Bitcoin's Record High: Fueled By US Regulatory Optimism

Table of Contents

The Impact of Grayscale's Legal Victory on Bitcoin's Price

Grayscale Investments' legal victory against the Securities and Exchange Commission (SEC) has sent shockwaves through the cryptocurrency market, significantly impacting Bitcoin's price. This landmark ruling, which overturned the SEC's rejection of Grayscale's application to convert its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF, is widely viewed as a major step towards greater regulatory clarity and legitimacy for Bitcoin in the US.

-

Details of the Grayscale vs. SEC lawsuit: Grayscale challenged the SEC's inconsistent treatment of Bitcoin-related investment products, arguing that the rejection of their ETF application was arbitrary and capricious. The court agreed, highlighting the SEC's flawed reasoning and potentially opening the door for future Bitcoin ETF approvals.

-

Impact on institutional investor confidence: The ruling has significantly boosted confidence among institutional investors, who have been hesitant to invest heavily in Bitcoin due to regulatory uncertainty. This increased confidence is expected to lead to greater institutional investment in the Bitcoin market.

-

Potential for increased Bitcoin ETF approvals: The court's decision sets a powerful precedent, increasing the likelihood that other Bitcoin ETF applications will be approved by the SEC. The availability of Bitcoin ETFs on major exchanges would dramatically increase accessibility and liquidity, potentially driving further price appreciation.

-

Short-term and long-term effects on Bitcoin price: The short-term impact has been a noticeable price surge. The long-term effects could be even more profound, as increased institutional investment and greater accessibility could lead to sustained price growth and increased market capitalization for Bitcoin.

Increased Institutional Adoption and Bitcoin's Future

The growing interest of institutional investors in Bitcoin is another key driver of its recent record high. Hedge funds, corporations, and even sovereign wealth funds are increasingly viewing Bitcoin as a valuable asset for diversification and portfolio management.

-

Examples of major companies investing in or using Bitcoin: Companies like MicroStrategy and Tesla have made significant Bitcoin investments, demonstrating a growing acceptance of Bitcoin as a legitimate asset class. Others are exploring its use for payments and treasury management.

-

The role of Bitcoin as a hedge against inflation: Many investors see Bitcoin as a potential hedge against inflation, especially in times of economic uncertainty. Its limited supply and decentralized nature make it an attractive alternative to traditional fiat currencies.

-

The impact of macroeconomic factors on institutional investment in Bitcoin: Macroeconomic conditions, such as inflation rates, interest rate hikes, and geopolitical instability, significantly influence institutional investment decisions regarding Bitcoin.

Navigating the Regulatory Landscape in the US and its Effect on Bitcoin

The regulatory environment for cryptocurrencies in the US is constantly evolving, and this dynamic landscape significantly impacts Bitcoin's price. While increased regulatory clarity is generally positive, uncertainty can lead to volatility.

-

Discussion of potential future regulations and their likely impact on Bitcoin: Future regulations could include stricter rules on KYC/AML compliance, taxation, and stablecoin regulation. The impact on Bitcoin will depend on the specific nature of these regulations.

-

Comparison of the US regulatory landscape with other countries: The US regulatory approach differs from that of other countries, such as El Salvador, which has embraced Bitcoin as legal tender. This difference can influence investment flows and price fluctuations.

-

The role of lobbying efforts by cryptocurrency companies: Cryptocurrency companies are actively engaging in lobbying efforts to influence the regulatory landscape and advocate for policies that support the growth of the industry.

Technical Analysis: Understanding Bitcoin's Recent Price Movements

Technical analysis offers insights into Bitcoin's price movements, though it's crucial to remember that it's not a perfect predictor. Examining Bitcoin charts and technical indicators can provide a potential context for recent price action.

-

Mention key technical indicators (e.g., moving averages, RSI): Analyzing moving averages, Relative Strength Index (RSI), and other indicators can help identify potential trends, support and resistance levels, and potential overbought or oversold conditions.

-

Discuss support and resistance levels: Identifying key support and resistance levels on Bitcoin charts can provide insights into potential price reversals or breakouts.

-

Caution against relying solely on technical analysis: Technical analysis should be used in conjunction with fundamental analysis and other factors to develop a comprehensive understanding of Bitcoin's price movements. It's not a foolproof method for predicting future prices.

Bitcoin's Record High and the Path Forward

Bitcoin's recent record high is a testament to the growing acceptance of cryptocurrencies, driven by increased institutional adoption and positive developments regarding US regulatory optimism. Grayscale's legal victory, the ongoing interest from institutional investors, and the evolving regulatory landscape all played significant roles in this price surge.

Key Takeaways:

- Grayscale's win against the SEC significantly boosted Bitcoin's legitimacy and potential.

- Increased institutional adoption is a major driver of Bitcoin's price appreciation.

- The evolving US regulatory landscape, while presenting challenges, also offers opportunities.

- Technical analysis provides valuable context but should not be the sole basis for investment decisions.

Call to Action: Stay updated on the latest developments regarding Bitcoin's price and the evolving US regulatory landscape. Understanding these factors will be crucial for navigating the exciting future of Bitcoin. Continuously monitor Bitcoin price analysis and news related to Bitcoin regulation and institutional investment in Bitcoin to make informed decisions in this dynamic market.

Featured Posts

-

Away Win For Zimbabwe Breaking The 2021 Drought In Sylhet

May 23, 2025

Away Win For Zimbabwe Breaking The 2021 Drought In Sylhet

May 23, 2025 -

Phase Eight Midi Skirt This Mornings Must Have Fashion Item

May 23, 2025

Phase Eight Midi Skirt This Mornings Must Have Fashion Item

May 23, 2025 -

New French Language Content Quotas For Quebec Streaming Platforms

May 23, 2025

New French Language Content Quotas For Quebec Streaming Platforms

May 23, 2025 -

Kevin Pollaks Tulsa King Season 3 Role A Threat To Dwight Manfredi

May 23, 2025

Kevin Pollaks Tulsa King Season 3 Role A Threat To Dwight Manfredi

May 23, 2025 -

Brundles Revelation Disturbing Facts About Lewis Hamilton

May 23, 2025

Brundles Revelation Disturbing Facts About Lewis Hamilton

May 23, 2025

Latest Posts

-

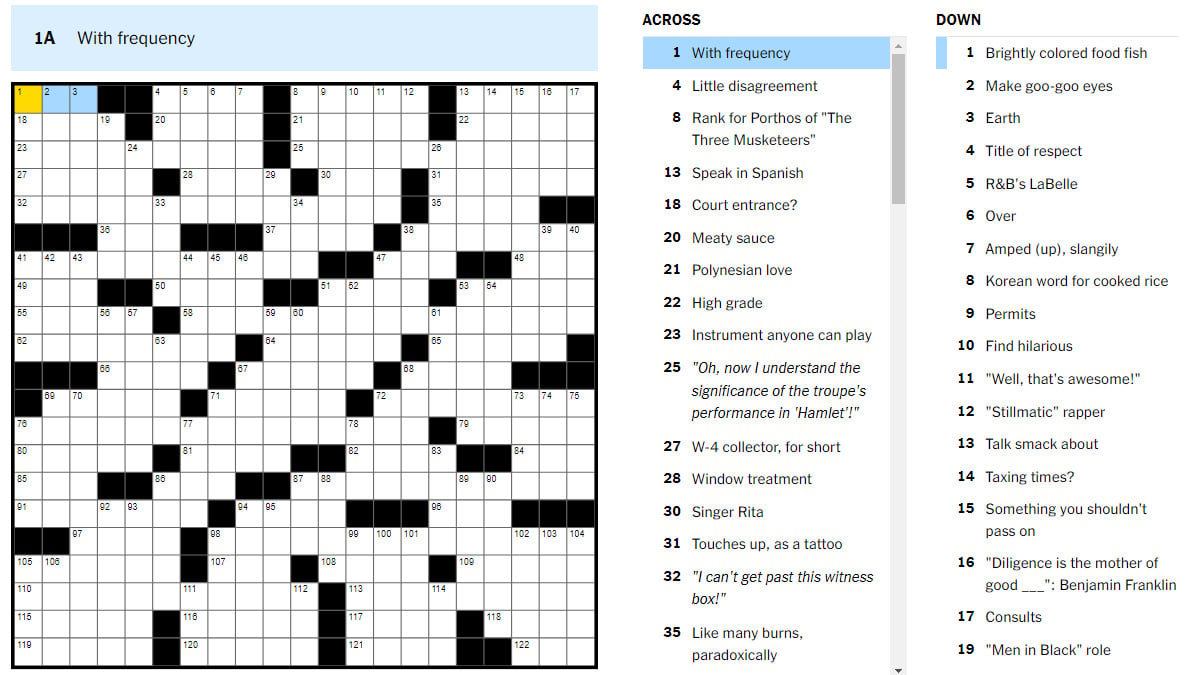

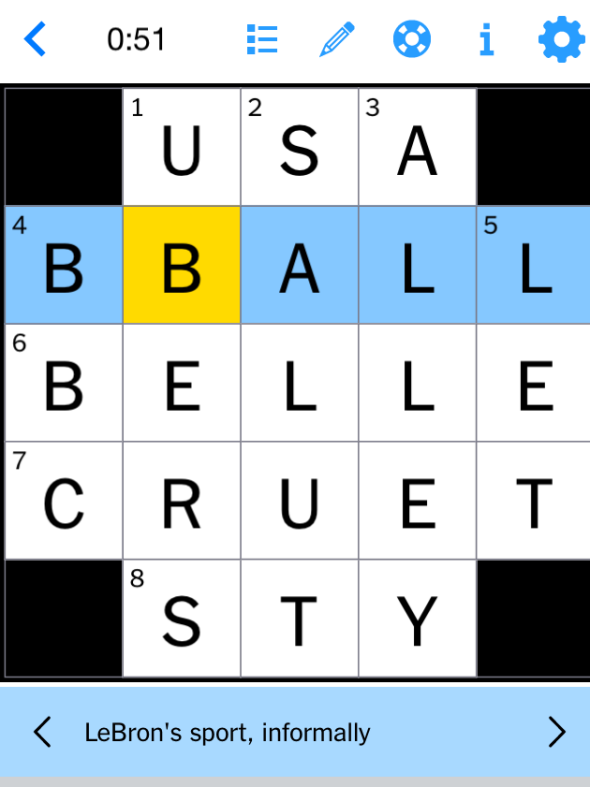

Nyt Mini Crossword Solutions March 12 2025

May 23, 2025

Nyt Mini Crossword Solutions March 12 2025

May 23, 2025 -

March 26 2025 Nyt Mini Crossword Clues Answers And Solutions

May 23, 2025

March 26 2025 Nyt Mini Crossword Clues Answers And Solutions

May 23, 2025 -

Solve The Nyt Mini Crossword March 12 2025 Answers And Hints

May 23, 2025

Solve The Nyt Mini Crossword March 12 2025 Answers And Hints

May 23, 2025 -

Nyt Mini Crossword Answers For March 26 2025 Complete Solutions

May 23, 2025

Nyt Mini Crossword Answers For March 26 2025 Complete Solutions

May 23, 2025 -

March 12 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025

March 12 2025 Nyt Mini Crossword Solutions And Clues

May 23, 2025