Boston Celtics Ownership Change: Fan Uncertainty Following $6.1 Billion Sale

Table of Contents

The New Owners: A Deep Dive into Bain Capital

The new custodians of the Boston Celtics are Bain Capital, a global private investment firm. Understanding Bain Capital's history and business model is crucial to predicting their impact on the team. Known for their sharp financial acumen and strategic investments across various sectors, Bain Capital brings a wealth of experience in business management and deal-making to the table. However, their experience specifically in sports ownership is relatively limited, representing both an opportunity and a risk.

- Bain Capital's experience in sports ownership (or lack thereof): While this is Bain Capital's first foray into NBA ownership, their experience in managing large-scale investments and navigating complex business landscapes is undeniable. This could translate into a strategic and financially savvy approach to running the Celtics.

- Their likely approach to player acquisitions and contract negotiations: We can expect a more data-driven approach to player acquisitions, prioritizing value and long-term strategic fit. Contract negotiations are likely to be shrewd and financially responsible.

- Potential changes in team management and coaching staff: While immediate sweeping changes are unlikely, Bain Capital might eventually bring in management personnel with a track record of success in similar high-pressure environments.

- Financial projections and potential impact on ticket prices and team spending: The massive investment suggests a commitment to maintaining, and potentially increasing, the team's competitiveness. However, the financial implications for fans, particularly concerning ticket prices, remain a significant concern.

Fan Reactions and Concerns: A Mixed Bag of Emotions

The Boston Celtics ownership change has elicited a wide spectrum of emotions among fans. While some express cautious optimism about the potential for increased financial resources and a stronger team, many harbor anxieties about the preservation of the Celtics' unique identity and winning culture.

- Social media sentiment analysis regarding the sale: A quick scan of social media reveals a mixed bag of reactions, ranging from excitement about the financial potential to apprehension about the potential loss of the team's familiar charm.

- Fan forums and discussions reflecting anxieties about the future: Online fan forums are buzzing with discussions focused on concerns about potential changes in team culture, the impact on ticket prices, and the overall direction of the franchise.

- Concerns about ticket pricing and accessibility for long-time fans: A primary concern among loyal fans is the potential for increased ticket prices, making attending games less accessible for long-time supporters.

- The importance of maintaining the Celtics' unique identity and winning culture: The Celtics' rich history and strong winning tradition are central to their identity. Fans are rightfully anxious about the potential for this legacy to be negatively impacted by the ownership change.

Impact on the Team's Performance: Short-Term and Long-Term Outlook

The immediate impact of the Boston Celtics ownership change on the team's performance is difficult to predict. However, the long-term implications are likely to be significant.

- Potential effects on player recruitment and retention: The team's increased financial resources could attract top free agents and facilitate the retention of key players.

- The impact on coaching decisions and game strategies: While the coaching staff may initially remain unchanged, a more data-driven approach to coaching decisions could be implemented.

- Analysis of the new ownership's likely approach to building a winning team: Expect a more analytical and strategic approach to team-building, focusing on long-term sustainable success rather than short-term gains.

- Predictions for the Celtics’ performance in the coming seasons: While predicting the future is speculative, the increased financial resources and potential for strategic improvement suggest a positive outlook for the Celtics' long-term performance.

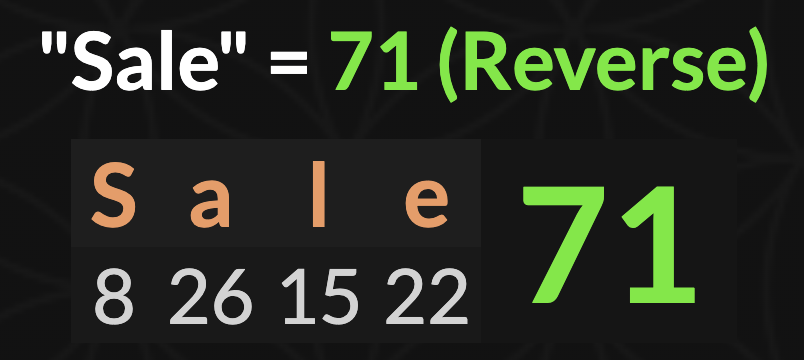

The Financial Implications: A $6.1 Billion Investment

The $6.1 billion sale price represents a record-breaking figure in NBA history, highlighting the immense value of the Boston Celtics franchise and the attractive financial opportunity it presents.

- Comparison with other recent NBA team sales: The price surpasses previous NBA team sales, underscoring the growing financial clout of the league and the Celtics' particularly strong brand.

- Analysis of the financial benefits for the previous owners: This sale represents a massive financial windfall for the previous owners, showcasing the lucrative nature of NBA team ownership.

- Potential for increased investment in team infrastructure and facilities: The significant capital infusion could lead to upgrades in team facilities, enhancing the overall fan experience.

- Impact on the Celtics' financial stability and long-term growth: The new ownership secures the team's financial stability for years to come, providing a solid foundation for long-term growth and success.

Conclusion

The Boston Celtics ownership change, finalized with a record-breaking $6.1 billion sale to Bain Capital, presents a complex mix of opportunities and uncertainties. While the new ownership brings significant financial resources and potential for future success, fan concerns regarding the preservation of team culture and tradition remain paramount. The coming years will be crucial in determining the long-term impact of this pivotal moment in Celtics history.

Call to Action: Stay tuned for further updates on the unfolding Boston Celtics ownership change and share your thoughts on this significant development in the comments below. What are your hopes and concerns regarding the future of the Celtics under new ownership? Let’s discuss the Boston Celtics ownership change and its potential impact together.

Featured Posts

-

High Bids Mark Kid Cudis Personal Item Auction

May 15, 2025

High Bids Mark Kid Cudis Personal Item Auction

May 15, 2025 -

Us Dependence On Canada Experts Weigh In On Trumps Statements

May 15, 2025

Us Dependence On Canada Experts Weigh In On Trumps Statements

May 15, 2025 -

The Surveillance Potential Of Ai Therapy A Necessary Concern

May 15, 2025

The Surveillance Potential Of Ai Therapy A Necessary Concern

May 15, 2025 -

Earthquakes Cant Solve Zach Steffens Problems Loss To Rapids Highlights Issues

May 15, 2025

Earthquakes Cant Solve Zach Steffens Problems Loss To Rapids Highlights Issues

May 15, 2025 -

Le Metier De Gardien Salaires Et Conditions De Travail

May 15, 2025

Le Metier De Gardien Salaires Et Conditions De Travail

May 15, 2025