BofA's Argument: Why Current Stock Market Valuations Are Justified

Table of Contents

BofA's Focus on Corporate Earnings Growth

BofA's primary justification for current stock market valuations centers on robust corporate earnings growth. They emphasize strong revenue growth across numerous sectors, indicating sustained profitability and supporting their belief in the current market valuation. This argument is crucial for understanding their overall investment strategy and market analysis.

- Strong Revenue Growth: BofA highlights compelling data showcasing significant revenue increases across various sectors. This sustained profitability is a cornerstone of their bullish prediction.

- High-Performing Sectors: BofA's report likely cites strong performance in sectors like technology and healthcare, where innovation and consistent demand drive earnings growth. Specific examples and data points from their report would solidify this argument.

- Inflation and Interest Rate Impact: While acknowledging the impact of inflation and rising interest rates, BofA likely projects that corporate earnings can withstand these pressures, thus maintaining the justification for the current market valuation. Their projections on these economic factors are key to understanding their overall assessment. For example, they might argue that pricing power allows companies to offset increased costs, maintaining profit margins.

The Role of Low Interest Rates (Historically)

While interest rates have increased, BofA's argument might include a comparison to historical averages, suggesting that rates remain relatively low. This perspective is critical to their assessment of market valuation. The relationship between interest rates and the present value of future cash flows is a key factor in their analysis.

- Historically Low Rates: A comparison showing current interest rates against long-term averages helps illustrate why BofA believes rates are still supportive of higher valuations despite recent increases.

- Present Value of Future Cash Flows: Lower discount rates, resulting from lower interest rates, increase the present value of future cash flows, thereby justifying higher stock prices. BofA's analysis likely uses this principle extensively.

- Future Interest Rate Changes: The report should also address the potential for future interest rate changes and their projected impact on stock valuations. Addressing these uncertainties is crucial for a comprehensive evaluation of their stance.

Addressing Concerns about Inflation and Recession

BofA's strategy directly confronts investor concerns regarding high inflation and the risk of a recession. While acknowledging these risks, their analysis likely emphasizes the resilience of the economy and corporate earnings, suggesting that a significant market correction is unlikely.

- Projected Inflation Rate: BofA's projected inflation rate and its impact on corporate earnings are vital aspects of their justification for the current market valuation.

- Recession Probability Assessment: Their assessment of the probability of a recession and its potential effect on stock prices is equally important. A detailed analysis of potential economic downturns and their impact on valuations is crucial.

- Mitigation Strategies: BofA's report likely includes potential mitigation strategies or opportunities that could arise even within a recessionary environment, further supporting their bullish stance. Identifying such opportunities enhances their overall argument.

BofA's Long-Term Perspective

BofA likely champions a long-term investment strategy, emphasizing the cyclical nature of the stock market. This long-term view is integral to their justification of current valuations, encouraging investors to consider market fluctuations within the context of larger trends.

- Historical Market Cycles: Examples from historical market cycles and their eventual recoveries illustrate the cyclical nature of the market, supporting a long-term perspective.

- Advantages of Long-Term Investing: BofA's argument likely underscores the advantages of long-term investing compared to short-term trading strategies, particularly in navigating market volatility.

Conclusion

This article explored BofA's arguments supporting their assessment of current stock market valuations. Their analysis hinges on robust corporate earnings growth, a relatively low interest rate environment compared to historical norms, and a long-term perspective on market cycles. This comprehensive approach aims to counter concerns about inflation and recessionary risks. However, it's important to remember that this is just one perspective.

While BofA's arguments provide a compelling perspective on stock market valuations, independent research and a careful assessment of your risk tolerance are absolutely crucial before making any investment decisions. Therefore, delve deeper into BofA's full report and conduct thorough due diligence to determine whether their analysis aligns with your own investment strategy and understanding of current market conditions. Consider whether their assessment of current stock market valuations accurately reflects your own expectations.

Featured Posts

-

Daily Lotto Results Friday 18 April 2025

May 02, 2025

Daily Lotto Results Friday 18 April 2025

May 02, 2025 -

Lotto Jackpot Results Wednesday April 9th

May 02, 2025

Lotto Jackpot Results Wednesday April 9th

May 02, 2025 -

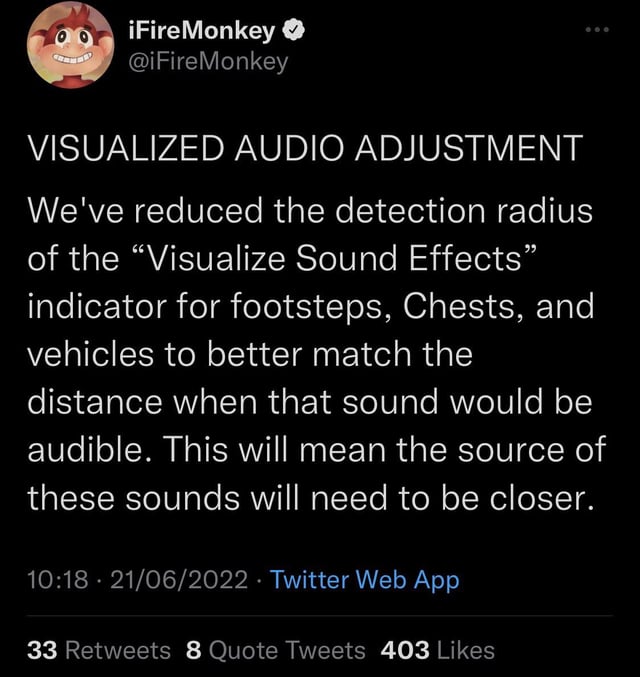

Negative Feedback On Fortnites Reversed Music Feature

May 02, 2025

Negative Feedback On Fortnites Reversed Music Feature

May 02, 2025 -

Breaking The Silence Understanding Mental Health With Dr Shradha Malik

May 02, 2025

Breaking The Silence Understanding Mental Health With Dr Shradha Malik

May 02, 2025 -

Six Nations 2024 France Triumphs England Dominates Scotland And Ireland Struggle

May 02, 2025

Six Nations 2024 France Triumphs England Dominates Scotland And Ireland Struggle

May 02, 2025

Latest Posts

-

Glastonburys Scheduling Fiasco Fans React To Clashing Acts

May 02, 2025

Glastonburys Scheduling Fiasco Fans React To Clashing Acts

May 02, 2025 -

Glastonbury Festival Fan Anger Over Conflicting Set Times

May 02, 2025

Glastonbury Festival Fan Anger Over Conflicting Set Times

May 02, 2025 -

Glastonbury Stage Times 2024 A Scheduling Nightmare

May 02, 2025

Glastonbury Stage Times 2024 A Scheduling Nightmare

May 02, 2025 -

Glastonbury Festival 2024 Clashing Stage Times Leave Fans Furious

May 02, 2025

Glastonbury Festival 2024 Clashing Stage Times Leave Fans Furious

May 02, 2025 -

Loyle Carner Exploring Fatherhood New Music And Glastonbury

May 02, 2025

Loyle Carner Exploring Fatherhood New Music And Glastonbury

May 02, 2025