BofA's Take: Are High Stock Market Valuations A Reason To Worry?

Table of Contents

BofA's Current Stance on Market Valuations

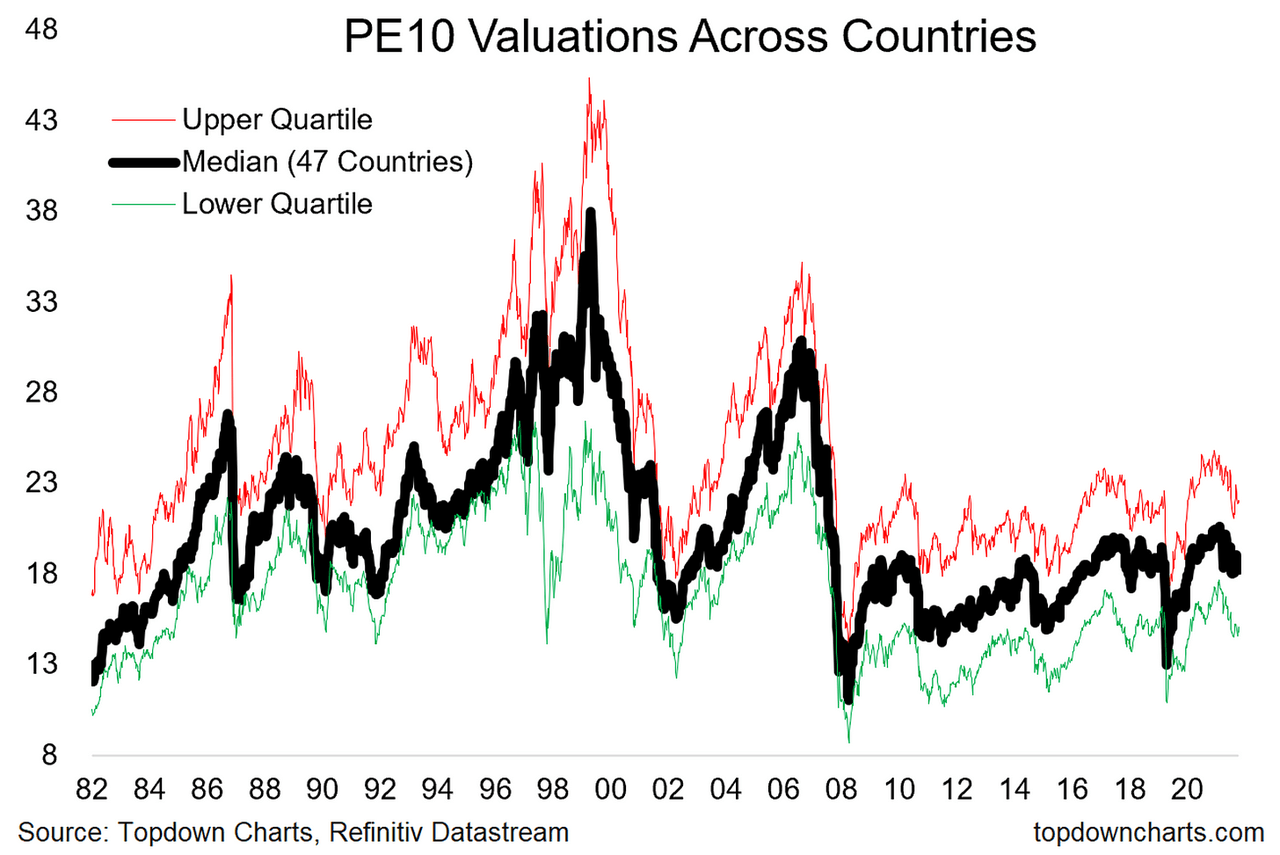

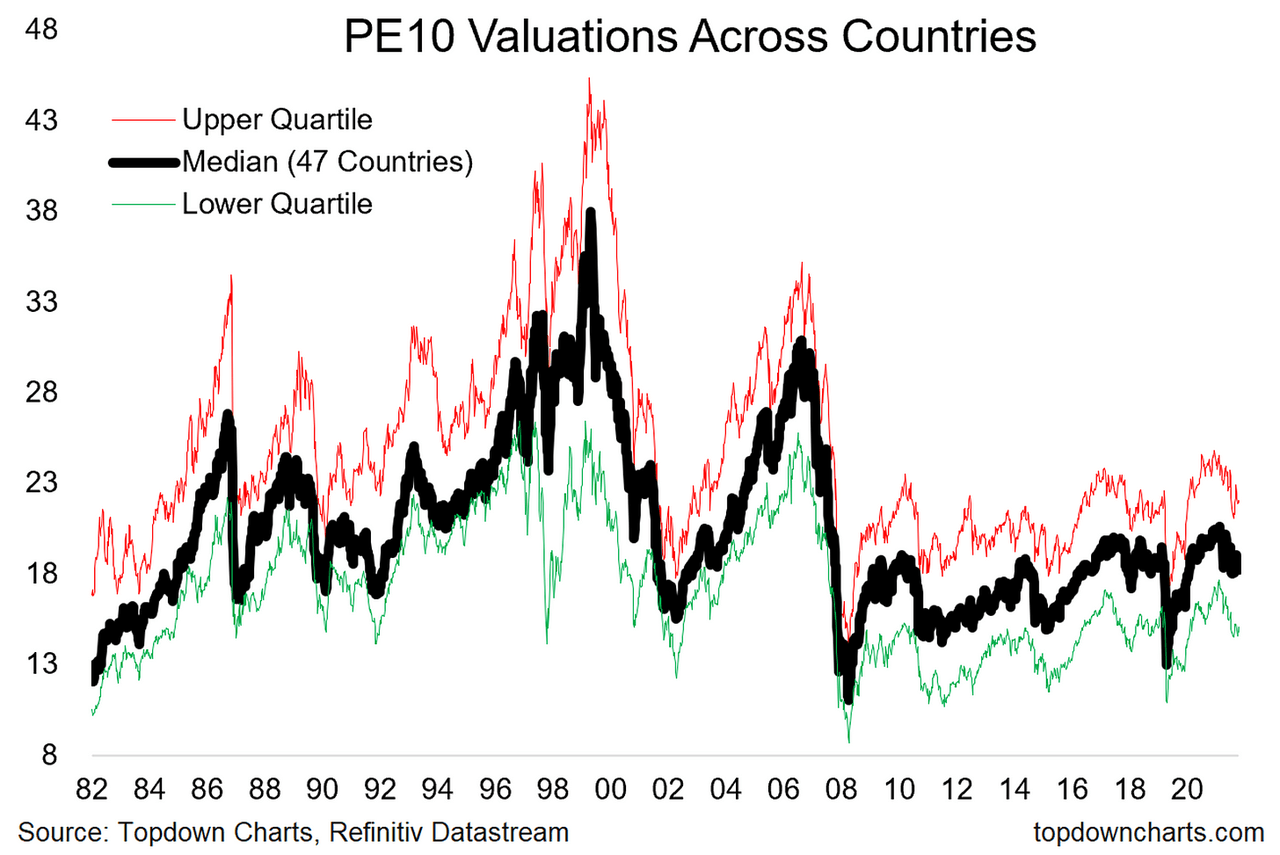

BofA's recent analyses paint a nuanced picture. While acknowledging the historically high valuations, their stance isn't a blanket call for panic. However, they emphasize the need for caution and strategic adjustments to investment portfolios. Their reports frequently cite metrics like elevated Price-to-Earnings (P/E) ratios and the Shiller PE (CAPE ratio), suggesting that certain sectors are trading at premiums compared to historical averages.

- Key findings from BofA's research: BofA consistently points towards a potential for increased market volatility in the near term due to these elevated valuations. They emphasize the importance of considering various economic factors before making major investment decisions.

- Specific valuation metrics used by BofA: Beyond P/E ratios, BofA incorporates metrics like the Shiller PE ratio (cyclically adjusted price-to-earnings ratio), which smooths out earnings fluctuations over time, offering a potentially more robust indicator of long-term valuations. They also analyze sector-specific valuations to identify potential overvaluation in specific areas.

- BofA's predictions for future market performance based on valuations: BofA's predictions are not definitive, reflecting the inherent uncertainty of the market. However, their analyses suggest a higher probability of market corrections or periods of slower growth given current valuations, urging investors to approach the market with a more conservative outlook.

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors have contributed to the current elevated stock market valuations. These include:

- Impact of low interest rates on stock valuations: Historically low interest rates have made bonds less attractive, driving investors towards equities in search of higher returns. This increased demand has pushed stock prices higher, inflating valuations.

- Influence of technological advancements and growth sectors: The remarkable growth of technology companies and other high-growth sectors has significantly influenced overall market valuations. These sectors often command premium valuations due to their perceived future growth potential.

- Role of investor speculation and fear of missing out (FOMO): Investor psychology plays a substantial role. The fear of missing out on potential gains can lead to speculative buying, pushing valuations even higher, further exacerbating the already elevated levels. This creates a self-reinforcing cycle.

Potential Risks Associated with High Valuations

Investing in a market with high valuations carries inherent risks:

-

Increased volatility: Highly valued markets are often more susceptible to sharp price swings. Even minor negative news can trigger significant sell-offs.

-

Potential for corrections or crashes: History is replete with examples of market corrections following periods of elevated valuations. While no one can predict the timing or severity of a correction, the risk increases with higher valuations.

-

Impact of rising interest rates on stock valuations: A rise in interest rates, a common tool used by central banks to combat inflation, can negatively impact stock valuations as investors shift their investments towards higher-yielding bonds.

-

Historical examples of market corrections following periods of high valuations: The dot-com bubble burst of 2000 and the 2008 financial crisis are prime examples of market corrections following periods of significantly inflated valuations. These events serve as stark reminders of the potential consequences.

-

Potential impact of inflation on stock prices: High inflation erodes purchasing power and can negatively affect corporate profits, leading to downward pressure on stock prices. This risk is particularly acute when valuations are already elevated.

-

Risks associated with specific sectors or asset classes: Not all sectors are equally overvalued. BofA's analysis highlights specific sectors that may be particularly vulnerable in a market correction.

BofA's Recommendations for Investors

BofA's advice to investors focuses on risk management and strategic adjustments:

- BofA's suggested asset allocation strategies: Diversification across different asset classes (e.g., stocks, bonds, real estate) is a cornerstone of BofA's recommendations, aiming to mitigate overall portfolio risk. They advocate for a more cautious approach, potentially reducing equity exposure.

- Recommendations for specific sectors or investment vehicles: BofA's reports may provide specific recommendations regarding sectors or investment vehicles that appear less overvalued or more resilient to potential market downturns.

- Advice on risk management and portfolio adjustments: Risk management is crucial in this environment. BofA emphasizes the importance of understanding your risk tolerance and adjusting your portfolio accordingly. This might involve shifting towards more defensive strategies.

Conclusion: Navigating High Stock Market Valuations – A BofA Perspective

BofA's analysis of high stock market valuations underscores the need for caution and strategic planning. While not predicting an imminent crash, they highlight the potential for increased volatility and corrections. Their recommendations emphasize diversification, risk management, and a more conservative approach to investing in this environment. By understanding the contributing factors, potential risks, and BofA's advice, investors can make more informed decisions and better navigate the complexities of the current market. To learn more about BofA's current market outlook and investment strategies, we encourage you to visit their website and consult with a financial advisor to discuss your individual circumstances and build a tailored investment plan that addresses your specific concerns about high stock market valuations.

Featured Posts

-

Champions League Semi Final Dates Barcelona Inter Arsenal And Psg Matchups

May 09, 2025

Champions League Semi Final Dates Barcelona Inter Arsenal And Psg Matchups

May 09, 2025 -

Predicting The Future Palantirs Ai And Its Implications For Nato And Public Sector

May 09, 2025

Predicting The Future Palantirs Ai And Its Implications For Nato And Public Sector

May 09, 2025 -

Nl Federal Election 2024 Candidate Overview

May 09, 2025

Nl Federal Election 2024 Candidate Overview

May 09, 2025 -

New Uk Immigration Rules Emphasize English Language Skills

May 09, 2025

New Uk Immigration Rules Emphasize English Language Skills

May 09, 2025 -

Ukraina I Oboronnoe Soglashenie Makron Tusk Analiz Klyuchevykh Punktov

May 09, 2025

Ukraina I Oboronnoe Soglashenie Makron Tusk Analiz Klyuchevykh Punktov

May 09, 2025