Bitcoin Mining Hashrate Soars: A Detailed Analysis Of The Recent Spike

Table of Contents

H2: Factors Contributing to the Bitcoin Mining Hashrate Surge

The recent spike in Bitcoin's mining hashrate is a complex phenomenon driven by several interconnected factors. Understanding these factors is crucial to grasping the current state and potential future trajectory of the Bitcoin network.

H3: Increased Miner Adoption

The influx of new miners into the Bitcoin network has significantly contributed to the hashrate increase. Several factors fuel this growth:

- Increased availability of affordable ASIC miners: The market has seen a surge in the availability of more affordable and efficient Application-Specific Integrated Circuit (ASIC) miners, making Bitcoin mining accessible to a wider range of individuals and businesses. This lowers the barrier to entry and encourages more participation.

- Growing institutional investment in mining operations: Large-scale institutional investors are increasingly recognizing the potential profitability of Bitcoin mining, leading to significant investments in mining infrastructure and operations. This influx of capital fuels expansion and enhances the overall hashrate.

- Expansion of large-scale mining farms: The establishment and expansion of large-scale mining farms, particularly in regions with favorable energy policies and low electricity costs, have contributed to a substantial increase in the total network hashrate. These farms often house thousands of ASIC miners, significantly impacting the overall computational power.

H3: The Role of Bitcoin's Price

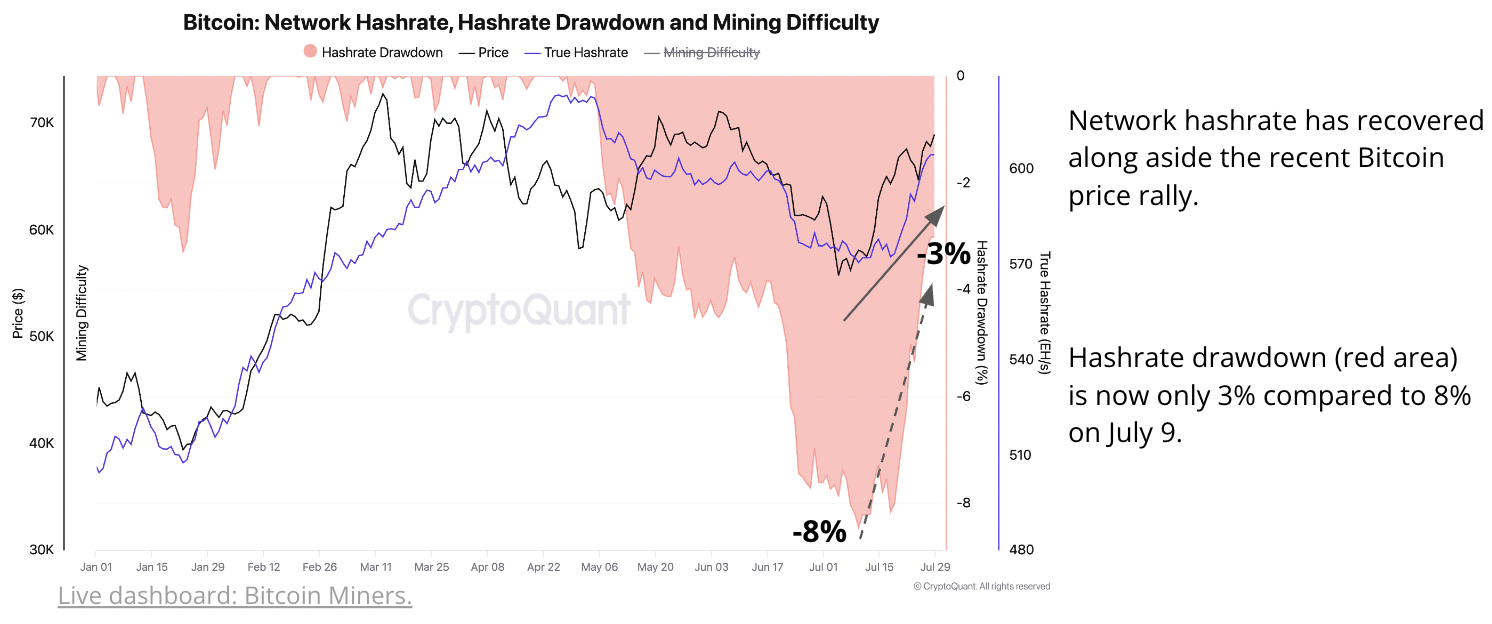

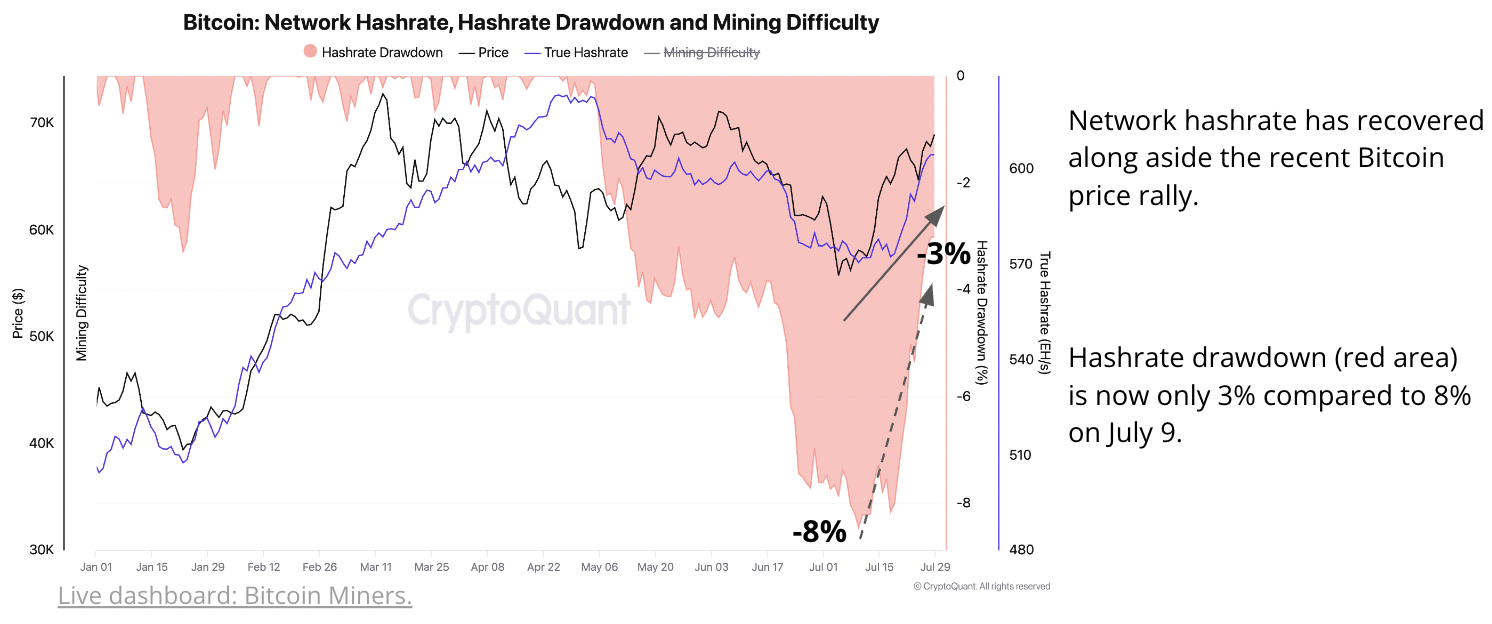

The price of Bitcoin is intrinsically linked to the profitability of mining. A higher Bitcoin price directly translates to increased revenue for miners, incentivizing more participation and driving up the hashrate.

- Price increase leading to higher revenue for miners: When the Bitcoin price rises, the reward for successfully mining a block increases proportionally, making mining more lucrative. This attracts new miners and encourages existing miners to increase their operational capacity.

- Impact of price volatility on miner participation: While price increases incentivize participation, volatility can create uncertainty. Sharp price drops can lead to miners temporarily shutting down operations if their costs exceed revenue, resulting in temporary hashrate dips.

- Analysis of historical price-hashrate correlations: Historical data clearly shows a strong positive correlation between Bitcoin's price and its mining hashrate. Price increases generally precede, and are followed by, corresponding increases in hashrate.

H3: Influence of Regulatory Changes and Geographic Factors

Regulatory landscapes and geographic factors play a significant role in shaping the distribution and intensity of Bitcoin mining activity.

- Impact of stricter regulations in certain countries: Stringent regulations or outright bans on cryptocurrency mining in some countries have forced miners to relocate to regions with more favorable regulatory environments. This has led to shifts in geographic mining dominance.

- Emergence of new mining hubs with favorable energy policies: Countries and regions with abundant renewable energy sources and supportive regulatory frameworks are becoming attractive hubs for Bitcoin mining. This creates new centers of mining activity, contributing to the global hashrate.

- Geographical distribution of mining power and its implications: The distribution of mining power across different geographic regions is a crucial aspect of Bitcoin's decentralization. A highly concentrated mining power in a few regions could raise concerns about censorship resistance and network security.

H3: Technological Advancements in Mining Hardware

Continuous advancements in ASIC technology are a major driver of the increased Bitcoin mining hashrate. Newer generation miners offer significant improvements in both efficiency and processing power.

- Improved energy efficiency of new ASICs: Modern ASICs consume considerably less energy per unit of hashing power compared to their predecessors. This reduction in energy consumption makes mining more profitable and environmentally sustainable.

- Increased processing power of newer mining hardware: New ASICs offer substantially higher hashing power, allowing miners to solve cryptographic puzzles faster and increase their chances of earning block rewards.

- Impact of technological innovation on mining profitability: Technological advancements continually push the boundaries of mining profitability, attracting new entrants and driving the overall hashrate higher.

H2: Implications of the Increased Bitcoin Mining Hashrate

The significant increase in Bitcoin's mining hashrate has far-reaching implications for the cryptocurrency's future.

H3: Enhanced Network Security

A higher hashrate translates directly into stronger network security. It makes 51% attacks—where a malicious actor controls more than half of the network's computing power—exponentially more difficult and costly to execute, bolstering Bitcoin's resilience against malicious actors.

H3: Decentralization and its impact

The impact on decentralization is complex. While increased hashrate generally strengthens the network, the concentration of mining power within specific geographic locations or among large mining pools could potentially raise concerns about the long-term decentralization of the Bitcoin network. Monitoring this aspect is crucial.

H3: Environmental Concerns

The increased energy consumption associated with the higher hashrate raises environmental concerns. The industry is actively exploring solutions like utilizing renewable energy sources to mitigate its environmental footprint. Sustainable mining practices are critical for the long-term viability of Bitcoin.

H3: Future Predictions and Market Outlook

Predicting the future trajectory of the Bitcoin hashrate is challenging. However, continued technological advancements, price fluctuations, and regulatory developments will likely continue to influence the network's computational power. Observing these trends is crucial for understanding the future of Bitcoin.

3. Conclusion

The recent surge in Bitcoin mining hashrate is a multifaceted phenomenon influenced by increased miner adoption, Bitcoin's price, regulatory changes, geographic factors, and advancements in mining hardware. This increase significantly enhances the network's security against attacks. However, it also presents challenges concerning decentralization and environmental impact. Understanding the interplay of these factors is crucial for navigating the evolving landscape of Bitcoin.

Key Takeaways: The increased Bitcoin mining hashrate strengthens network security, but also raises questions regarding decentralization and environmental sustainability. Further research and analysis are needed to fully understand the long-term implications of this trend.

Call to Action: Keep abreast of the latest developments in Bitcoin mining and its hashrate. Understanding these trends is crucial for anyone interested in the future of this groundbreaking cryptocurrency. Monitoring the Bitcoin mining hashrate and its influencing factors remains essential for informed participation in the cryptocurrency market.

Featured Posts

-

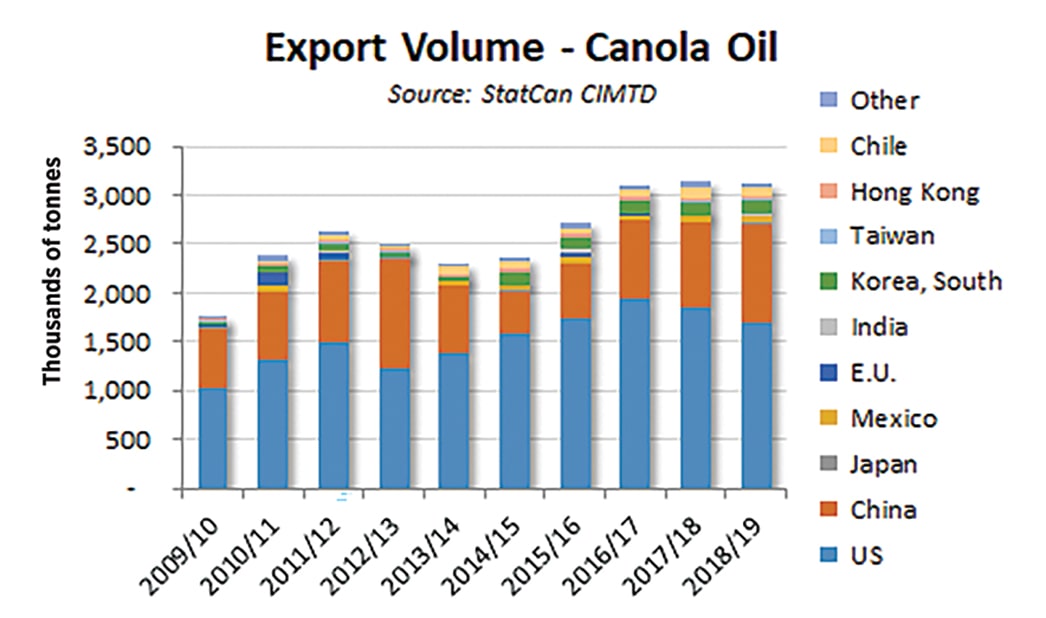

Shifting Supply Chains Chinas Canola Imports Diversify

May 09, 2025

Shifting Supply Chains Chinas Canola Imports Diversify

May 09, 2025 -

Silniy Snegopad Paralizoval Aeroport Permi

May 09, 2025

Silniy Snegopad Paralizoval Aeroport Permi

May 09, 2025 -

From 3 K Babysitter To 3 6 K Daycare A Fathers Financial Struggle

May 09, 2025

From 3 K Babysitter To 3 6 K Daycare A Fathers Financial Struggle

May 09, 2025 -

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Public Servants

May 09, 2025

Aviations Living Legends Celebrate Bravery Honoring Firefighters And Public Servants

May 09, 2025 -

Municipales Dijon 2026 La Strategie Des Ecologistes

May 09, 2025

Municipales Dijon 2026 La Strategie Des Ecologistes

May 09, 2025