BofA's View: Why Current Stock Market Valuations Shouldn't Worry You

Table of Contents

BofA's Bullish Outlook: Factors Supporting Positive Market Sentiment

BofA's positive market sentiment rests on several key pillars, suggesting that the current valuations are not as alarming as they might initially appear.

Strong Corporate Earnings Despite Inflation

Despite persistent inflationary pressures, corporate earnings have remained remarkably resilient. BofA's analysis reveals several factors contributing to this strength:

- Strong-performing sectors: Technology, healthcare, and consumer staples have demonstrated consistent growth, offsetting weakness in other areas. These sectors often possess significant pricing power.

- Profit margin resilience: While inflation has increased costs, many companies have successfully passed these increased costs onto consumers, maintaining healthy profit margins. This pricing power is a key indicator of strong underlying business models.

- Strategic cost-cutting measures: Many companies have implemented efficient cost-cutting strategies, mitigating the impact of inflation on their bottom lines and protecting their stock market performance.

The Role of Technological Innovation

Technological advancements are a significant driver of future growth, and BofA argues that this justifies, to some extent, the higher valuations we see today.

- Innovative sectors leading the way: Artificial intelligence (AI), biotechnology, and renewable energy are just a few examples of sectors poised for exponential growth, significantly impacting market capitalization.

- Long-term growth potential: These technologies offer transformative potential across various industries, fueling long-term investment opportunities and justifying higher valuations based on future earnings potential.

- Disruptive technologies reshaping markets: The constant emergence of disruptive technologies creates new markets and opportunities, making today's valuations less concerning in the context of future potential.

Interest Rate Hikes Reaching a Peak

BofA anticipates that interest rate hikes by central banks, while impacting borrowing costs, are nearing their peak.

- Interest rate levels plateauing: The current interest rate levels are expected to plateau soon, marking a potential turning point.

- Predictions for future rate adjustments: BofA's economists predict either a pause or even potential rate cuts in the future, easing financial pressure on businesses and consumers.

- Impact on borrowing costs and market response: While higher rates increase borrowing costs in the short term, a stabilization or decrease would positively impact economic activity and positively influence stock market performance.

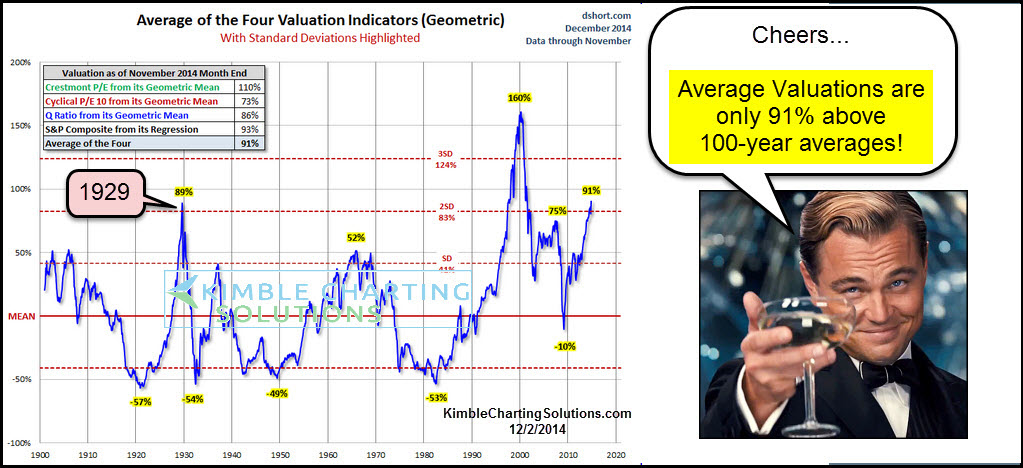

Addressing Concerns About High Stock Market Valuations

While current valuations might seem high based on traditional metrics, BofA argues for a more nuanced perspective.

Valuation Metrics in Context

BofA cautions against relying solely on traditional metrics like the price-to-earnings ratio (P/E) when assessing valuations.

- Alternative valuation metrics: They advocate for considering alternative valuation metrics like discounted cash flow (DCF) analysis and comparing current valuations to historical valuations in similar economic environments.

- Long-term growth prospects: The focus should shift to assessing long-term growth prospects rather than being fixated solely on short-term earnings.

- Relative valuation: Comparing valuations across sectors and considering the relative strength of individual companies offers a more accurate assessment.

The Impact of Low Unemployment and Consumer Spending

The strength of the economy, particularly low unemployment and robust consumer spending, supports BofA's optimistic outlook.

- Unemployment rates near historic lows: Low unemployment rates indicate a healthy labor market and strong consumer confidence.

- Consumer confidence indices remain positive: Positive consumer confidence translates to increased spending, boosting economic activity.

- Retail sales data and spending trends: Solid retail sales data confirm sustained consumer spending, further strengthening the overall economic picture. These macroeconomic factors play a significant role in supporting current valuations.

Long-Term Investment Strategy Over Short-Term Volatility

BofA emphasizes the importance of a long-term investment strategy to mitigate risks associated with short-term market fluctuations.

- Dollar-cost averaging: Dollar-cost averaging helps to reduce the impact of market volatility on your portfolio.

- Portfolio diversification: Diversifying investments across various asset classes reduces overall portfolio risk.

- Long-term benefits of high-growth sectors: Investing in high-growth sectors offers the potential for substantial returns over the long term.

Conclusion

BofA's analysis suggests that while current stock market valuations may seem high, several positive factors, such as strong corporate earnings, technological innovation, and the potential peak of interest rate hikes, counterbalance this concern. By considering a broader range of valuation metrics, focusing on long-term growth prospects, and recognizing the resilience of the economy, investors can adopt a more balanced perspective. Don't let anxieties over current stock market valuations deter you from a well-researched investment strategy. Understand BofA's perspective and, after conducting your own thorough research, make informed decisions for your financial future. Consider consulting a financial advisor to develop an investment strategy tailored to your specific risk tolerance and long-term goals.

Featured Posts

-

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada A Sus Tenistas

Apr 27, 2025

Revolucionario Wta Ofrece Licencia De Maternidad Remunerada A Sus Tenistas

Apr 27, 2025 -

Ariana Grandes Bold Style Change Understanding The Significance Of Tattoos And Hair Transformations

Apr 27, 2025

Ariana Grandes Bold Style Change Understanding The Significance Of Tattoos And Hair Transformations

Apr 27, 2025 -

Is Canada The New Top Travel Destination A Look At Recent Trends

Apr 27, 2025

Is Canada The New Top Travel Destination A Look At Recent Trends

Apr 27, 2025 -

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025

Sorpresa En Indian Wells Caida Inesperada De Una Favorita

Apr 27, 2025 -

Justin Herbert Chargers 2025 Brazil Season Opener Confirmed

Apr 27, 2025

Justin Herbert Chargers 2025 Brazil Season Opener Confirmed

Apr 27, 2025

Latest Posts

-

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025

Watch Blue Jays Vs Yankees Live Free Mlb Spring Training Stream March 7 2025

Apr 28, 2025 -

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025

Mlb Spring Training Blue Jays Vs Yankees Live Stream Free Options And Tv Schedule March 7 2025

Apr 28, 2025 -

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025

Where To Watch Blue Jays Vs Yankees Mlb Spring Training Game March 7 2025

Apr 28, 2025 -

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025

Blue Jays Vs Yankees Spring Training Free Live Stream Time And Channel Info

Apr 28, 2025 -

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025