Bitcoin Price Prediction: Trump's 100-Day Speech And The $100,000 BTC Target

Table of Contents

Trump's Economic Policies and Bitcoin's Price

Historical Context: Trump's Economic Policies and their Ripple Effect on Bitcoin

Donald Trump's presidency was marked by significant economic policy changes. His emphasis on deregulation, tax cuts, and trade protectionism profoundly impacted the US dollar and global markets. Understanding the historical context is vital for any Bitcoin price prediction. For example, his tax cuts initially boosted market confidence, potentially indirectly influencing investor sentiment towards riskier assets like Bitcoin. Conversely, his trade wars created global economic uncertainty, which could have simultaneously driven investors towards Bitcoin as a safe haven asset.

- Examples of past policies and their effects: Tax cuts led to a short-term economic boost but also increased the national debt. Trade wars disrupted global supply chains and increased inflation in some sectors.

- Influence on investor sentiment: The initial positive sentiment from tax cuts might have spilled over into the crypto market, but the uncertainty created by trade wars likely led some investors to seek refuge in Bitcoin’s decentralized nature.

- Market dynamic shifts: The fluctuating dollar value resulting from these policies directly impacts the price of Bitcoin, expressed in USD.

Regulatory Uncertainty and Bitcoin: A Tightrope Walk

Regulatory uncertainty surrounding cryptocurrencies remains a major factor influencing Bitcoin price predictions. A strong regulatory framework could increase institutional investment, boosting Bitcoin's price. However, overly restrictive regulations could stifle innovation and negatively impact the market. Trump's administration's somewhat ambiguous stance on cryptocurrency regulation created a climate of uncertainty.

- Potential scenarios: Increased regulation could attract institutional investment but also limit adoption. Conversely, a lack of clear regulations might increase volatility and attract less institutional involvement.

- Impact on investor confidence: Clear, well-defined regulations tend to improve investor confidence. Uncertainty breeds fear and can trigger sell-offs.

- Past examples: Previous regulatory crackdowns in China significantly impacted Bitcoin's price, highlighting the crucial role of regulatory clarity.

Geopolitical Factors and Bitcoin's Potential

Global Economic Instability: Bitcoin as a Safe Haven?

Global events and political instability often drive investors towards alternative assets perceived as safe havens, and Bitcoin increasingly fits this description. Periods of heightened uncertainty in traditional markets can lead to increased Bitcoin adoption.

- Past events boosting Bitcoin's price: The 2008 financial crisis and the ongoing global economic uncertainty related to the war in Ukraine and inflation have all seen increased Bitcoin adoption.

- Uncertainty leading to Bitcoin adoption: When traditional markets falter, investors seek assets that are less correlated to traditional financial systems; Bitcoin's decentralized nature makes it attractive in such scenarios.

- Bitcoin as an inflation hedge: Many investors view Bitcoin as a hedge against inflation, as its fixed supply of 21 million coins is immune to inflationary monetary policies.

International Relations and Bitcoin Adoption: A Global Perspective

Trump's foreign policies, like trade wars and sanctions, significantly impacted the global financial system and, indirectly, the cryptocurrency market. Different countries' regulatory approaches to cryptocurrencies also play a significant role.

- Impact of trade wars and sanctions: Trade conflicts and sanctions can disrupt global financial stability, potentially pushing investors towards Bitcoin as a less volatile alternative.

- Country-specific adoption rates: The varying regulatory landscapes in different countries affect Bitcoin adoption rates and ultimately influence its global price. Widespread adoption in developing countries could significantly increase demand.

- Specific examples: El Salvador's adoption of Bitcoin as legal tender is a prime example of how government policies can dramatically influence Bitcoin's price and adoption.

The $100,000 Bitcoin Target: Realistic or Speculative?

Market Analysis and Predictions: A Balanced View

Reaching a $100,000 Bitcoin price is a bold prediction. Several market analyses offer varying perspectives. Some analysts point to Bitcoin's scarcity, growing institutional adoption, and its potential as a store of value as factors supporting this target. Conversely, others highlight the inherent volatility of cryptocurrencies, regulatory risks, and potential competition from other cryptocurrencies as reasons for skepticism.

- Bullish arguments: Increased institutional adoption, growing global acceptance, and limited supply could propel Bitcoin towards $100,000.

- Bearish arguments: Regulatory uncertainty, market corrections, and the emergence of competing cryptocurrencies pose significant challenges.

- Technological advancements: Developments like the Lightning Network could enhance Bitcoin's scalability and transaction speed, boosting its usability and potentially driving up the price.

Technical Indicators and Chart Analysis: A Deeper Dive (Optional)

While beyond the scope of this article, technical indicators and chart analysis offer another layer of insight for Bitcoin price predictions. Moving averages, Relative Strength Index (RSI), and other indicators provide clues about potential price trends. However, it's crucial to remember that technical analysis is not foolproof.

- Specific indicators: Moving averages, RSI, MACD, and Bollinger Bands can provide valuable signals, but should be interpreted cautiously.

- Visual aids: Charts and graphs illustrating these indicators can provide a clearer picture of potential price movements.

Conclusion

Predicting Bitcoin's price with certainty is impossible. However, analyzing the potential impact of significant global events and policies, particularly those influenced by figures like Donald Trump, provides valuable context. While the $100,000 Bitcoin target remains highly speculative, various factors could drive – or hinder – Bitcoin's growth. The interplay of economic policies, geopolitical instability, regulatory landscapes, and technological advancements all contribute to the complex equation that determines Bitcoin's price. Stay informed about future Bitcoin price predictions by following reputable market analyses and conducting your own thorough research before investing. Understanding Bitcoin price analysis and exploring various Bitcoin price forecasts are crucial steps in navigating this dynamic market.

Featured Posts

-

Violenta Pelea Entre Flamengo Y Botafogo Detalles Del Incidente En El Partido

May 08, 2025

Violenta Pelea Entre Flamengo Y Botafogo Detalles Del Incidente En El Partido

May 08, 2025 -

Expanding Horizons Psg Opens State Of The Art Labs In Doha

May 08, 2025

Expanding Horizons Psg Opens State Of The Art Labs In Doha

May 08, 2025 -

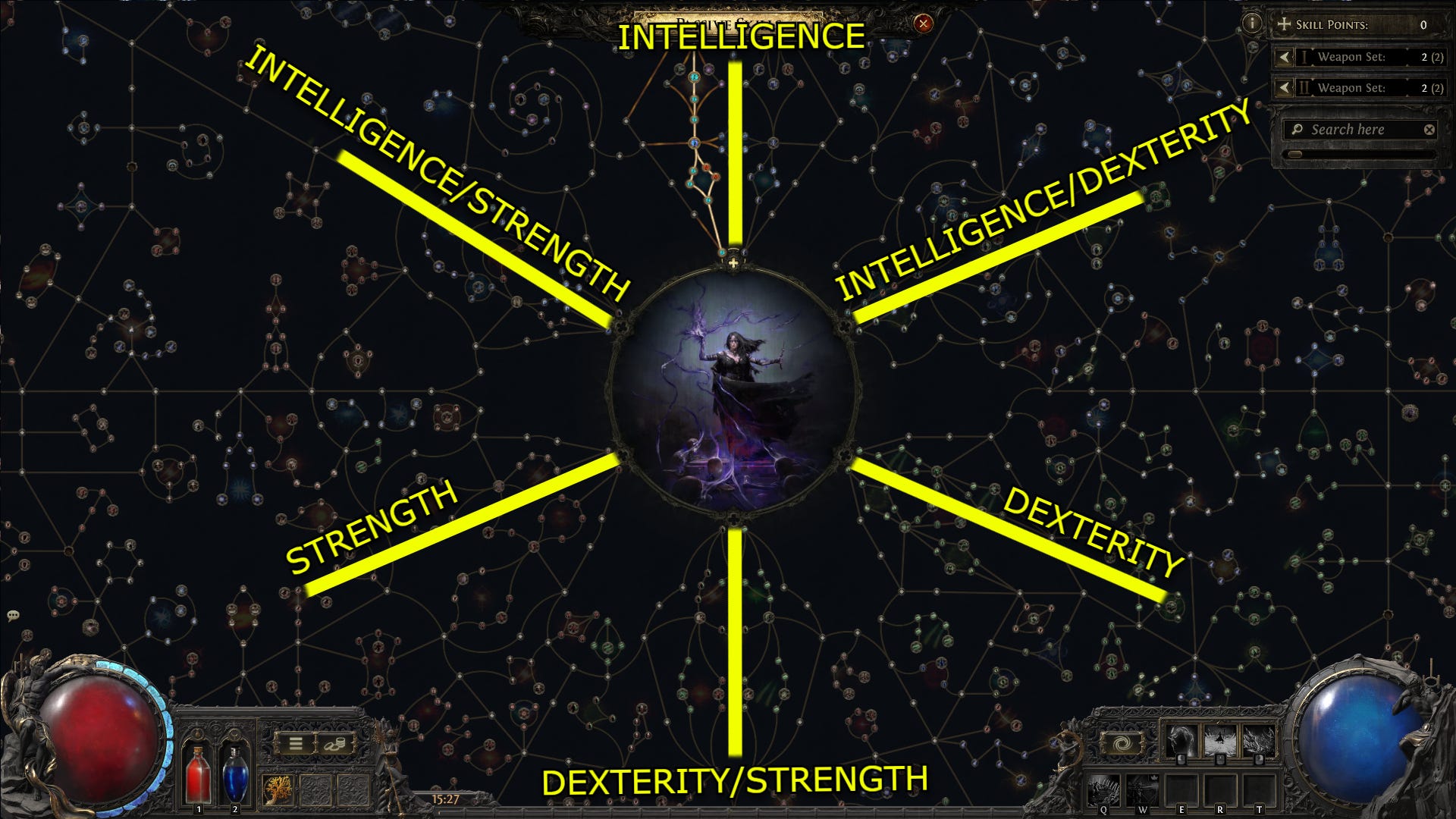

Exploring Rogue Exiles Your Path Of Exile 2 Guide

May 08, 2025

Exploring Rogue Exiles Your Path Of Exile 2 Guide

May 08, 2025 -

Confirmado Neymar Vuelve A La Seleccion Y Jugara Contra Messi En El Monumental

May 08, 2025

Confirmado Neymar Vuelve A La Seleccion Y Jugara Contra Messi En El Monumental

May 08, 2025 -

De Andre Carter From Chicago Bears To Cleveland Browns A Key Free Agent Signing

May 08, 2025

De Andre Carter From Chicago Bears To Cleveland Browns A Key Free Agent Signing

May 08, 2025