Bitcoin Or MicroStrategy Stock: Predicting Investment Performance In 2025

Table of Contents

Bitcoin's Projected Performance in 2025

Bitcoin's Price Volatility and Future Predictions

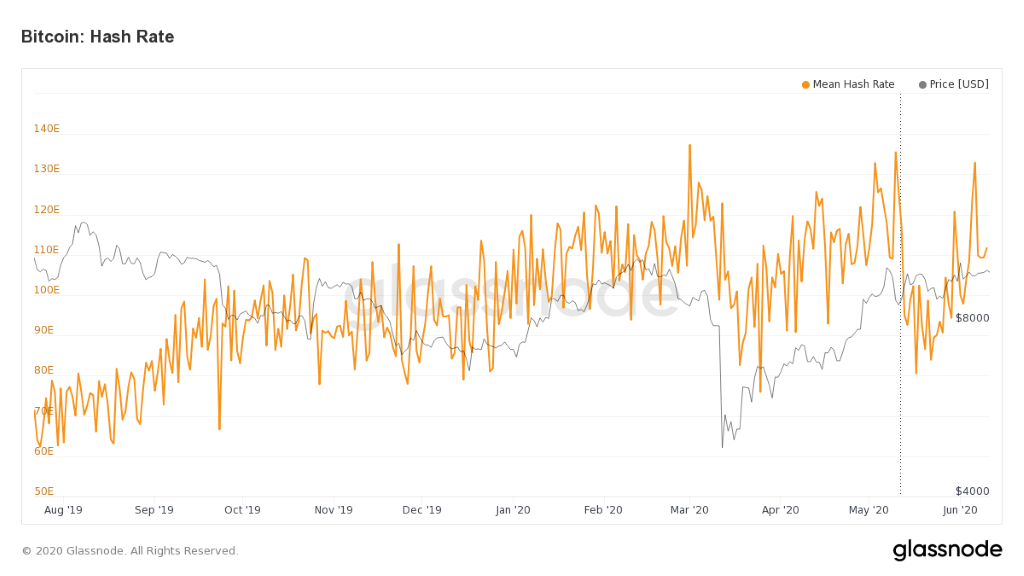

Bitcoin's history is marked by dramatic price swings. Factors influencing its price include market sentiment (fear and greed cycles), technological advancements (like the Lightning Network), and the ever-changing regulatory landscape. Predicting its price in 2025 is inherently speculative, with various models offering drastically different outcomes. Some analysts predict values exceeding $100,000, while others foresee significantly lower figures.

- Positive Catalysts: Widespread institutional adoption, increased global acceptance as a legitimate currency or store of value, and successful integration into mainstream financial systems could drive significant price increases.

- Negative Catalysts: Stringent regulatory crackdowns, major market crashes, or the emergence of superior competing cryptocurrencies could negatively impact Bitcoin's price.

Bitcoin Adoption and Technological Developments

The expansion of Bitcoin's utility across various sectors is crucial to its long-term value. Increased adoption in payments, decentralized finance (DeFi), and as a store of value against inflation are all potential drivers of growth.

- Growth Areas: The Lightning Network, aiming to improve Bitcoin's scalability and transaction speed, is a key technological development to watch. Increased use in cross-border payments and institutional investment are also significant factors.

- Challenges: Wider adoption faces hurdles, including scalability issues, regulatory uncertainty, and the need for improved user-friendliness.

MicroStrategy's Stock Performance and Bitcoin Holdings

MicroStrategy's Business Model and Financial Performance

MicroStrategy is a business intelligence company that has made a significant strategic bet on Bitcoin. Its financial health and stock performance are intrinsically linked to Bitcoin's price. Analyzing its core business and financial performance independent of its Bitcoin holdings is essential.

- Core Business: Understanding MicroStrategy's traditional business operations and their profitability is key to assessing its overall value. This helps separate the Bitcoin investment risk from the underlying company performance.

- Bitcoin Dependence: MicroStrategy's heavy reliance on Bitcoin exposes it to significant volatility. A downturn in Bitcoin's price directly impacts its balance sheet and stock valuation.

MicroStrategy's Bitcoin Investment Strategy and Risk

MicroStrategy's massive Bitcoin holdings represent a bold investment strategy. While potentially highly rewarding if Bitcoin's price appreciates, it also carries substantial risk.

- Investment Strategy: Understanding the rationale behind MicroStrategy's Bitcoin investment strategy is crucial for evaluating its potential success.

- Risks: The primary risk is the inherent volatility of Bitcoin. Regulatory changes and market downturns could significantly impact the value of its Bitcoin holdings, and thus its stock price.

Comparing Bitcoin and MicroStrategy Stock: A Comparative Analysis

Risk vs. Reward

Bitcoin offers higher potential rewards but also higher risk compared to MicroStrategy stock. MicroStrategy offers some diversification (though limited) through its core business, but its stock's performance remains heavily influenced by Bitcoin's price.

- Bitcoin: High risk, high reward.

- MicroStrategy: Moderate risk (relative to Bitcoin), moderate reward (dependent on Bitcoin's price).

Diversification and Portfolio Allocation

Both Bitcoin and MicroStrategy stock should be considered within the context of a diversified investment portfolio. Neither should comprise a significant portion of an investor's holdings unless they have a high-risk tolerance.

- Risk Management: Diversification is key to mitigating risk. Investing in both Bitcoin and MicroStrategy introduces considerable correlation, limiting diversification benefits.

Regulatory Considerations

The regulatory landscape surrounding Bitcoin and cryptocurrencies is constantly evolving, posing a significant risk to both Bitcoin's price and MicroStrategy's investment. Similarly, regulations affecting publicly traded companies like MicroStrategy also impact their stock valuation.

Conclusion: Making Informed Investment Decisions: Bitcoin or MicroStrategy in 2025?

Predicting the performance of Bitcoin or MicroStrategy stock in 2025 remains challenging. Bitcoin presents a higher-risk, higher-reward opportunity, while MicroStrategy offers a potentially less volatile, yet still Bitcoin-dependent, investment. Thorough research is crucial. Consider your risk tolerance, investment goals, and the potential impact of regulatory changes before investing in either Bitcoin or MicroStrategy stock. Consult with a qualified financial advisor to make informed decisions aligned with your individual circumstances. Remember, this analysis is for informational purposes and not financial advice.

Featured Posts

-

Boston Celtics Star Jayson Tatum Suffers Bone Bruise Game 2 Participation Uncertain

May 08, 2025

Boston Celtics Star Jayson Tatum Suffers Bone Bruise Game 2 Participation Uncertain

May 08, 2025 -

Bitcoin Madenciligi Yaklasan Son Ve Gelecegi

May 08, 2025

Bitcoin Madenciligi Yaklasan Son Ve Gelecegi

May 08, 2025 -

Tatums Respectful Comments On Curry Following The Nba All Star Game

May 08, 2025

Tatums Respectful Comments On Curry Following The Nba All Star Game

May 08, 2025 -

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

May 08, 2025

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

May 08, 2025 -

Pennsylvania Senator Fetterman Rebuts Fitness For Office Allegations

May 08, 2025

Pennsylvania Senator Fetterman Rebuts Fitness For Office Allegations

May 08, 2025