BofA's Reassurance: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Red Flag

BofA's positive assessment of the market, despite high valuations, rests on several key pillars. Their analysis suggests that current prices are justified by a confluence of favorable economic and market factors.

-

Low Interest Rates: Persistently low interest rates globally continue to fuel investment in equities. The low cost of borrowing encourages companies to invest and expand, leading to stronger earnings growth, while simultaneously making bonds less attractive compared to stocks. This low-interest-rate environment supports higher stock valuations.

-

Strong Corporate Earnings Growth: Many companies are reporting robust earnings growth, exceeding expectations in several key sectors. This strong performance fuels investor confidence and justifies higher price-to-earnings (P/E) ratios. This positive trend indicates a healthy underlying economy driving corporate profitability.

-

Innovation and Technological Advancements: The ongoing technological revolution is driving significant innovation and creating new growth opportunities across various sectors. Companies at the forefront of technological advancements command higher valuations reflecting their future potential and market dominance. This is a crucial factor in BofA's positive outlook.

-

Positive Economic Outlook: BofA's economic forecasts point to continued, albeit perhaps moderate, economic growth. This positive economic outlook provides a supportive backdrop for continued stock market strength. This expectation of future economic gains reinforces the justification for current valuations.

Addressing Common Investor Concerns About High Stock Market P/E Ratios

High P/E ratios are often cited as a primary indicator of overvaluation, prompting investor anxiety. However, BofA counters these concerns by providing valuable context.

-

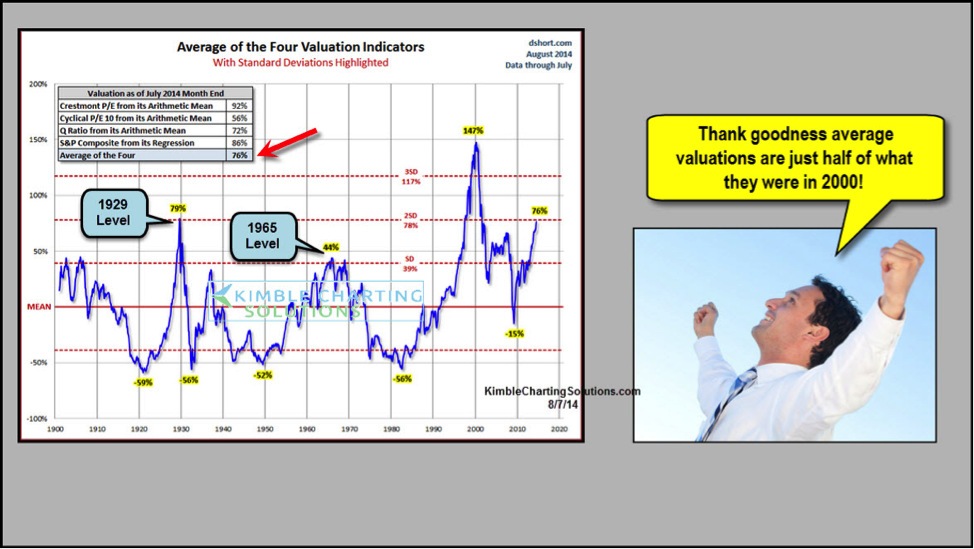

Historical Context: While current P/E ratios might seem elevated, a comparison to historical data reveals that they are not unprecedented. There have been periods in the past where valuations were even higher, without resulting in immediate market crashes. Putting current valuations into historical context helps to alleviate some anxieties.

-

Future Earnings Growth Potential: BofA emphasizes the potential for future earnings growth to justify current valuations. The strong economic outlook and continued innovation suggest that earnings are likely to continue growing, thus narrowing the P/E ratio over time. This argument hinges on the expectation of continued corporate performance.

-

Impact of Low Interest Rates on Valuation Metrics: BofA highlights how low interest rates influence valuation metrics. Low interest rates make equities more attractive relative to bonds, driving up valuations. This fundamental shift in the investment landscape must be considered when interpreting P/E ratios.

(Include a chart here comparing historical P/E ratios if possible)

BofA's Investment Strategies for Navigating High Valuations

BofA's positive outlook doesn't imply blind optimism. They advocate for a measured and strategic approach to investment, suggesting several key strategies:

-

Sector-Specific Recommendations: BofA recommends focusing on sectors poised for continued strong growth, such as technology and healthcare, while carefully assessing the valuations within those sectors. This selective approach helps to manage risk while targeting higher-growth areas.

-

Emphasis on Long-Term Investing: BofA emphasizes the importance of a long-term investment horizon. Focusing on long-term growth potential mitigates the impact of short-term market fluctuations. This strategy is crucial for weathering market volatility.

-

Portfolio Diversification: A well-diversified portfolio is crucial to mitigate risk. Diversification across different asset classes and sectors helps to reduce overall portfolio volatility. This minimizes the impact of any individual sector underperforming.

-

Risk Management Techniques: Employing appropriate risk management techniques, such as stop-loss orders and regular portfolio reviews, is essential for managing potential losses. Proactive risk management helps to protect investments and limit potential downsides.

Conclusion: BofA's Reassurance and a Call to Action

BofA's analysis offers a reassuring perspective on high stock market valuations. Their assessment, supported by strong earnings growth, low interest rates, and ongoing innovation, suggests that current valuations are not necessarily a cause for immediate alarm. While acknowledging the inherent risks in any investment, BofA's insights emphasize the importance of a measured, long-term approach. Consider BofA's recommendations, diversify your portfolio, and potentially consult with a financial advisor to develop a robust investment strategy that accounts for current market conditions and aligns with your personal risk tolerance. Don't let anxieties about high stock market valuations paralyze you; make informed decisions based on a comprehensive understanding of the market dynamics. Develop a sound investment plan that accounts for the current environment and positions you for long-term success.

Featured Posts

-

Daisy May Cooper And Brother Charlies Post Celeb Traitors Bbc Project

May 03, 2025

Daisy May Cooper And Brother Charlies Post Celeb Traitors Bbc Project

May 03, 2025 -

Nigel Farages Savile Slogan Reform Party Sparks Online Outrage

May 03, 2025

Nigel Farages Savile Slogan Reform Party Sparks Online Outrage

May 03, 2025 -

Gaza Flotilla Under Attack Latest Updates From Malta

May 03, 2025

Gaza Flotilla Under Attack Latest Updates From Malta

May 03, 2025 -

New Poll Shows Farage Ahead Of Starmer For Uk Prime Minister In Majority Of Constituencies

May 03, 2025

New Poll Shows Farage Ahead Of Starmer For Uk Prime Minister In Majority Of Constituencies

May 03, 2025 -

Reform Uk In Danger Five Reasons For Concern

May 03, 2025

Reform Uk In Danger Five Reasons For Concern

May 03, 2025

Latest Posts

-

Analyzing The Grand Theft Auto Vi Trailer New Insights

May 04, 2025

Analyzing The Grand Theft Auto Vi Trailer New Insights

May 04, 2025 -

Bookstore Holds 45 000 Rare Novel

May 04, 2025

Bookstore Holds 45 000 Rare Novel

May 04, 2025 -

Are The Thunderbolts Marvels Salvation Or A Missed Opportunity

May 04, 2025

Are The Thunderbolts Marvels Salvation Or A Missed Opportunity

May 04, 2025 -

Lets Rewatch The Gta Vi Trailer A Frame By Frame Breakdown

May 04, 2025

Lets Rewatch The Gta Vi Trailer A Frame By Frame Breakdown

May 04, 2025 -

Exploring The Versatility Of Special Little Bags Uses And Benefits

May 04, 2025

Exploring The Versatility Of Special Little Bags Uses And Benefits

May 04, 2025