BP CEO Pay Cut: A 31% Decrease In Executive Compensation

Table of Contents

H2: The Magnitude of the BP CEO Pay Cut

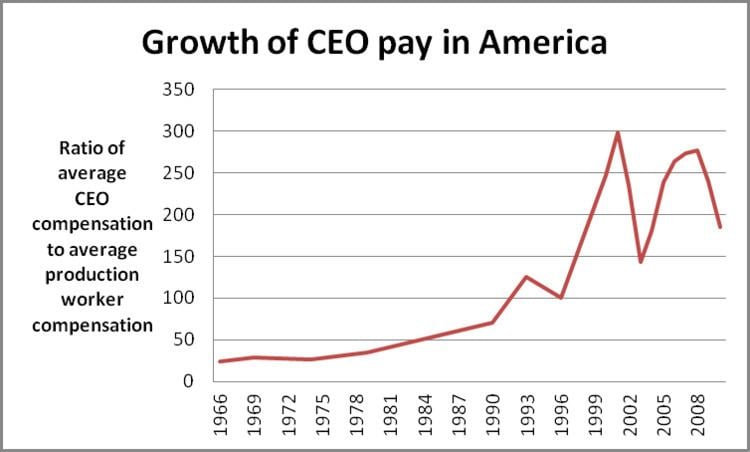

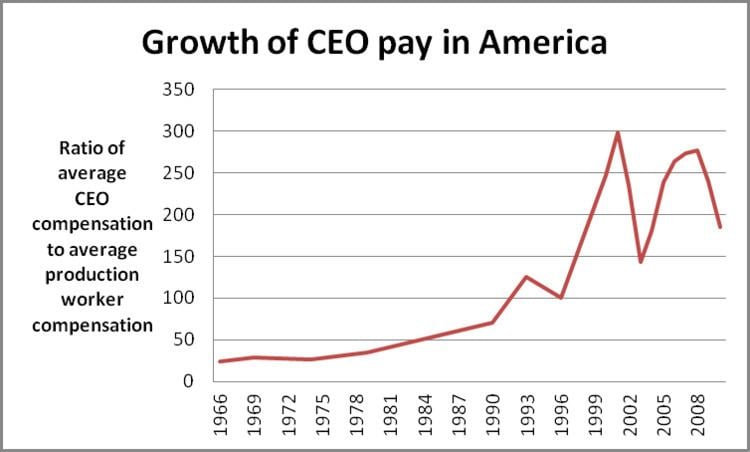

H3: Specific Figures and Comparisons

The BP CEO pay cut represents a substantial reduction in Bernard Looney's total compensation. While precise figures vary depending on the final accounting and bonuses, reports suggest a decrease from approximately £4 million in the previous year to approximately £2.75 million. This 31% decrease is significant when compared to the salaries of CEOs in similar large-cap oil and gas companies. Many competitors remain in the £5-7 million range for total compensation.

- Previous Year's Salary: Approximately £4 million (this figure may need updating based on the most recent financial reports)

- Current Year's Salary: Approximately £2.75 million (this figure may need updating based on the most recent financial reports)

- Percentage Change: 31% decrease

- Comparison to Industry Average: Significantly below the average CEO pay in the oil and gas industry.

- Compensation Components: The reduction likely affected a combination of base salary, annual bonuses, and long-term incentive plans (LTIPs), such as stock options. A detailed breakdown of each component would require access to BP's official financial statements.

H2: Reasons Behind the BP CEO Pay Cut

H3: Shareholder Pressure and Activism

Significant shareholder pressure played a crucial role in the decision to reduce BP CEO pay. Activist investors and proxy advisory firms increasingly scrutinize executive compensation packages, particularly in the context of corporate performance and environmental, social, and governance (ESG) concerns. Shareholder resolutions often call for greater transparency and alignment of executive pay with company performance and sustainability goals.

- Activist Groups: Specific details on individual shareholders or activist groups leading the charge for pay reduction would require further research into BP's shareholder registry and related news reports.

- Shareholder Resolutions: Any filed resolutions pushing for changes to executive compensation at BP should be referenced here, linking to official documentation if available.

- Arguments Used: Shareholder arguments typically center on the need for accountability, responsible use of company funds, and a stronger focus on long-term value creation rather than short-term gains reflected in excessive executive pay.

H3: Company Performance and Financial Results

BP's recent financial performance undoubtedly influenced the decision to reduce the BP CEO pay. While specific details need to be gleaned from the company's financial reports, factors such as profit margins, stock price fluctuations, and the overall financial health of the company likely played a role. Underperformance, compared to expectations and competitor performance, can put pressure on the board to demonstrate fiscal responsibility, starting with executive compensation.

- Profit Levels: Analyze the trends in BP's profitability over the past few years, correlating this with the CEO’s compensation.

- Stock Price Fluctuations: Discuss any significant stock price drops or underperformance relative to market benchmarks.

- Financial Health: Assess BP's overall financial health, including debt levels and investment returns.

H3: Environmental, Social, and Governance (ESG) Concerns

ESG factors are increasingly influencing corporate decision-making, including executive compensation. BP, like other oil and gas majors, faces growing pressure to demonstrate its commitment to sustainability and climate change mitigation. Aligning CEO pay with ESG goals can signal a company's seriousness about environmental and social responsibility.

- BP's Sustainability Commitments: Highlight BP's public statements and initiatives related to climate change, renewable energy, and other ESG concerns.

- ESG Impact on Compensation: Discuss how linking CEO pay to the achievement of ESG targets can incentivize the CEO to prioritize sustainability initiatives.

H2: Implications of the BP CEO Pay Cut

H3: Impact on Employee Morale and Compensation

The BP CEO pay cut could have varying impacts on employee morale and overall compensation within BP. A significant pay cut at the top might be seen as fair by some employees if it’s accompanied by comparable adjustments elsewhere; others may see it as unfair, particularly if it contrasts with their own salary increases or lack thereof.

- Domino Effect: Discuss the potential for this to affect other executive salaries and the broader compensation structure at BP.

- Fairness Concerns: Analyze the perception of fairness among employees, considering the overall compensation strategy and potential implications for workforce morale.

H3: Signal to the Industry

The BP CEO pay cut might set a precedent for other oil and gas companies. Increased shareholder activism and growing public pressure on executive compensation in the face of both company and industry-wide underperformance are pushing towards more responsible pay practices.

- Industry Precedent: Analyze whether this sets a trend for executive pay adjustments in the oil and gas sector.

- Increased Shareholder Activism: Discuss the potential impact on shareholder activism concerning executive pay across the industry.

3. Conclusion

The 31% reduction in BP CEO pay represents a significant shift in executive compensation practices within the oil and gas industry. Driven by a combination of shareholder pressure, company performance, and growing ESG concerns, this decision has wide-ranging implications. The long-term effects on employee morale, industry trends, and future executive compensation negotiations remain to be seen. Stay updated on future developments regarding BP CEO pay and learn more about executive compensation practices in the energy industry to better understand this evolving landscape.

Featured Posts

-

John Lithgow And Jimmy Smits Officially Returning For Dexter Resurrection

May 21, 2025

John Lithgow And Jimmy Smits Officially Returning For Dexter Resurrection

May 21, 2025 -

The Future Of Gumball Streaming Exclusively On Hulu And Hulu On Disney

May 21, 2025

The Future Of Gumball Streaming Exclusively On Hulu And Hulu On Disney

May 21, 2025 -

10 Man Juventus Held To Draw By Lazio

May 21, 2025

10 Man Juventus Held To Draw By Lazio

May 21, 2025 -

Stephane La Conquete Parisienne D Une Chanteuse Suisse

May 21, 2025

Stephane La Conquete Parisienne D Une Chanteuse Suisse

May 21, 2025 -

Analyzing Liverpools Victory Against Psg Arne Slots Strategy And Alissons Brilliance

May 21, 2025

Analyzing Liverpools Victory Against Psg Arne Slots Strategy And Alissons Brilliance

May 21, 2025

Latest Posts

-

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025

Kamerbrief Verkoopprogramma Certificaten Abn Amro Een Complete Gids

May 21, 2025 -

Abn Amro Renteverlaging En De Impact Op De Huizenmarkt

May 21, 2025

Abn Amro Renteverlaging En De Impact Op De Huizenmarkt

May 21, 2025 -

Huizenmarktverwachting Abn Amro Hogere Prijzen Dalende Rente

May 21, 2025

Huizenmarktverwachting Abn Amro Hogere Prijzen Dalende Rente

May 21, 2025 -

Stijgende Huizenprijzen Abn Amros Verwachting Ondanks Dalende Rente

May 21, 2025

Stijgende Huizenprijzen Abn Amros Verwachting Ondanks Dalende Rente

May 21, 2025 -

Abn Amro Huizenprijzen Omhoog Ondanks Economische Tegenwind

May 21, 2025

Abn Amro Huizenprijzen Omhoog Ondanks Economische Tegenwind

May 21, 2025