BofA's View: Why Stretched Stock Market Valuations Are Not A Cause For Alarm

Table of Contents

BofA's Rationale: Low Interest Rates Justify Higher P/E Ratios

A primary pillar of BofA's argument rests on the inverse relationship between interest rates and stock valuations. Lower interest rates make stocks comparatively more attractive than bonds. When interest rates are low, the opportunity cost of investing in stocks – forgoing the return from bonds – is reduced. This encourages more investment in equities, driving up demand and, consequently, valuations.

BofA's research (while specific data points would need to be sourced from their publications) likely supports this claim by demonstrating a historical correlation between low interest rate environments and higher price-to-earnings (P/E) ratios.

- Lower discount rates increase the present value of future earnings. Lower interest rates decrease the discount rate used in valuation models, leading to higher present values for future earnings streams.

- Historically low interest rates support higher price-to-earnings (P/E) multiples. Analysis of past periods with similarly low interest rates shows a tendency towards higher P/E ratios in the stock market.

- Comparison of current P/E ratios to historical averages in similar low-interest rate environments. BofA's analysis likely compares current P/E ratios to those observed during past periods with comparable interest rate levels, demonstrating that current valuations aren't unprecedented.

The Impact of Strong Corporate Earnings Growth

Robust corporate earnings growth serves as another significant counterpoint to concerns about stretched stock market valuations. Even with elevated valuations, strong earnings growth can justify higher stock prices. BofA likely highlights specific sectors exhibiting exceptional growth, potentially including technology, healthcare, or consumer staples, citing their research and earnings reports to substantiate these claims.

- Examples of high-growth companies justifying higher valuations. Identifying companies with demonstrably strong earnings growth that support their current valuations.

- Analysis of earnings forecasts and their implications for valuations. Examining future earnings projections to assess whether current valuations are sustainable given anticipated growth.

- Mention of factors driving strong corporate earnings (e.g., technological innovation, global economic growth). Exploring the underlying economic and technological drivers fueling this robust corporate performance.

Addressing Inflationary Concerns and Their Limited Impact

Inflation is a valid concern; it can erode purchasing power and potentially impact stock valuations negatively. However, BofA likely addresses this by focusing on the expectation of controlled inflation or the ability of companies to pass increased costs onto consumers through pricing power. Their counter-arguments would likely mitigate the impact of inflation on stock valuations.

- BofA's inflation predictions and their impact on stock valuations. Presenting BofA's outlook on inflation and quantifying its expected impact on stock prices.

- Discussion of corporate pricing power and its role in mitigating inflation risks. Analyzing the ability of corporations to offset rising costs through price increases, thus protecting profit margins.

- Comparative analysis of inflation's historical impact on stock market performance. Comparing the current inflationary environment to historical periods, showing that while inflation is a risk, it doesn't always lead to catastrophic market declines.

Long-Term Growth Prospects and Technological Innovation

The long-term growth potential of the economy, fueled by technological innovation, provides another strong justification for BofA's bullish view. They likely emphasize the transformative impact of emerging technologies on various sectors, leading to increased productivity, efficiency, and ultimately, higher earnings.

- Discussion of emerging technologies and their impact on various sectors. Highlighting the transformative potential of technologies like AI, cloud computing, and biotechnology, and how they will reshape industries.

- Analysis of long-term economic growth forecasts and their relevance to stock valuations. Connecting long-term growth projections with the justification for higher stock valuations.

- Mention of specific companies benefiting from these long-term trends. Providing examples of companies poised to benefit substantially from technological advancements and long-term economic growth.

Conclusion: Why You Shouldn't Panic Over Stretched Stock Market Valuations (According to BofA)

In summary, BofA's analysis suggests that current stretched stock market valuations are not inherently alarming. Their arguments center on the impact of historically low interest rates, robust corporate earnings growth, manageable inflationary pressures, and the significant potential for long-term growth fueled by technological innovation. While acknowledging the inherent risks in any market, BofA’s perspective emphasizes the need to consider these broader economic factors before drawing solely on valuation metrics to inform investment decisions. While stretched stock market valuations might seem concerning, BofA's analysis suggests a nuanced perspective. Conduct your own thorough research, considering the factors discussed, to inform your investment strategy. Remember to consult with a financial advisor before making any investment decisions.

Featured Posts

-

Dzherard Btlr Nay Miliyat Mu Spomen Ot Blgariya Razchupva Mrezhata

May 13, 2025

Dzherard Btlr Nay Miliyat Mu Spomen Ot Blgariya Razchupva Mrezhata

May 13, 2025 -

Broadcoms Extreme Price Hike On V Mware At And T Faces 1 050 Cost Increase

May 13, 2025

Broadcoms Extreme Price Hike On V Mware At And T Faces 1 050 Cost Increase

May 13, 2025 -

Pochemu Lishili Roditelskikh Prav Syna Kadyshevoy Semeyniy Skandal

May 13, 2025

Pochemu Lishili Roditelskikh Prav Syna Kadyshevoy Semeyniy Skandal

May 13, 2025 -

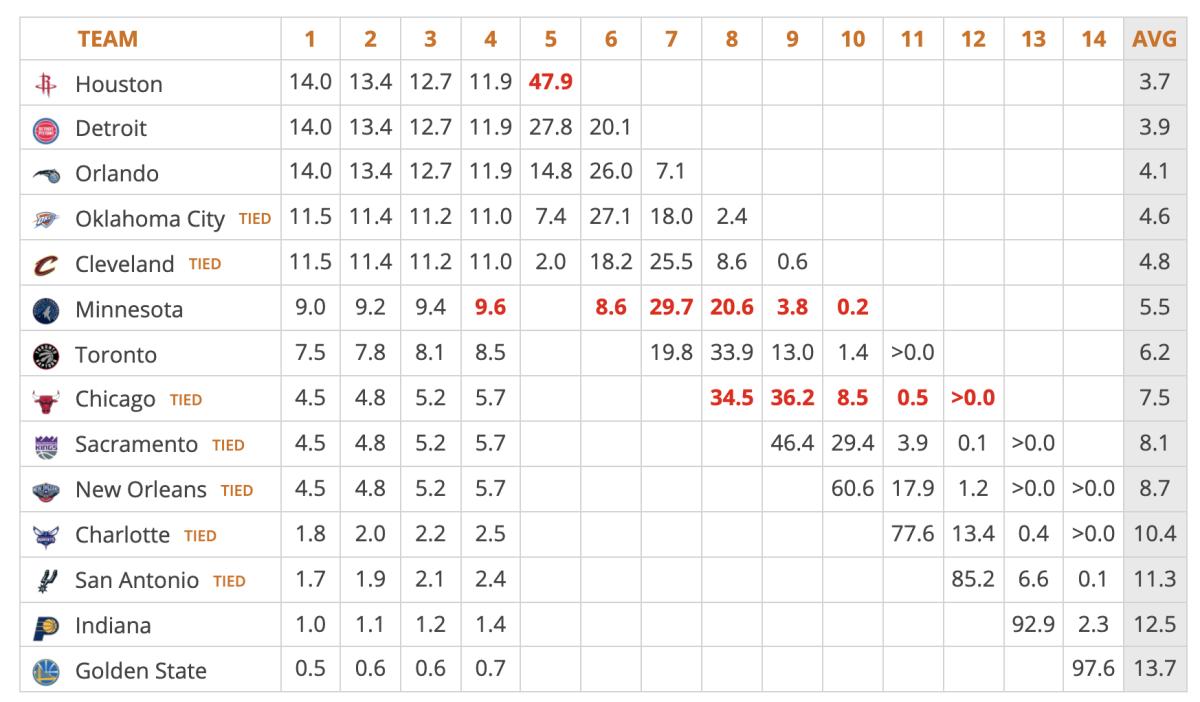

Nba Draft Lottery Betting Odds Toronto Raptors And Cooper Flagg

May 13, 2025

Nba Draft Lottery Betting Odds Toronto Raptors And Cooper Flagg

May 13, 2025 -

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 13, 2025

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 13, 2025

Latest Posts

-

Where To Stream Captain America Brave New World Digital And Disney Release Dates

May 14, 2025

Where To Stream Captain America Brave New World Digital And Disney Release Dates

May 14, 2025 -

When Can I Stream Captain America Brave New World On Disney

May 14, 2025

When Can I Stream Captain America Brave New World On Disney

May 14, 2025 -

Where To Stream Captain America Brave New World Online Via Pvod

May 14, 2025

Where To Stream Captain America Brave New World Online Via Pvod

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait A Must See Video

May 14, 2025

Scotty Mc Creerys Son Honors George Strait A Must See Video

May 14, 2025 -

Captain America Brave New World When Can You Stream It On Disney

May 14, 2025

Captain America Brave New World When Can You Stream It On Disney

May 14, 2025