BofA Says: Don't Worry About Stretched Stock Market Valuations

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Problem

BofA's analysts present a multi-faceted argument to explain why current high valuations, while seemingly risky, might not signal an impending market crash. Their perspective hinges on several key factors:

Low Interest Rates and Abundant Liquidity

For years, central banks, including the Federal Reserve, have implemented policies of low interest rates and quantitative easing (QE). These measures have injected massive amounts of liquidity into the financial system, making it cheaper for companies to borrow money and for investors to seek higher-yielding assets, even if those assets command higher prices. This has, in effect, supported higher stock valuations across the board.

- Sectors benefiting from low rates: Real estate, infrastructure, and consumer discretionary sectors have seen significant growth fueled by readily available credit.

- Impact of QE on market liquidity: The increase in market liquidity has allowed investors to pursue riskier, higher-growth stocks, further pushing up valuations. BofA's research (though specific data needs citation here if available) likely points to a correlation between QE and elevated P/E ratios.

- Keyword integration: Low interest rates, quantitative easing (QE), market liquidity, stock valuations, P/E ratios, readily available credit

Strong Corporate Earnings and Future Growth Prospects

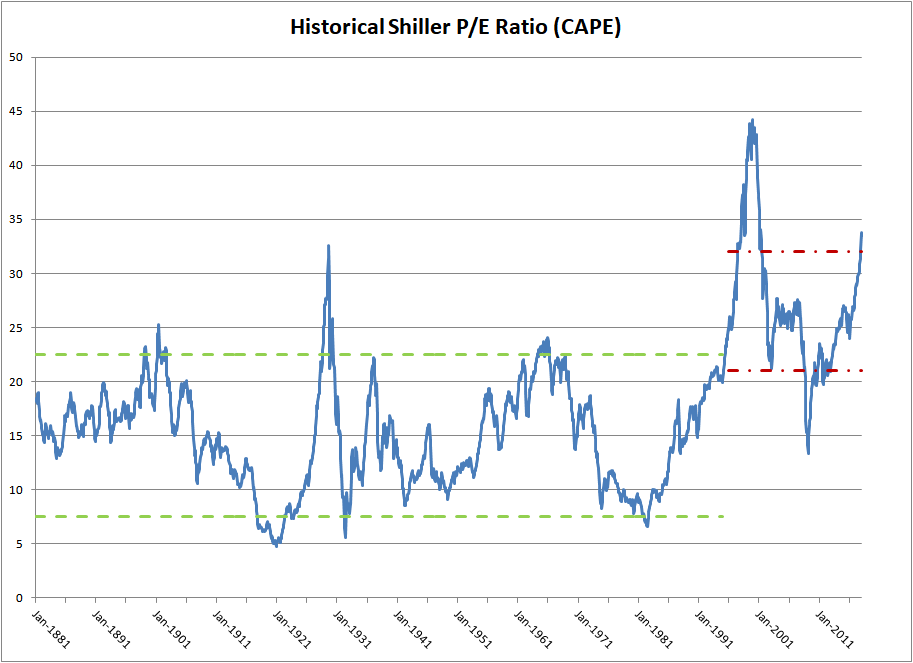

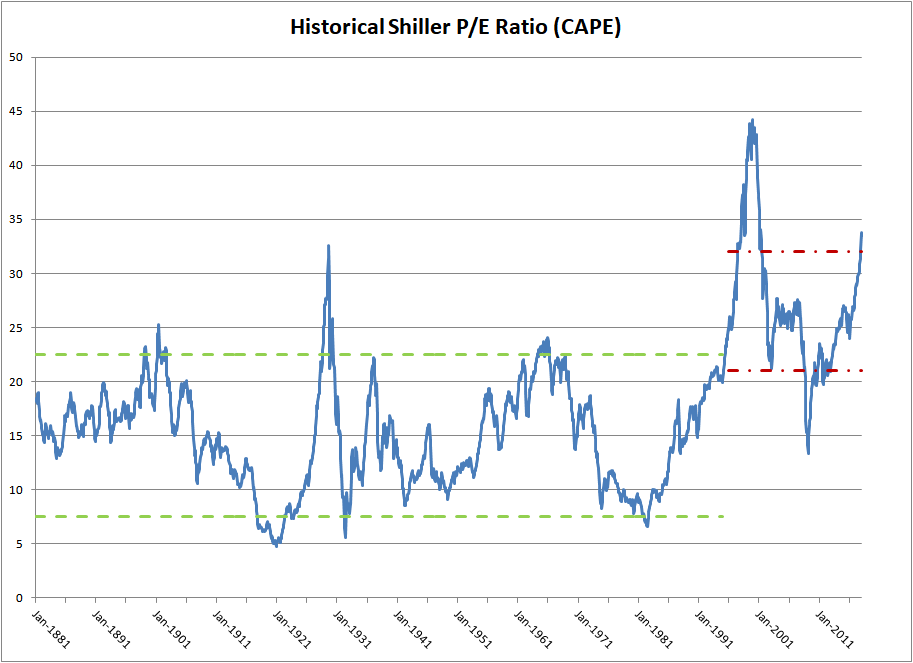

Despite the high valuations, many companies are reporting robust corporate earnings, and analysts predict strong future growth prospects. This positive outlook, according to BofA, justifies the higher Price-to-Earnings (P/E) ratios we're seeing, even if they exceed historical averages.

- Strong-performing sectors and companies: Technology, healthcare, and certain segments of the consumer staples sector continue to show strong earnings growth. BofA may cite specific examples of companies exceeding expectations in their analysis.

- Forecasts for future economic growth: Positive economic forecasts contribute to the belief that these higher earnings are sustainable, supporting the current valuation levels.

- Keyword integration: Corporate earnings, P/E ratios, stock market growth, future growth prospects, earnings growth, strong-performing sectors

The Role of Technological Innovation

Technological innovation is a key driver of higher valuations, particularly in certain sectors. Disruptive technologies and rapid advancements are creating new markets and business models, leading to high growth potential that may not be fully reflected in traditional valuation metrics.

- Examples of tech companies with high valuations and strong growth potential: Companies leading in artificial intelligence, cloud computing, and biotechnology often command significantly higher valuations based on their growth potential.

- Keyword integration: Technological innovation, disruptive technologies, high-growth stocks, tech valuations, artificial intelligence, cloud computing, biotechnology

Counterarguments and Potential Risks

While BofA presents a relatively optimistic outlook, it's crucial to acknowledge the counterarguments and potential risks associated with stretched stock market valuations.

Valuation Bubbles and Market Corrections

The possibility of a market correction or even a bursting of a valuation bubble remains a valid concern. History is replete with examples of markets becoming overvalued, followed by significant declines.

- Potential triggers for a market correction: Unexpected economic downturns, rising interest rates, geopolitical instability, and shifts in investor sentiment can all trigger market corrections.

- BofA's strategies for navigating market volatility: While specific strategies would require referencing BofA's report, their analysis likely includes recommendations for risk management and portfolio diversification to mitigate the impact of market volatility.

- Keyword integration: Market correction, stock market bubble, risk management, market volatility, portfolio diversification, geopolitical instability

Inflationary Pressures and Rising Interest Rates

Inflationary pressures and subsequent interest rate hikes represent a significant threat to stock valuations. Higher interest rates increase borrowing costs for companies, potentially impacting earnings, and also make bonds more attractive relative to stocks.

- Potential effects of inflation on earnings and stock prices: Inflation erodes purchasing power and can reduce corporate profits, leading to lower stock prices.

- BofA's predicted trajectory for interest rates: BofA's view on the likely path of interest rates would be crucial here, influencing their overall assessment of the market.

- Keyword integration: Inflation, interest rate hikes, stock market inflation, valuation impact, bond yields

BofA's Investment Recommendations (if available)

To provide truly comprehensive coverage, this section would ideally detail any specific investment strategies or recommendations offered by BofA based on their analysis of stretched valuations. This could include:

- Specific sector recommendations: Identifying sectors that are expected to outperform despite the overall market valuation.

- Asset allocation strategies: Suggesting optimal allocations across different asset classes to manage risk.

- Risk tolerance levels: Advising investors on how to adjust their portfolios according to their individual risk tolerance.

- Keyword integration: Investment strategy, asset allocation, portfolio diversification, investment recommendations, risk tolerance

Conclusion

BofA's analysis suggests that while current stock market valuations are indeed high, they aren't necessarily a harbinger of an imminent market crash. Their rationale rests on the continued impact of low interest rates and abundant liquidity, strong corporate earnings and future growth prospects, and the transformative power of technological innovation. However, it's crucial to acknowledge the inherent risks, including the potential for market corrections and the impact of inflation and rising interest rates. Therefore, while BofA offers a more nuanced perspective than immediate alarm, investors should carefully consider BofA's analysis of stretched stock market valuations within the context of their own risk tolerance and investment goals. Conduct thorough research and consider consulting with a financial advisor before making any investment decisions based on this analysis. Learn more about managing your portfolio in a market with stretched valuations and make informed choices.

Featured Posts

-

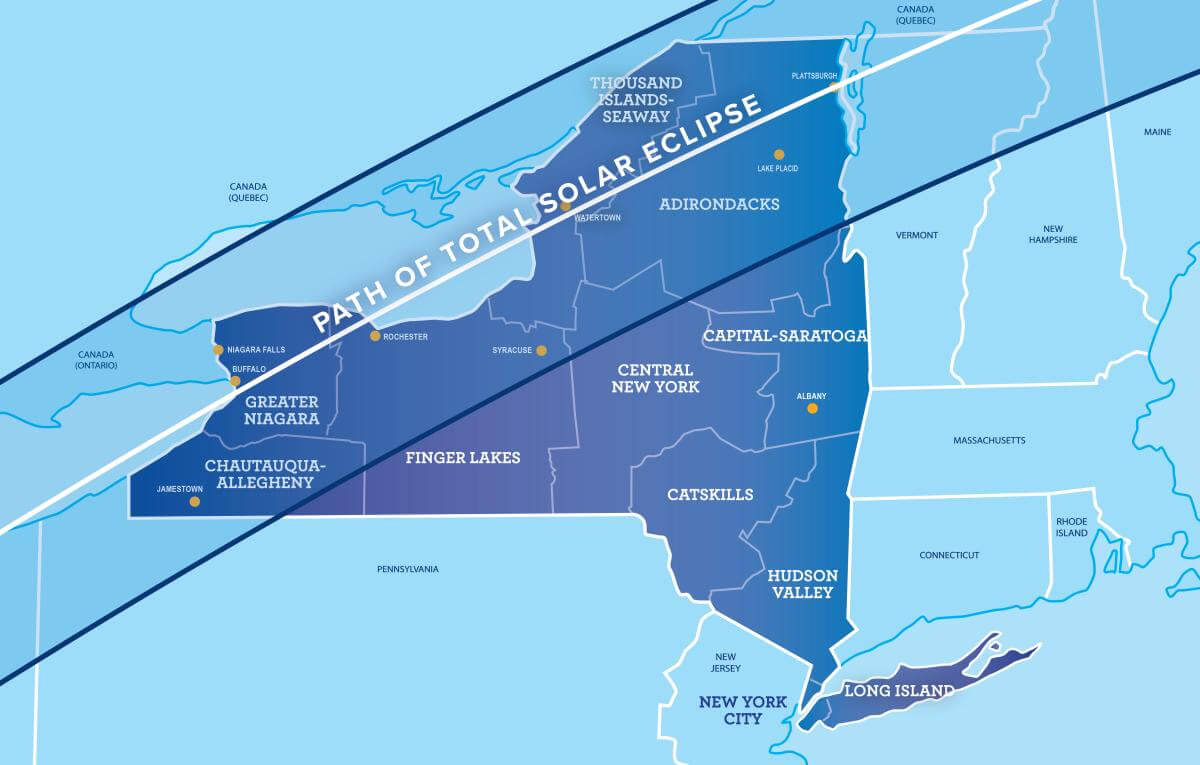

Partial Solar Eclipse This Saturday Viewing Times And Safety For Nyc

May 05, 2025

Partial Solar Eclipse This Saturday Viewing Times And Safety For Nyc

May 05, 2025 -

Summer Style Inspiration Anna Kendricks Shell Crop Top

May 05, 2025

Summer Style Inspiration Anna Kendricks Shell Crop Top

May 05, 2025 -

How Much Do Lizzos In Real Life Tour Tickets Cost

May 05, 2025

How Much Do Lizzos In Real Life Tour Tickets Cost

May 05, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Information

May 05, 2025

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Information

May 05, 2025 -

Double Strike Cripples Hollywood Writers And Actors Demand Fair Contracts

May 05, 2025

Double Strike Cripples Hollywood Writers And Actors Demand Fair Contracts

May 05, 2025

Latest Posts

-

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Breakdown

May 05, 2025

Alexander Volkanovski Vs Diego Lopes Ufc 314 Ppv Event Breakdown

May 05, 2025 -

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Information

May 05, 2025

Ufc 314 Volkanovski Vs Lopes Full Fight Card And Ppv Information

May 05, 2025 -

Ufc 314 Early Betting Odds For The Complete Fight Card

May 05, 2025

Ufc 314 Early Betting Odds For The Complete Fight Card

May 05, 2025 -

Ufc 314 Fan Favorite Knockout Bout Cancelled Major Setback For Event

May 05, 2025

Ufc 314 Fan Favorite Knockout Bout Cancelled Major Setback For Event

May 05, 2025 -

Ufc 314 Fight Card Volkanovski Vs Lopes Ppv Event Details

May 05, 2025

Ufc 314 Fight Card Volkanovski Vs Lopes Ppv Event Details

May 05, 2025