Bitcoin Price Forecast: Exploring The Potential Of A $100,000 BTC Price After Trump's Speech

Table of Contents

Analyzing Trump's Speech and its Implications for Bitcoin

Trump's pronouncements, whether directly or indirectly related to cryptocurrencies, can significantly impact market sentiment. Let's examine the potential influence of his latest speech on Bitcoin's price.

Direct Mentions of Bitcoin (or Crypto):

Did Trump explicitly mention Bitcoin or cryptocurrencies in his speech? This is crucial. Direct endorsements, even implied ones, can trigger substantial buying pressure. Conversely, negative comments could lead to a sell-off. Unfortunately, without specific details on the speech's content, a precise analysis of direct mentions is impossible. However, historical examples show that even tweets from influential figures can sway the market significantly.

- Example: A positive tweet from a prominent figure could instantly boost Bitcoin's price, potentially due to increased media attention and subsequent retail investor interest.

- Analyzing Sentiment: If direct mentions exist, careful analysis of the tone and context is vital. Were the comments positive, neutral, or negative towards cryptocurrencies? This would greatly impact the short-term price movements.

- Quote Analysis (If Available): Including direct quotes from the speech, if they relate to Bitcoin or the crypto market, is essential for context and transparency.

Indirect Impact Through Economic Policies:

Even without direct mentions, Trump's economic policies can indirectly affect Bitcoin. His stance on fiscal policy, trade, and regulation could create a ripple effect.

- Inflationary Pressures: Expansionary fiscal policies could lead to inflation, potentially driving investors towards Bitcoin as a hedge against inflation.

- Dollar's Strength: Changes in the value of the US dollar influence Bitcoin's price. A weakening dollar often correlates with Bitcoin price increases, as investors seek alternative assets.

- Regulatory Changes: Announcements regarding cryptocurrency regulation, or the lack thereof, can drastically influence investor confidence and price volatility.

Market Sentiment and Media Reaction:

The media's interpretation and subsequent reporting of Trump's speech are vital in shaping public perception and influencing trading decisions.

- Media Analysis: A thorough examination of how major news outlets covered the speech and its impact on Bitcoin is needed. This includes analyzing the headlines, tone, and the overall narrative presented.

- Analyst Opinions: The opinions of financial analysts and cryptocurrency experts offer additional insight into the potential market effects. Their predictions and reasoning need to be evaluated.

- Price Charts: Including graphs depicting Bitcoin's price movements immediately before, during, and after Trump's speech provides a visual representation of the market's reaction.

Factors Contributing to a Potential $100,000 Bitcoin Price

Several factors beyond Trump's speech could independently contribute to a Bitcoin price surge towards $100,000.

Adoption and Institutional Investment:

The growing acceptance of Bitcoin among institutional investors is a significant bullish factor.

- ETF Approvals: The approval of Bitcoin Exchange-Traded Funds (ETFs) could open the floodgates for institutional investment, leading to increased demand and price appreciation.

- Corporate Adoption: Companies holding Bitcoin on their balance sheets demonstrates growing confidence in the asset's long-term value.

- Investment Vehicles: The proliferation of other investment vehicles, such as Bitcoin futures contracts, also adds to liquidity and facilitates institutional participation.

Scarcity and Halving Events:

Bitcoin's limited supply of 21 million coins is a fundamental factor underpinning its potential value.

- Halving Mechanism: The periodic halving of Bitcoin's block reward reduces the rate of new coin creation, creating scarcity and potentially driving up the price.

- Supply and Demand Dynamics: The fixed supply contrasts sharply with the potentially increasing demand, suggesting a path to higher prices in the long term.

- Predictability: The predictable nature of the halving events allows investors to anticipate future supply shocks.

Global Economic Uncertainty:

Geopolitical instability and economic uncertainty often lead investors to seek safe haven assets, and Bitcoin has emerged as a potential contender in this space.

- Inflation Hedge: Bitcoin's perceived resistance to inflation attracts investors concerned about traditional fiat currencies losing purchasing power.

- Safe Haven Asset: In times of economic or political turmoil, investors may move towards Bitcoin as a store of value, independent of traditional financial systems.

- Decentralized Nature: Bitcoin's decentralized nature and resistance to government manipulation could be major attractions during uncertain times.

Factors that Could Prevent Bitcoin from Reaching $100,000

While the potential for a $100,000 Bitcoin price exists, several factors could prevent it from being realized.

Regulatory Uncertainty:

Government regulations play a significant role in shaping the cryptocurrency market.

- Varying Regulations: Different countries have differing regulatory frameworks for cryptocurrencies, creating uncertainty and potential obstacles to growth.

- Crackdowns: Harsh regulatory crackdowns could negatively impact Bitcoin's price and adoption.

- Legal Grey Areas: The legal ambiguity surrounding cryptocurrencies creates risks for investors and businesses operating in the space.

Market Volatility and Correction Risks:

The cryptocurrency market is notoriously volatile, and significant price corrections are common.

- Price Swings: Bitcoin's history is marked by periods of dramatic price increases followed by sharp declines.

- Market Sentiment: Sudden shifts in investor sentiment can lead to rapid price movements, both up and down.

- Bear Markets: Predicting the timing and depth of bear markets is challenging but crucial for risk management.

Technological Challenges and Scalability Issues:

The Bitcoin network's scalability and technological limitations could pose challenges to its long-term growth.

- Transaction Fees: High transaction fees can deter users, especially during periods of high network congestion.

- Transaction Speed: Compared to some other cryptocurrencies, Bitcoin's transaction speed can be relatively slow.

- Network Upgrades: The need for ongoing network upgrades and improvements is crucial for addressing scalability concerns and maintaining competitiveness.

Conclusion: Bitcoin Price Forecast and Future Outlook – Is $100,000 Realistic?

Whether Bitcoin will reach $100,000 after Trump's speech, or any other catalyst, is a complex question with no definitive answer. While factors like increasing institutional adoption, scarcity, and global economic uncertainty could contribute to significant price appreciation, regulatory hurdles, market volatility, and technological limitations present significant obstacles. Trump's influence, either through direct statements or indirect policy changes, will continue to play a role in shaping market sentiment and Bitcoin's price trajectory. Conduct your own research, stay informed on the latest developments, and keep a close eye on the Bitcoin price forecast to navigate this dynamic market. Remember, understanding the potential for a $100,000 BTC price requires a nuanced perspective considering all the influencing factors.

Featured Posts

-

Small But Mighty A Review Of The 12 Inch Microsoft Surface Pro

May 08, 2025

Small But Mighty A Review Of The 12 Inch Microsoft Surface Pro

May 08, 2025 -

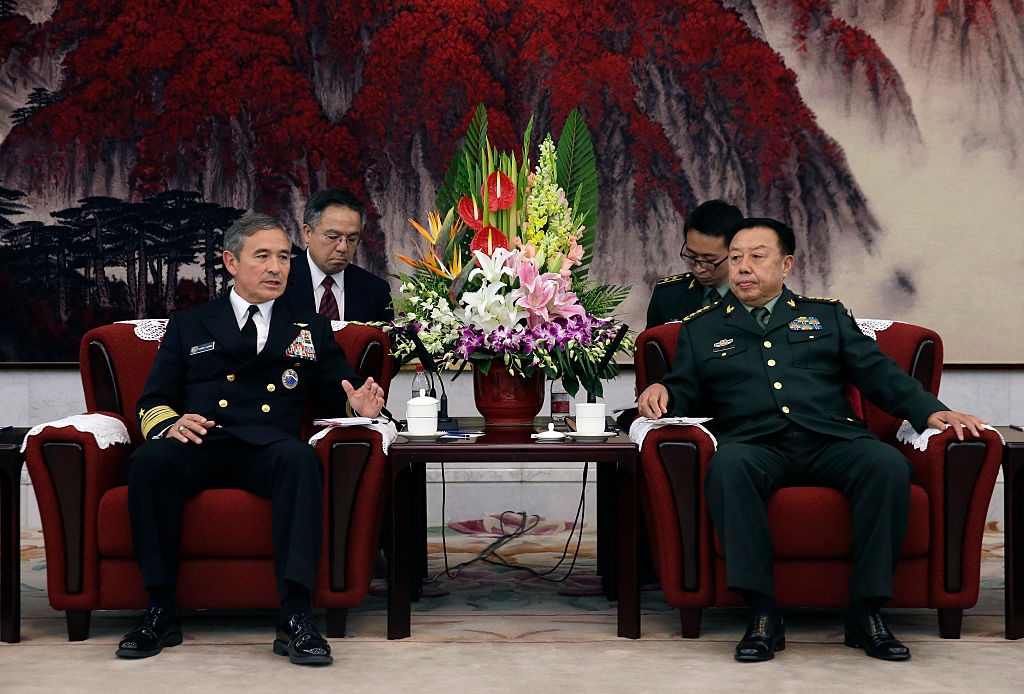

High Level U S And Chinese Officials To Discuss Trade War Resolution

May 08, 2025

High Level U S And Chinese Officials To Discuss Trade War Resolution

May 08, 2025 -

Artis Goesteren Sms Dolandiriciligi Sikayetleri Korunma Yollari Ve Oenlemler

May 08, 2025

Artis Goesteren Sms Dolandiriciligi Sikayetleri Korunma Yollari Ve Oenlemler

May 08, 2025 -

Xrp Future Price Analyzing The Potential For 5 And Beyond

May 08, 2025

Xrp Future Price Analyzing The Potential For 5 And Beyond

May 08, 2025 -

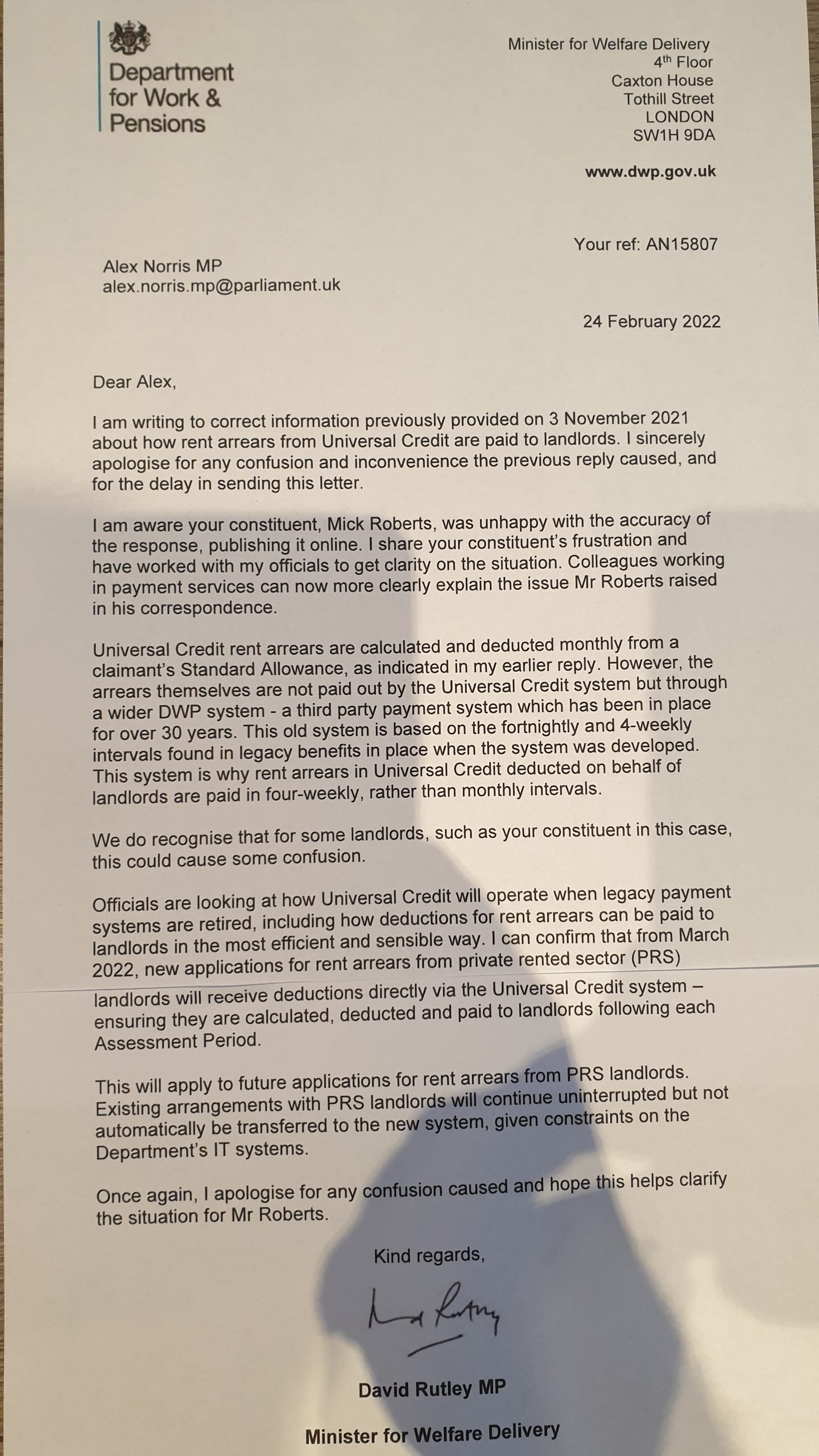

Lost Dwp Letter How To Avoid A 6 828 Financial Penalty

May 08, 2025

Lost Dwp Letter How To Avoid A 6 828 Financial Penalty

May 08, 2025