Bitcoin Reaches All-Time High On Positive US Regulatory Sentiment

Table of Contents

Positive US Regulatory Developments Boost Bitcoin Confidence

Positive shifts in the US regulatory landscape have played a crucial role in boosting investor confidence and driving the recent Bitcoin all-time high. This newfound confidence is translating into increased investment and market activity.

Grayscale Bitcoin Trust Approval and its Impact

The approval of the Grayscale Bitcoin Trust (GBTC) was a watershed moment. This development has significantly legitimized Bitcoin investment, paving the way for broader institutional participation.

- Increased institutional investment: GBTC's approval opened the doors for large institutional investors, who previously faced hurdles in directly investing in Bitcoin, to gain exposure through a regulated vehicle.

- Improved liquidity: The increased trading volume associated with GBTC has improved Bitcoin's liquidity, making it easier to buy and sell large quantities without significantly impacting the price.

- Reduced regulatory uncertainty: The approval provided clarity regarding the regulatory status of Bitcoin investment products, reducing uncertainty and attracting more institutional investors.

This approval signifies a monumental shift. It signals a move toward the mainstream acceptance of Bitcoin as a legitimate asset class, driving up demand and contributing significantly to the recent Bitcoin all-time high.

Clearer Regulatory Frameworks on the Horizon

While regulations remain a complex and evolving topic, the potential for clearer frameworks is contributing to positive market sentiment.

- Reduced ambiguity: The prospect of clearer regulations reduces uncertainty for investors, making Bitcoin a more attractive investment option.

- Increased investor confidence: A well-defined regulatory environment fosters trust and encourages participation from risk-averse investors.

- Potential for broader adoption: Clear regulations could pave the way for wider adoption of Bitcoin by businesses and individuals, further fueling demand.

The expectation of clearer guidelines, even without their immediate implementation, is a powerful catalyst for increased investment and a key driver behind the current Bitcoin all-time high.

Statements from US Government Officials

Supportive statements from influential figures within the US government have also played a significant role in shaping positive sentiment towards Bitcoin.

- Positive comments on technological innovation: Recognition of Bitcoin's underlying blockchain technology as a significant innovation has boosted its appeal.

- Recognition of Bitcoin as a potential asset class: Statements acknowledging Bitcoin's potential as a store of value and an alternative asset have increased investor confidence.

These pronouncements, even seemingly subtle ones, can significantly influence market perception and encourage further investment, directly contributing to this Bitcoin all-time high.

Increased Institutional Investment Fuels Bitcoin Price Surge

The influx of institutional capital has been a powerful force behind the recent price surge. Large-scale investments are significantly impacting market dynamics.

Major Corporations Adding Bitcoin to their Balance Sheets

Several major corporations have adopted Bitcoin as a strategic reserve asset, demonstrating a growing belief in its long-term potential.

- MicroStrategy: MicroStrategy's significant Bitcoin purchases have become a landmark example of institutional adoption.

- Tesla: Tesla's investment in Bitcoin further cemented its place as a mainstream asset.

- Other notable examples: Other notable companies are following suit, underscoring the increasing confidence in Bitcoin as a valuable asset.

These large-scale investments are not only injecting significant capital into the market but also validating Bitcoin's position as a credible asset for major corporations, a key factor in pushing the Bitcoin all-time high.

Growth of Bitcoin ETFs and Investment Funds

The emergence of Bitcoin ETFs and investment funds has made it significantly easier for investors to participate in the Bitcoin market.

- Increased accessibility for retail investors: These products lower the barrier to entry, allowing retail investors to participate without needing to navigate the complexities of directly purchasing and storing Bitcoin.

- Enhanced liquidity: Increased accessibility through these products further enhances Bitcoin's liquidity, making it easier to trade and reducing price volatility.

This increased accessibility and improved liquidity are directly fueling demand and contributing to this Bitcoin all-time high.

Growing Global Adoption and Demand Drive Bitcoin's All-Time High

Beyond institutional investment, broader global adoption is a fundamental factor in driving Bitcoin's price.

Increased Use of Bitcoin for Payments and Transactions

The growing acceptance of Bitcoin as a medium of exchange is a significant driver of demand.

- Examples of businesses accepting Bitcoin: An increasing number of businesses worldwide are now accepting Bitcoin as payment, broadening its use cases.

- Increased transaction volumes: The rising volume of Bitcoin transactions indicates growing adoption and usage.

This increasing functionality solidifies Bitcoin's position as a viable alternative payment method and further contributes to the Bitcoin all-time high.

Bitcoin's Role as a Hedge Against Inflation

Bitcoin's limited supply and its decentralized nature have led some to view it as a potential hedge against inflation.

- Scarcity of Bitcoin: The fixed supply of 21 million Bitcoins makes it a deflationary asset, potentially protecting against the erosion of purchasing power caused by inflation.

- Potential for value preservation: During periods of economic uncertainty, investors often seek assets that can retain or increase their value, driving demand for Bitcoin.

The macroeconomic environment, characterized by inflationary pressures, is driving increased demand for Bitcoin as a potential safe haven asset, boosting this Bitcoin all-time high.

Conclusion

The recent Bitcoin all-time high is a significant event driven by a confluence of factors, primarily positive US regulatory sentiment and increased institutional adoption. Clearer regulatory frameworks, coupled with the growing acceptance of Bitcoin by major corporations and investors, have resulted in a surge in confidence and demand. This positive momentum suggests a promising future for Bitcoin, though investment in cryptocurrencies inherently carries risks. Stay informed about the latest developments in the Bitcoin market and consider diversifying your portfolio strategically. Continue to monitor news related to Bitcoin all-time high and its implications for the future of cryptocurrency.

Featured Posts

-

Dazi Usa Su Abbigliamento Previsioni Prezzi E Consigli Per Gli Acquisti

May 24, 2025

Dazi Usa Su Abbigliamento Previsioni Prezzi E Consigli Per Gli Acquisti

May 24, 2025 -

Glastonbury 2024 Unconfirmed Us Band Leak Hints At Performance

May 24, 2025

Glastonbury 2024 Unconfirmed Us Band Leak Hints At Performance

May 24, 2025 -

Rehabilitation Of Dreyfus French Parliament Debates 130th Anniversary

May 24, 2025

Rehabilitation Of Dreyfus French Parliament Debates 130th Anniversary

May 24, 2025 -

Is Glastonbury 2025s Lineup The Best Yet Charli Xcx Neil Young And More

May 24, 2025

Is Glastonbury 2025s Lineup The Best Yet Charli Xcx Neil Young And More

May 24, 2025 -

Ihanete Ugrayanlarin Aninda Intikam Alan Burclar

May 24, 2025

Ihanete Ugrayanlarin Aninda Intikam Alan Burclar

May 24, 2025

Latest Posts

-

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

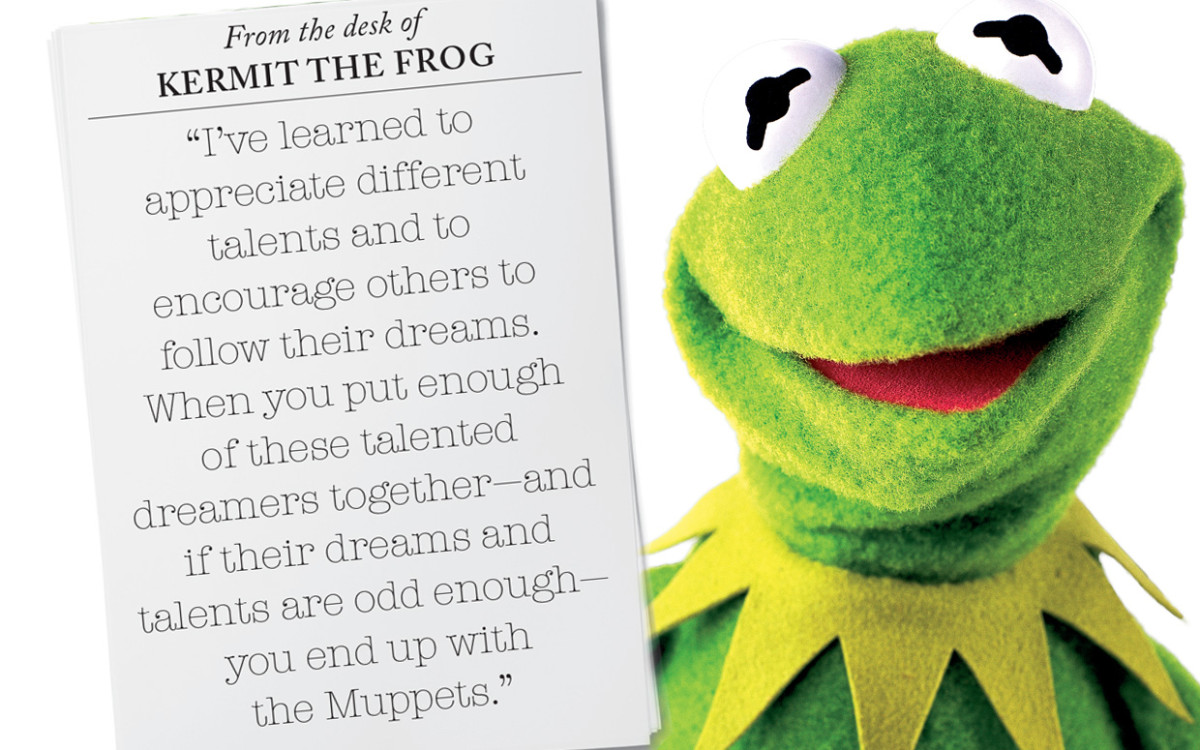

Graduation Inspiration Kermit The Frog At The University Of Maryland

May 24, 2025

Graduation Inspiration Kermit The Frog At The University Of Maryland

May 24, 2025 -

Commencement 2024 University Of Maryland Welcomes Famous Amphibian Speaker

May 24, 2025

Commencement 2024 University Of Maryland Welcomes Famous Amphibian Speaker

May 24, 2025 -

Kermits Words Of Wisdom A Look At His University Of Maryland Speech

May 24, 2025

Kermits Words Of Wisdom A Look At His University Of Maryland Speech

May 24, 2025 -

University Of Maryland Graduation Kermit The Frogs Motivational Message

May 24, 2025

University Of Maryland Graduation Kermit The Frogs Motivational Message

May 24, 2025