Bitcoin Price Surge: Trade Tensions Boost Crypto Investments

Table of Contents

Trade Wars and Safe Haven Assets

The concept of a safe-haven asset refers to an investment that holds its value or even appreciates during times of economic or political uncertainty. Traditionally, gold has been the go-to safe-haven asset. However, Bitcoin is increasingly viewed as a digital alternative, attracting investors seeking shelter from the storm.

-

Increased uncertainty in traditional markets (stocks, bonds) due to trade wars: The ongoing trade disputes between major global economies have created significant volatility in traditional stock and bond markets. Investors are worried about the potential for prolonged economic slowdowns and are actively seeking ways to protect their portfolios.

-

Investors seeking diversification and protection from geopolitical risks: Diversification is a cornerstone of sound investment strategy. Bitcoin, with its independent nature, offers a way to diversify away from traditional, correlated assets. Its decentralized nature means it's less susceptible to the whims of individual governments or central banks, making it appealing during times of geopolitical instability.

-

Bitcoin's decentralized nature and limited supply make it attractive during times of instability: Unlike fiat currencies, Bitcoin's supply is capped at 21 million coins. This scarcity, coupled with its decentralized network, makes it a compelling alternative to assets vulnerable to inflation or government manipulation.

-

Comparison to gold as a traditional safe-haven asset and how Bitcoin is competing in this space: While gold remains a popular safe haven, Bitcoin offers several advantages, including ease of transfer and 24/7 accessibility. The competition between these two asset classes is ongoing, with Bitcoin carving out its own niche in the market.

Increased Institutional Investment in Bitcoin

The growing interest of institutional investors, including hedge funds and corporations, significantly contributes to the Bitcoin price surge. This influx of capital brings increased legitimacy and liquidity to the cryptocurrency market.

-

Reports on increased Bitcoin holdings by major financial institutions: Numerous reports indicate a rise in Bitcoin holdings by prominent financial institutions, demonstrating a shift in institutional perception of cryptocurrencies.

-

Potential reasons for institutional adoption (diversification, portfolio hedging): Institutions are incorporating Bitcoin into their portfolios for diversification, hedging against inflation, and exploring potential long-term growth opportunities.

-

Impact of institutional investment on Bitcoin's price and liquidity: Large institutional investments increase buying pressure, pushing the Bitcoin price upwards. Increased liquidity makes it easier for investors to buy and sell Bitcoin.

-

Mention specific examples of institutional players entering the Bitcoin market (if available): While specific details are often kept confidential, publicly available information regarding significant institutional investments should be included here, linking to reputable sources.

Regulatory Uncertainty and its Impact

Regulatory uncertainty surrounding cryptocurrencies globally plays a complex role in influencing the Bitcoin price.

-

Discussion of varying regulatory approaches across different countries: Different countries have adopted varying approaches to regulating cryptocurrencies. This lack of a unified global regulatory framework creates both uncertainty and opportunity.

-

The potential impact of clear regulatory frameworks on Bitcoin adoption and price stability: Clearer, more consistent regulations could lead to increased institutional adoption and potentially greater price stability.

-

How uncertainty can both drive and hinder investment in Bitcoin: Regulatory uncertainty can deter some investors while simultaneously attracting others who see potential in a largely unregulated market.

Technical Factors Contributing to the Bitcoin Price Surge

Technical aspects, such as halving events and network upgrades, also play a crucial role in Bitcoin's price fluctuations.

-

Explain the Bitcoin halving and its impact on supply and demand: The Bitcoin halving, which reduces the rate of new Bitcoin creation, directly impacts supply and demand dynamics. Reduced supply with consistent demand often leads to price appreciation.

-

Mention any recent significant technological advancements in the Bitcoin network: Improvements in transaction speed and scalability can contribute to increased adoption and potentially higher prices.

-

Discuss the role of Bitcoin's limited supply in driving price appreciation: The finite supply of Bitcoin (21 million coins) is a key factor driving price appreciation, as demand continues to increase.

Analyzing Future Trends of Bitcoin Price

Predicting Bitcoin's future price is inherently challenging, yet analyzing current trends offers a cautiously optimistic outlook.

-

Considerations for short-term and long-term price predictions: Short-term price movements are often volatile, influenced by market sentiment and news events. Long-term price predictions depend on broader adoption and technological advancements.

-

Potential risks and challenges facing Bitcoin's growth: Regulatory hurdles, security concerns, and competition from other cryptocurrencies pose potential challenges to Bitcoin's growth.

-

The importance of conducting thorough research before investing: Before investing in Bitcoin, it is crucial to conduct thorough research, understand the risks involved, and carefully consider your investment strategy.

Conclusion

The recent Bitcoin price surge is undeniably linked to escalating trade tensions, pushing investors to seek alternative, decentralized assets like Bitcoin. The combination of institutional investment, regulatory uncertainty, and inherent technical factors has contributed to this remarkable growth. While predicting future price movements is inherently speculative, understanding the interplay between global economic events and Bitcoin's characteristics is crucial for navigating this dynamic market. Conduct thorough research and consider your risk tolerance before investing in Bitcoin or any other cryptocurrency. Don't miss out on the potential of this exciting market; stay informed about future Bitcoin price surges and their underlying causes. Learn more about managing your Bitcoin investments and stay updated on the latest Bitcoin price movements.

Featured Posts

-

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

May 08, 2025

Hkd Usd Plummets Hong Kong Dollar Interest Rates Sharpest Drop Since 2008

May 08, 2025 -

Lotto Draw Results Wednesday April 9th Jackpot Numbers

May 08, 2025

Lotto Draw Results Wednesday April 9th Jackpot Numbers

May 08, 2025 -

Lyon Sufre Derrota Local Frente Al Psg

May 08, 2025

Lyon Sufre Derrota Local Frente Al Psg

May 08, 2025 -

Rogue Exiles In Path Of Exile 2 Locations Strategies And Rewards

May 08, 2025

Rogue Exiles In Path Of Exile 2 Locations Strategies And Rewards

May 08, 2025 -

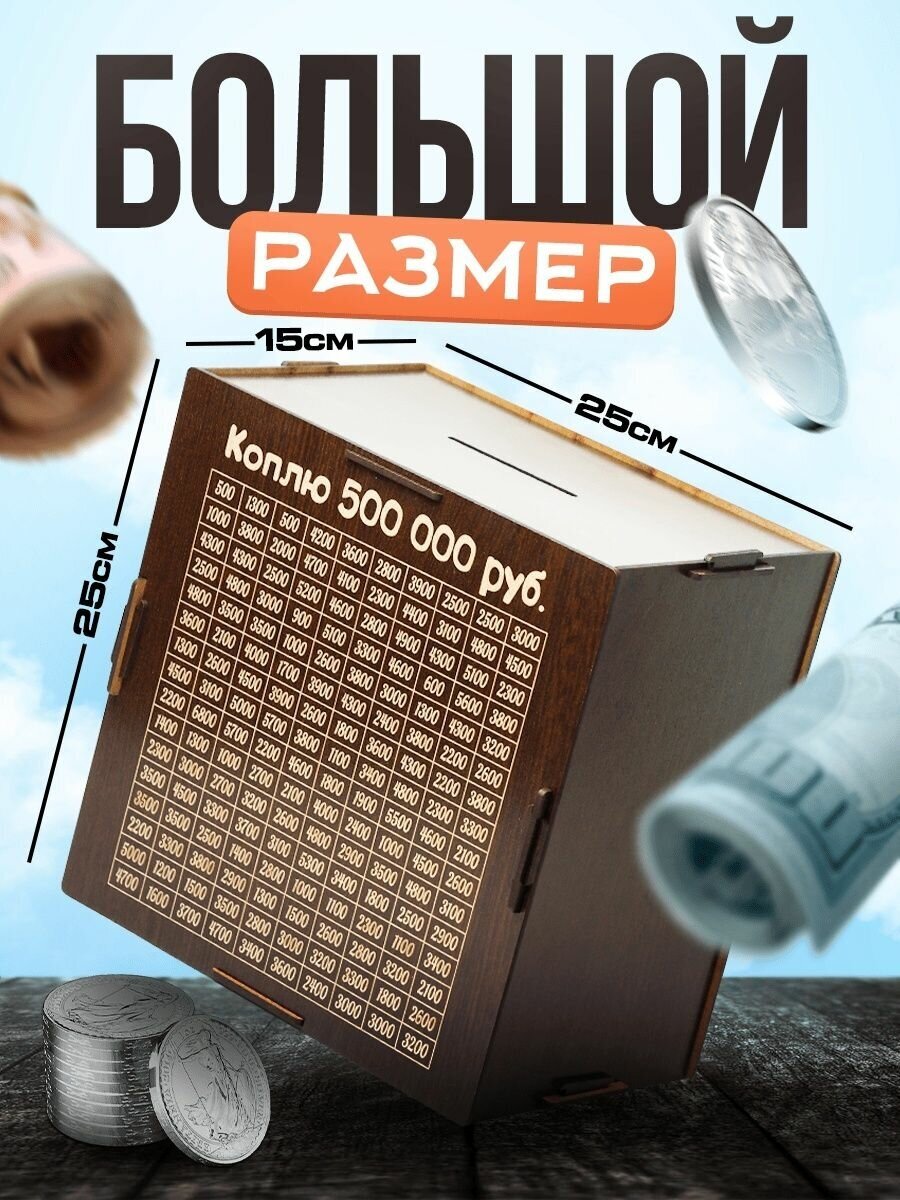

Zenit Predlagaet Zhersonu Kontrakt Na 500 Tysyach Evro Podrobnosti Ot Zhurnalista

May 08, 2025

Zenit Predlagaet Zhersonu Kontrakt Na 500 Tysyach Evro Podrobnosti Ot Zhurnalista

May 08, 2025