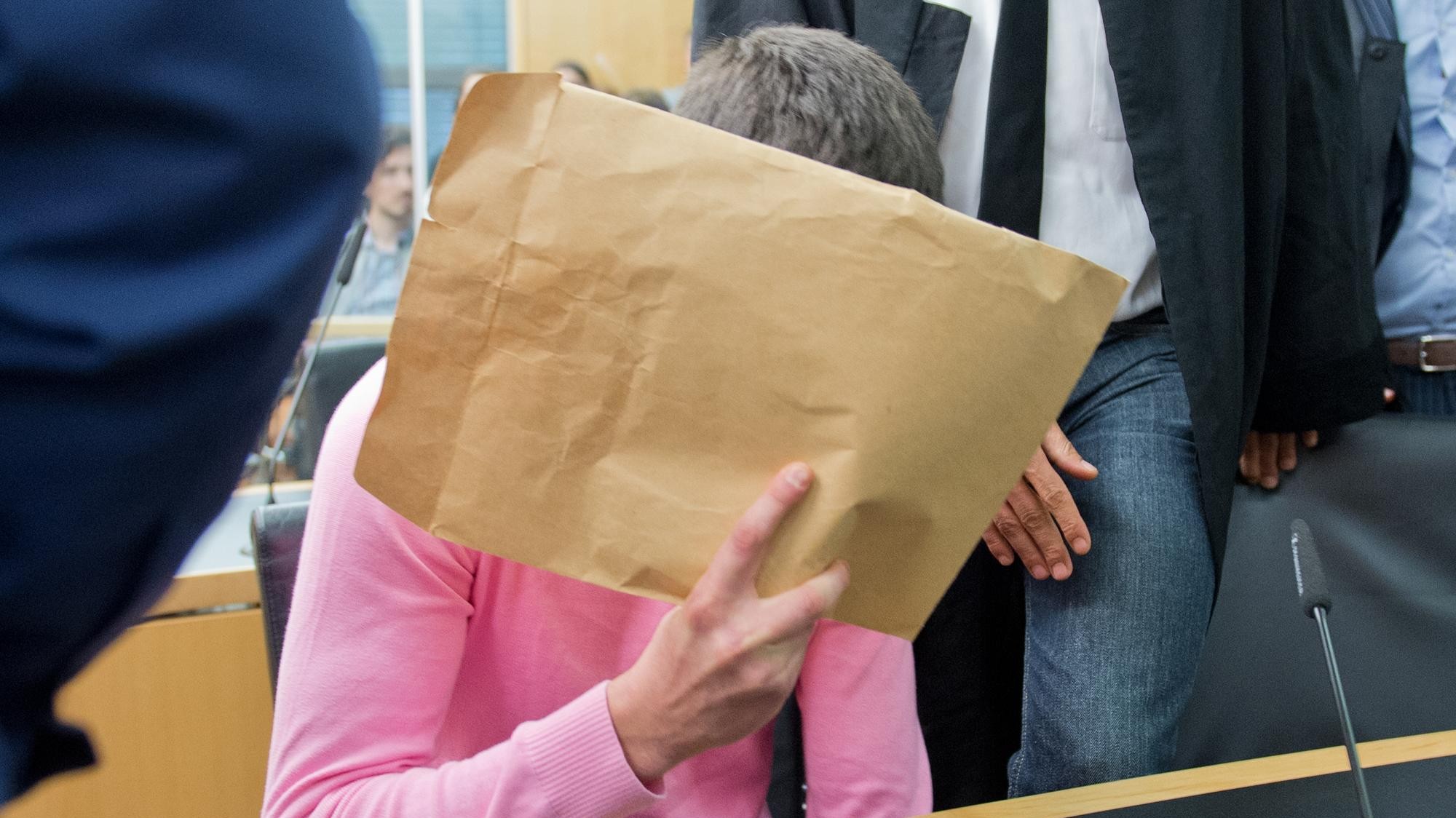

Notenmanipulation An Nrw Hochschule Angeklagte Erhalten Gefaengnisstrafen

May 23, 2025

Notenmanipulation An Nrw Hochschule Angeklagte Erhalten Gefaengnisstrafen

May 23, 2025 -

Uniklinikum Essen Und Seine Nachbarschaft Berichte Und Geschichten

May 23, 2025

Uniklinikum Essen Und Seine Nachbarschaft Berichte Und Geschichten

May 23, 2025 -

Nrw Universitaet Urteil Im Fall Der Notenmanipulation Haftstrafen Verhaengt

May 23, 2025

Nrw Universitaet Urteil Im Fall Der Notenmanipulation Haftstrafen Verhaengt

May 23, 2025 -

Alsltat Alalmanyt Tshn Hmlt Mdahmat Ela Mshjeyn Ryadyyn

May 23, 2025

Alsltat Alalmanyt Tshn Hmlt Mdahmat Ela Mshjeyn Ryadyyn

May 23, 2025