Bitcoin Price Prediction: Can Trump's Policies Push BTC Past $100,000?

Table of Contents

Trump's Potential Economic Policies and Their Impact on Bitcoin

A hypothetical return to certain economic policies could significantly impact Bitcoin's price. Let's analyze several key areas.

Fiscal Policy and Inflation

Expansionary fiscal policies, such as increased government spending or significant tax cuts, could potentially lead to higher inflation. This is where Bitcoin's role as a potential inflation hedge comes into play. Historically, periods of high inflation have seen increased interest in Bitcoin as investors seek to protect their purchasing power.

- Inflation and Bitcoin: High inflation erodes the value of fiat currencies. Bitcoin, with a fixed supply, offers a potential alternative.

- Historical Examples: While not a perfect correlation, past periods of significant inflation in various countries have often coincided with increased Bitcoin adoption and price appreciation.

- Data Points: Further research is needed to quantify this correlation precisely. However, analyzing historical inflation rates alongside Bitcoin's price movements could reveal interesting trends.

Regulatory Uncertainty and Bitcoin

A less regulated environment, hypothetically similar to certain periods under previous administrations, could have a dual impact on Bitcoin.

- Pros of Reduced Regulation: Less stringent regulations could attract more institutional investment, boosting liquidity and potentially driving up the price.

- Cons of Reduced Regulation: Conversely, reduced oversight could also increase the risk of scams and illicit activities, potentially undermining investor confidence and suppressing the price. The balance between these two factors is critical in determining the overall impact.

Geopolitical Instability and Safe-Haven Assets

A more protectionist or isolationist foreign policy could lead to increased geopolitical instability. This uncertainty often drives investors towards safe-haven assets, which Bitcoin increasingly represents.

- Geopolitical Uncertainty and Bitcoin: During times of heightened global uncertainty, investors often seek assets perceived as less correlated with traditional markets, leading to increased demand for Bitcoin.

- Examples: Past geopolitical events, such as the 2020 US election or various international conflicts, have often shown short-term increases in Bitcoin's price as investors sought shelter from risk.

Factors Beyond Trump's Policies Influencing Bitcoin's Price

While political climates play a role, other crucial factors influence Bitcoin's price trajectory.

Technological Advancements

Technological advancements within the Bitcoin ecosystem significantly impact its usability and appeal.

- Bitcoin Scaling Solutions: Improvements like the Lightning Network aim to enhance transaction speed and reduce fees, increasing Bitcoin's practicality for everyday use.

- Other Developments: Ongoing development and upgrades to the Bitcoin protocol itself continue to improve its efficiency, security, and overall functionality.

Market Sentiment and Adoption

Market sentiment, heavily influenced by media coverage and institutional adoption, plays a dominant role in price fluctuations.

- Media Influence: Positive media coverage and growing mainstream acceptance can significantly boost investor confidence and drive demand.

- Institutional Adoption: Increased investment from large financial institutions lends credibility to Bitcoin, often leading to price increases.

- Retail Investor Sentiment: The collective actions and beliefs of individual investors also contribute to Bitcoin price volatility.

Supply and Demand Dynamics

Bitcoin's inherent scarcity, with a fixed maximum supply of 21 million coins, is a crucial factor in its long-term price potential.

- Bitcoin Halving: The halving events, which reduce the rate of new Bitcoin creation, historically have led to price increases due to reduced supply.

- Supply and Demand Analysis: Analyzing current market data on supply and demand helps project potential future price movements, although predicting with accuracy is challenging.

Predicting Bitcoin's Price: Challenges and Considerations

Predicting Bitcoin's price with certainty is inherently difficult.

Volatility and Market Uncertainty

Bitcoin's price is notoriously volatile, influenced by numerous unpredictable factors.

- Factors Contributing to Volatility: News events, regulatory changes, market sentiment swings, and technological developments all contribute to significant price fluctuations.

- Uncertainty: Any Bitcoin price prediction should be considered with a high degree of caution and acknowledged uncertainty.

Regulatory Landscape

Regulatory actions around the globe can profoundly impact Bitcoin's price.

- Jurisdictional Differences: Different countries have vastly different regulatory approaches toward cryptocurrencies, leading to market fragmentation and price variations.

- Impact of Regulation: Favorable regulations can boost investor confidence and drive adoption, while restrictive regulations can have the opposite effect.

Conclusion

While a hypothetical return to certain policies could potentially influence Bitcoin's price, numerous other factors play crucial roles. Whether Bitcoin reaches $100,000 depends on a complex interplay of economic conditions, technological advancements, regulatory developments, and market sentiment. Predicting the precise price remains incredibly challenging due to the inherent volatility of the cryptocurrency market. Therefore, a definitive prediction is impossible. While a surge past $100,000 is possible, it's equally possible that other factors could significantly influence the price in either direction.

Continue your research on Bitcoin price prediction and make informed investment decisions. Remember that any investment carries risk, and thorough due diligence is crucial before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

Fitorja E Psg Se Strategji Taktika Dhe Rezultati

May 08, 2025

Fitorja E Psg Se Strategji Taktika Dhe Rezultati

May 08, 2025 -

Counting Crows 2025 Tour Predicted Setlist And Song Possibilities

May 08, 2025

Counting Crows 2025 Tour Predicted Setlist And Song Possibilities

May 08, 2025 -

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025 -

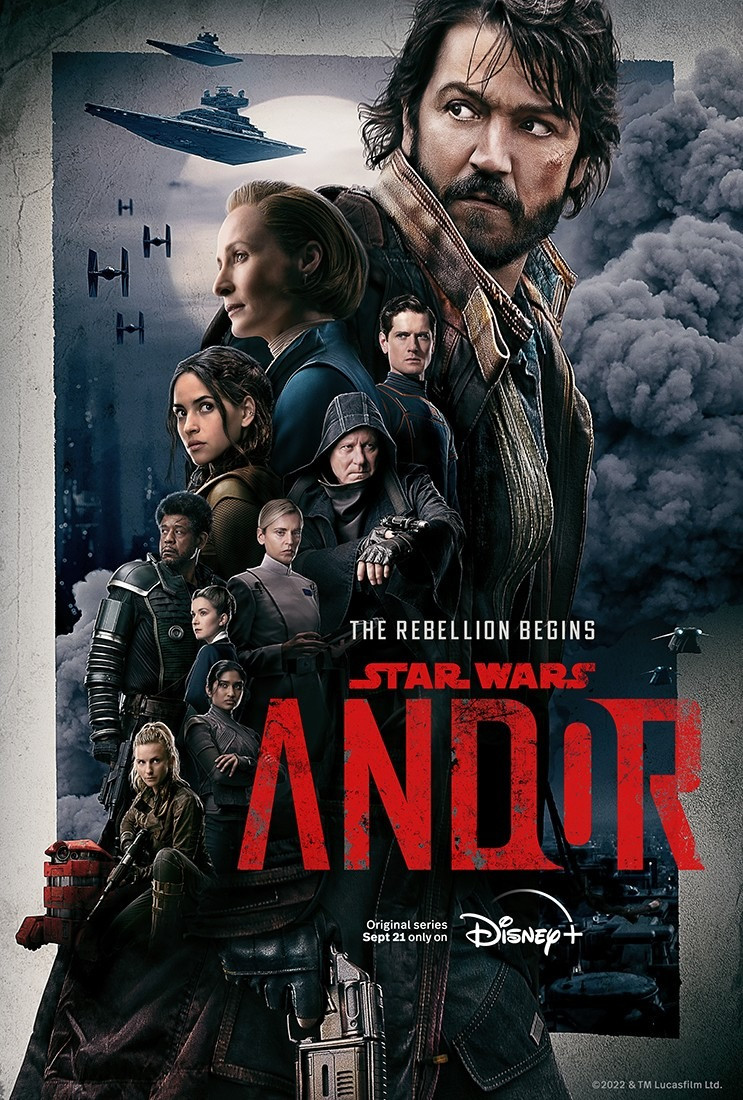

The Significance Of Andor A Star Wars Show According To Its Creator

May 08, 2025

The Significance Of Andor A Star Wars Show According To Its Creator

May 08, 2025 -

Check Daily Lotto Results For Wednesday April 16 2025

May 08, 2025

Check Daily Lotto Results For Wednesday April 16 2025

May 08, 2025