Bitcoin Price Analysis: Rally Potential And Key Support Zones (May 6th)

Table of Contents

Current Bitcoin Market Conditions and Sentiment

Analyzing the current Bitcoin market conditions is crucial for understanding its potential trajectory. Market capitalization and trading volume provide valuable insights into overall market strength and investor participation. Currently, Bitcoin's market capitalization sits at [Insert Current Market Cap], reflecting [Insert Analysis - e.g., a slight increase compared to last week, a consolidation phase, etc.]. Trading volume is [Insert Current Trading Volume and Analysis – e.g., relatively low, suggesting consolidation; high, indicating increased activity; etc.].

Prevailing market sentiment is currently [Insert Sentiment Analysis – e.g., cautiously bullish, leaning towards neutral, etc.]. This sentiment is influenced by various factors, including recent news and events. For example, [mention specific relevant news – e.g., recent regulatory announcements, institutional investment news, significant on-chain activity, etc.]. This news has [explain the impact of the news on market sentiment – e.g., boosted confidence, introduced uncertainty, etc.].

- Market cap analysis: Comparing Bitcoin's current market cap to previous bull and bear cycles can offer valuable context and perspective on its current valuation.

- Trading volume trends: A significant increase in trading volume, particularly alongside a price increase, can signal a potential breakout. Conversely, low volume may indicate a lack of conviction behind price movements.

- Sentiment indicators: Analyzing social media sentiment, news sentiment scores, and other quantitative indicators can provide additional context to the overall market mood.

Identifying Key Support and Resistance Levels

Identifying key support and resistance levels is crucial for Bitcoin price prediction and trading strategy. Support levels represent price points where buying pressure is expected to outweigh selling pressure, potentially preventing further price declines. Resistance levels, conversely, represent price points where selling pressure may overcome buying pressure, hindering further price increases.

We can utilize technical analysis tools to identify these crucial levels. For example, Fibonacci retracements can help pinpoint potential support and resistance areas based on previous price swings. Moving averages, such as the 50-day and 200-day moving averages, can also provide insights into potential support or resistance.

- Specific support levels: Based on our technical analysis, key support levels for Bitcoin currently include [Insert specific price points with chart examples – visuals are extremely important here. Include clear labels on the chart showing support/resistance levels].

- Technical indicators used: We utilize Fibonacci retracements, moving averages (50-day and 200-day MA), and [mention any other technical indicators used].

- Potential price targets: If the current support levels hold, Bitcoin could potentially rally towards [Insert potential price target]. However, a break below these support levels could trigger further price declines toward [Insert potential downside target].

Technical Indicators Suggesting a Potential Bitcoin Rally

Several technical indicators suggest the potential for a Bitcoin rally. The Relative Strength Index (RSI) is [Insert RSI Value and Interpretation – e.g., currently below 30, suggesting oversold conditions]. A move above [Insert value] could signal a potential bullish reversal. The Moving Average Convergence Divergence (MACD) shows [Explain MACD signal – e.g., a bullish crossover, indicating a potential shift in momentum].

Furthermore, the Bollinger Bands currently exhibit [Explain Bollinger Bands – e.g., a squeeze, suggesting potential increased volatility in the near future]. This can often precede a significant price movement, either upward or downward. The interplay of these indicators supports the possibility of a Bitcoin price rally, though caution is warranted.

- RSI readings: An RSI reading below 30 often indicates oversold conditions, which can precede a price rebound.

- MACD crossover signals: A bullish MACD crossover can signal a potential shift from bearish to bullish momentum.

- Bollinger Band squeeze: A Bollinger Band squeeze often indicates a period of low volatility, which can be followed by a significant price breakout.

Risks and Potential Downside Scenarios for Bitcoin

While a Bitcoin rally is possible, it's crucial to acknowledge potential risks and downside scenarios. Regulatory uncertainty remains a significant concern, as governments worldwide grapple with the implications of cryptocurrencies. Unexpected market corrections, driven by factors outside the crypto market (e.g., macroeconomic factors), also pose a risk.

Should the current support levels fail, Bitcoin could experience further price declines. However, there are potential support levels that could act as a cushion against sharper drops.

- Potential negative news events: Unexpected regulatory crackdowns, major security breaches, or significant macroeconomic events could negatively impact the Bitcoin price.

- Key support levels to watch: In case of a price drop, key support levels to monitor include [Insert specific price levels].

- Risk mitigation techniques: Implementing risk management strategies, such as setting stop-loss orders, diversifying investments, and only investing what you can afford to lose, is crucial for mitigating potential losses.

Conclusion

This Bitcoin price analysis suggests a potential for a Bitcoin rally, based on several key factors. Technical indicators point towards a possible bullish reversal, and several key support zones offer potential price floors. However, it's crucial to acknowledge the inherent risks associated with Bitcoin trading, including regulatory uncertainty and potential market corrections. Monitoring the identified key support levels – [reiterate key support levels] – is essential for informed decision-making.

Continue monitoring the Bitcoin price and its support levels for informed decision-making. Stay updated on the latest Bitcoin price analysis and market insights by subscribing to our newsletter! Share your thoughts on the potential Bitcoin rally in the comments below! Remember, conducting thorough research is crucial before making any investment decisions. This Bitcoin price prediction is for informational purposes only and does not constitute financial advice.

Featured Posts

-

The Liberation Day Tariff Increase A Stock Market Perspective

May 08, 2025

The Liberation Day Tariff Increase A Stock Market Perspective

May 08, 2025 -

Impact Of De Andre Hopkins On The Ravens Offense

May 08, 2025

Impact Of De Andre Hopkins On The Ravens Offense

May 08, 2025 -

The Monkey Movie 2025 Potential Success Or Failure For Stephen Kings Year

May 08, 2025

The Monkey Movie 2025 Potential Success Or Failure For Stephen Kings Year

May 08, 2025 -

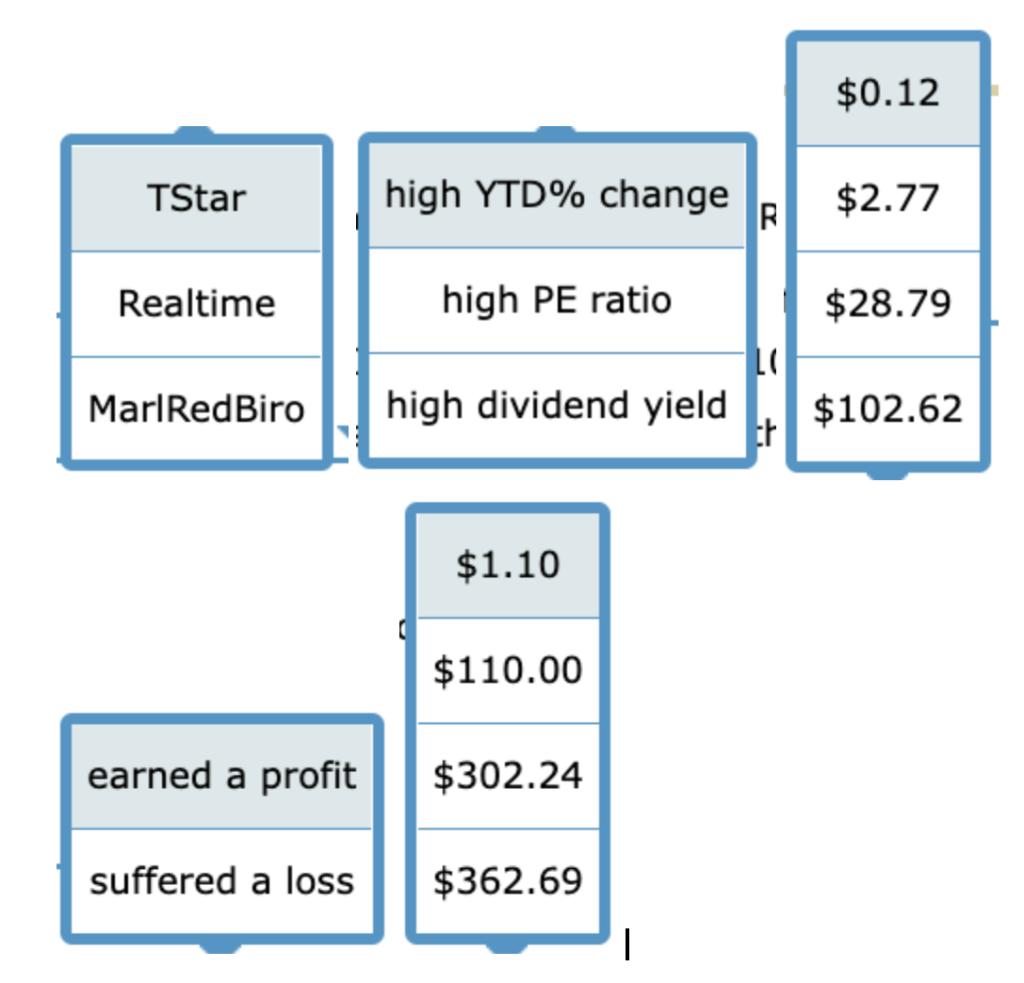

Analyzing Scholar Rocks Stock Performance After Mondays Dip

May 08, 2025

Analyzing Scholar Rocks Stock Performance After Mondays Dip

May 08, 2025 -

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kylye Tby Bymh Ka Aelan

May 08, 2025

Lahwr Hayykwrt Awr Dley Edaltwn Ke Jjz Kylye Tby Bymh Ka Aelan

May 08, 2025