BofA's Take: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Current Market Environment

BofA's overall assessment of the current economic landscape considers several crucial factors: interest rates, inflation, and economic growth. They believe the interplay of these elements contributes to a market environment that can support, at least partially, higher valuations. This isn't to say there are no risks, but rather that the situation isn't as dire as some might believe.

- BofA's key economic indicators and forecasts: BofA's recent reports indicate a moderate expectation for continued economic growth, albeit at a slower pace than previously experienced. Inflation, while still a concern, is projected to gradually decrease. Interest rates, while rising, are still considered relatively low in a historical context. (Note: Links to relevant BofA reports would be inserted here).

- Why BofA believes these factors support higher valuations: The combination of sustained (though slower) growth and gradually decreasing inflation, coupled with relatively low interest rates, creates an environment where investors may still find higher stock valuations justifiable. The slower growth mitigates some of the risk associated with higher valuations.

- Specific BofA reports and analyses: Consult BofA's Global Research publications for detailed data and analysis supporting their viewpoint. (Again, links to relevant reports would be inserted here).

The Role of Low Interest Rates in Justifying High Valuations

Low interest rates play a significant role in supporting higher stock valuations. There's an inverse relationship between interest rates and Price-to-Earnings (P/E) ratios. Lower interest rates make future earnings more valuable in present-day terms.

- Impact on the present value of future earnings: Lower discount rates (driven by lower interest rates) increase the present value of future corporate earnings, thus justifying higher stock prices.

- Comparison of current interest rates to historical levels: Current interest rates, while rising, remain historically low compared to previous decades. This contributes to the environment that supports higher valuations.

- Examples: A company with projected high future earnings will see those earnings discounted less heavily with lower interest rates, leading to a higher present valuation.

Long-Term Growth Potential and Future Earnings Expectations

BofA's projections for long-term economic growth are central to their justification of current valuations. They focus on the potential for future earnings and sustainable growth across various sectors.

- BofA's projections for specific sectors: BofA identifies sectors like technology, renewable energy, and healthcare as exhibiting strong long-term growth potential. These sectors are expected to drive future earnings growth.

- Technological advancements: Technological innovation continues to fuel productivity gains and create new market opportunities, supporting long-term earnings growth across various sectors.

- Higher justified valuations: The expectation of robust future earnings from these growth sectors contributes to higher justified stock valuations.

Addressing the Risks: A Balanced Perspective from BofA

While BofA presents a relatively optimistic view, they acknowledge potential risks associated with high valuations. It's crucial to maintain a balanced perspective.

- Potential risks: Inflation spikes, unexpected economic downturns, geopolitical instability, and interest rate shocks are potential headwinds.

- BofA's strategies for mitigating risks: Diversification of investments, strategic asset allocation, and careful risk management are vital strategies for navigating these risks.

- BofA's consideration of these risks: BofA's analysis explicitly incorporates these risks and provides insights into their potential impact.

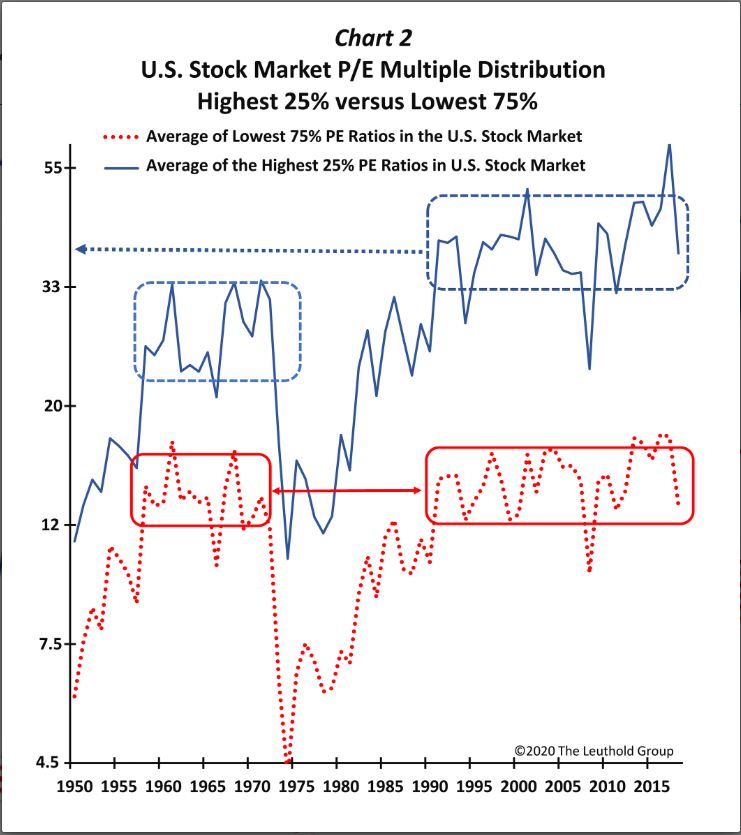

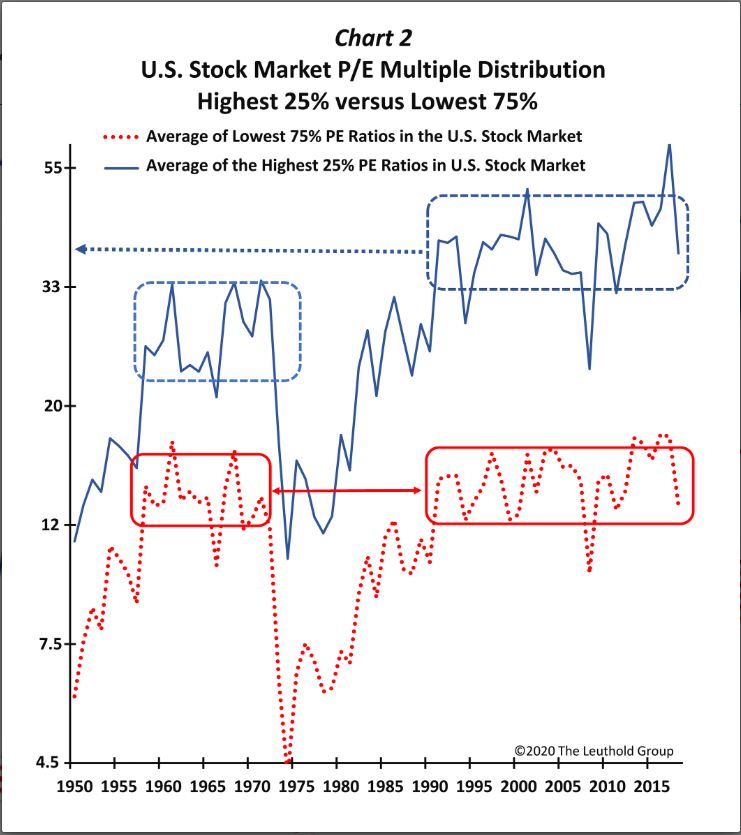

Comparing Current Valuations to Historical Data

A comparative analysis of current valuations against historical averages, adjusted for relevant economic factors, reveals that current levels are not necessarily unprecedented. [Insert chart/graph here comparing current P/E ratios to historical averages, adjusted for inflation and interest rates]. This visualization helps demonstrate that while valuations are high, they are not entirely outside the range of historical norms, particularly considering the current low interest rate environment.

Conclusion: Why High Stock Market Valuations Shouldn't Deter You (BofA's Perspective)

BofA's analysis suggests that while stock market valuations are high, they are not necessarily cause for immediate alarm. Their perspective highlights the importance of considering long-term growth potential and the impact of low interest rates on valuations. While acknowledging inherent risks like inflation and economic downturns, BofA emphasizes the importance of strategic risk management through diversification and careful planning.

Don't let concerns about high stock market valuations paralyze your investment decisions. Review BofA's analysis and discuss your investment strategy with a financial advisor. Remember that a long-term perspective and a well-diversified portfolio are crucial for navigating any market environment, including one with high stock market valuations.

Featured Posts

-

11 Minciu Apie M Ivaskeviciaus Isvaryma Analize Filmas Priesistore Ir Keiksmazodziai

Apr 29, 2025

11 Minciu Apie M Ivaskeviciaus Isvaryma Analize Filmas Priesistore Ir Keiksmazodziai

Apr 29, 2025 -

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025 -

The Pete Rose Pardon Trump Baseball And The Issue Of Sports Betting

Apr 29, 2025

The Pete Rose Pardon Trump Baseball And The Issue Of Sports Betting

Apr 29, 2025 -

How Npr Explains You Tubes Increasing Popularity With Older Generations

Apr 29, 2025

How Npr Explains You Tubes Increasing Popularity With Older Generations

Apr 29, 2025 -

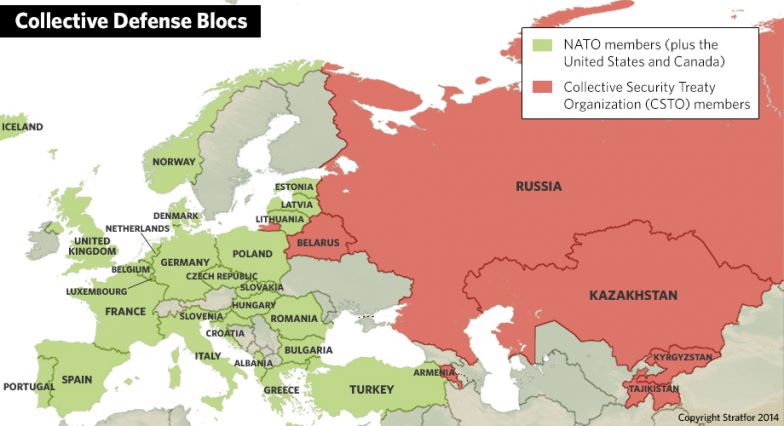

Russias Military Posture A Source Of European Anxiety

Apr 29, 2025

Russias Military Posture A Source Of European Anxiety

Apr 29, 2025