Boosting Capital Market Cooperation: Pakistan, Sri Lanka, And Bangladesh Unite

Table of Contents

Shared Opportunities for Growth Through Capital Market Cooperation

Deepening capital market cooperation offers substantial benefits for Pakistan, Sri Lanka, and Bangladesh. A more integrated financial market fosters growth across several key areas:

Increased Investment Flows

Deepening CMC will significantly boost investment flows, both domestically and internationally. This will be achieved through:

- Reduced barriers to entry for foreign investors: Streamlined regulations and harmonized legal frameworks will attract foreign direct investment (FDI) and portfolio investment. This includes simplifying procedures for registering businesses and managing investments.

- Increased cross-border investment opportunities: Investors gain access to a wider range of investment instruments and asset classes across the three nations, diversifying their portfolios and mitigating risk.

- Access to a larger pool of capital for businesses: Companies in Pakistan, Sri Lanka, and Bangladesh will gain access to a larger and more diverse pool of capital, facilitating expansion and innovation. This opens doors for larger-scale projects and attracts more competitive financing options.

- Diversification of investment portfolios for investors: Investors can diversify their holdings across geographically diverse markets, reducing the impact of economic shocks specific to one country.

Enhanced Regional Integration

Stronger financial linkages are fundamental to closer economic integration within South Asia. CMC facilitates:

- Facilitated trade financing: Improved access to trade finance instruments simplifies cross-border transactions and supports the growth of regional trade.

- Improved cross-border payments systems: More efficient and reliable payment systems reduce transaction costs and processing times, encouraging greater trade and investment.

- Development of regional financial infrastructure: Investing in shared financial infrastructure, such as electronic trading platforms and clearing houses, improves market efficiency and reduces costs.

- Shared regulatory frameworks and best practices: Harmonized regulations create a more predictable and transparent investment environment, attracting both domestic and foreign capital.

Promoting Financial Stability

Collaboration on financial stability is paramount. Joint efforts will lead to:

- Sharing of risk management strategies: Sharing best practices in risk management enhances the resilience of the regional financial system as a whole.

- Early warning systems for financial crises: Collaborative efforts can identify and address potential financial vulnerabilities more effectively.

- Strengthened regulatory oversight: Joint regulatory efforts increase the effectiveness of supervision and reduce the risk of systemic crises.

- Increased cooperation in tackling illicit financial flows: Working together to combat money laundering and terrorist financing improves the integrity of the regional financial system.

Key Initiatives Driving Capital Market Cooperation

Several key initiatives are driving forward capital market cooperation in the region:

Regulatory Harmonization

Aligning regulations is crucial for seamless cross-border activity. This includes:

- Standardized accounting and reporting practices: Adopting common accounting standards improves transparency and comparability of financial information.

- Harmonized listing requirements for companies: Standardized requirements make it easier for companies to list on stock exchanges across the region, increasing liquidity and access to capital.

- Mutual recognition of professional qualifications: Recognition of professional credentials improves the mobility of skilled workers and strengthens the regional financial workforce.

- Joint efforts to combat market manipulation and fraud: Cooperative efforts to enforce regulations and combat illegal activity strengthen investor confidence.

Infrastructure Development

Investing in modern infrastructure is vital for efficient capital markets. This involves:

- Development of regional electronic trading platforms: Creating integrated trading platforms increases liquidity and reduces trading costs.

- Upgrading clearing and settlement systems: Modernizing clearing and settlement systems ensures efficient and reliable processing of transactions.

- Improved data sharing and communication networks: Efficient data sharing improves market transparency and helps regulators monitor the market effectively.

- Investment in cybersecurity infrastructure: Robust cybersecurity measures are crucial to protect the integrity of the capital markets.

Capacity Building

Investing in human capital is crucial for sustainable development:

- Joint training programs for market professionals: Collaborative training programs enhance the expertise of market participants.

- Exchange of best practices and regulatory expertise: Sharing knowledge and best practices improves regulatory effectiveness and market efficiency.

- Technical assistance from international organizations: Seeking support from international organizations such as the World Bank or IMF can provide valuable technical expertise and funding.

- Development of local expertise in capital market operations: Building local expertise ensures long-term sustainability of the initiatives.

Challenges and Mitigation Strategies

While the opportunities are vast, several challenges need to be addressed:

Political and Economic Instability

Political and economic volatility can hinder CMC development. Strategies include:

- Strengthening regional political and economic stability: Promoting political stability and economic reforms within each nation is crucial.

- Developing robust risk management mechanisms: Developing effective mechanisms to manage political and economic risks is vital to attract investment.

- Promoting transparency and good governance: Improving transparency and governance strengthens investor confidence.

Regulatory Differences

Significant regulatory differences remain a hurdle. Mitigation strategies include:

- Phased approach to regulatory harmonization: A gradual approach allows for smoother implementation and adaptation.

- Mutual recognition of regulatory frameworks: Recognizing each other's regulatory frameworks simplifies cross-border operations.

- Addressing differences in legal and institutional settings: Addressing legal and institutional differences requires careful collaboration and negotiation.

Lack of Investor Confidence

Building trust and confidence is crucial. This involves:

- Promoting transparency and market integrity: Maintaining transparency and enforcing regulations enhance investor confidence.

- Improving investor protection mechanisms: Strengthening investor protection mechanisms reduces investor risk.

- Strengthening corporate governance standards: Strong corporate governance improves the quality of investment opportunities.

Conclusion

Boosting capital market cooperation between Pakistan, Sri Lanka, and Bangladesh presents a significant opportunity for unlocking regional economic growth. By addressing challenges through collaborative initiatives focusing on regulatory harmonization, infrastructure development, and capacity building, these nations can create a more integrated, stable, and prosperous financial landscape. The success of this CMC hinges on sustained commitment and collaborative action from all participating countries. Let’s work together to enhance capital market cooperation and unlock the immense potential of South Asia.

Featured Posts

-

Nottingham Families Demand Delay Of Farcical Misconduct Proceedings

May 09, 2025

Nottingham Families Demand Delay Of Farcical Misconduct Proceedings

May 09, 2025 -

Analyzing The Difficulties Faced By Premium Car Brands In The Chinese Market

May 09, 2025

Analyzing The Difficulties Faced By Premium Car Brands In The Chinese Market

May 09, 2025 -

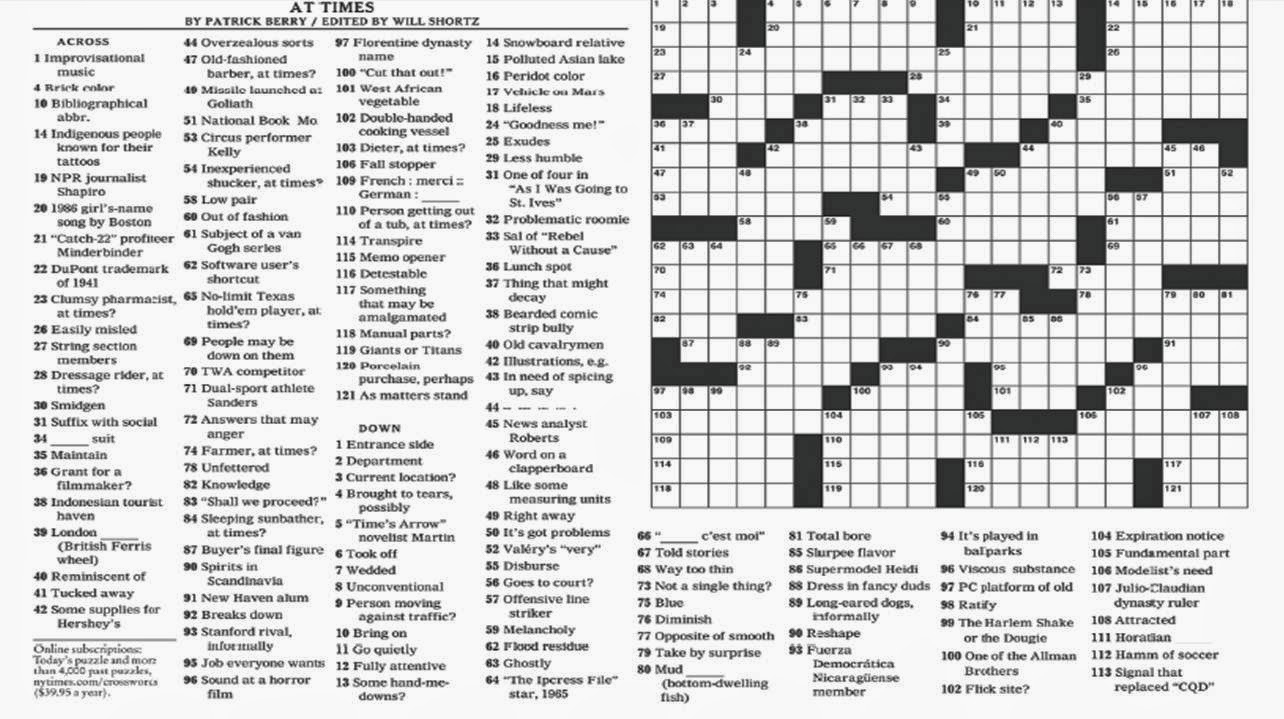

Crack The Nyt Spelling Bee April 4 2025 Strategies And Answers

May 09, 2025

Crack The Nyt Spelling Bee April 4 2025 Strategies And Answers

May 09, 2025 -

Ftc To Challenge Activision Blizzard Acquisition Approval

May 09, 2025

Ftc To Challenge Activision Blizzard Acquisition Approval

May 09, 2025 -

Nyt Crossword April 12 2025 Complete Guide To Solving Strands

May 09, 2025

Nyt Crossword April 12 2025 Complete Guide To Solving Strands

May 09, 2025