BofA's Reassurance: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Bullish Outlook Despite High Valuations

Bank of America maintains a bullish outlook for the stock market, expressing confidence despite the current high valuations. Their positive forecast is based on a confluence of factors, suggesting that the market's current price levels are justifiable.

-

Projected Earnings Growth: BofA's report cites robust projected earnings growth across several key sectors, particularly in technology and consumer discretionary. This anticipated increase in corporate profits is seen as a key driver supporting current valuations. Strong earnings per share (EPS) growth is expected to continue throughout the year.

-

Positive Economic Indicators: BofA points to several positive economic indicators, including moderating inflation and a resilient consumer spending environment, as underpinning their optimistic view. They predict interest rate hikes will eventually stabilize, creating a more predictable environment for investors.

-

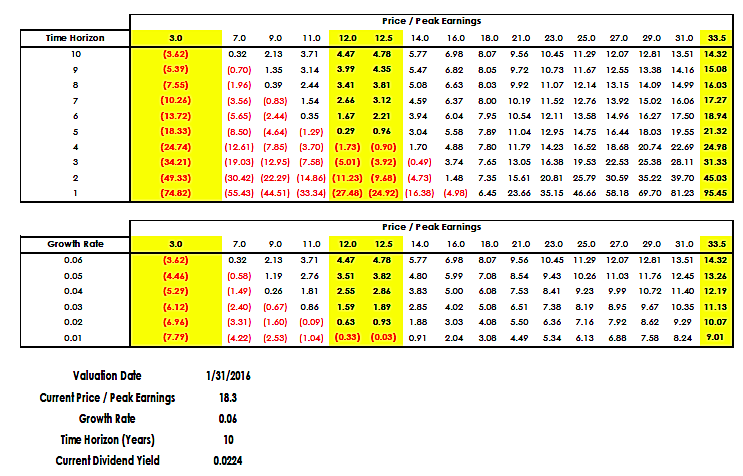

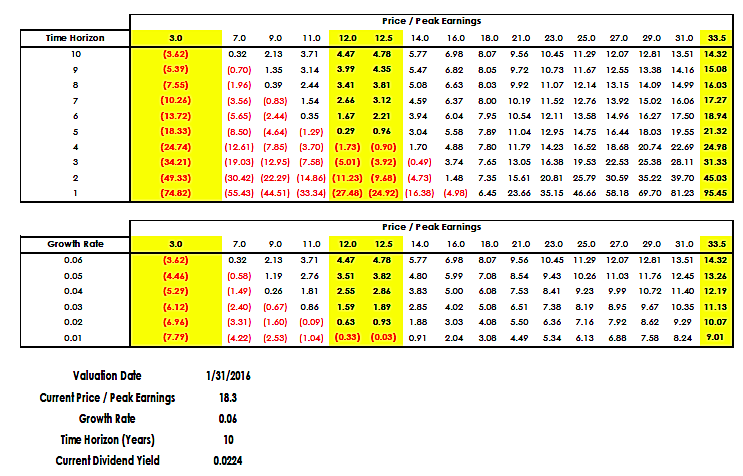

Valuation Justification: BofA justifies the current high valuations by linking them to these strong projected earnings and positive economic forecasts. They argue that the market is pricing in future growth, and that current valuations are not necessarily overblown in the context of this anticipated performance. The current price-to-earnings ratio (P/E ratio) is viewed as justified given these predictions.

Understanding the Drivers of Stretched Stock Market Valuations

Several factors contribute to the current perception of stretched stock market valuations. It's crucial to understand these drivers to assess the validity of concerns.

-

Low Interest Rate Environment: The prolonged period of low interest rates has made bonds less attractive relative to stocks. This has driven capital flows into the equity market, contributing to higher stock prices and valuations. Low bond yields directly influence investor appetite for riskier assets like stocks.

-

Strong Corporate Earnings: Robust corporate profit growth has supported higher price-to-earnings ratios. Many companies have reported exceeding expectations, fueling investor confidence and driving stock prices upward. This increase in corporate profit growth has helped to sustain market valuations.

-

Technological Innovation and Growth Stocks: The continued growth and innovation within the tech sector, particularly among high-growth companies, are significant factors. The high valuations of these growth stocks influence the overall market valuation, even if other sectors show more moderate growth. The tech sector's performance significantly impacts overall market perception.

Addressing the Risk of a Market Correction

While BofA maintains a positive outlook, acknowledging the risk of a market correction is crucial. High valuations inherently make the market more vulnerable to a downturn.

-

Potential Triggers: Potential triggers for a correction include a faster-than-expected increase in interest rates, escalating geopolitical instability, or a significant negative economic surprise.

-

BofA's Perspective on Corrections: BofA acknowledges the possibility of a correction but suggests that it might be relatively short-lived, given the underlying strength of the economy and corporate earnings. They don't see a major bear market as the most likely scenario.

-

Risk Mitigation Strategies: BofA, and most financial advisors, recommend diversifying investments across different asset classes and sectors to mitigate the risk associated with a market correction. This could include holding some fixed-income securities or alternative investments.

Long-Term Investment Strategies in a High-Valuation Market

Navigating a market with seemingly stretched stock market valuations requires a thoughtful, long-term approach.

-

Portfolio Diversification: Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.) and sectors is crucial to manage risk. This strategy helps reduce the impact of any single investment performing poorly. Effective asset allocation is key to a resilient portfolio.

-

Value Investing Strategies: Investors may consider seeking out undervalued stocks or sectors within the market. This approach focuses on identifying companies with strong fundamentals that are trading below their intrinsic value, offering potential for higher returns. Value investing can help mitigate some of the risks associated with high overall valuations.

-

Long-Term Investment Horizon: Maintaining a long-term investment horizon is essential. Market fluctuations are inevitable, and a long-term strategy allows investors to ride out short-term corrections and benefit from the long-term growth potential of the market. A buy-and-hold strategy can be particularly effective in navigating market volatility.

Conclusion

Bank of America's analysis suggests that while stretched stock market valuations are a legitimate concern, the underlying economic and corporate fundamentals support a continued positive outlook. Understanding the drivers of these valuations—low interest rates, strong corporate earnings, and the dynamism of the tech sector—is key. While acknowledging the inherent risk of market corrections and employing risk mitigation strategies like diversification and a long-term investment horizon are crucial, investors shouldn't necessarily panic. Review BofA's full report for detailed insights. Develop a well-informed investment strategy, and remember to consult with a financial advisor for personalized advice tailored to your individual circumstances and risk tolerance regarding stretched stock market valuations.

Featured Posts

-

Cassie Addresses Diddy Assault Claims Shares Positive Update

May 18, 2025

Cassie Addresses Diddy Assault Claims Shares Positive Update

May 18, 2025 -

Five Seriously Wounded In Amsterdam Hotel Knife Attack Police Conduct Raid

May 18, 2025

Five Seriously Wounded In Amsterdam Hotel Knife Attack Police Conduct Raid

May 18, 2025 -

Should Snl Embrace Stronger Language Bowen Yang Weighs In

May 18, 2025

Should Snl Embrace Stronger Language Bowen Yang Weighs In

May 18, 2025 -

Nwodims Weekend Update Snls Shocking Twist

May 18, 2025

Nwodims Weekend Update Snls Shocking Twist

May 18, 2025 -

Office365 Security Failure Millions Lost To Hacker Exploiting Executive Emails

May 18, 2025

Office365 Security Failure Millions Lost To Hacker Exploiting Executive Emails

May 18, 2025

Latest Posts

-

Angels 1 0 Victory Over White Sox A Masterclass By Jose Soriano

May 18, 2025

Angels 1 0 Victory Over White Sox A Masterclass By Jose Soriano

May 18, 2025 -

Los Angeles Angels Ben Joyce Fireballing Lessons From Kenley Jansen

May 18, 2025

Los Angeles Angels Ben Joyce Fireballing Lessons From Kenley Jansen

May 18, 2025 -

I Syggnomi Toy Kanie Goyest Pros Ton Jay Z Kai Tin Beyonce

May 18, 2025

I Syggnomi Toy Kanie Goyest Pros Ton Jay Z Kai Tin Beyonce

May 18, 2025 -

Syggnomi Apo Ton Jay Z Kai Tin Beyonce O Kanie Goyest Anakoinonei Tin Allagi Stasis Toy

May 18, 2025

Syggnomi Apo Ton Jay Z Kai Tin Beyonce O Kanie Goyest Anakoinonei Tin Allagi Stasis Toy

May 18, 2025 -

Kanye West Defies Kim Kardashian Releases Song Featuring Diddy And Daughter North West

May 18, 2025

Kanye West Defies Kim Kardashian Releases Song Featuring Diddy And Daughter North West

May 18, 2025