BofA's Take: Are High Stock Market Valuations Cause For Concern?

Table of Contents

BofA's Current Valuation Assessment

BofA regularly publishes market analyses and outlooks, employing sophisticated valuation models to assess the health of the stock market. Their "BofA stock market outlook" often incorporates a range of metrics to gauge whether current valuations are sustainable. Understanding their perspective is crucial for informed investment decisions.

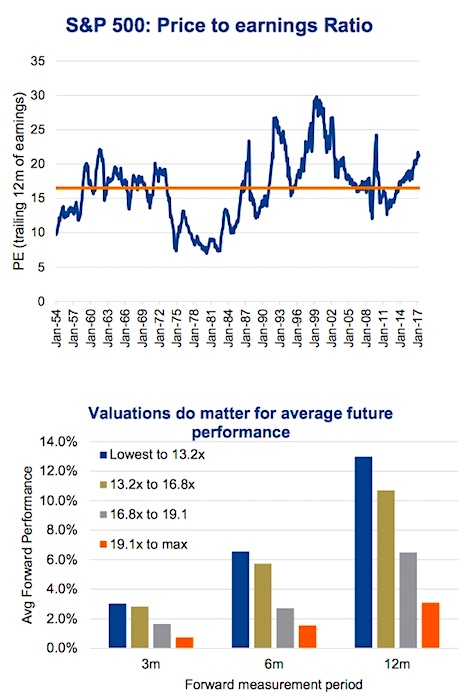

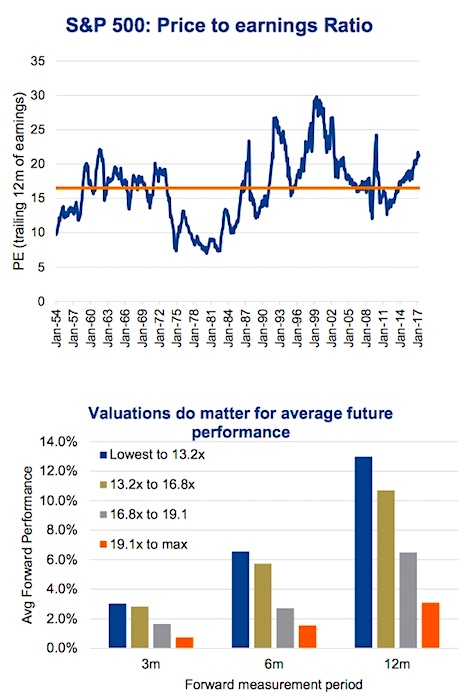

- Metrics Used: BofA utilizes key metrics like the Price-to-Earnings ratio (P/E), the Shiller PE ratio (CAPE), and other proprietary models to assess valuations across various sectors and indices. These metrics compare current stock prices to historical earnings, providing a context for current levels.

- Valuation Ranking: BofA's reports frequently compare current valuation levels to historical averages, identifying whether current valuations are significantly above or below long-term norms. This historical context is critical in understanding potential risks.

- Overvalued Sectors: BofA's analyses often pinpoint specific sectors or indices deemed overvalued based on their models. These insights can help investors adjust their portfolio allocations strategically, avoiding excessive exposure to potentially vulnerable areas.

Factors Influencing High Valuations

Several macroeconomic factors have contributed to the current high stock market valuations. Understanding these forces is key to predicting future market trends and managing investment risk effectively.

- Low Interest Rates: Years of low interest rates, particularly after periods of quantitative easing (QE), have pushed investors towards higher-yielding assets, including stocks. This has inflated valuations across various asset classes.

- Quantitative Easing (QE): QE programs, implemented by central banks to stimulate economic growth, inject massive amounts of liquidity into the market. This increased liquidity can fuel asset price inflation, including stocks.

- Economic Growth (or Lack of Negative Indicators): Positive economic indicators, or even the absence of significant negative news, boosts investor confidence, leading to higher demand and subsequently higher prices. However, it's important to note that overly optimistic sentiment can also inflate valuations beyond sustainable levels.

- Technology Sector Growth: The rapid growth and innovation in the technology sector have significantly impacted overall market valuations. High-growth tech companies often command high valuations, even if their earnings do not justify those levels in the short-term.

Potential Risks Associated with High Valuations

While high valuations can signal strong investor confidence, they also carry significant risks. Understanding these risks is paramount for effective investment risk management.

- Market Corrections/Crashes: High valuations often precede market corrections or even crashes. When investor sentiment shifts, even slightly, a sharp decline in prices can occur.

- Increased Volatility: Highly valued markets tend to exhibit greater price volatility. Rapid price swings can make it challenging to navigate the market and protect capital.

- Higher Potential for Capital Losses: The higher the stock price, the greater the potential for losses if the market declines. Investors in highly valued markets are therefore more vulnerable to capital loss.

- "Bubble" Scenarios: History shows that periods of extremely high valuations can create speculative bubbles. These bubbles eventually burst, leading to significant market corrections. Identifying potential bubbles requires careful analysis and consideration of historical precedents.

BofA's Recommendations for Investors

Given the current valuation environment, BofA likely offers investors guidance on adjusting their strategies to mitigate potential risks while still capturing market opportunities.

- Adjusting Portfolio Allocation: BofA's recommendations might involve adjusting portfolio allocations based on an investor's risk tolerance. This could mean reducing exposure to highly valued sectors and increasing exposure to less volatile assets.

- Diversification: Diversifying across different asset classes (stocks, bonds, real estate, alternative investments) is essential to reduce risk. BofA likely emphasizes the importance of a well-diversified portfolio.

- Sector-Specific Strategies: BofA might recommend sector-specific investment strategies, focusing on undervalued sectors or companies with strong fundamentals. This can help balance risk and opportunity.

- Long-Term Investment Horizons: BofA likely emphasizes the importance of maintaining a long-term investment horizon, allowing time to recover from short-term market fluctuations.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

BofA's analysis of high stock market valuations suggests a cautious approach. While strong economic fundamentals might support current prices, the elevated valuation levels increase the potential for corrections and losses. The key factors influencing these valuations—low interest rates, QE, and sector-specific growth—need careful consideration. BofA's recommendations for investors likely involve careful portfolio allocation, diversification, and a focus on long-term investment goals. To create a personalized investment strategy that effectively navigates these high stock market valuations, consult with a financial advisor. Stay informed about BofA's ongoing market analysis to stay ahead of market shifts. [Insert link to relevant BofA resources here].

Featured Posts

-

Verstappens First Child Name Revealed Before Miami Grand Prix

May 05, 2025

Verstappens First Child Name Revealed Before Miami Grand Prix

May 05, 2025 -

The Albanese Government And The Australian Economy Key Priorities

May 05, 2025

The Albanese Government And The Australian Economy Key Priorities

May 05, 2025 -

Holi Heatwave South Bengal Temperatures Reach Near 38 Degrees

May 05, 2025

Holi Heatwave South Bengal Temperatures Reach Near 38 Degrees

May 05, 2025 -

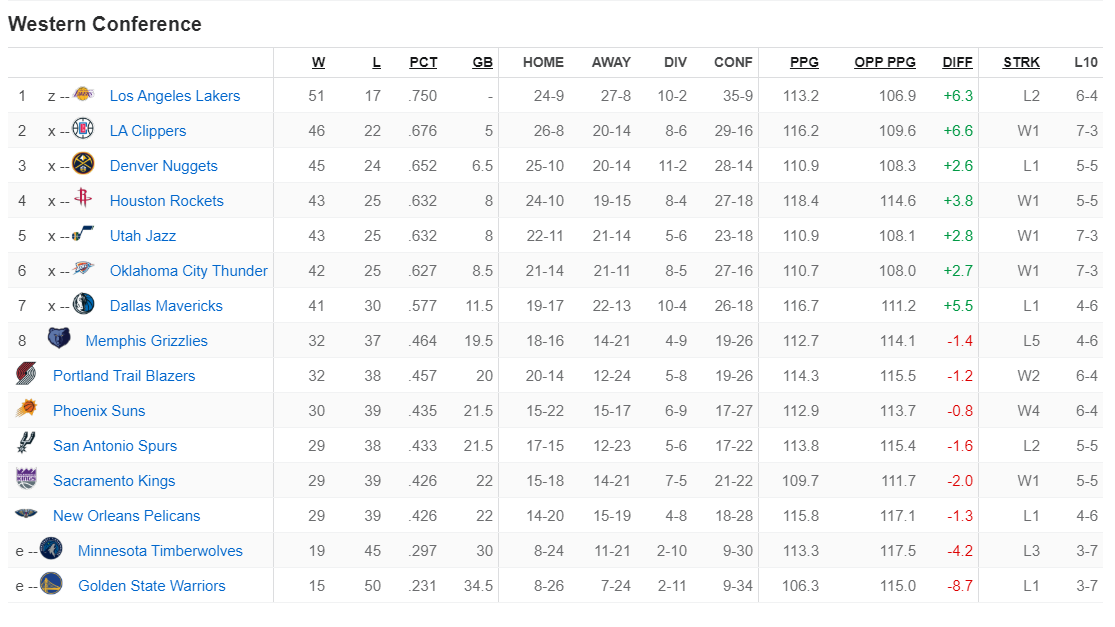

25 Points Big Impact Nba Reaction To Russell Westbrooks Performance

May 05, 2025

25 Points Big Impact Nba Reaction To Russell Westbrooks Performance

May 05, 2025 -

Convicted Paedophile Receives Significant Prison Term Following Multi Agency Operation

May 05, 2025

Convicted Paedophile Receives Significant Prison Term Following Multi Agency Operation

May 05, 2025

Latest Posts

-

Nba 2025 Conference Semifinals Dates Times And Matchups

May 06, 2025

Nba 2025 Conference Semifinals Dates Times And Matchups

May 06, 2025 -

2025 Nba Playoffs Conference Semifinals Full Schedule

May 06, 2025

2025 Nba Playoffs Conference Semifinals Full Schedule

May 06, 2025 -

Polski Trotyl Podbija Ameryke Analiza Kontraktu Z Us Army

May 06, 2025

Polski Trotyl Podbija Ameryke Analiza Kontraktu Z Us Army

May 06, 2025 -

Uchastie Aliny Voskresenskoy V Univer Molodye Podrobnosti O Roli I Syemkakh

May 06, 2025

Uchastie Aliny Voskresenskoy V Univer Molodye Podrobnosti O Roli I Syemkakh

May 06, 2025 -

Spak Banesa E Motrave Nikolli Nen Hetim

May 06, 2025

Spak Banesa E Motrave Nikolli Nen Hetim

May 06, 2025