BofA's View: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Bullish Outlook Despite High Valuations

BofA maintains a positive outlook on the stock market despite acknowledging the elevated valuations. Their rationale rests on a robust foundation of economic indicators and long-term growth projections. This bullish sentiment isn't blind optimism; it's based on careful analysis and consideration of various factors.

- BofA Reports and Analyst Opinions: Several recent BofA reports emphasize the resilience of the corporate sector and the potential for sustained earnings growth. Their analysts highlight a disconnect between current market sentiment and underlying economic fundamentals.

- Key Economic Indicators: BofA's positive outlook is supported by projections of continued GDP growth, albeit at a moderated pace, and a gradual decline in inflation. These indicators suggest a healthy economic environment capable of supporting higher stock valuations.

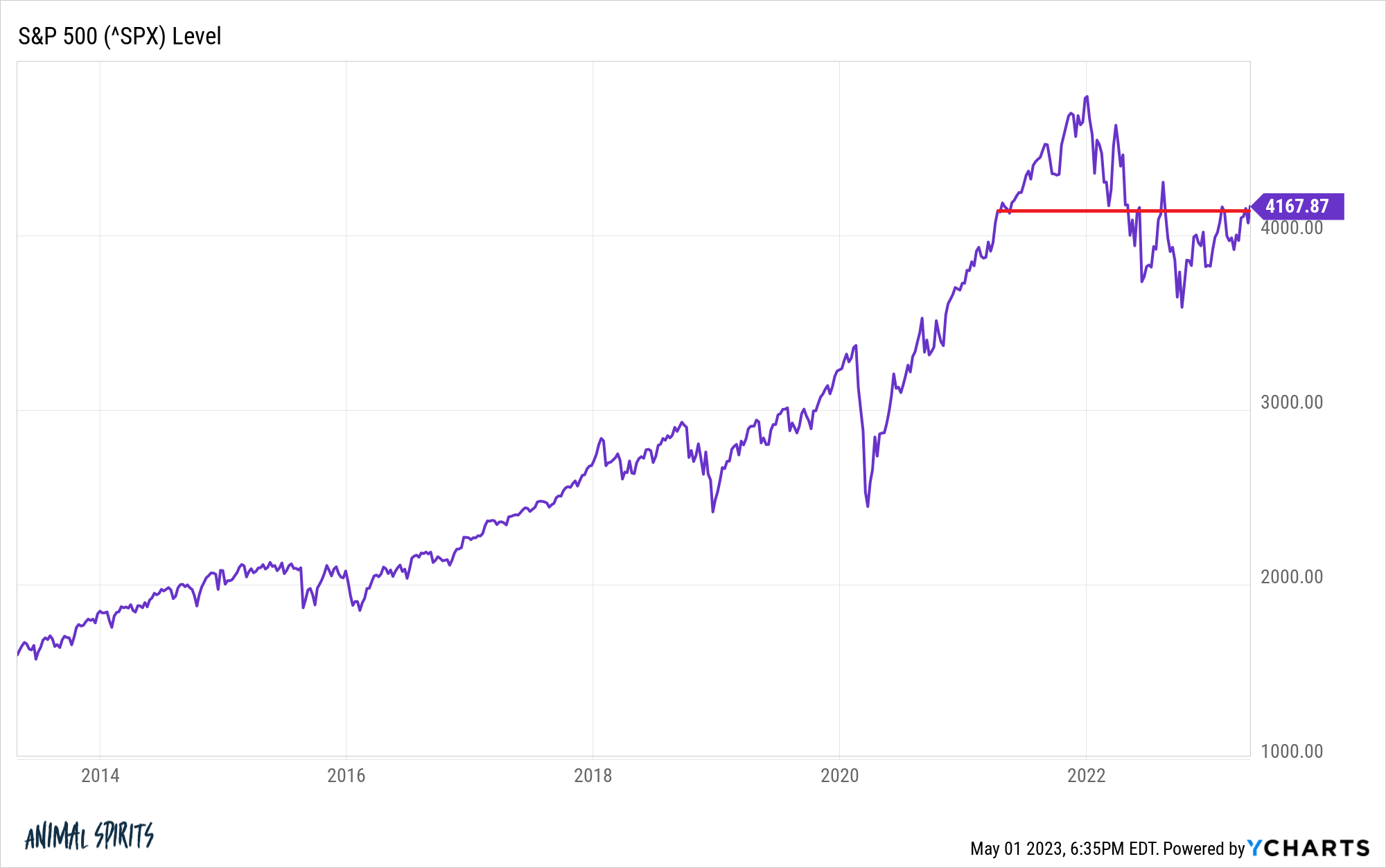

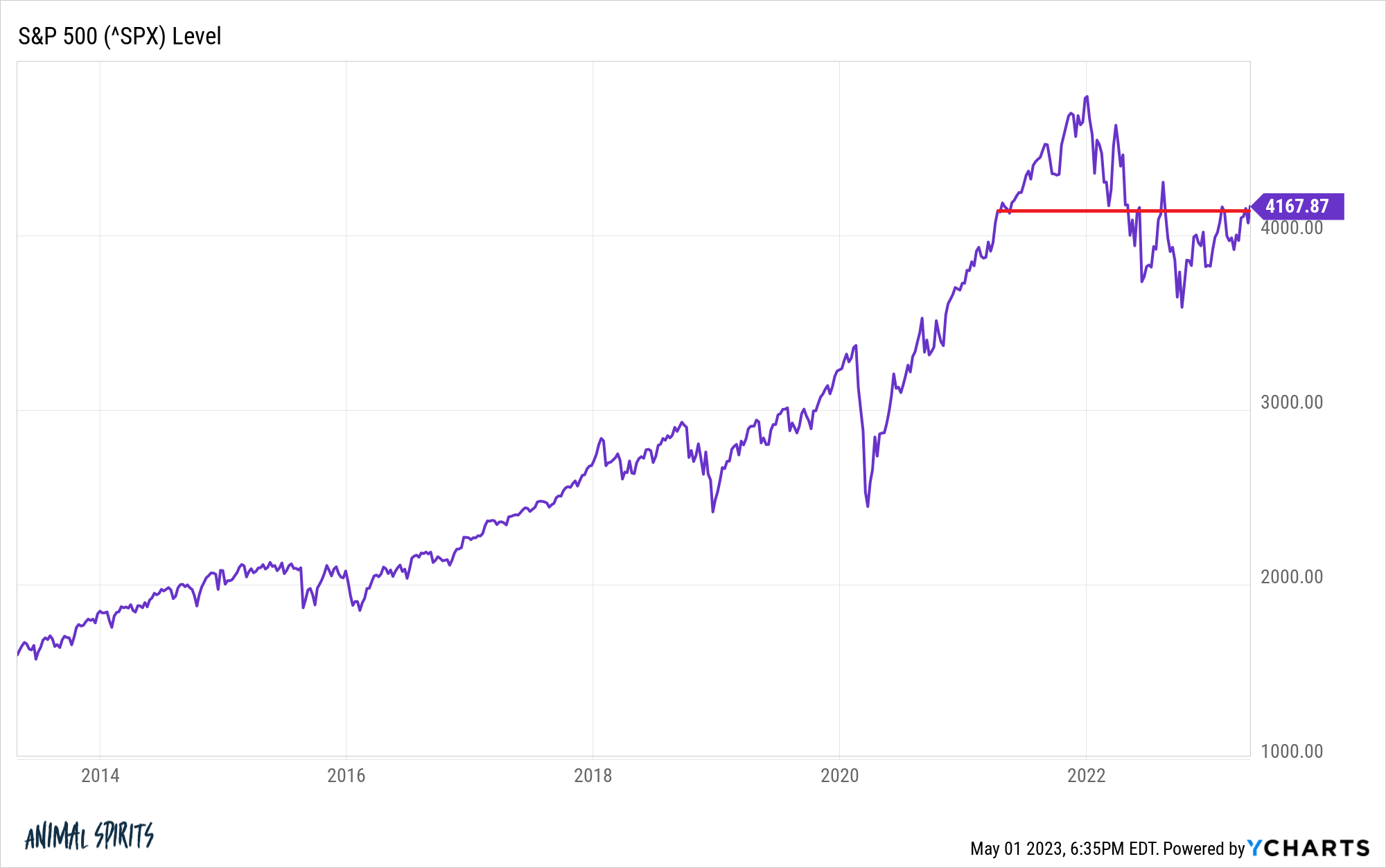

- Historical Context: While current P/E ratios might appear high compared to historical averages, BofA analysts point out that low interest rates and strong corporate earnings justify a premium valuation to some extent. They emphasize the importance of comparing valuations across different sectors and economic cycles, not solely relying on historical comparisons.

Understanding Current Market Valuations

Current market valuations are a product of several interconnected factors. Understanding these factors is crucial to grasping BofA's perspective.

- Low Interest Rates (Historically): Historically low interest rates have fueled investment in equities, driving up valuations. While interest rates are rising, their effect on valuations is complex and depends on the speed and extent of increases.

- Strong Corporate Earnings: Robust corporate earnings, particularly in certain sectors, have supported higher stock prices. Companies have demonstrated resilience in the face of economic challenges.

- Technological Innovation: Technological advancements continue to drive productivity and economic growth, supporting higher valuations in technology-related sectors and beyond.

Valuation Metrics: Understanding key valuation metrics like the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and Price-to-Book ratio (P/B) is crucial. These ratios provide insights into how the market values a company relative to its earnings, sales, and book value. However, it's critical to use these metrics in conjunction with other indicators and not in isolation.

- Sectoral Variations: Valuations vary considerably across different sectors. Some sectors, such as technology and healthcare, command higher valuations due to their growth potential, while others may trade at lower multiples.

Limitations of Valuation Metrics: It's important to remember that valuation metrics are just one piece of the puzzle. They don't capture all aspects of a company's value, such as intangible assets, future growth potential, or management quality.

The Long-Term Growth Perspective

BofA emphasizes the importance of adopting a long-term perspective when evaluating stock market valuations. Short-term market fluctuations are to be expected. The focus should be on the long-term growth potential of companies and the overall economy.

- Continued Corporate Earnings Growth: BofA anticipates continued growth in corporate earnings, driven by factors such as technological innovation, globalization, and increasing consumer spending.

- High-Growth Sectors: Specific sectors, including technology and healthcare, are expected to outperform the broader market due to their strong growth prospects and innovative products and services.

- Technological Advancements: Technological advancements are expected to drive productivity gains and create new economic opportunities, further supporting long-term growth.

Addressing Interest Rate Concerns

Rising interest rates are a legitimate concern for investors, as they can impact stock valuations and overall market sentiment. BofA acknowledges these concerns but provides a balanced perspective.

- BofA's Interest Rate Projections: BofA provides projections for interest rate hikes, acknowledging their potential to dampen market enthusiasm. However, their projections suggest a gradual increase, allowing companies time to adjust.

- Company Preparedness: Many companies are well-positioned to navigate a rising rate environment, having implemented strategies to manage their debt and maintain profitability.

- Interest Rate-Insensitive Sectors: Certain sectors, such as consumer staples and utilities, are less sensitive to interest rate changes and may offer relative stability during periods of rising rates.

Strategic Investment Opportunities

Based on their analysis, BofA identifies specific investment opportunities that investors may consider. These recommendations are based on their long-term growth potential and ability to navigate a changing economic landscape. It is vital to note that these are just potential investment strategies, and any investment involves risk.

- Specific Stock and Sector Recommendations: BofA may recommend specific stocks or sectors based on their valuation, growth potential, and competitive advantages. (Note: Specific recommendations are beyond the scope of this general article and should be obtained through direct consultation with BofA or a qualified financial advisor).

- Reasoning Behind Recommendations: The rationale behind these recommendations is usually based on a combination of quantitative and qualitative factors, including financial performance, industry trends, and management quality.

- Disclaimer: Investing in the stock market involves inherent risks, and there is always the possibility of losing money. Before making any investment decisions, it's crucial to conduct thorough research and consult with a qualified financial advisor.

Investing Wisely Despite Market Valuations – A BofA Perspective

In summary, BofA's positive outlook on the stock market isn't based on ignoring high valuations; it's based on a nuanced understanding of the underlying economic fundamentals, long-term growth potential, and the strategic opportunities presented. The key takeaways are the importance of a long-term investment strategy, the need to consider valuations within the context of broader economic trends, and the opportunities available in specific sectors. Don't let current stock market valuations deter you from pursuing a well-diversified investment strategy aligned with your long-term financial goals. Learn more about BofA's market outlook through their official channels and consult a financial advisor to discuss your investment strategy and risk tolerance before making any investment decisions.

Featured Posts

-

Steam 2025 Sale Dates Your Essential Guide

May 16, 2025

Steam 2025 Sale Dates Your Essential Guide

May 16, 2025 -

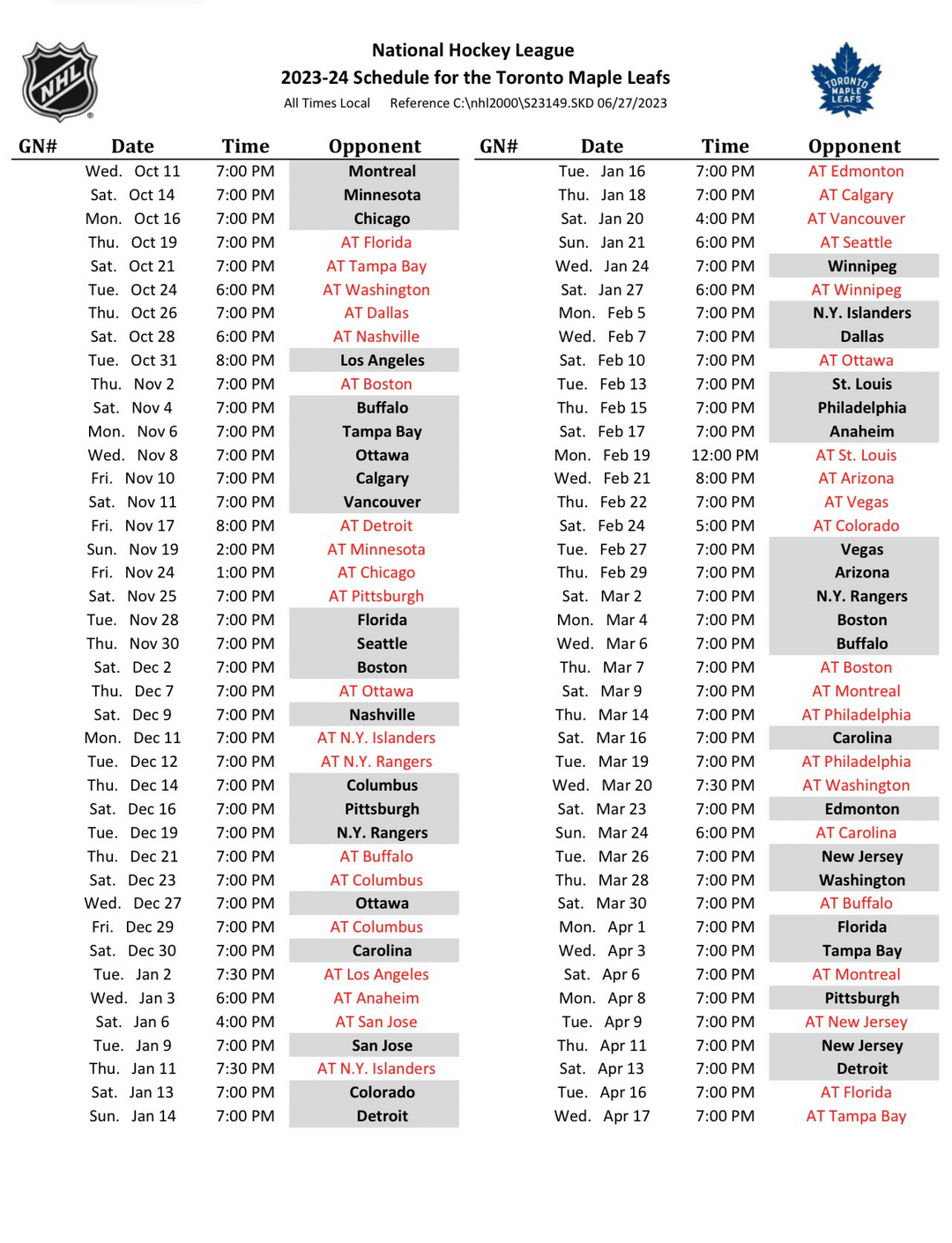

Toronto Maple Leafs Playoff Spot On The Line Against Florida Panthers

May 16, 2025

Toronto Maple Leafs Playoff Spot On The Line Against Florida Panthers

May 16, 2025 -

Jiskefet Wint Ere Zilveren Nipkowschijf

May 16, 2025

Jiskefet Wint Ere Zilveren Nipkowschijf

May 16, 2025 -

Tom Cruise And Ana De Armas Spotted Together Again In England Are They Dating

May 16, 2025

Tom Cruise And Ana De Armas Spotted Together Again In England Are They Dating

May 16, 2025 -

Cloudflare Seeks Court Intervention To Stop La Ligas Illegal Blocking Of Encrypted Connections

May 16, 2025

Cloudflare Seeks Court Intervention To Stop La Ligas Illegal Blocking Of Encrypted Connections

May 16, 2025