Bond Market Reaction: Powell's Comments Counter Rate Cut Expectations

Table of Contents

Powell's Hawkish Stance and Its Implications

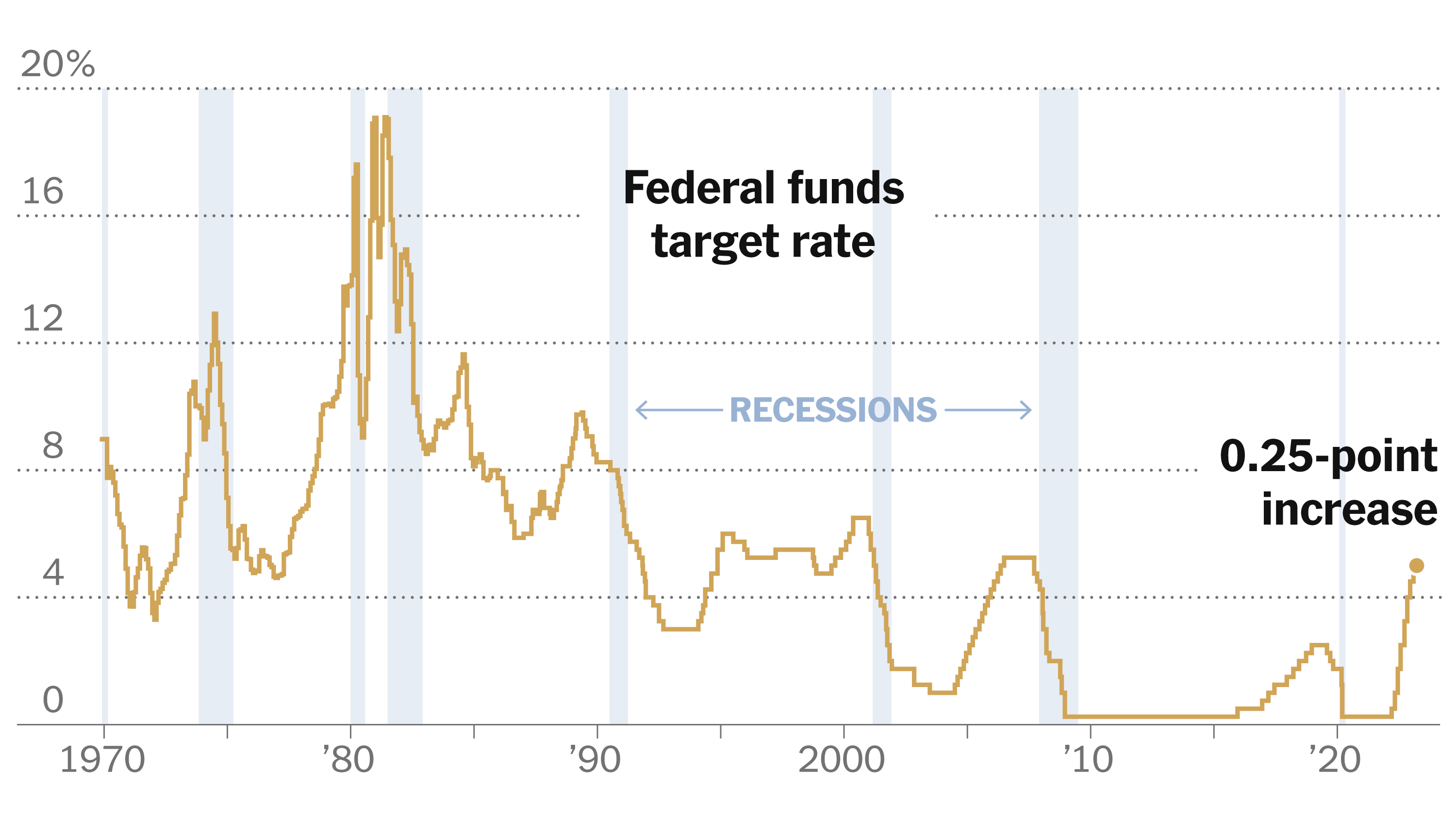

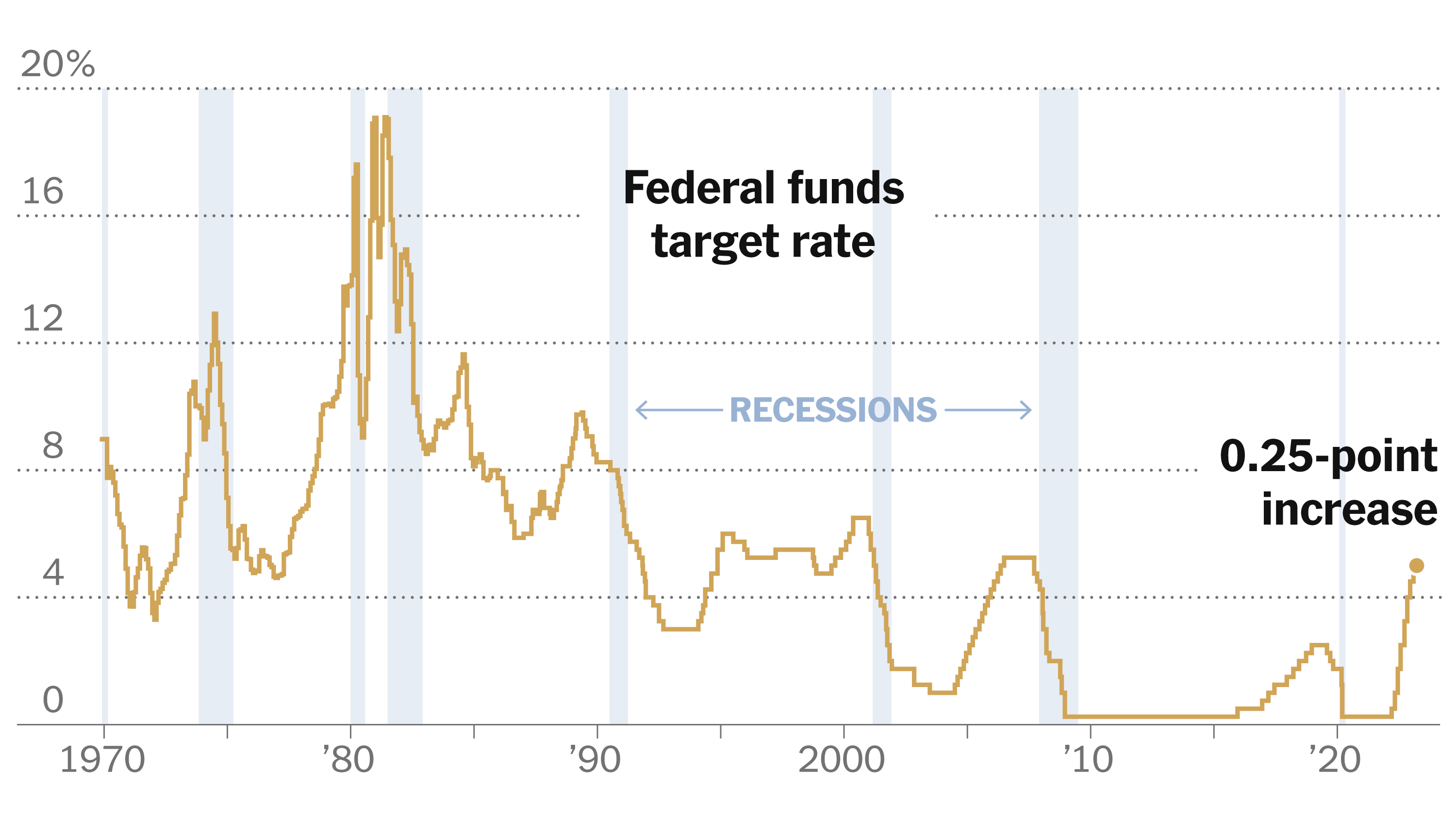

Powell's recent pronouncements regarding inflation painted a picture far less optimistic than many market analysts had predicted. He reiterated the Federal Reserve's unwavering commitment to controlling price increases, even at the cost of slower economic growth. This "hawkish" stance, prioritizing inflation control over immediate economic stimulus, directly contradicted the prevalent rate cut expectations.

- Specific quotes from Powell: Powell emphasized the "persistence of inflation," stating that the Fed needs to see "convincing evidence" of disinflation before considering altering its monetary policy. He highlighted the continued strength in the labor market as a factor contributing to persistent inflationary pressures.

- Details on the Fed's assessment: The Fed continues to closely monitor key economic indicators like the Consumer Price Index (CPI) and the Personal Consumption Expenditures (PCE) index, both of which remain stubbornly elevated. Powell indicated that the Fed's future decisions will be data-dependent, suggesting further rate hikes or holds are possible depending on upcoming economic data.

- Inflation metrics: Powell's remarks specifically referenced the continued elevated levels of core inflation, suggesting that the fight against inflation is far from over. The persistence of core inflation, which excludes volatile food and energy prices, fueled concerns that inflation is becoming ingrained in the economy.

This firm stance directly countered the market's anticipation of rate cuts, which had been fueled by slowing economic growth indicators and concerns about a potential recession. The market's surprise stemmed from a perceived disconnect between the Fed's assessment of inflation and the more pessimistic economic outlook reflected in some market indicators.

The Bond Market's Immediate Response

Powell's comments triggered an immediate and noticeable shift in the bond market. The unexpected hawkish tone led to a sell-off in bonds, resulting in a rise in yields.

- Changes in Treasury yields: The 10-year Treasury yield saw a noticeable increase, reflecting investor concerns about higher interest rates for longer. The 2-year Treasury yield, which is more sensitive to short-term interest rate expectations, also rose.

- Movement in bond prices: Bond prices moved inversely to the rise in yields, declining as investors sold their holdings. This price decrease reflects the reduced attractiveness of fixed-income securities in a higher interest rate environment.

- Increased volatility: The bond market experienced increased volatility in the aftermath of Powell's speech, as investors scrambled to adjust their portfolios in light of the changed expectations. This volatility is a clear sign of uncertainty and market readjustment.

The correlation is clear: Powell's indication of a prolonged fight against inflation directly fueled increased demand for higher-yielding assets, driving up Treasury yields and subsequently lowering bond prices. Indices like the Barclays Aggregate Bond Index, a broad measure of the US investment-grade bond market, reflected this downward trend.

Long-Term Outlook and Investor Sentiment

The long-term consequences of Powell's comments remain uncertain, but they suggest a potentially more challenging environment for bond investors.

- Future interest rate hikes or holds: The possibility of further interest rate hikes or a prolonged period of high interest rates could dampen demand for bonds, keeping yields elevated and prices suppressed.

- Impact on investor confidence: The unexpected shift in the Fed's stance has shaken investor confidence, leading to a reassessment of risk appetite. Many investors are now questioning the safety and attractiveness of traditional bond investments.

- Shifts in investment strategies: Bond investors may now consider shifting towards alternative investment strategies, potentially exploring higher-yield options or diversifying into other asset classes to mitigate the risk of further yield increases.

The impact extends across different bond types. Corporate bonds and municipal bonds, for example, will also likely experience volatility and potential price adjustments depending on their credit quality and sensitivity to interest rate changes. Investors may explore alternative investment options such as short-term bonds or inflation-protected securities (TIPS) to hedge against uncertainty.

Alternative Interpretations and Market Uncertainty

While the prevailing interpretation of Powell's remarks points to a hawkish stance, some analysts suggest alternative interpretations. Some argue that the Fed is simply buying time before making further decisions based on upcoming economic data.

However, the inherent uncertainty remains significant. Future movements in the bond market will depend on several factors including: the actual trajectory of inflation, the strength of the labor market, and any unexpected economic shocks.

Conclusion: Understanding the Bond Market Reaction to Powell's Comments

The unexpected shift in market expectations following Powell's comments has significantly impacted bond yields and prices. His hawkish stance, emphasizing the Fed's continued commitment to controlling inflation, countered the widespread anticipation of rate cuts, leading to a sell-off in bonds and a rise in yields. The long-term implications for investor sentiment and investment strategies remain uncertain, with the market now facing a period of increased volatility. The impact extends to various bond types, and investors are considering alternative strategies to navigate this challenging environment. Stay tuned for further updates on the bond market reaction to Powell's comments and how this affects your investment strategy. Closely following news and analysis related to Bond Market Reaction, Powell's Comments, and Rate Cut Expectations is crucial for informed decision-making in this dynamic market.

Featured Posts

-

Conor Mc Gregors Latest Fox News Appearance A Detailed Analysis

May 12, 2025

Conor Mc Gregors Latest Fox News Appearance A Detailed Analysis

May 12, 2025 -

Bilateral Anophthalmia Challenges And Hope For Children Born Without Eyes

May 12, 2025

Bilateral Anophthalmia Challenges And Hope For Children Born Without Eyes

May 12, 2025 -

Get Ready The John Wick Experience Is Coming To Las Vegas

May 12, 2025

Get Ready The John Wick Experience Is Coming To Las Vegas

May 12, 2025 -

New Mom Lily Collins An Intimate Look At Motherhood

May 12, 2025

New Mom Lily Collins An Intimate Look At Motherhood

May 12, 2025 -

Understanding Manon Fiorot Her Journey In The Ufc

May 12, 2025

Understanding Manon Fiorot Her Journey In The Ufc

May 12, 2025