BOE Rate Cut Probabilities Fall: Pound Climbs On UK Inflation Figures

Table of Contents

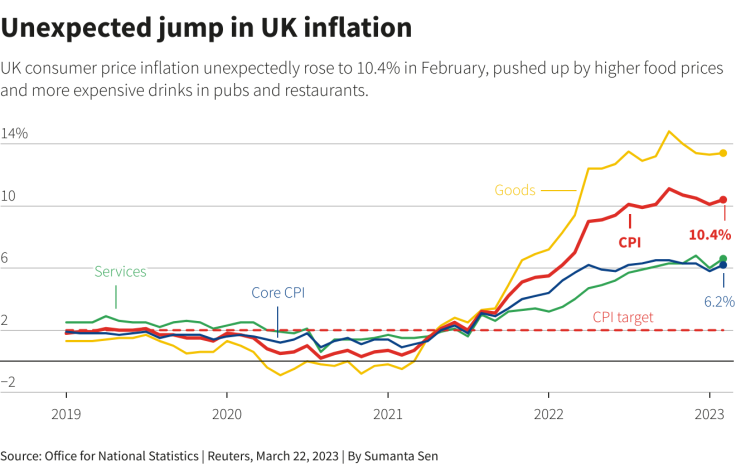

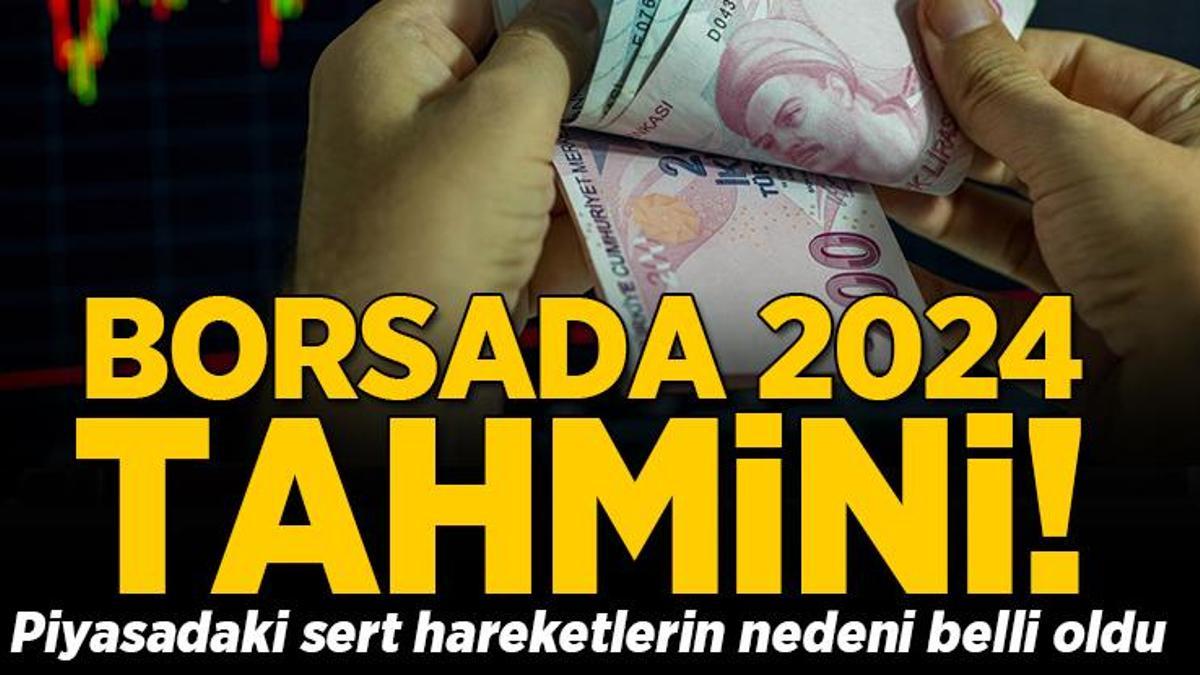

UK Inflation Data Surprises Markets

Higher-Than-Expected CPI

The Consumer Price Index (CPI) rose unexpectedly, exceeding market forecasts and signaling persistent inflationary pressures within the UK economy.

- Specific CPI figures: The CPI for July 2024 was reported at 7.1%, significantly higher than the predicted 6.8% and the previous month's 6.9%. This represents a year-on-year increase of 2.5%.

- Comparison to previous months/year: This is the highest CPI figure recorded in the last six months, demonstrating a concerning trend of persistent inflation. Compared to July 2023, the increase is substantial, highlighting the ongoing inflationary pressures.

- Contributing factors: Several factors contributed to this higher-than-expected CPI, including sustained increases in energy prices, particularly gas and electricity, and elevated food costs driven by global supply chain disruptions and unfavorable weather conditions.

Detail: Analysts had predicted a moderation in inflation based on previous economic indicators. However, the actual figures paint a different picture, suggesting that inflationary pressures are more persistent than initially anticipated. This deviation from predicted figures is a significant factor in the shift in BOE rate cut probabilities.

Impact on BOE Rate Expectations

The robust inflation data significantly reduces the likelihood of an imminent interest rate cut by the BOE. Markets had previously priced in a substantial probability of rate cuts to combat slowing economic growth.

- Mention of previous rate cut predictions: Before the inflation data release, many market analysts and financial institutions predicted a high probability of a 25-basis-point rate cut by the BOE in the coming months.

- Changes in market sentiment: The unexpected inflation figures have led to a dramatic shift in market sentiment. Investors are now significantly less optimistic about the possibility of near-term rate cuts.

- Shifts in future rate hike probabilities: Instead of rate cuts, some analysts now predict a possibility of further rate hikes by the BOE to control inflation, even at the risk of further slowing economic growth.

Detail: The inflation data directly contradicts the narrative supporting the need for rate cuts. The persistent inflationary pressures suggest that the BOE may need to maintain a more hawkish monetary policy stance to bring inflation back to its target level of 2%.

Pound Sterling Strengthens Against Major Currencies

Positive Reaction to Inflation Data

The pound experienced a noticeable surge against the US dollar, euro, and other major currencies following the release of the inflation figures. Investors are now pricing in a different monetary policy trajectory.

- Specific exchange rate changes: The GBP/USD exchange rate jumped from 1.25 to 1.27 following the news, while the GBP/EUR rose from 1.15 to 1.16.

- Comparison to previous day/week: This represents a significant increase compared to the previous day's trading and a considerable rebound from the recent lows seen in the pound's value.

Detail: The higher-than-expected inflation data bolstered investor confidence in the pound. The reduced likelihood of BOE rate cuts, and the potential for future rate hikes, made the pound a more attractive investment, leading to increased demand and consequently a strengthening of its value against other currencies. This is because higher interest rates tend to attract foreign investment.

Implications for UK Businesses and Consumers

The stronger pound can impact UK businesses involved in international trade, affecting both import and export costs. Consumers may also feel the effect through changing prices of imported goods.

- Discuss potential impact on exporters: A stronger pound makes UK exports more expensive for international buyers, potentially harming the competitiveness of UK businesses in global markets.

- Discuss potential impact on importers: Conversely, it makes imports cheaper for UK consumers and businesses, potentially lowering the cost of goods and services.

- Discuss potential impact on consumers: The net effect on consumers will depend on the balance between cheaper imports and potentially higher prices for domestically produced goods due to decreased export competitiveness.

Detail: The strengthening pound presents a double-edged sword. While it offers benefits to importers and consumers through lower import costs, it can negatively impact UK exporters who face reduced demand due to higher prices in foreign markets. The overall economic impact requires careful consideration of these competing factors.

Conclusion

The unexpected surge in UK inflation has dramatically altered the outlook for BOE rate cut probabilities. The stronger-than-anticipated CPI figures have led to a significant increase in the pound's value against major currencies and reduced expectations for imminent interest rate reductions. This shift highlights the complexities of monetary policy decision-making in the face of conflicting economic signals. Staying informed about BOE rate cut probabilities and their influence on the UK economy and the pound's value is crucial for investors and businesses alike. Monitor future economic releases and BOE announcements closely to navigate this evolving market landscape. Understanding BOE rate cut probabilities is key to making informed financial decisions in the current climate.

Featured Posts

-

Understanding The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025

Understanding The Net Asset Value Nav Of Amundi Msci World Catholic Principles Ucits Etf

May 24, 2025 -

16 Mart Hangi Burc Burc Oezellikleri Ve Daha Fazlasi

May 24, 2025

16 Mart Hangi Burc Burc Oezellikleri Ve Daha Fazlasi

May 24, 2025 -

Nisanda Hangi Burclar Zengin Olacak 2024 Para Tahmini

May 24, 2025

Nisanda Hangi Burclar Zengin Olacak 2024 Para Tahmini

May 24, 2025 -

En Cok Aci Ceken Babalar Erkek Burclarinin Analizi

May 24, 2025

En Cok Aci Ceken Babalar Erkek Burclarinin Analizi

May 24, 2025 -

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Michael Caine Recalls Awkward Mia Farrow Sex Scene Encounter

May 24, 2025

Latest Posts

-

5 Zodiac Signs Excellent Horoscopes On April 14 2025

May 24, 2025

5 Zodiac Signs Excellent Horoscopes On April 14 2025

May 24, 2025 -

Positive Horoscope Outlook 5 Zodiac Signs On April 14 2025

May 24, 2025

Positive Horoscope Outlook 5 Zodiac Signs On April 14 2025

May 24, 2025 -

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Tu Guia Astrologica Completa

May 24, 2025

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Tu Guia Astrologica Completa

May 24, 2025 -

Lucky Zodiac Signs For April 14 2025

May 24, 2025

Lucky Zodiac Signs For April 14 2025

May 24, 2025 -

April 14 2025 Top 5 Zodiac Signs With Positive Horoscopes

May 24, 2025

April 14 2025 Top 5 Zodiac Signs With Positive Horoscopes

May 24, 2025