Bitcoin Price Rebound: What To Expect Next

Table of Contents

Analyzing the Recent Bitcoin Price Dip

Understanding the Causes

Several factors contributed to Bitcoin's recent price decline. The cryptocurrency market is notoriously volatile, and several events exacerbated this volatility.

- Regulatory Uncertainty: Increased regulatory scrutiny in various jurisdictions created uncertainty and impacted investor sentiment. News regarding stricter regulations often leads to a

Bitcoin price volatilityspike, followed by a dip as investors react. - Macroeconomic Factors: Global economic instability, including high inflation and rising interest rates, negatively impacted risk assets, including Bitcoin. The correlation between the

crypto market downturnand traditional markets is increasingly evident. - Market Sentiment: Negative news cycles and overall bearish market sentiment contributed to selling pressure, further driving down the

Bitcoin price. Fear, Uncertainty, and Doubt (FUD) play a significant role in these fluctuations.

Technical Analysis of the Dip

Analyzing Bitcoin charts reveals key support and resistance levels. Observing the price action around these levels is crucial for understanding potential future movements.

- Support Levels: These are price points where buying pressure is expected to outweigh selling pressure, potentially preventing further declines. Identifying strong

support levelsis vital forBitcoin chart analysis. - Resistance Levels: These are price points where selling pressure is expected to outweigh buying pressure, potentially hindering upward price movements. Breaking through resistance is a crucial signal in

Bitcoin priceanalysis. - Technical Indicators: Using indicators like Relative Strength Index (RSI) and Moving Averages can provide further insights into potential price reversals and trends. Examining these

technical indicatorsprovides a more comprehensive picture.

[Insert image of Bitcoin chart highlighting support and resistance levels]

Factors Contributing to the Potential Rebound

Institutional Investment and Adoption

Growing institutional interest in Bitcoin is a significant catalyst for a potential rebound.

- Institutional Bitcoin Adoption: Large corporations and institutional investors are increasingly allocating assets to Bitcoin, viewing it as a hedge against inflation and a store of value.

- Bitcoin ETF: The potential approval of a Bitcoin Exchange-Traded Fund (ETF) could significantly boost liquidity and attract further institutional investment.

- Corporate Bitcoin Holdings: Many publicly traded companies now hold Bitcoin on their balance sheets, signaling growing acceptance and confidence. This increased

corporate Bitcoin holdingsdemonstrates faith in the long-term value of the asset.

Positive Regulatory Developments (if any)

While regulatory uncertainty remains a concern, positive regulatory developments in some jurisdictions could significantly boost investor confidence and drive up the Bitcoin price. For example, clearer regulatory frameworks could help legitimize Bitcoin and reduce risk perception.

Growing User Base and Decentralized Finance (DeFi)

The expanding user base and the growth of Decentralized Finance (DeFi) contribute to Bitcoin's long-term potential.

- Bitcoin Adoption Rate: Increasing global adoption of Bitcoin as a payment method and store of value strengthens its position as a leading cryptocurrency.

- DeFi: The growth of the DeFi ecosystem, with Bitcoin playing a role in some DeFi protocols, could lead to increased demand and price appreciation. The integration of Bitcoin into

Decentralized financesolutions offers new use cases and broader appeal.

Predicting Future Bitcoin Price Movements

Short-Term Predictions

Based on technical and fundamental analysis, a short-term price increase is possible. However, it's crucial to remember that short-term price predictions are inherently speculative. Factors influencing the short-term Bitcoin forecast include news events, trading volume, and overall market sentiment.

Long-Term Outlook

The long-term outlook for Bitcoin remains positive for many analysts, with predictions varying widely. Factors driving the long-term Bitcoin forecast include continued institutional adoption, technological advancements, and increasing global awareness. A long-term Bitcoin investment strategy should consider these factors.

Conclusion

The recent Bitcoin price dip was influenced by a combination of regulatory uncertainty, macroeconomic factors, and market sentiment. However, growing institutional adoption, potential positive regulatory developments, and the expansion of DeFi applications suggest a potential rebound. While short-term price predictions are inherently uncertain, the long-term outlook for Bitcoin remains promising. It’s vital to conduct thorough research and manage risk effectively when investing in Bitcoin. Stay informed about the latest developments affecting the Bitcoin price rebound by following reputable financial news sources and staying updated on market trends. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Xrp Etf Risks Assessing The Impact Of Low Institutional Adoption And Abundant Supply

May 08, 2025

Xrp Etf Risks Assessing The Impact Of Low Institutional Adoption And Abundant Supply

May 08, 2025 -

Cryptocurrencys Resilience Navigating The Trade War

May 08, 2025

Cryptocurrencys Resilience Navigating The Trade War

May 08, 2025 -

Arsenals Transfer Plans Hampered By Dembele Injury News

May 08, 2025

Arsenals Transfer Plans Hampered By Dembele Injury News

May 08, 2025 -

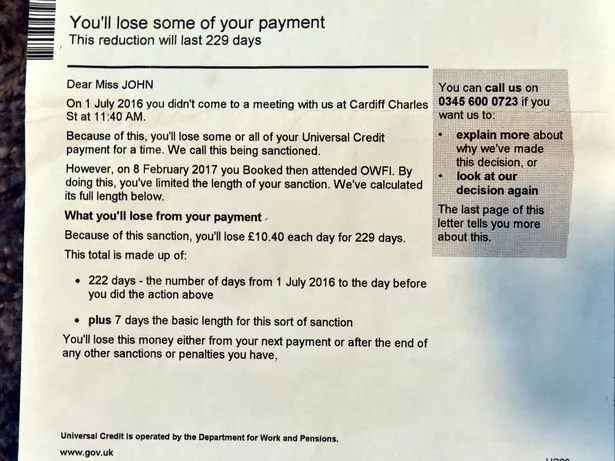

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025

5 Billion Universal Credit Cuts Dwp Refund Details For April And May

May 08, 2025 -

Bitcoin Price Prediction 1 500 Growth In 5 Years

May 08, 2025

Bitcoin Price Prediction 1 500 Growth In 5 Years

May 08, 2025