Boston Celtics' $6.1 Billion Sale: Analyzing The Implications For The Future

Table of Contents

Impact on Team Management and Player Acquisition

The Boston Celtics sale dramatically alters the team's financial landscape, potentially reshaping its management and player acquisition strategies.

Potential Changes in Team Strategy

Will the new ownership prioritize short-term wins or long-term team building? This is a crucial question. The increased financial resources available following the sale could lead to several key changes:

- Increased spending power: The new owners can now afford to aggressively pursue top free agents, significantly improving the team's competitive standing. This could involve exceeding the salary cap to sign marquee players.

- Potential for attracting top free agents: The Celtics' newfound wealth makes them a much more attractive destination for coveted players. The allure of a large market team with significant resources will be a powerful recruiting tool.

- Focus on developing young talent: While pursuing stars, the new owners might also prioritize developing existing young talent, blending established veterans with promising rookies for long-term success. This could involve strategic draft picks and player development programs.

- Impact on existing player contracts: The sale could influence negotiations with current players, potentially leading to contract extensions or adjustments based on the team's enhanced financial capabilities.

The Role of the New Ownership Group

Understanding the background and experience of the new owners is critical to predicting future team direction. Their stated goals, business acumen, and approach to community engagement will shape the Celtics' future.

- Previous ownership's legacy: Comparing the new ownership group's vision to that of the previous owners will reveal potential shifts in team philosophy and priorities.

- New owner's business acumen: The success of the new owners will depend heavily on their business expertise and ability to leverage the team's assets effectively.

- Focus on community engagement: A significant aspect of a successful sports franchise is community engagement. The new owners' commitment to this area could significantly impact the team's public image and local support.

- Potential investment in infrastructure: The sale might trigger investments in the team's training facilities, scouting network, and other infrastructural improvements.

Financial Implications and Arena Development

The Boston Celtics sale has profound financial implications, impacting revenue generation and potentially leading to significant arena development.

Increased Revenue Streams

The record-breaking sale price points towards a significant expansion of revenue streams.

- Potential for stadium renovations: The increased financial capacity might lead to substantial upgrades and expansions at TD Garden, improving the fan experience.

- Expansion of fan experiences: The new owners could invest in enhancing the overall fan experience, perhaps incorporating innovative technologies and amenities.

- Increased marketing budget: A larger marketing budget would allow for more extensive and impactful campaigns, reaching wider audiences.

- Attracting new investors: The high valuation might attract additional investors seeking to capitalize on the Celtics' potential for growth and profitability.

Modernization and Investment in TD Garden

TD Garden, the Celtics' home arena, is ripe for modernization.

- Renovations and expansions: Upgrades to seating, concessions, and other amenities could enhance the game-day experience.

- Technological upgrades: Investments in state-of-the-art technology could improve the fan experience, including enhanced Wi-Fi, interactive displays, and improved audio-visual systems.

- Improved accessibility: Modernization efforts might also focus on making the arena more accessible to fans with disabilities.

- Potential for naming rights changes: The increased value of the franchise could lead to negotiations for new naming rights for the arena.

Broader Implications for the NBA

The $6.1 billion Boston Celtics sale sets a new benchmark for NBA franchise valuations, impacting the league's financial landscape and the future of team ownership.

Setting a New Valuation Benchmark

This sale dramatically reshapes the perception of NBA franchise value.

- Impact on other team valuations: The sale price establishes a new high watermark, potentially driving up the valuation of other NBA teams.

- Implications for future ownership changes: We can expect increased interest from potential buyers, accelerating the pace of future ownership changes.

- Potential for increased franchise values: The trend of increasing franchise values is likely to continue, attracting even more investors to the NBA.

- League revenue sharing: This sale could influence future negotiations surrounding league revenue sharing, impacting the distribution of wealth among franchises.

The Future of Team Ownership in Professional Sports

The sale reflects broader trends in sports ownership, including the increasing involvement of private equity and global investors.

- Increased globalization of sports ownership: This sale highlights the growing international interest in owning major sports franchises.

- Role of private equity firms: Private equity firms are increasingly involved in sports ownership, bringing significant financial resources and expertise.

- Impact on team culture and community engagement: The shift towards larger, more global ownerships might influence team culture and community engagement strategies.

- Long-term implications for fans: The long-term impact on fans will depend on the new owners' commitment to maintaining the team's connection to its fanbase and local community.

Conclusion

The record-breaking sale of the Boston Celtics for $6.1 billion signifies a turning point for the franchise and the wider NBA. The implications are far-reaching, impacting everything from player acquisition and arena development to the league's overall financial landscape. The new ownership group's vision, coupled with the increased financial resources, will likely reshape the Celtics’ future trajectory. Analyzing the specifics of this momentous Boston Celtics Sale will help understand the future direction of the franchise and its impact on the league. Stay tuned for further developments and continue following the unfolding story of the Boston Celtics Sale to fully grasp its long-term ramifications. Understanding the intricacies of this significant NBA team sale is crucial for anyone interested in the future of professional basketball.

Featured Posts

-

Upstairs Downstairs Star Jean Marsh Dies At 90 A Legacy Remembered

May 17, 2025

Upstairs Downstairs Star Jean Marsh Dies At 90 A Legacy Remembered

May 17, 2025 -

Missed Call Costs Pistons In Crucial Game 4 Loss

May 17, 2025

Missed Call Costs Pistons In Crucial Game 4 Loss

May 17, 2025 -

Josh Cavallo A New Era For Lgbtq Inclusion In Football

May 17, 2025

Josh Cavallo A New Era For Lgbtq Inclusion In Football

May 17, 2025 -

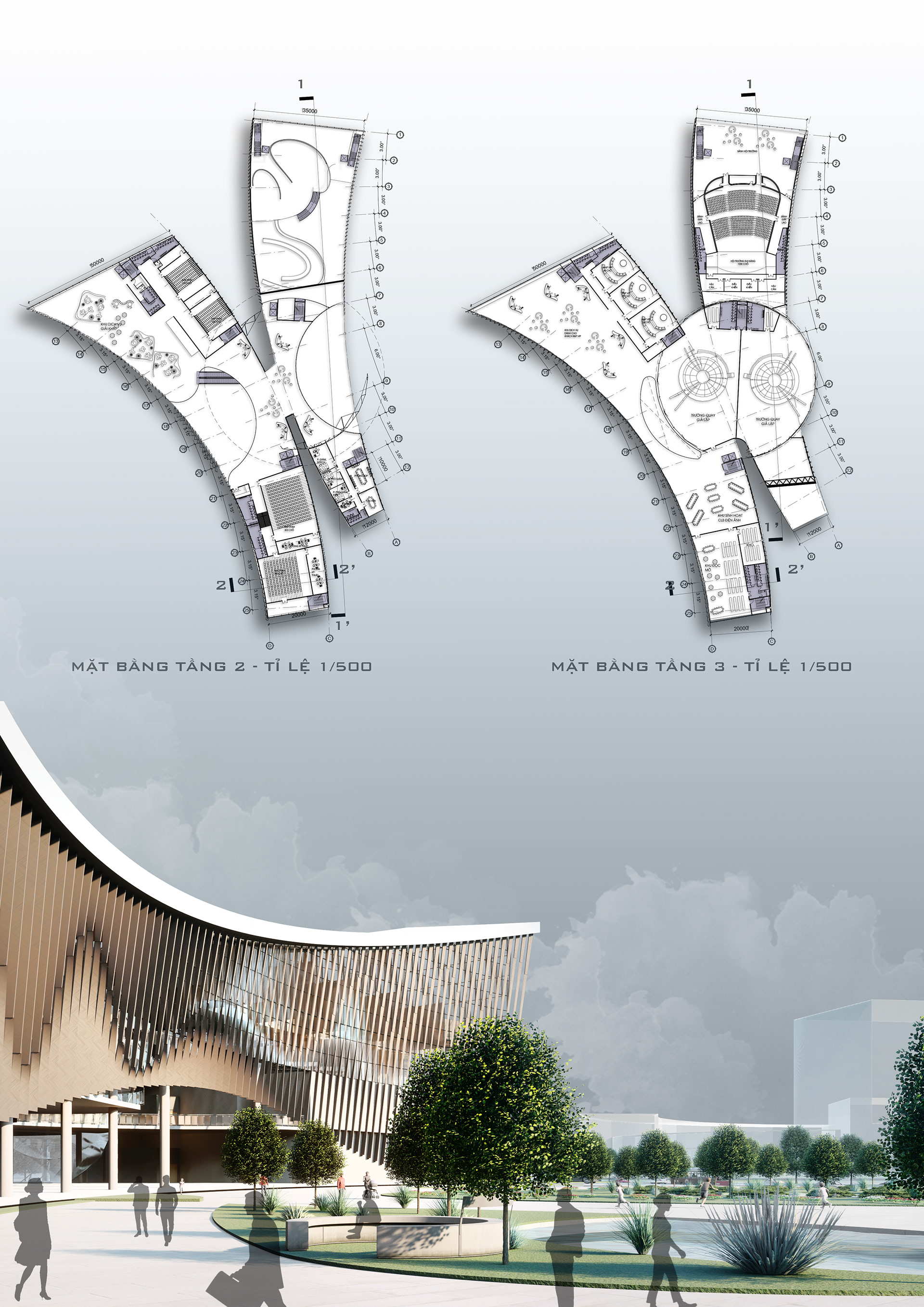

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Hap Dan

May 17, 2025

Can Canh Phoi Canh Cong Vien Dien Anh Thu Thiem De Xuat Hap Dan

May 17, 2025 -

Warner Bros Unveils 2025 Slate At Cinema Con Key Announcements And Trailers

May 17, 2025

Warner Bros Unveils 2025 Slate At Cinema Con Key Announcements And Trailers

May 17, 2025