BP CEO Targets Valuation Doubling: Rejects US Stock Market Transfer

Table of Contents

The CEO's Vision for BP's Future Valuation

The CEO's declaration to double BP's valuation represents a significant shift in strategy. This isn't merely a wishful projection; it's backed by a comprehensive plan focused on several key areas. The rationale behind this ambitious target stems from BP's belief in its capacity for substantial growth and its commitment to becoming a leader in the energy transition. The strategy involves a multi-pronged approach:

- Aggressive Investment in Renewables: BP is significantly increasing its investments in renewable energy sources, such as wind and solar power, aiming to capitalize on the burgeoning green energy market. This diversification strategy is intended to reduce reliance on fossil fuels and appeal to environmentally conscious investors.

- Operational Excellence and Efficiency Improvements: The company is committed to streamlining operations, optimizing processes, and reducing costs across its entire value chain. This includes technological advancements and the implementation of lean management principles.

- Strategic Acquisitions and Partnerships: BP plans to strategically acquire companies and form partnerships that will bolster its capabilities in renewable energy and other growth areas. This approach will accelerate its expansion and market penetration.

Specific Targets and KPIs:

- Revenue Increase: A projected 50% increase in revenue within the next five years.

- Profit Margin Expansion: A target of increasing profit margins by 20% through improved efficiency and cost optimization.

- Timeline: The CEO aims to achieve the valuation doubling within the next 7-10 years. This ambitious timeline necessitates swift execution and consistent progress against the established KPIs.

Reasons Behind Rejecting a US Stock Market Transfer

The CEO's decision to reject a US stock market listing, despite the potential benefits of increased investor access, is a strategic choice driven by several key factors:

- Regulatory Hurdles and Compliance Costs: Listing on a US exchange entails significant regulatory compliance costs and complexities, particularly in the context of BP's global operations and diverse energy portfolio. The compliance burden, coupled with the potential for increased scrutiny, has been cited as a significant deterrent.

- Impact on Existing Shareholder Base: A US listing could potentially dilute the existing shareholder base and alter the overall investor profile of the company. Maintaining a strong and stable shareholder base is considered paramount.

- Strategic Considerations: The company believes its current listing provides adequate access to capital markets globally, and a US listing is not deemed strategically necessary at this time.

Counterarguments and Alternatives:

While a US listing offers broader access to capital, the complexities and potential downsides seem to outweigh the advantages for BP at this juncture. The company might explore alternative strategies for accessing US capital markets, such as private placements or targeted investment partnerships, to avoid the complexities of a full exchange listing.

Market Reaction and Analyst Opinions

The market's initial reaction to the CEO's announcement was mixed. BP's stock price experienced a slight dip immediately following the news but subsequently recovered, demonstrating some investor confidence in the long-term strategy.

- Stock Price Fluctuations: A temporary 2% dip was observed immediately after the announcement, followed by a gradual recovery within the next trading week.

- Analyst Opinions: While some analysts expressed caution regarding the ambitious valuation target, others praised the strategy's focus on renewables and operational efficiency. Many analysts acknowledged the potential risks and opportunities associated with the plan, emphasizing the need for effective execution.

- Potential Risks and Opportunities: The primary risk is the potential for failure to meet the ambitious targets, leading to investor disappointment. However, successful execution could significantly enhance BP’s value and position it as a leader in the evolving energy landscape.

Long-Term Implications for BP and Investors

The long-term success of BP's strategy hinges on its ability to execute its plan effectively and navigate the challenges of the energy transition. The potential impact on investors will largely depend on the company's performance against its ambitious targets.

- Risks and Rewards for Long-Term Investors: Long-term investors who believe in BP's vision and its ability to execute its strategy stand to benefit significantly from a potential valuation doubling. However, there's inherent risk involved, and the investment might not be suitable for all investors.

- Competitive Position: Successful execution will strengthen BP's competitive position in the energy sector, allowing it to compete effectively with other major energy players.

- ESG Considerations: BP’s focus on renewable energy and sustainability aligns with growing investor interest in ESG factors, potentially attracting more environmentally conscious investors.

Conclusion: BP CEO Targets Valuation Doubling: A Bold Strategy

In conclusion, BP CEO's ambitious target of doubling the company's valuation is a bold and potentially transformative strategy. The decision to forgo a US stock market transfer reflects a carefully considered strategic approach focused on managing regulatory complexities and maintaining shareholder alignment. The success of this strategy depends heavily on effective execution, and market response will be closely monitored. The long-term implications for BP and its investors are significant. Stay tuned for updates on BP's progress toward doubling its valuation and consider the implications for your investment strategy. Careful monitoring of BP's stock and its performance against the set KPIs is crucial for assessing the viability of this ambitious plan and its impact on BP's future value.

Featured Posts

-

Saskatchewan Political Panel Deciphering The Federal Election Results

May 22, 2025

Saskatchewan Political Panel Deciphering The Federal Election Results

May 22, 2025 -

Late Season Snow In The Southern French Alps Weather Update

May 22, 2025

Late Season Snow In The Southern French Alps Weather Update

May 22, 2025 -

Barry Ward Interview The Irish Actor On Type Casting

May 22, 2025

Barry Ward Interview The Irish Actor On Type Casting

May 22, 2025 -

La Petite Italie De L Ouest Une Architecture Toscane Surprenante

May 22, 2025

La Petite Italie De L Ouest Une Architecture Toscane Surprenante

May 22, 2025 -

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Sentence Appeal For Ex Tory Councillors Wife Over Racist Tweet

May 22, 2025

Latest Posts

-

Directeur Hypotheken Intermediair Abn Amro Florius And Moneyou Karin Polman Benoemd

May 22, 2025

Directeur Hypotheken Intermediair Abn Amro Florius And Moneyou Karin Polman Benoemd

May 22, 2025 -

Karin Polman Nieuwe Directeur Hypotheken Intermediair Voor Abn Amro Florius And Moneyou

May 22, 2025

Karin Polman Nieuwe Directeur Hypotheken Intermediair Voor Abn Amro Florius And Moneyou

May 22, 2025 -

Optimaliseer Uw Verkoop Van Abn Amro Kamerbrief Certificaten

May 22, 2025

Optimaliseer Uw Verkoop Van Abn Amro Kamerbrief Certificaten

May 22, 2025 -

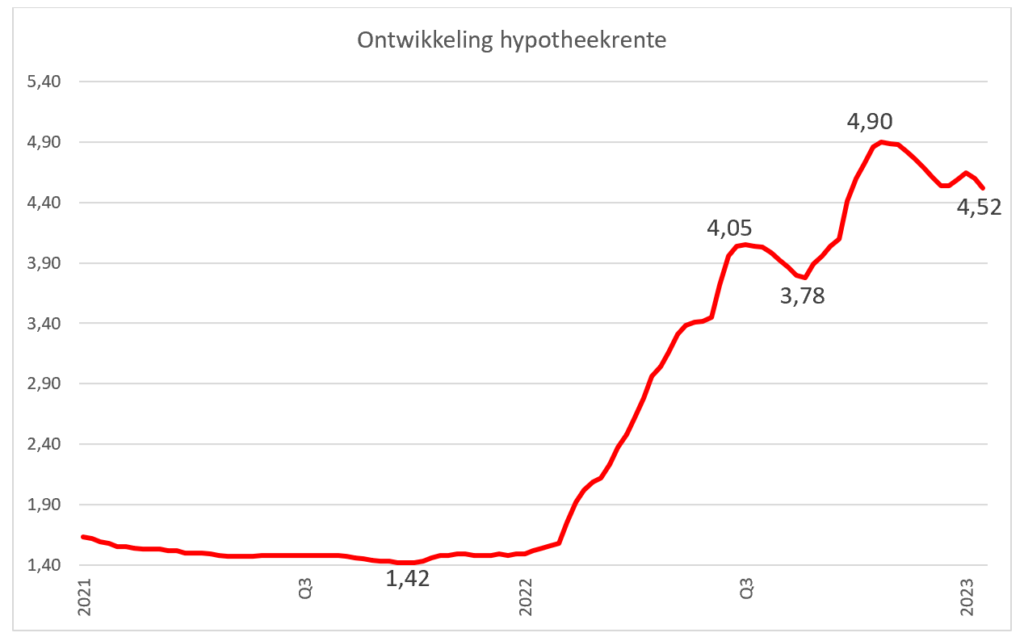

Rentedaling En Stijgende Huizenprijzen Abn Amros Analyse

May 22, 2025

Rentedaling En Stijgende Huizenprijzen Abn Amros Analyse

May 22, 2025 -

Stijgende Huizenprijzen Abn Amros Verwachting Voor De Nederlandse Huizenmarkt

May 22, 2025

Stijgende Huizenprijzen Abn Amros Verwachting Voor De Nederlandse Huizenmarkt

May 22, 2025