Bitcoin's 10x Multiplier: A Wall Street Disruptor?

Table of Contents

Bitcoin's Technological Advantages and Scarcity as Catalysts for Growth

Bitcoin's inherent characteristics lay a strong foundation for its potential price surge. Two crucial elements stand out: its technological innovation and its inherent scarcity.

Decentralization and Security

Bitcoin operates on a decentralized, peer-to-peer network known as the blockchain. This revolutionary technology eliminates single points of failure and the potential for manipulation inherent in centralized systems controlled by banks or governments.

- Blockchain Technology: A distributed ledger recording all Bitcoin transactions, ensuring transparency and immutability.

- Immutability: Once a transaction is recorded on the blockchain, it cannot be altered or reversed, enhancing security and trust.

- Enhanced Security: The decentralized nature of Bitcoin makes it extremely resistant to censorship and hacking attempts, unlike traditional financial systems vulnerable to single points of failure.

This robust security and lack of central control are key to Bitcoin's appeal, attracting investors seeking a more secure and transparent financial system.

Limited Supply and Increasing Demand

Unlike fiat currencies that can be printed at will, Bitcoin has a fixed supply of 21 million coins. This inherent scarcity is a fundamental driver of its potential value appreciation. As demand grows, and the supply remains constant, the price inevitably rises.

- Institutional Adoption: Major corporations like MicroStrategy and Tesla have made significant Bitcoin investments, signaling growing acceptance among institutional investors.

- Growing Global Awareness: Increasing mainstream understanding of Bitcoin's potential is fueling demand from both individuals and institutions.

- Hedge Against Inflation: Many view Bitcoin as a hedge against inflation, further driving demand during times of economic uncertainty.

The combination of limited supply and accelerating demand creates a powerful upward pressure on price, making a Bitcoin 10x multiplier a conceivable scenario.

Institutional Adoption and Growing Mainstream Acceptance

The growing acceptance of Bitcoin by major players and the evolving regulatory landscape are further contributing factors.

Major Players Entering the Crypto Space

The entrance of major financial institutions into the cryptocurrency market is a significant endorsement of Bitcoin's legitimacy.

- MicroStrategy: A significant holder of Bitcoin, demonstrating confidence in its long-term potential.

- Tesla: Elon Musk's company's investment further propelled Bitcoin into the mainstream consciousness.

- Other Institutional Investors: Numerous hedge funds, asset management firms, and family offices are now actively investing in Bitcoin.

This institutional adoption not only adds to the demand but also lends credibility to Bitcoin, making it a more attractive investment for a broader range of investors.

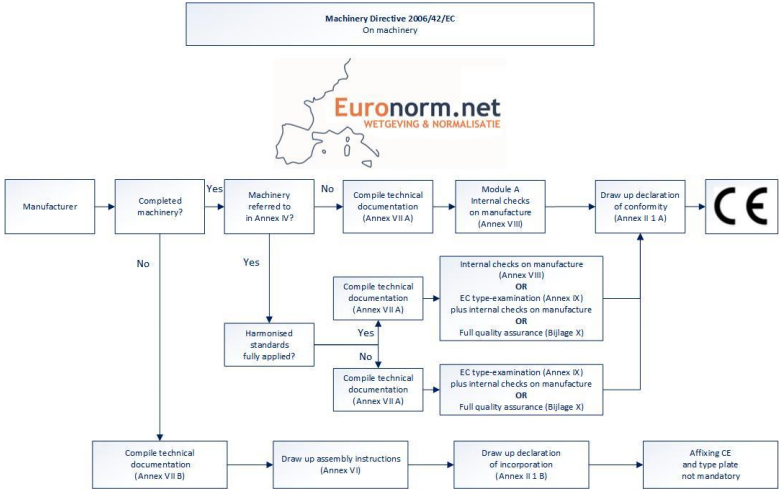

Regulatory Developments and Their Impact

The regulatory landscape surrounding cryptocurrencies is still evolving, but the trend suggests increasing clarity and acceptance.

- Gradual Regulatory Frameworks: Many countries are developing specific regulations for cryptocurrencies, fostering a more predictable and stable environment.

- Increased Regulatory Clarity: Clearer regulations reduce uncertainty, encouraging greater institutional involvement and potentially driving up the price.

- Potential for Positive Impact: Well-defined regulations can increase investor confidence and improve market liquidity.

While regulatory uncertainty can still present challenges, the overall trend points toward a more regulated and accepted crypto market, benefiting Bitcoin in the long run.

Bitcoin as a Hedge Against Inflation and Economic Uncertainty

Bitcoin's characteristics make it a compelling asset for those seeking protection against economic instability.

Safe Haven Asset Potential

Bitcoin's decentralized nature and limited supply offer a potential alternative to traditional assets, particularly during periods of economic turbulence.

- Inflation Protection: Bitcoin's finite supply makes it a potential hedge against the inflationary pressures that erode the value of fiat currencies.

- Economic Uncertainty: During times of economic uncertainty, investors often seek assets perceived as safe havens, increasing demand for Bitcoin.

- Historical Price Movements: Bitcoin's price has historically shown a positive correlation with periods of increased economic uncertainty and inflation.

Macroeconomic Factors Driving Bitcoin's Value

Global macroeconomic trends significantly impact Bitcoin's price.

- Inflationary Pressures: Rising inflation in various countries fuels demand for Bitcoin as an inflation hedge.

- Geopolitical Instability: Geopolitical events can trigger a flight to safety, benefiting Bitcoin as a decentralized, less susceptible asset.

- Monetary Policy Changes: Changes in central bank policies can impact Bitcoin's price, often positively during periods of quantitative easing or unconventional monetary measures.

These macroeconomic factors can significantly contribute to a potential Bitcoin 10x multiplier.

Conclusion: Bitcoin's 10x Multiplier – A Realistic Possibility?

The possibility of a Bitcoin 10x multiplier is not simply speculation. Its technological advantages, growing institutional adoption, and its role as a hedge against inflation all support this potential. While volatility remains a risk, and regulatory uncertainty persists, the overall trend suggests increasing acceptance and potential for significant price appreciation. Is a Bitcoin 10x multiplier on the horizon? Learn more about Bitcoin's potential and start exploring your investment options today! Remember to always conduct thorough research and invest responsibly.

Featured Posts

-

Expanding Horizons Psg Opens State Of The Art Labs In Doha

May 08, 2025

Expanding Horizons Psg Opens State Of The Art Labs In Doha

May 08, 2025 -

Building Trust In The Age Of Crypto A Guide To Reliable News Sources

May 08, 2025

Building Trust In The Age Of Crypto A Guide To Reliable News Sources

May 08, 2025 -

Xrp Ripple Investment A Path To Financial Independence

May 08, 2025

Xrp Ripple Investment A Path To Financial Independence

May 08, 2025 -

Strategies For Expediting Crime Control A Directive Approach

May 08, 2025

Strategies For Expediting Crime Control A Directive Approach

May 08, 2025 -

Gewinnzahlen Lotto 6aus49 Mittwoch 09 04 2025 Jetzt Pruefen

May 08, 2025

Gewinnzahlen Lotto 6aus49 Mittwoch 09 04 2025 Jetzt Pruefen

May 08, 2025