BMO Survey: Recession Concerns Halt Canadian Home Purchases

Table of Contents

Key Findings of the BMO Survey

The BMO survey, conducted in [Insert Month, Year] with a sample size of [Insert Sample Size] Canadian adults representing a cross-section of potential homebuyers, employed [Insert Methodology, e.g., online questionnaires, telephone interviews]. The results paint a concerning picture for the Canadian housing market, highlighting a significant decrease in buyer confidence and activity.

Decreased Buyer Confidence

The survey revealed a [Insert Percentage]% decrease in buyer confidence compared to the previous [Insert Time Period, e.g., quarter, year]. This decline is primarily attributed to several key factors cited by respondents:

- Rising Interest Rates: The Bank of Canada's aggressive interest rate hikes have significantly increased mortgage costs, making homeownership less affordable for many Canadians.

- High Inflation: Persistent inflation is eroding purchasing power and reducing consumer confidence, leading to greater hesitancy in making large financial commitments like buying a home.

- Job Security Concerns: Uncertainty surrounding the job market, with potential layoffs and economic slowdown looming, is causing many to postpone major purchases such as a home.

- Economic Uncertainty: The overall sense of economic instability is contributing to a wait-and-see approach amongst prospective buyers.

Statistics show a [Insert Percentage]% decline in purchase intentions among survey respondents, indicating a substantial slowdown in the Canadian housing market driven by recession concerns.

Impact on Different Housing Segments

The BMO survey also analyzed the impact of recession concerns across different housing segments. The data suggests that:

- Condos: The condo market appears to be [More/Less] affected than the detached home market, potentially due to [Explain reason, e.g., lower price point, higher rental demand].

- Price Ranges: The impact of recession concerns is more pronounced in the [Higher/Lower] price ranges, suggesting that affordability is a key driver of the current market slowdown. [Include data on price segment impact if available].

- Regional Variations: [Discuss any regional differences revealed in the survey data. For example: "The impact on home purchases appears to be more significant in [Region] compared to [Region], potentially due to [Explain reason, e.g., regional economic factors, differences in housing supply]".]

[Include charts or graphs here, if data is available, visually representing the impact across different segments.]

Increased Seller Hesitancy

The BMO survey also indicated a notable increase in seller hesitancy. Many homeowners are reluctant to list their properties due to the decreased buyer demand. This hesitation is reflected in:

- Reduced Listing Volumes: The number of homes listed for sale has [Increased/Decreased] significantly, indicating a less active seller market.

- Shifts in Pricing Strategies: Some sellers are adjusting their pricing strategies, becoming more open to negotiations to attract buyers in a slower market. There is a clear correlation between buyer hesitancy and seller behavior, creating a more balanced, but still relatively slow, market.

Economic Factors Fueling Recession Concerns

The current state of the Canadian economy plays a pivotal role in shaping the housing market's trajectory. Several key economic factors are fueling recession concerns and impacting home purchase decisions.

Inflation and Interest Rate Hikes

The Bank of Canada's interest rate hikes, aimed at curbing inflation, have made mortgages significantly more expensive. This has reduced affordability and dampened buyer enthusiasm.

- Mortgage Affordability: The increase in interest rates translates directly into higher monthly mortgage payments, making homeownership less accessible for many.

- Consumer Spending: Inflation is impacting consumer spending habits, leading to reduced disposable income and increased caution around major purchases.

- Inflation Rate and Interest Rate Changes: [Include relevant statistics on inflation rates and interest rate changes, providing context and impact].

Job Market Uncertainty

The job market's health significantly influences consumer confidence and homebuying decisions.

- Unemployment Rates: [Include statistics on current unemployment rates and job growth forecasts].

- Job Security: Concerns about job security are making potential homebuyers hesitant to commit to a large financial obligation like a mortgage. A perception of insecurity often leads to a delay in purchasing.

Potential Implications for the Canadian Housing Market

The BMO survey’s findings have significant implications for the Canadian housing market in both the short and long term.

Short-Term Market Slowdown

The near-term outlook suggests a noticeable slowdown in the market.

- Sales Volume: Home sales are expected to [Increase/Decrease] in the coming months due to reduced buyer confidence.

- Price Corrections: A potential for price corrections or market stagnation is likely as supply and demand adjust.

- Short-Term Forecasts: [Include expert opinions or forecasts on short-term market trends, referencing reputable sources].

Long-Term Market Outlook

The long-term impact on the Canadian housing market remains uncertain but could involve:

- Affordability: The long-term implications for housing affordability and accessibility will depend on factors such as future interest rate changes, government policies, and economic growth.

- Government Policies: Government interventions, such as changes to mortgage rules or tax incentives, could shape the market's trajectory.

- Shifts in Buyer/Seller Behaviour: The current situation may lead to shifts in buyer and seller behavior, potentially resulting in a more balanced market over the longer term.

Conclusion

The BMO survey clearly highlights the significant impact of recession concerns on Canadian home purchases. Rising interest rates, high inflation, and job market uncertainty have combined to create a climate of hesitancy among potential buyers, resulting in a noticeable slowdown in the housing market. Understanding these factors and their influence on buyer confidence is crucial for navigating the current economic landscape. Stay informed about the evolving Canadian housing market by following updates on the BMO survey and other relevant economic indicators. Understanding the impact of recession concerns on Canadian home purchases is crucial for both buyers and sellers navigating this dynamic market. Learn more about [link to relevant resource, e.g., BMO's website or another reputable source] to make informed decisions in today's real estate climate.

Featured Posts

-

Ripple Xrp Price Prediction Will Xrp Hit 3 40

May 07, 2025

Ripple Xrp Price Prediction Will Xrp Hit 3 40

May 07, 2025 -

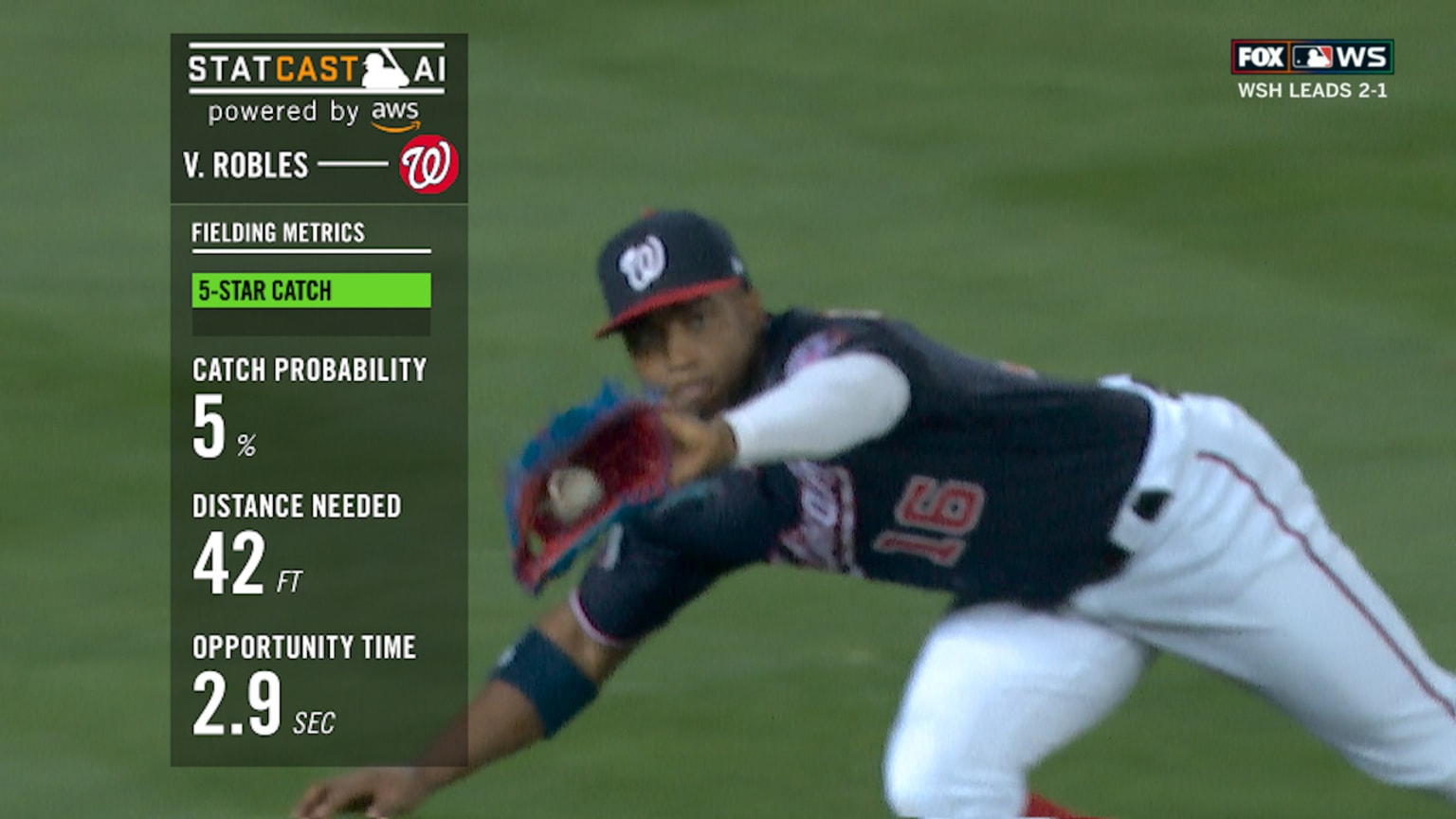

Robles Diving Catch And Injury Mariner Out After Crashing Into Oracle Park Netting

May 07, 2025

Robles Diving Catch And Injury Mariner Out After Crashing Into Oracle Park Netting

May 07, 2025 -

How Trump Made Millions From Crypto After Dismissing It

May 07, 2025

How Trump Made Millions From Crypto After Dismissing It

May 07, 2025 -

Possible Ps 5 And Ps 4 Game Reveals During The Nintendo Direct March 2025

May 07, 2025

Possible Ps 5 And Ps 4 Game Reveals During The Nintendo Direct March 2025

May 07, 2025 -

Nba Playoffs Mitchell And Brunsons Rise To Prominence

May 07, 2025

Nba Playoffs Mitchell And Brunsons Rise To Prominence

May 07, 2025

Latest Posts

-

Bitcoin Guencel Fiyati Son Dakika Degerlendirme

May 08, 2025

Bitcoin Guencel Fiyati Son Dakika Degerlendirme

May 08, 2025 -

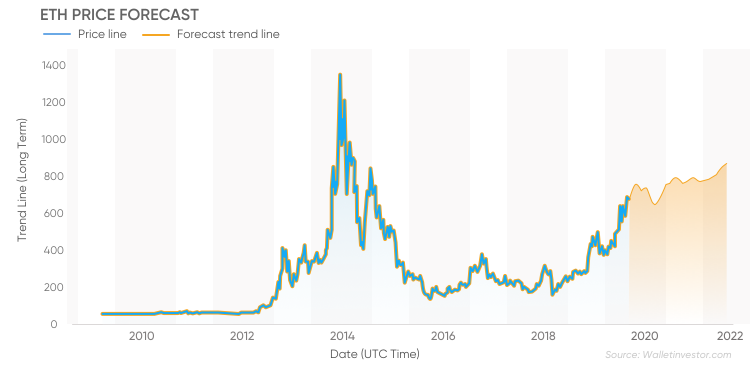

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025

Comprehensive Ethereum Price Prediction Analyzing Future Trends And Market Dynamics

May 08, 2025 -

New Crypto Etfs Trump Media And Crypto Com Partnership Explained

May 08, 2025

New Crypto Etfs Trump Media And Crypto Com Partnership Explained

May 08, 2025 -

Artis Goesteren Sms Dolandiriciligi Sikayetleri Korunma Yollari Ve Oenlemler

May 08, 2025

Artis Goesteren Sms Dolandiriciligi Sikayetleri Korunma Yollari Ve Oenlemler

May 08, 2025 -

Dogecoin Shiba Inu And Sui A Deep Dive Into Their Recent Market Performance

May 08, 2025

Dogecoin Shiba Inu And Sui A Deep Dive Into Their Recent Market Performance

May 08, 2025