BOE Rate Cut Probabilities Fall Following UK Inflation Figures: Pound Impact

Table of Contents

Persistent Inflation Dashes Hopes for BOE Rate Cuts

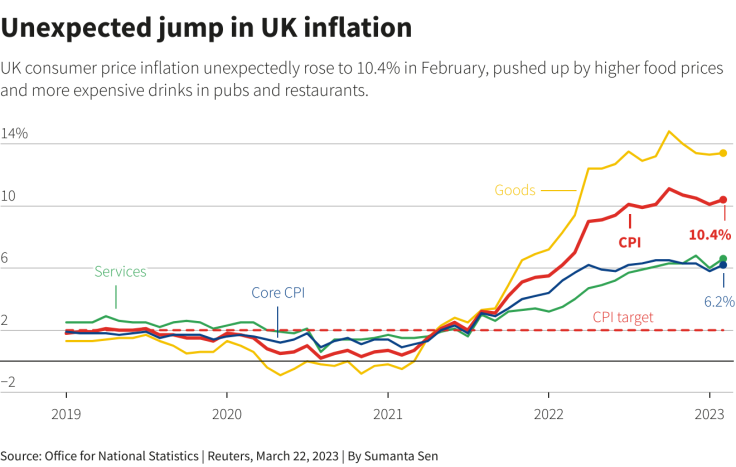

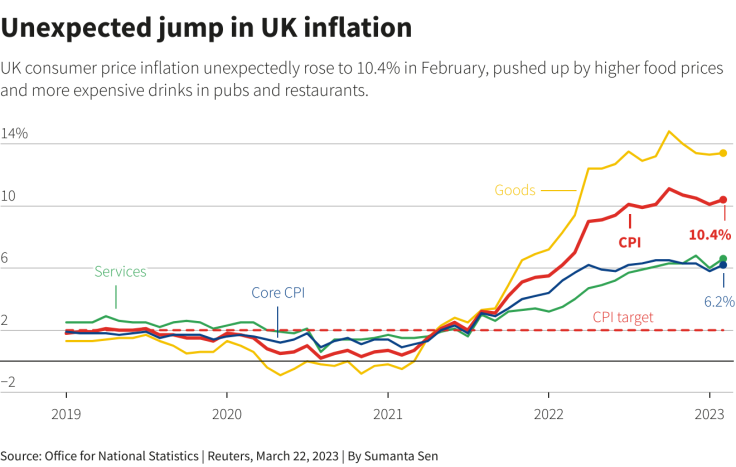

Recent UK inflation figures significantly deviated from expectations, revealing a more persistent inflationary pressure than previously anticipated. This dashed hopes for a near-term BOE interest rate cut, a move that had been considered a possibility just weeks ago. The implications for the BOE's monetary policy are significant, forcing a reassessment of its strategy to control rising prices.

- Detailed breakdown of the inflation figures: The Consumer Price Index (CPI) rose to [Insert actual CPI figure and percentage change], exceeding the BOE's target of 2% and analyst forecasts of [Insert analyst forecast]. The Retail Price Index (RPI), a broader measure of inflation, also showed a substantial increase.

- Contributing factors to high inflation: Several factors contributed to this persistent inflation, including soaring energy prices driven by global events, ongoing supply chain disruptions, and robust consumer demand. These intertwined challenges have made it difficult for the BOE to effectively manage inflation.

- BOE's previous statements and forecasts: The BOE previously indicated a willingness to consider rate cuts if inflation showed signs of easing. However, the recent figures contradict this expectation, suggesting that a more hawkish approach – maintaining or even raising interest rates – is now more likely.

Market Reaction: Pound Strengthens Against Major Currencies

The immediate market response to the unexpectedly high inflation data was a strengthening of the Pound. The GBP experienced gains against major currencies like the US dollar (USD) and the Euro (EUR), reflecting increased investor confidence in the UK economy's resilience despite inflationary pressures.

- GBP performance against USD and EUR: Charts would be inserted here visually illustrating the GBP's appreciation against the USD and EUR following the inflation announcement. (Note: This would require the actual chart data).

- Reaction of forex traders and analysts: Forex traders reacted swiftly, adjusting their positions to reflect the altered outlook for BOE monetary policy. Analysts have revised their GBP forecasts upwards, anticipating further strength in the short to medium term.

- Short-term and long-term effects on exchange rates: The short-term effect is a stronger Pound, benefiting those buying GBP and potentially impacting import/export costs. The long-term impact will depend on future inflation data and BOE decisions. Continued high inflation could lead to further interest rate hikes and sustained GBP strength. Conversely, if inflation begins to fall, the Pound might weaken.

Implications for UK Businesses and Consumers

The reduced likelihood of a BOE rate cut carries significant implications for UK businesses and consumers.

- Impact on businesses: Businesses face potentially higher borrowing costs, which could impact investment decisions and expansion plans. This is especially true for businesses with significant debt.

- Consequences for consumers: Consumers will likely continue to face a high cost of living, potentially exacerbated by increased mortgage rates if the BOE raises interest rates. Savings accounts may yield higher returns, however.

- Ripple effect on other economic indicators: The interplay between inflation, interest rates, and consumer spending will influence other key economic indicators, such as GDP growth and unemployment.

Future Outlook: BOE Policy and GBP Predictions

Predicting the future path of BOE policy and the GBP is challenging, given the complex interplay of global and domestic factors. However, several scenarios are plausible.

- Potential future interest rate decisions: The BOE may opt to maintain current interest rates, raise them further to combat inflation, or cautiously hold off on any significant changes while monitoring economic data.

- Impact of global economic factors: Global economic conditions, including global inflation and growth rates, will significantly influence the BOE's decisions and the performance of the GBP.

- Expert opinions and forecasts: A range of expert opinions and forecasts for the Pound would be included here, highlighting the uncertainty and different perspectives on future GBP performance. (Note: This would require referencing actual expert analysis).

Conclusion: Navigating the Uncertainty of BOE Rate Cut Probabilities and their Impact on the Pound

Persistent inflation in the UK has significantly diminished the probability of a near-term BOE rate cut. This has resulted in a stronger Pound Sterling. The implications are far-reaching, affecting businesses through borrowing costs, consumers via the cost of living, and investors through currency exchange rate fluctuations. To navigate this uncertainty, businesses should carefully manage their financial risks, consumers should monitor interest rates and inflation data closely, and investors should consider hedging strategies to mitigate currency risk. Stay informed about BOE interest rate decisions and their impact on the Pound Sterling forecast by subscribing to our regular updates or seeking advice from financial experts. Understanding UK monetary policy is crucial for successfully navigating the current economic climate.

Featured Posts

-

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025

Tikkie Gebruiken Een Gids Voor Nederlandse Bankieren

May 22, 2025 -

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025

Susquehanna Valley Storm Damage Assessing The Impact And Recovery

May 22, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 22, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 22, 2025 -

Trinidad Trip Curtailed Dancehall Stars Visit Under New Rules

May 22, 2025

Trinidad Trip Curtailed Dancehall Stars Visit Under New Rules

May 22, 2025 -

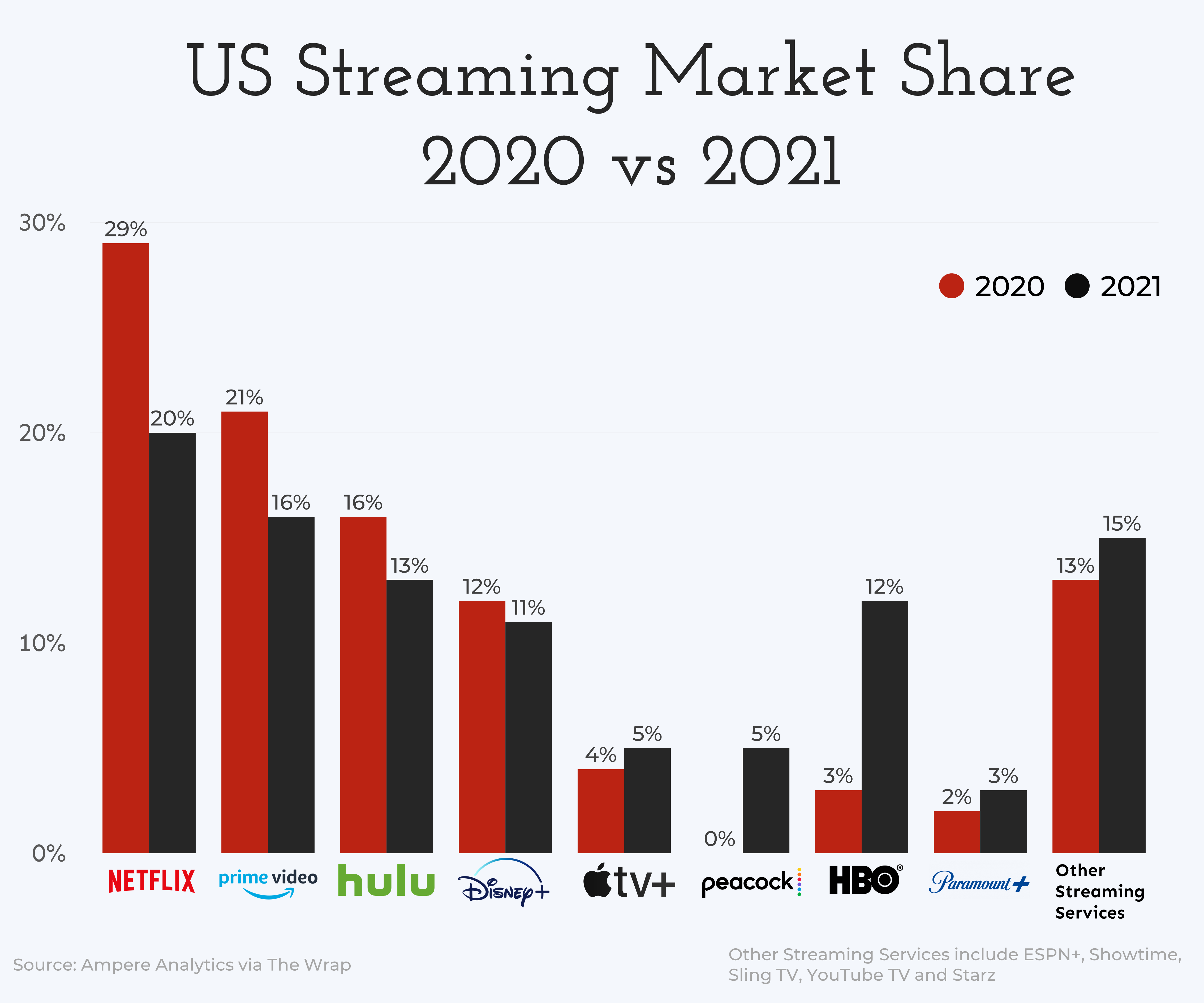

Streaming Services Profitability Vs User Experience

May 22, 2025

Streaming Services Profitability Vs User Experience

May 22, 2025

Latest Posts

-

Analyzing The Pittsburgh Steelers Interest In Nfl Draft Quarterbacks

May 22, 2025

Analyzing The Pittsburgh Steelers Interest In Nfl Draft Quarterbacks

May 22, 2025 -

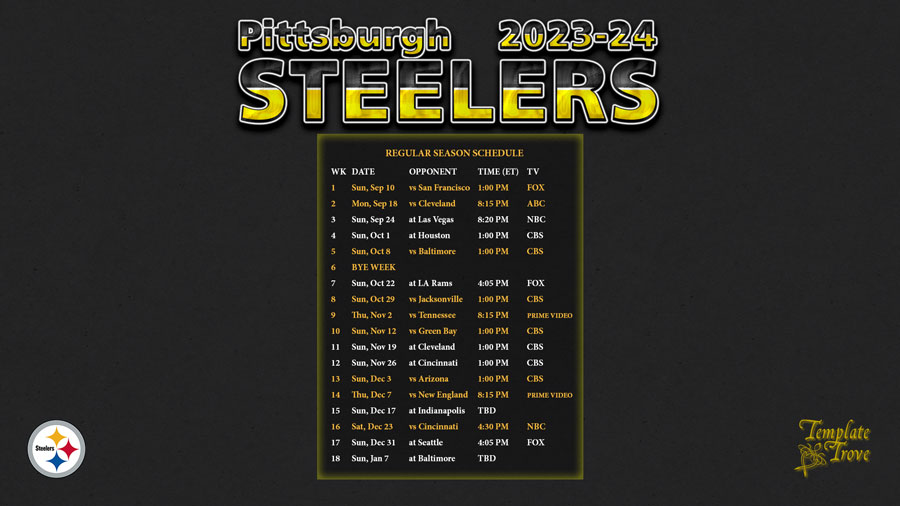

Pittsburgh Steelers Schedule A Deep Dive Into The Takeaways

May 22, 2025

Pittsburgh Steelers Schedule A Deep Dive Into The Takeaways

May 22, 2025 -

Pittsburgh Steelers Draft Strategy The Quarterback Question

May 22, 2025

Pittsburgh Steelers Draft Strategy The Quarterback Question

May 22, 2025 -

Nfl Draft 2024 Are The Pittsburgh Steelers Targeting A New Quarterback

May 22, 2025

Nfl Draft 2024 Are The Pittsburgh Steelers Targeting A New Quarterback

May 22, 2025 -

Steelers Schedule Released Important Takeaways For The Upcoming Season

May 22, 2025

Steelers Schedule Released Important Takeaways For The Upcoming Season

May 22, 2025