BMW, Porsche, And The Complexities Of The Chinese Automotive Market

Table of Contents

The Allure and Challenges of the Chinese Luxury Car Market

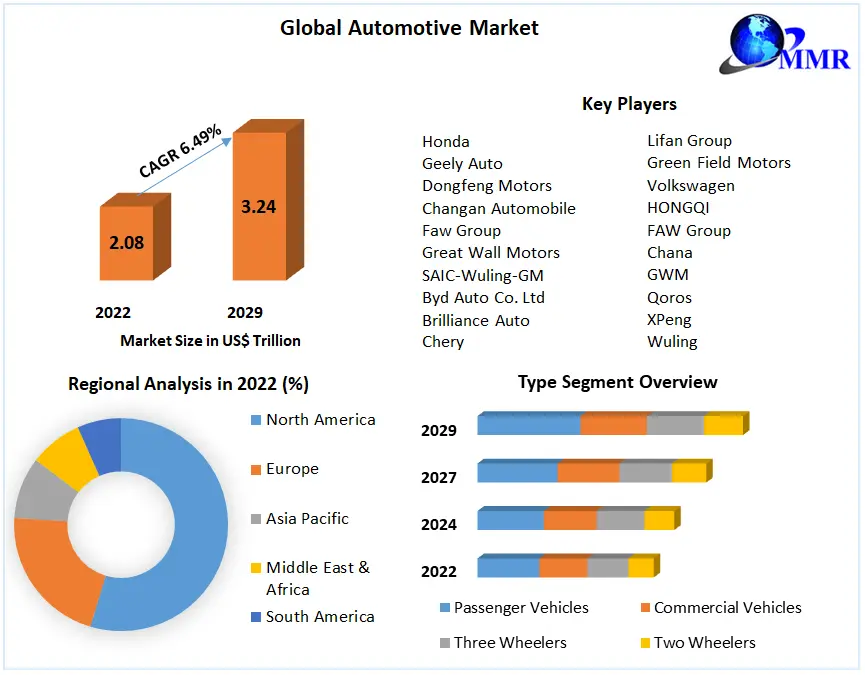

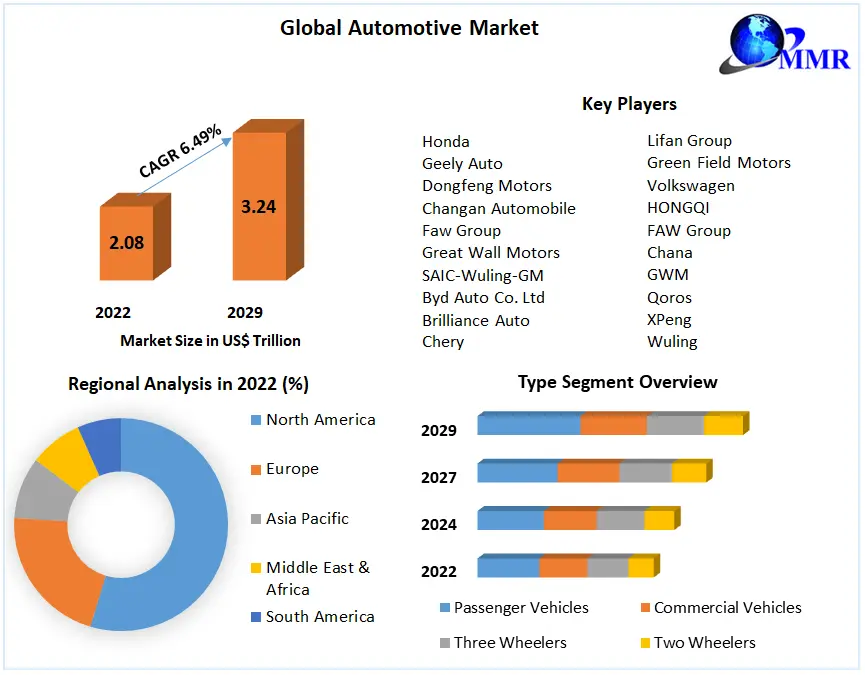

The Chinese luxury car market is a potent force, exhibiting phenomenal growth potential and representing a significant share of global luxury vehicle sales. However, success isn't guaranteed. Understanding the nuances of this market is paramount. Chinese luxury car buyers possess unique preferences and demands, significantly differing from those in Western markets. Brand prestige remains a key factor, with heritage and established reputations holding considerable weight. Technological features are highly valued, reflecting the country's technological advancement and consumer expectations. The purchase of a luxury car often carries strong status symbol implications within Chinese society.

- High demand for SUVs and electric vehicles: The Chinese market shows a strong preference for SUVs, accounting for a large percentage of luxury vehicle sales. Furthermore, the government's push towards electric vehicles (EVs) and new energy vehicles (NEVs) has created a rapidly expanding market for these models.

- Importance of brand reputation and heritage: Established luxury brands with a long history and strong brand recognition enjoy a significant advantage in the Chinese market. This emphasizes the importance of maintaining brand image and quality.

- Growing preference for domestic brands: The rise of domestic Chinese brands like BYD and NIO presents stiff competition. These brands are increasingly appealing to Chinese consumers due to their competitive pricing, technological advancements, and strong national appeal.

- Impact of government regulations and policies: Government regulations, including emission standards, safety requirements, and import tariffs, significantly impact the operating environment for luxury car manufacturers. Navigating these complexities is vital for long-term success.

BMW's Strategy in the Chinese Market

BMW has adopted a comprehensive localization strategy to thrive in the Chinese automotive market. This involves significant investment in local production facilities, allowing for quicker delivery times and better responsiveness to market demands. Their marketing and sales approaches are highly targeted, leveraging digital channels and social media platforms to engage Chinese consumers effectively.

- Investment in local production facilities: BMW's significant investment in manufacturing plants within China streamlines production and reduces reliance on imports, improving both efficiency and responsiveness.

- Targeted marketing campaigns on social media: BMW actively utilizes popular Chinese social media platforms like WeChat and Weibo to connect with consumers, tailoring their messaging to resonate with local preferences and cultural nuances.

- Development of China-specific models and features: BMW offers models and features tailored to the specific demands of the Chinese market, demonstrating responsiveness to local needs and preferences.

- Partnerships with local businesses and dealers: Building strong relationships with local businesses and dealers is crucial for effective distribution and market penetration in China's complex automotive landscape.

Porsche's Approach to the Chinese Automotive Market

Porsche focuses on maintaining its exclusivity and brand image in China, targeting high-net-worth individuals with personalized services and experiences. This strategy emphasizes a premium customer journey and exclusive access, solidifying brand loyalty.

- Emphasis on bespoke services and personalized experiences: Porsche offers tailored services, including customized configurations and exclusive events, to cater to the desires of its affluent clientele.

- Strong online presence and digital marketing initiatives: Porsche has a robust online presence, using digital marketing to reach its target audience through targeted advertising and engaging content.

- Events and experiences to build brand loyalty: Porsche hosts exclusive events and experiences to cultivate brand loyalty and create a strong sense of community amongst its customers.

- Leveraging the power of celebrity endorsements: Porsche strategically uses celebrity endorsements to amplify its brand message and reach a wider audience in the Chinese market.

Navigating Regulatory Hurdles and Competition

The Chinese automotive market presents significant regulatory hurdles. Stringent emission standards and fuel efficiency regulations require manufacturers to invest in cleaner technologies and more efficient engines. Intense competition from both established international brands and rapidly growing domestic players necessitates strategic innovation and adaptation.

- Stricter emission standards and fuel efficiency regulations: Compliance with increasingly stringent environmental regulations is crucial for operating within the Chinese automotive market.

- Intense competition from domestic brands like BYD and NIO: The rise of competitive domestic brands presents a significant challenge, requiring international players to constantly innovate and adapt.

- Challenges related to intellectual property protection: Protecting intellectual property remains a concern for international brands operating in the Chinese market.

- Fluctuations in import duties and taxes: Changes in import duties and taxes can significantly impact profitability and necessitate flexible pricing strategies.

Future Trends in the Chinese Automotive Market

The Chinese automotive market is poised for continued evolution. The demand for electric and hybrid vehicles is rapidly increasing, driven by government incentives and growing environmental awareness. Autonomous driving technology is also gaining traction, presenting both opportunities and challenges.

- Increasing demand for electric and hybrid vehicles: The shift towards electric mobility presents a significant growth opportunity for manufacturers willing to invest in this segment.

- The rise of autonomous driving technology: The integration of autonomous driving technology is transforming the automotive landscape and necessitates strategic investments and development.

- Growing importance of digital connectivity and in-car entertainment: Chinese consumers increasingly value advanced connectivity features and in-car entertainment systems.

- The potential for further government regulations and incentives: Future government policies will continue to shape the market, creating both opportunities and challenges for manufacturers.

Conclusion

The Chinese automotive market presents a complex yet rewarding landscape for luxury brands like BMW and Porsche. Success hinges on understanding the unique preferences of Chinese consumers, adapting to local regulations, and effectively competing against both international and domestic rivals. Both companies have shown adaptability, but continued vigilance and innovation will be crucial in this ever-evolving market. To stay informed on the latest developments in the dynamic Chinese automotive market, continue to follow industry news and analyses. Understanding the intricacies of this market is key to success for any player hoping to thrive in this competitive arena. Learn more about the strategies employed by successful brands navigating the Chinese auto market.

Featured Posts

-

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 27, 2025

La Fires Landlords Accused Of Price Gouging Amid Crisis

Apr 27, 2025 -

Derrota Inesperada Paolini Y Pegula Fuera Del Wta 1000 De Dubai

Apr 27, 2025

Derrota Inesperada Paolini Y Pegula Fuera Del Wta 1000 De Dubai

Apr 27, 2025 -

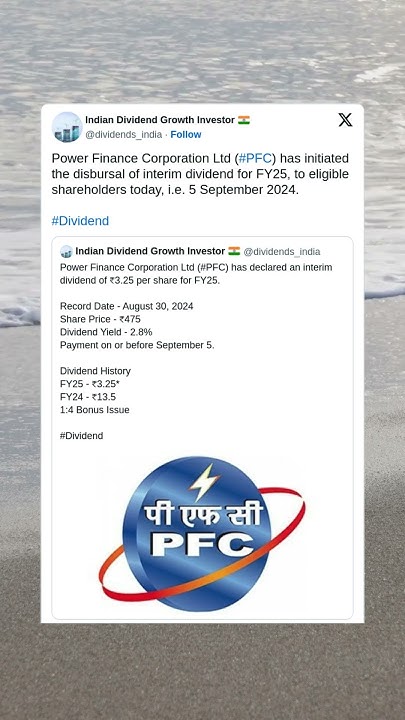

March 12 Power Finance Corporations Fy 25 Dividend Announcement

Apr 27, 2025

March 12 Power Finance Corporations Fy 25 Dividend Announcement

Apr 27, 2025 -

The Perfect Couple Season 2 New Cast And Source Material Revealed

Apr 27, 2025

The Perfect Couple Season 2 New Cast And Source Material Revealed

Apr 27, 2025 -

Wildfire Speculation Analyzing The Market For Los Angeles Disaster Bets

Apr 27, 2025

Wildfire Speculation Analyzing The Market For Los Angeles Disaster Bets

Apr 27, 2025

Latest Posts

-

Pirates Steal Victory Over Yankees With Walk Off In Extra Innings Game

Apr 28, 2025

Pirates Steal Victory Over Yankees With Walk Off In Extra Innings Game

Apr 28, 2025 -

Pirates Walk Off Win Against Yankees In Extras

Apr 28, 2025

Pirates Walk Off Win Against Yankees In Extras

Apr 28, 2025 -

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025