BofA's Reassurance: Why Current Stock Market Valuations Aren't A Worry

Table of Contents

BofA's Bullish Outlook and its Underlying Rationale

BofA maintains a bullish outlook for the stock market, despite the current anxieties surrounding market volatility. Their prediction rests on several key pillars, supported by a detailed analysis of various economic indicators. They cite strong corporate earnings growth as a major factor, arguing that many companies are demonstrating resilience in the face of persistent economic headwinds.

-

Strong Corporate Earnings Growth: Despite inflationary pressures and supply chain disruptions, many companies have exceeded earnings expectations, demonstrating adaptability and underlying strength. BofA's analysis points to robust earnings growth across several key sectors.

-

Resilience of the Consumer Sector: Consumer spending remains relatively strong, indicating continued economic momentum. While inflation has impacted purchasing power, the consumer sector shows remarkable resilience, providing a solid foundation for corporate earnings.

-

Moderating Inflation: BofA analysts believe that inflation is starting to moderate, easing pressure on both businesses and consumers. This positive trend could lead to a more stable economic environment and support further stock market gains. They project an inflation rate [Insert projected inflation rate from BofA report here] by [Insert timeframe].

-

Strategic Investment Opportunities: Market corrections, while unsettling, often create opportunities for savvy investors to acquire undervalued assets. BofA suggests that the current market volatility presents a chance to identify and invest in companies with strong long-term growth prospects at attractive prices.

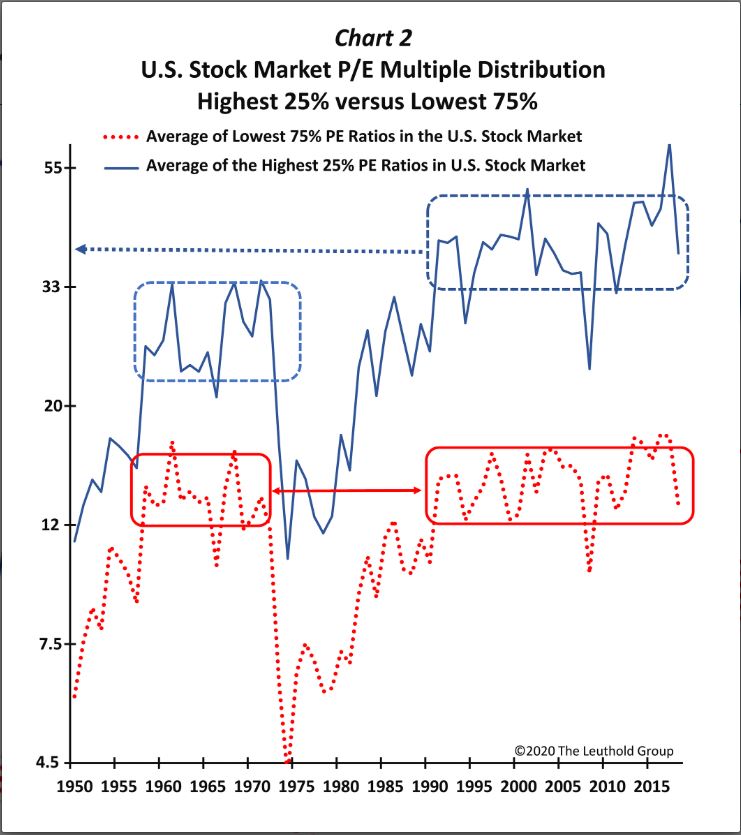

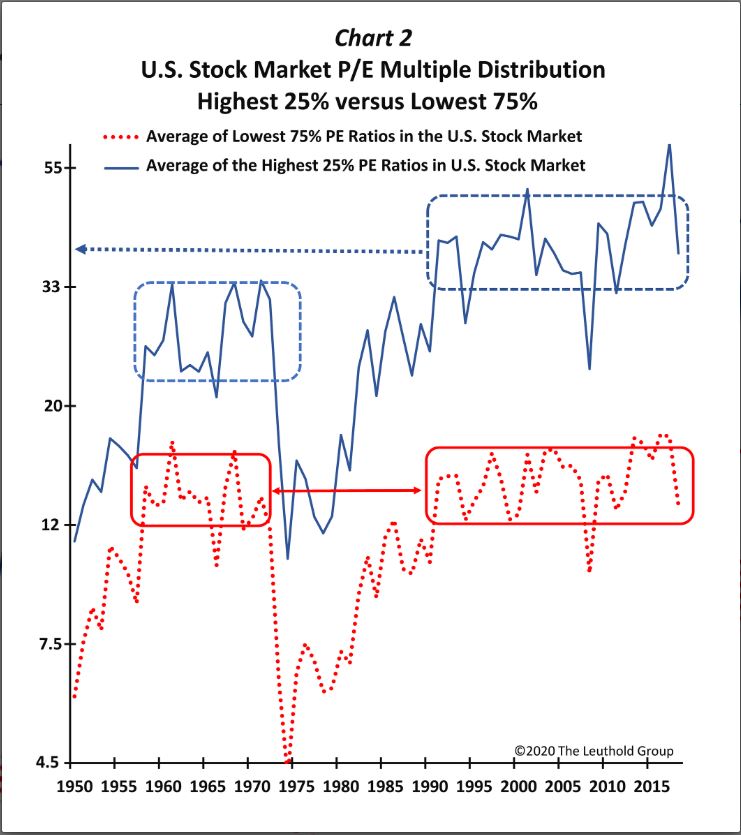

Addressing Concerns About High Stock Market Valuations

The concern about overvalued stocks is valid; many investors point to high Price-to-Earnings (P/E) ratios and elevated market capitalization as indicators of potential risk. However, BofA counters these concerns by focusing on long-term growth potential.

-

Long-Term Growth Prospects: BofA's analysis suggests that the long-term growth prospects of many companies outweigh concerns about current valuation levels. They emphasize the importance of considering future earnings potential, not just current metrics.

-

Undervalued Sectors: While the overall market might seem expensive based on some valuation metrics, BofA highlights specific sectors they believe to be undervalued, offering attractive entry points for investors. [Mention specific sectors highlighted by BofA, if available].

-

Potential for Further Interest Rate Cuts: While interest rate hikes have impacted stock prices, BofA's assessment also includes the possibility of future interest rate cuts if economic growth slows significantly. Such cuts could boost stock valuations. The analysis includes considerations of the potential impact of monetary policy shifts by the Federal Reserve.

The Role of Interest Rates and Monetary Policy in BofA's Assessment

Interest rates play a crucial role in BofA's assessment of stock market valuations. The Federal Reserve's monetary policy directly impacts borrowing costs for corporations and influences investor sentiment.

-

Interest Rate Trajectories: BofA's analysis incorporates different scenarios for interest rate trajectories, considering both further hikes and potential future cuts. They model the impact of each scenario on corporate profits and stock prices.

-

Impact on Corporate Borrowing: Higher interest rates increase the cost of borrowing for corporations, potentially impacting investment and profitability. Conversely, lower rates stimulate borrowing and investment, potentially driving economic growth and higher stock prices.

-

Interest Rate Expectations: Investor expectations regarding future interest rate changes significantly impact stock valuations. BofA's assessment considers these expectations and their influence on market sentiment. Understanding the interplay between interest rates and market expectations is crucial for informed investment decisions.

Diversification and Risk Management Strategies in a Volatile Market (Following BofA's Recommendations)

Given the inherent market volatility, BofA emphasizes the importance of portfolio diversification and effective risk management.

-

Sectoral Diversification: Spreading investments across different sectors helps to mitigate risk. By diversifying, investors can reduce the impact of poor performance in any single sector.

-

Strategic Asset Allocation: A strategic asset allocation plan, tailored to individual risk tolerance and financial goals, is crucial for navigating market uncertainty. BofA likely suggests adjusting asset allocation based on market conditions and predictions.

-

Long-Term Investment Horizons: BofA likely recommends focusing on a long-term investment strategy to weather short-term market fluctuations. The long-term growth potential of well-chosen investments can outweigh the risks associated with short-term market volatility.

Conclusion: BofA's Reassurance: A Cautiously Optimistic Outlook on Stock Market Valuations

BofA's analysis presents a cautiously optimistic outlook on stock market valuations, emphasizing the potential for continued growth despite current high levels. Their reassurance rests on strong corporate earnings, the resilience of the consumer sector, moderating inflation, and the possibility of future interest rate cuts. While acknowledging the remaining uncertainties and inherent market risks, BofA's assessment offers a valuable perspective for investors.

It’s crucial to remember that this is just one perspective. We strongly encourage you to conduct your own thorough research, understand BofA's perspective in detail, and assess your stock market valuations carefully. Make informed decisions about your investment portfolio based on your individual risk tolerance and financial goals. Remember to consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

These 4 Randall Flagg Theories Will Change Your Perspective On Stephen Kings Works

May 10, 2025

These 4 Randall Flagg Theories Will Change Your Perspective On Stephen Kings Works

May 10, 2025 -

Seattle Businesses Accepting Canadian Dollars For Sports Fans

May 10, 2025

Seattle Businesses Accepting Canadian Dollars For Sports Fans

May 10, 2025 -

Rejoignez Notre Equipe A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025

Rejoignez Notre Equipe A Dijon Restaurants Et Rooftop Dauphine

May 10, 2025 -

Best Show To Watch Before Roman Fate Season 2 Avoiding Spoilers And Streaming Options

May 10, 2025

Best Show To Watch Before Roman Fate Season 2 Avoiding Spoilers And Streaming Options

May 10, 2025 -

Abcs High Potential A Ballsy Season 1 Finale

May 10, 2025

Abcs High Potential A Ballsy Season 1 Finale

May 10, 2025