BofA: Understanding And Addressing Elevated Stock Market Valuations

Table of Contents

BofA's Current Market Outlook and Valuation Metrics

BofA's current stance on the stock market is one of cautious optimism, tempered by concerns about persistently high valuations. Their analysts frequently reference key valuation metrics to gauge market health. These include:

- Price-to-Earnings ratio (P/E): This compares a company's stock price to its earnings per share, indicating how much investors are willing to pay for each dollar of earnings. A high P/E ratio suggests higher valuations.

- Price-to-Sales ratio (P/S): This compares a company's stock price to its revenue per share, providing another perspective on valuation, especially useful for companies with low or negative earnings.

- Cyclically Adjusted Price-to-Earnings ratio (CAPE): This metric smooths out earnings fluctuations over a longer period (typically 10 years), providing a more stable measure of valuation, less susceptible to short-term economic cycles.

BofA's valuation assessments reveal:

- Specific examples: BofA may highlight overvalued sectors like technology or consumer discretionary, while identifying undervalued sectors like energy or financials, based on their proprietary models and analysis. These assessments often vary based on the specific indices and companies analyzed.

- Historical comparison: Current valuations are often compared to historical averages using these metrics. A comparison shows whether current prices are significantly above or below long-term averages, indicating potential overvaluation or undervaluation.

- Analyst concerns: BofA analysts may express concerns about specific risks—for example, the impact of rising interest rates on highly valued growth stocks or the potential for a correction in certain sectors.

Factors Contributing to Elevated Stock Market Valuations

Several macroeconomic factors contribute to the current elevated stock market valuations:

- Low interest rates: Historically low interest rates make borrowing cheaper, encouraging companies to invest and consumers to spend, driving up asset prices.

- Quantitative easing (QE): Central bank policies like QE inject liquidity into the market, increasing the money supply and potentially inflating asset prices.

- Inflation: While inflation can erode purchasing power, moderate inflation can sometimes stimulate economic growth, which can positively affect stock prices. However, high and unpredictable inflation is generally negative for stock markets.

- Investor sentiment: Positive investor sentiment, fueled by optimism about future growth and low interest rates, often drives up demand and prices.

- Technological advancements and growth sectors: Rapid advancements in technology, particularly in areas like artificial intelligence and renewable energy, have created high growth sectors, commanding significant valuations.

The risks associated with these factors are substantial:

- High valuations make markets vulnerable to corrections if investor sentiment shifts or interest rates rise unexpectedly.

- Inflation, if uncontrolled, can significantly erode corporate earnings and reduce investor confidence.

Strategies for Addressing Elevated Stock Market Valuations

Addressing elevated stock market valuations requires a cautious and proactive approach:

- Diversification: BofA, and general best practice, advocates for diversification across different asset classes (stocks, bonds, real estate) and sectors to mitigate risk. Sector rotation, systematically moving investments between sectors based on market performance, is another important strategy.

- Risk management: Careful risk management involves understanding your risk tolerance and aligning your portfolio accordingly. Regular portfolio rebalancing ensures your asset allocation remains in line with your risk profile.

- Alternative investments: Consider alternative investments like bonds, real estate, or commodities to diversify your portfolio and potentially reduce exposure to high-valuation stocks.

BofA's Recommendations and Investment Outlook

BofA's overall recommendation is to proceed cautiously, acknowledging the high valuations but also recognizing potential future growth. Their predictions often consider various scenarios—from a gradual correction to sustained growth, with varying impacts on different sectors. They might:

- Highlight specific sectors: BofA may recommend a focus on companies with strong fundamentals, consistent earnings growth, and reasonable valuations, perhaps favoring value stocks over growth stocks in a high-valuation environment.

- Potential risks and opportunities: BofA regularly assesses potential risks, such as rising interest rates or geopolitical events, and seeks out corresponding opportunities in undervalued sectors or resilient companies.

- Investment strategy advice: BofA's advisors typically offer tailored investment advice, balancing risk and reward based on individual investor profiles and financial goals.

Navigating the High Valuations Landscape with BofA's Insights

In summary, BofA's analysis reveals elevated stock market valuations driven by factors like low interest rates, quantitative easing, and strong investor sentiment. While acknowledging the potential for future growth, they stress the importance of cautious diversification, robust risk management, and consideration of alternative investment options. Understanding and addressing these high valuations are crucial for navigating the current market. Utilize BofA's insights and market analysis to develop a robust investment strategy for navigating these elevated stock market valuations. Stay informed and adapt your portfolio accordingly.

Featured Posts

-

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 29, 2025

Starbucks Unions Rejection Of Companys Wage Guarantee

Apr 29, 2025 -

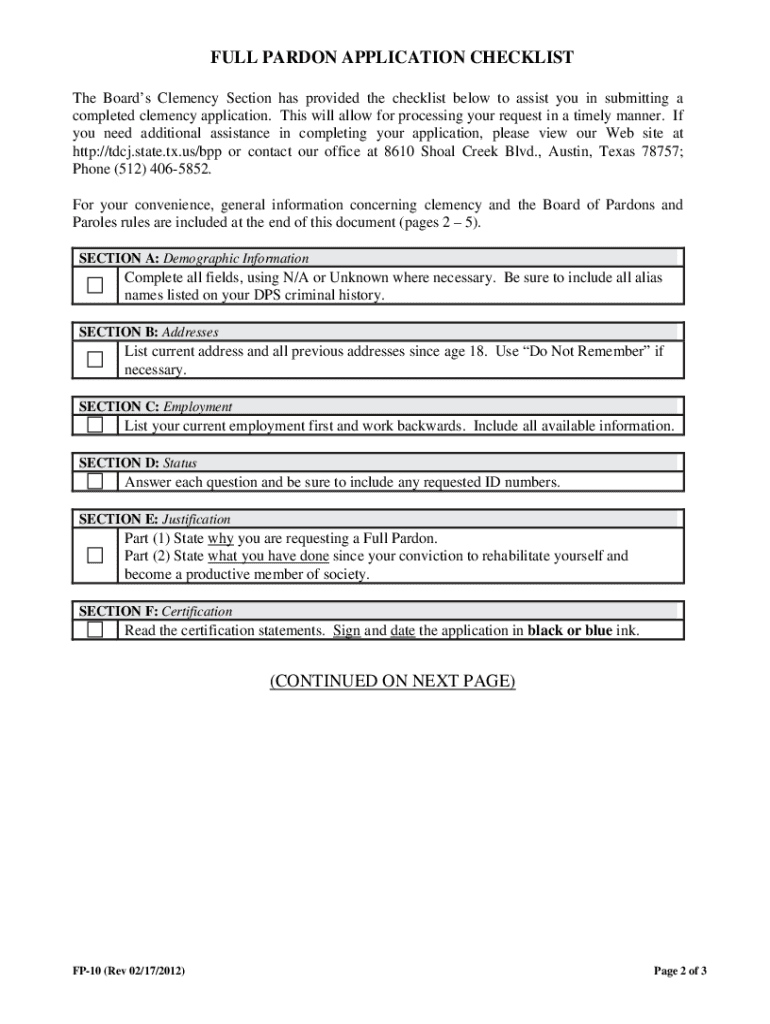

Full Pardon For Rose Understanding Trumps Potential Move

Apr 29, 2025

Full Pardon For Rose Understanding Trumps Potential Move

Apr 29, 2025 -

Managing Adhd Naturally Diet Exercise And Lifestyle Changes

Apr 29, 2025

Managing Adhd Naturally Diet Exercise And Lifestyle Changes

Apr 29, 2025 -

Russias Ukraine Offensive North Korean Troop Deployment Confirmed

Apr 29, 2025

Russias Ukraine Offensive North Korean Troop Deployment Confirmed

Apr 29, 2025 -

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 29, 2025

16 Million Fine For T Mobile Details Of Three Years Of Data Security Lapses

Apr 29, 2025