BlackRock ETF: Billionaire Investment Strategy For 2025 And Beyond

Table of Contents

Understanding BlackRock's ETF Dominance

BlackRock's iShares brand is synonymous with ETFs. They command a significant market share, setting the benchmark for innovation and accessibility within the ETF landscape. Their extensive catalog covers a broad spectrum of asset classes, from the widely popular iShares Core US Aggregate Bond ETF (AGG) to the benchmark-tracking iShares Core S&P 500 ETF (IVV). This breadth allows for comprehensive diversification strategies, catering to a wide range of investor risk tolerances and investment goals. BlackRock's reputation is built on years of experience, rigorous research, and a commitment to providing investors with high-quality, low-cost investment vehicles.

- Market Share Statistics: BlackRock consistently holds the largest market share globally in the ETF industry, often exceeding 30%. Precise figures fluctuate but consistently illustrate their dominance.

- Examples of Flagship BlackRock ETFs: Beyond AGG and IVV, consider iShares MSCI Emerging Markets ETF (EEM) for exposure to developing economies, or sector-specific ETFs like those focusing on technology or healthcare.

- Key Innovations Introduced by BlackRock: BlackRock has been instrumental in developing innovative ETF structures, including smart beta and factor-based ETFs, which aim to enhance returns while managing risk.

Analyzing Billionaire Portfolio Holdings in BlackRock ETFs

While precise details of billionaire investment portfolios are often confidential, publicly available information suggests a significant allocation to BlackRock ETFs. The rationale behind this is clear: ETFs offer diversification, liquidity, and cost-effectiveness, all attractive features for sophisticated investors managing large sums of money. Billionaires likely utilize BlackRock ETFs as a core component of their diversified investment strategy, often incorporating a mix of broad market, sector-specific, and international ETFs.

- Examples of Billionaires Known to Invest in BlackRock ETFs (if available and verifiable): Due to privacy concerns, pinpointing specific billionaires and their holdings is challenging. However, the prevalence of BlackRock ETFs in institutional portfolios suggests significant billionaire holdings.

- Specific BlackRock ETFs Held in These Portfolios (if available and verifiable): Similar to the above, precise details are generally not publicly available.

- Analysis of Diversification Strategies: Billionaires likely utilize BlackRock ETFs to achieve geographic and asset class diversification, mitigating risk across their portfolio.

BlackRock ETFs for Long-Term Growth in 2025 and Beyond

BlackRock ETFs offer compelling prospects for long-term growth. By strategically allocating to ETFs tracking various sectors and asset classes, investors can position themselves to benefit from future market trends. For instance, tech ETFs could capitalize on ongoing technological advancements, while emerging markets ETFs might profit from the growth of developing economies. However, it's crucial to acknowledge potential risks. Market volatility, geopolitical events, and economic downturns can impact ETF performance.

- Specific ETF Examples with Growth Potential: iShares Global Clean Energy ETF (ICLN) represents a bet on renewable energy, while iShares Robotics and Artificial Intelligence Multisector ETF (IRBO) focuses on innovative technologies.

- Long-Term Investment Strategies Using BlackRock ETFs: Dollar-cost averaging and strategic rebalancing are recommended approaches for long-term success with BlackRock ETFs.

- Risk Assessment and Diversification Considerations: Diversifying across different asset classes and geographies within BlackRock's ETF offerings is crucial for mitigating risk.

Accessing BlackRock ETFs: A Practical Guide

Investing in BlackRock ETFs is straightforward. You'll need a brokerage account with access to ETF trading. Most major brokerage firms offer this capability. Remember to carefully review the expense ratios and fees associated with each ETF and your brokerage account. BlackRock's website (www.blackrock.com) provides detailed information on their ETF offerings.

- Step-by-Step Guide for Purchasing BlackRock ETFs: Open a brokerage account, research desired ETFs, place a buy order specifying the number of shares.

- Comparison of Fees Across Different Brokerages: Brokerage fees and ETF expense ratios should be considered when choosing a platform.

- Links to Useful Resources: [Link to a reputable brokerage (replace with actual link)].

Conclusion: Unlocking Billionaire Investment Strategies with BlackRock ETFs

BlackRock ETFs offer a compelling pathway to diversify your portfolio, gain access to a broad range of asset classes, and potentially achieve long-term growth. Their low cost, accessibility, and the vast selection offered by BlackRock make them an attractive choice for investors of all levels, mirroring the strategies employed by sophisticated investors. Start exploring the world of BlackRock ETFs today and build a portfolio aligned with successful investment strategies for 2025 and beyond!

Featured Posts

-

Lotto Draw Results Wednesday April 9th Jackpot Numbers

May 08, 2025

Lotto Draw Results Wednesday April 9th Jackpot Numbers

May 08, 2025 -

The Rise Of Deadly Fungi A Looming Superbug Crisis

May 08, 2025

The Rise Of Deadly Fungi A Looming Superbug Crisis

May 08, 2025 -

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025

Dwp Universal Credit Refunds April And May Payments After 5 Billion Cuts

May 08, 2025 -

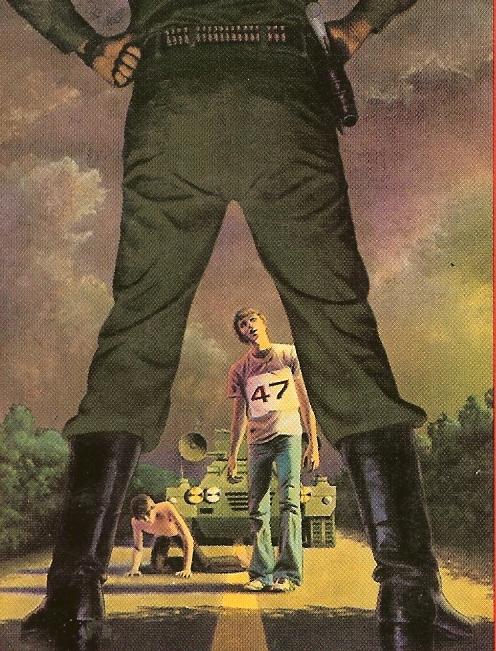

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025 -

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025

Ps Zh Aston Villa Istoriya Protistoyan U Yevrokubkakh

May 08, 2025