BofA's Reassuring View: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Factors Behind Their Positive Outlook

BofA's core argument centers on the idea that current valuations, while appearing high, are justified by several key factors indicating strong underlying economic health and future growth potential. They don't believe a market crash is imminent, based on their analysis. Instead, they see a continued, albeit perhaps slower, growth trajectory. This positive outlook isn't based on blind optimism, but rather on a careful consideration of several interconnected elements.

-

Strong Corporate Earnings Growth Projections: BofA's analysts project continued, albeit potentially moderating, growth in corporate earnings. This expectation stems from several sources, including sustained consumer spending and ongoing business investment. Their models incorporate various economic indicators to arrive at these projections.

-

Low Interest Rates Supporting Higher Valuations: The prevailing low-interest-rate environment allows companies to borrow money at relatively low costs, supporting investment and boosting profitability. This translates to higher valuations as investors are willing to pay more for future earnings streams discounted at lower rates. This is a key pillar in BofA's justification for current market levels.

-

Technological Advancements Driving Future Growth: BofA highlights the transformative impact of technological advancements, particularly in sectors like artificial intelligence, renewable energy, and biotechnology, as significant drivers of future economic growth and higher valuations. These innovations are expected to reshape industries and create new opportunities for significant returns.

-

BofA's Research: To support their claims, BofA regularly publishes detailed research reports and market commentaries from leading analysts. [Insert link to relevant BofA research reports here, if available]. These reports offer a deeper dive into their methodology and supporting data.

Addressing the "Overvalued" Narrative: Debunking Common Concerns

Many investors are understandably concerned about potentially overvalued markets, often citing historical comparisons and fearing a market correction. Let's address these common anxieties using BofA's perspective:

-

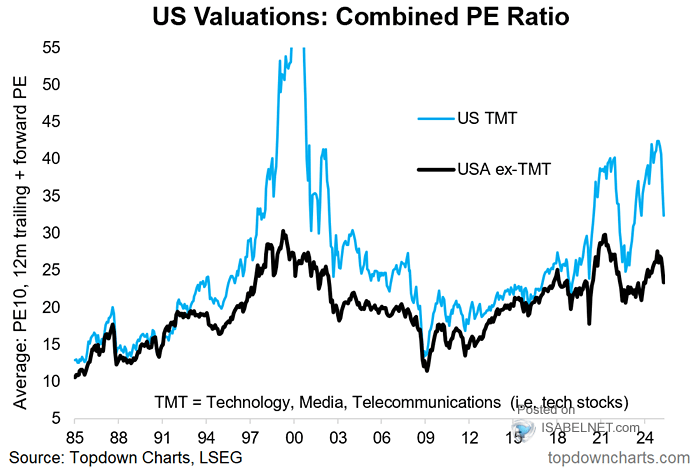

Refuting Concerns: BofA acknowledges the apparent high valuations but argues that traditional valuation metrics, such as the Price-to-Earnings ratio (P/E), don't fully capture the long-term growth potential fueled by technological innovation. They emphasize the importance of looking beyond these traditional metrics.

-

Limitations of Traditional Metrics: Simply relying on historical P/E ratios or other traditional valuation methods can be misleading in a rapidly evolving technological landscape. BofA suggests adjusting valuation models to account for factors like disruptive innovation and the potential for exponential growth in certain sectors.

-

Long-Term Growth Potential: The focus should be on long-term growth potential rather than short-term fluctuations. BofA's analysis suggests that the long-term prospects for many companies, particularly those at the forefront of technological advancements, justify current, seemingly high, valuations.

The Role of Innovation and Technological Advancements in Justifying High Valuations

Technological advancements are arguably the most significant factor supporting BofA's positive outlook. Innovation is driving earnings growth across various sectors at an unprecedented rate.

-

Innovative Sectors: The AI revolution, the burgeoning renewable energy sector, and advancements in biotechnology are just a few examples of the innovative sectors propelling market valuations. These sectors represent immense growth potential and are attracting significant investment.

-

Impact on Valuation Models: Traditional valuation models struggle to accurately capture the exponential growth potential of these innovative sectors. BofA implicitly suggests modifying traditional approaches to account for the unique characteristics of companies driving this innovation.

-

Long-Term Returns: Despite current high valuations, BofA maintains that the long-term potential for returns in these innovative sectors outweighs the perceived risks. This long-term perspective is a cornerstone of their investment strategy recommendations.

Strategic Investment Approaches in a High-Valuation Market: BofA's Recommendations

Given the current market landscape, BofA suggests a strategic approach to investing:

-

Focus on Quality: Invest in high-quality companies with strong fundamentals, proven track records, and demonstrable competitive advantages. This reduces the risk associated with seemingly high valuations.

-

Diversification: Maintain a well-diversified portfolio across various sectors and asset classes to mitigate risk. This lessens the impact of any single sector underperforming.

-

Long-Term Horizon: Adopt a long-term investment horizon rather than reacting to short-term market volatility. This allows investors to ride out market corrections and benefit from the long-term growth potential.

-

Value and Growth: BofA likely suggests considering both value and growth investment strategies. Combining these approaches can provide a balanced portfolio that benefits from both established, undervalued companies and high-growth innovative businesses.

BofA's Reassuring View: A Call to Action for Investors

In summary, BofA's analysis presents a compelling counter-argument to the widespread concern about overvalued stock markets. Their positive outlook is grounded in strong corporate earnings projections, the supportive low-interest-rate environment, and the transformative potential of technological advancements. By addressing common concerns and outlining a strategic investment approach, BofA offers investors a reassuring perspective on navigating this market. Don't let high stock market valuations deter you. Learn more about BofA's analysis and develop a well-informed investment strategy today. Consider BofA's reassuring view on high stock market valuations when making your investment decisions.

Featured Posts

-

Faa Announces No Fly Zone For Space X Starship Launch

May 29, 2025

Faa Announces No Fly Zone For Space X Starship Launch

May 29, 2025 -

Seattle Police File Murder Charges After Baker Park Shooting

May 29, 2025

Seattle Police File Murder Charges After Baker Park Shooting

May 29, 2025 -

Eyd Astqlal Alardn Thnyt Khast Mn Alshykh Fysl Alhmwd Ela Jw 24

May 29, 2025

Eyd Astqlal Alardn Thnyt Khast Mn Alshykh Fysl Alhmwd Ela Jw 24

May 29, 2025 -

Hollywood Shutdown Writers And Actors On Strike What This Means For The Industry

May 29, 2025

Hollywood Shutdown Writers And Actors On Strike What This Means For The Industry

May 29, 2025 -

Did The Switch Finally Bridge The Gap For Nintendos Tech

May 29, 2025

Did The Switch Finally Bridge The Gap For Nintendos Tech

May 29, 2025

Latest Posts

-

2025 Pro Motocross Championship A Season Preview

May 31, 2025

2025 Pro Motocross Championship A Season Preview

May 31, 2025 -

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025

Nikola Jokics One Handed Highlight Key To Nuggets Blowout Win Over Jazz

May 31, 2025 -

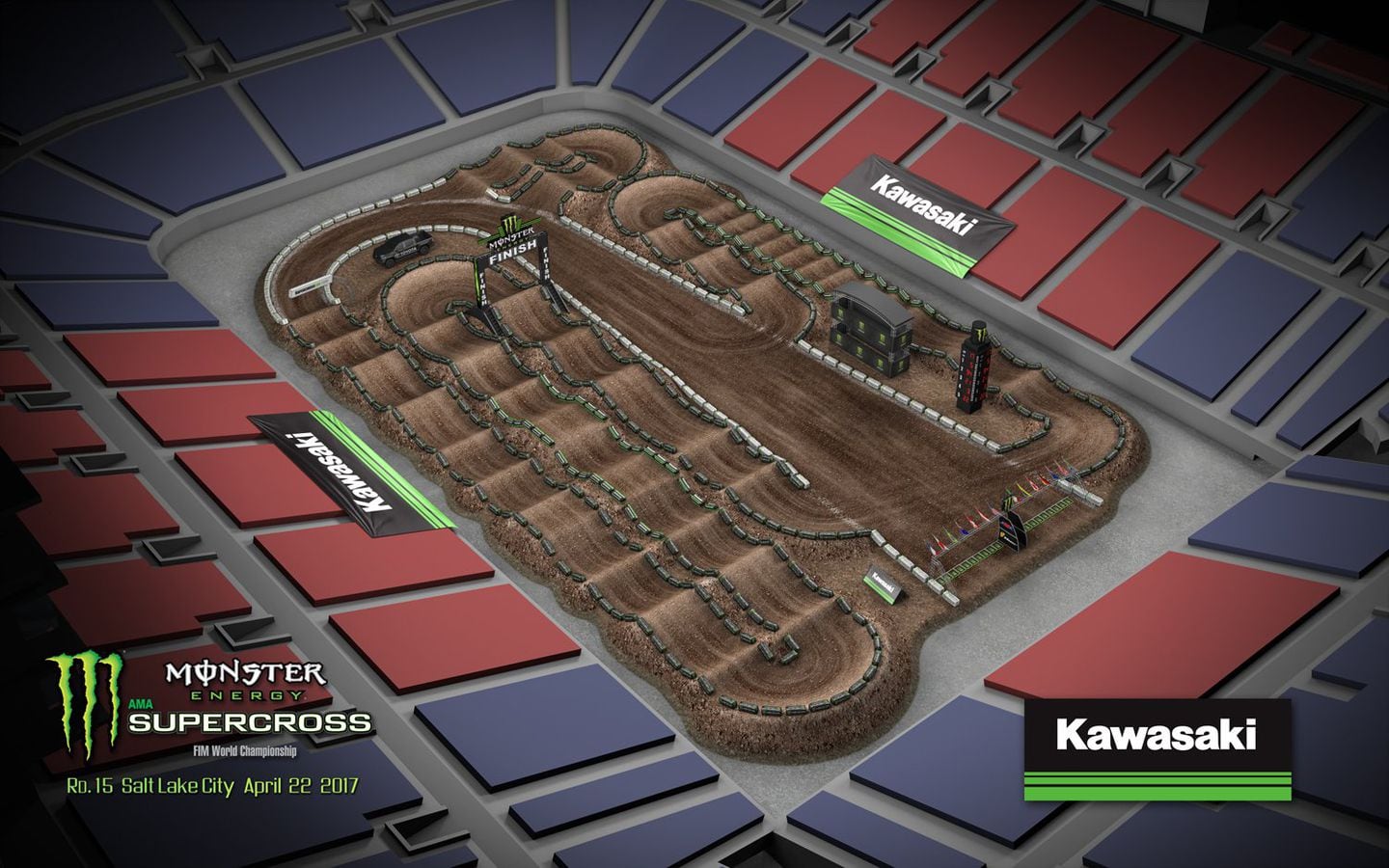

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025

Supercross In Salt Lake City A Riders Guide To The Event

May 31, 2025 -

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025 -

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025