Bitcoin Price Surge: A 1,500% Forecast And Its Implications

Table of Contents

Analyzing the 1,500% Bitcoin Price Forecast

The prediction of a 1,500% Bitcoin price surge is, understandably, met with both excitement and skepticism. Understanding the basis of this forecast requires examining several key factors.

The Basis of the Forecast

Several factors contribute to this optimistic Bitcoin price prediction:

- Growing institutional investment in Bitcoin: Large financial institutions are increasingly allocating assets to Bitcoin, viewing it as a hedge against inflation and a potential store of value. This institutional adoption significantly increases demand.

- Increased demand from retail investors: The growing awareness and understanding of Bitcoin among retail investors fuels further demand, driving up the price.

- Halving events and Bitcoin's deflationary nature: The Bitcoin halving, which reduces the rate of new Bitcoin creation, creates inherent scarcity, potentially driving up the price over time. This deflationary nature is a key argument for long-term price appreciation.

- Government and central bank policies favoring crypto (in some regions): While regulatory uncertainty remains a concern, some governments are exploring the potential benefits of cryptocurrencies and blockchain technology, potentially fostering a more favorable environment for Bitcoin's growth.

- Technological innovations in the Bitcoin ecosystem: Advancements like the Lightning Network are improving Bitcoin's scalability and transaction speed, making it more attractive for wider adoption.

Challenges and Counterarguments

Despite the bullish outlook, several challenges and counterarguments exist:

- Increased regulatory scrutiny and potential bans: Governments worldwide are grappling with how to regulate cryptocurrencies, with potential for bans or restrictive regulations that could negatively impact the Bitcoin price.

- Market volatility and potential for sharp corrections: Bitcoin's price is notoriously volatile, and sharp corrections are a common occurrence. A 1,500% surge would likely be followed by significant volatility.

- Technological risks and security concerns: While Bitcoin's blockchain technology is secure, vulnerabilities exist, and security breaches could negatively affect investor confidence and the price.

- Competition from alternative cryptocurrencies: The cryptocurrency market is crowded, with numerous altcoins competing for investor attention and market share.

- Environmental concerns related to Bitcoin mining: The energy consumption associated with Bitcoin mining is a growing concern, potentially leading to stricter regulations and impacting its long-term sustainability.

Economic Implications of a Bitcoin Price Surge

A substantial Bitcoin price surge would have profound economic consequences.

Impact on Global Markets

The implications for traditional financial markets are significant:

- Increased volatility in traditional markets: A major Bitcoin price movement could trigger volatility in stock markets, precious metals markets, and fiat currencies as investors reallocate assets.

- Potential flight to safety into Bitcoin: If Bitcoin’s price continues its ascent, investors might seek refuge in Bitcoin, particularly during times of economic uncertainty.

- Shifting investment strategies among institutions: Institutions might adjust their investment portfolios to include a larger allocation to cryptocurrencies, potentially reshaping the landscape of global finance.

- Potential for inflation or deflation depending on the scale: A massive inflow of capital into Bitcoin could potentially impact inflation or deflation depending on the scale and the speed of the price increase.

Influence on National Economies

The impact on national economies would vary significantly:

- Potential for increased tax revenue in countries with strong crypto regulations: Countries with clear and favorable regulations could benefit from increased tax revenue generated by Bitcoin transactions and trading.

- Job creation in the crypto industry and related sectors: A Bitcoin price surge would likely fuel growth in the cryptocurrency industry, creating jobs in development, mining, and related services.

- Economic instability in countries heavily reliant on fiat currencies: Countries heavily reliant on fiat currencies could face economic instability if a significant portion of their population shifts to Bitcoin.

- Geopolitical implications of Bitcoin's decentralized nature: Bitcoin's decentralized nature challenges the traditional power structures of national economies and could have significant geopolitical implications.

Societal Implications of a Massive Bitcoin Price Increase

A dramatic Bitcoin price increase would have wide-ranging societal impacts.

Increased Crypto Adoption and Mainstream Acceptance

Widespread Bitcoin adoption would lead to several significant societal shifts:

- Increased financial literacy and understanding of blockchain technology: Greater Bitcoin adoption would likely lead to increased financial literacy and a broader understanding of blockchain technology.

- Potential for greater financial inclusion: Cryptocurrencies like Bitcoin offer the potential for greater financial inclusion, especially in regions with limited access to traditional banking services.

- Increased demand for crypto-related services and infrastructure: A rise in Bitcoin’s price would fuel demand for various crypto-related services, including wallets, exchanges, and security solutions.

- Potential social inequalities related to access and understanding: The benefits of Bitcoin adoption might not be evenly distributed, potentially exacerbating existing social and economic inequalities.

Ethical Considerations and Potential Risks

A significant Bitcoin price surge also presents ethical concerns and risks:

- Increased risk of scams and fraudulent activities: The price surge could attract fraudulent schemes and scams targeting unsuspecting investors.

- Potential for increased wealth inequality: The benefits of Bitcoin's price increase might not be shared equally, potentially widening the gap between the wealthy and the less fortunate.

- Environmental concerns related to energy consumption: The environmental impact of Bitcoin mining remains a significant concern, and a price surge could further exacerbate this issue.

- Security vulnerabilities and potential for hacking: Increased value makes Bitcoin a more attractive target for hackers, increasing the risk of security breaches and theft.

Conclusion: Bitcoin Price Surge: Navigating the Uncertain Future

The 1,500% Bitcoin price forecast presents a complex picture with both significant opportunities and substantial risks. While factors like institutional adoption and Bitcoin's deflationary nature support the bullish prediction, challenges like regulatory uncertainty, market volatility, and environmental concerns cannot be ignored. The potential economic and societal impacts are equally significant, ranging from shifts in global financial markets to increased financial inclusion, alongside risks of increased inequality and scams. Careful consideration and informed decision-making are crucial. Stay informed about the fluctuating Bitcoin price and its implications by following reputable sources. Understand the risks before investing in Bitcoin. Learn more about the potential of Bitcoin price surges and how to navigate the cryptocurrency market responsibly.

Featured Posts

-

The Long Walk Trailer A Different Kind Of Hamill Performance

May 08, 2025

The Long Walk Trailer A Different Kind Of Hamill Performance

May 08, 2025 -

Improved Trade Relations Washington Responds To Canadas Trade Overtures

May 08, 2025

Improved Trade Relations Washington Responds To Canadas Trade Overtures

May 08, 2025 -

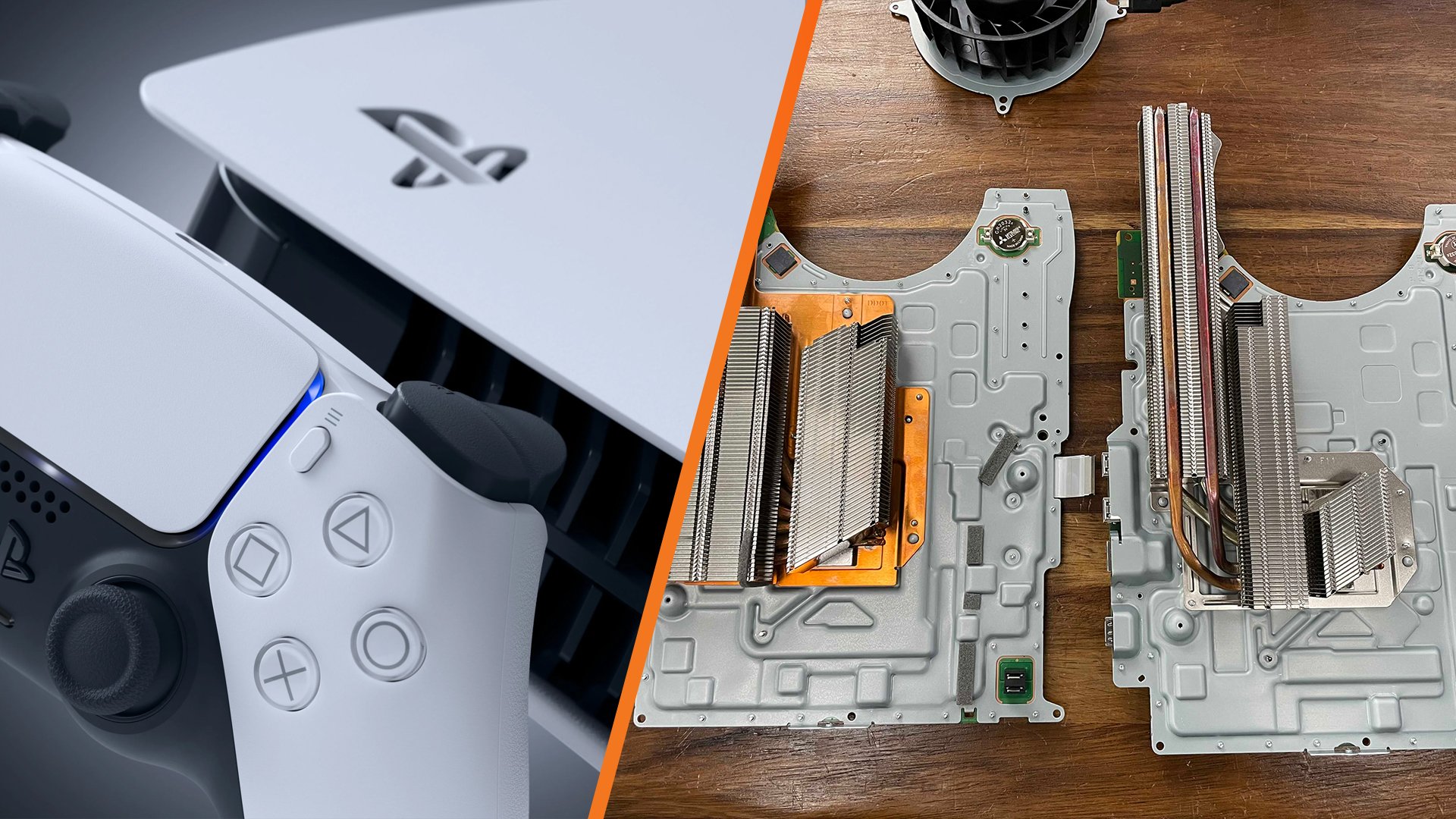

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Cooling

May 08, 2025

Inside The Ps 5 Pro A Detailed Teardown And Analysis Of Its Cooling

May 08, 2025 -

Latest Arsenal News Dembele Injury Casts Doubt On Season

May 08, 2025

Latest Arsenal News Dembele Injury Casts Doubt On Season

May 08, 2025 -

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Detayli Analiz

May 08, 2025

Kripto Para Piyasasinda Kripto Lider In Yuekselisi Detayli Analiz

May 08, 2025