Bitcoin's Future: Analyzing The Potential Impact Of Trump's Economic Agenda

Table of Contents

Trump's Deregulatory Approach and its Effect on Bitcoin

Trump's administration championed a deregulatory approach across many sectors. This has significant implications for Bitcoin and the broader cryptocurrency market.

Reduced Regulatory Uncertainty

A less regulated environment could be a boon for Bitcoin adoption.

- Increased Institutional Investment: Reduced regulatory uncertainty could encourage institutional investors, like hedge funds and pension funds, to allocate a portion of their portfolios to Bitcoin, leading to increased market capitalization and price stability.

- Clearer Legal Frameworks: While a completely unregulated environment presents risks, clearer legal frameworks governing cryptocurrencies in the US could provide much-needed structure and transparency, attracting more legitimate businesses and investors.

- Increased Mainstream Adoption: Less regulatory scrutiny may attract more mainstream adoption, as individuals and businesses feel more comfortable using and investing in Bitcoin.

- Price Stabilization: Increased clarity and a more structured regulatory landscape could potentially lead to a more stable Bitcoin price, reducing extreme volatility.

Potential for Increased Financial Instability

However, deregulation also presents significant downsides.

- Increased Market Volatility: A lack of regulatory oversight could lead to increased market volatility, making Bitcoin an even riskier investment. Sudden price swings could become more frequent and extreme.

- Rise of Scams and Fraudulent Activities: A less regulated environment could create fertile ground for scams and fraudulent activities within the cryptocurrency space, potentially harming unsuspecting investors.

- Market Manipulation: Lack of robust oversight increases the chances of market manipulation by large players, potentially distorting Bitcoin's true value.

- Investor Caution: Investors need to be significantly more discerning and cautious in a less regulated environment, conducting thorough due diligence before making any investment decisions.

Inflation and Bitcoin as a Hedge

Trump's economic policies, including significant fiscal spending, raised concerns about potential inflation. This could impact Bitcoin's value.

Impact of Fiscal Policies on Inflation

Trump's fiscal policies, characterized by tax cuts and increased government spending, could potentially lead to higher inflation rates in the US and globally.

- Bitcoin as an Inflation Hedge: Bitcoin, as a decentralized and limited asset (21 million total Bitcoin), could act as a hedge against inflation. During periods of rising inflation, investors might turn to Bitcoin as a store of value, preserving their purchasing power.

- Increased Demand and Price: Increased demand for Bitcoin as an inflation hedge could drive up its price, making it a potentially lucrative investment during inflationary periods.

The Role of the US Dollar

The value of the US dollar is intrinsically linked to Bitcoin's price.

- Dollar Strength and Bitcoin Demand: The strength of the US dollar is a key factor influencing Bitcoin's price. A strong dollar might decrease Bitcoin's demand as investors prefer holding the more stable currency.

- Dollar Weakness and Bitcoin Appeal: Conversely, a weaker dollar could increase Bitcoin's appeal as an alternative currency or a safe haven asset, potentially boosting its price. Trump's policies had a direct impact on the dollar's value, influencing Bitcoin indirectly.

Geopolitical Factors and Bitcoin's Role

Trump's foreign policy and trade actions created significant geopolitical uncertainty. This impacted Bitcoin's position in the global financial landscape.

Trade Wars and Global Uncertainty

Trade disputes and protectionist policies initiated under Trump's administration created global economic uncertainty.

- Bitcoin as a Safe Haven Asset: During times of geopolitical instability and economic uncertainty, Bitcoin might benefit as a safe haven asset. Investors may flock to Bitcoin, seeking a store of value outside traditional financial systems.

- Increased Demand and Price: Increased demand during such periods could boost Bitcoin's price, making it a potentially profitable investment during times of crisis.

International Adoption of Cryptocurrency

Trump's foreign policy and interactions with other nations could influence their attitudes towards cryptocurrencies.

- International Adoption and Market Capitalization: Increased international adoption of Bitcoin could significantly impact its market capitalization and overall value. Positive relationships with crypto-friendly nations could be beneficial.

- Strained Relations and Negative Impact: Conversely, strained relations with major global economies could negatively impact Bitcoin's growth and adoption.

Conclusion

Trump's economic legacy continues to influence global markets, including the cryptocurrency sector. His policies, characterized by deregulation and fiscal expansion, hold significant implications for Bitcoin’s future. While deregulation could potentially boost institutional investment and clarity, it also carries risks. The potential for inflation might strengthen Bitcoin's role as a hedge, but the strength of the US dollar remains a crucial factor. Geopolitical factors significantly impact Bitcoin's trajectory. Understanding the interplay of these factors is crucial for navigating the complexities of Bitcoin investing. Stay informed about developments in the world of Bitcoin and its relationship to prevailing economic policies for making informed investment decisions about Bitcoin.

Featured Posts

-

Wynne Evans Go Compare Advert Future Uncertain After Strictly Controversy

May 09, 2025

Wynne Evans Go Compare Advert Future Uncertain After Strictly Controversy

May 09, 2025 -

Inter Milan Eyeing De Ligt Loan Move From Man United

May 09, 2025

Inter Milan Eyeing De Ligt Loan Move From Man United

May 09, 2025 -

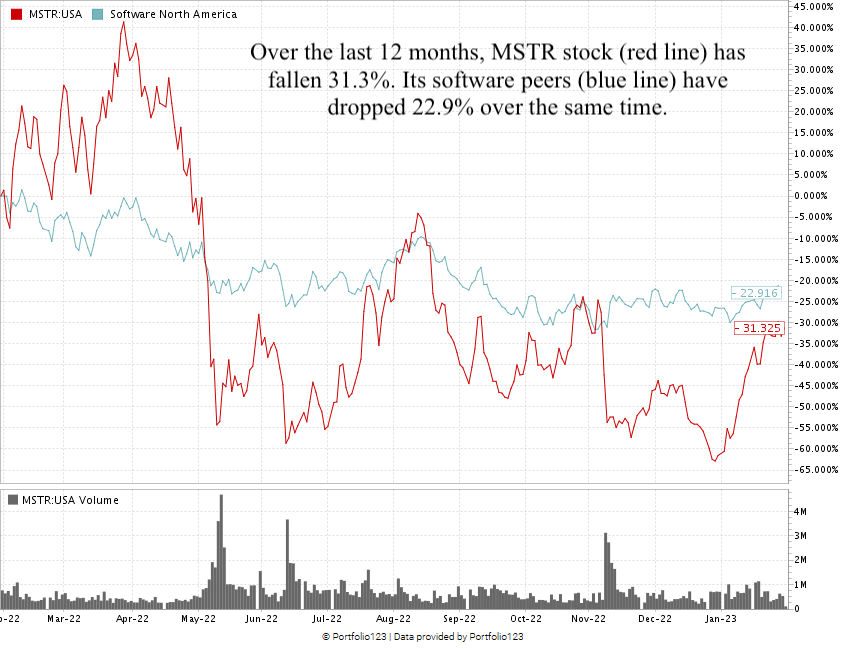

Micro Strategy Competitor A Deep Dive Into The Latest Spac Investment Frenzy

May 09, 2025

Micro Strategy Competitor A Deep Dive Into The Latest Spac Investment Frenzy

May 09, 2025 -

Jeanine Pirro On El Salvador Deportations A Due Process Debate

May 09, 2025

Jeanine Pirro On El Salvador Deportations A Due Process Debate

May 09, 2025 -

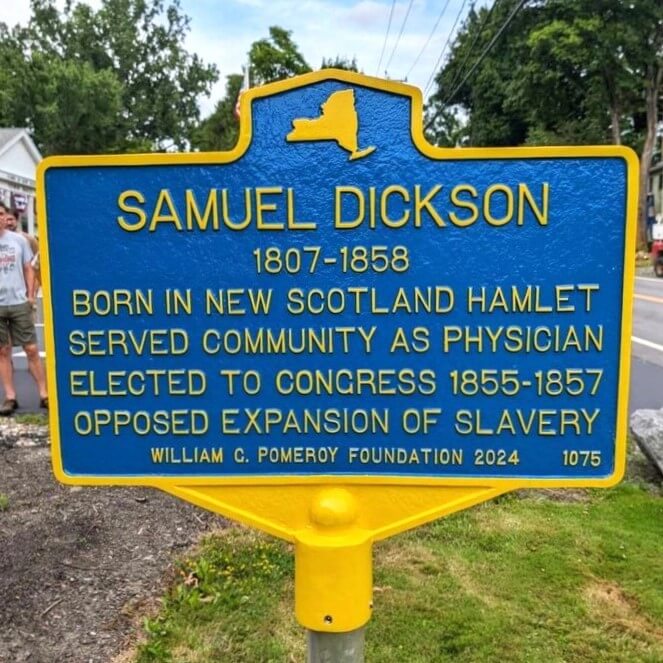

Samuel Dickson Industrialist And Pioneer Of The Canadian Lumber Industry

May 09, 2025

Samuel Dickson Industrialist And Pioneer Of The Canadian Lumber Industry

May 09, 2025