BP Executive Compensation: A 31% Decrease

Table of Contents

The Extent of the Compensation Decrease

The 31% reduction in BP executive compensation represents a substantial shift in the company's approach to executive pay. While precise figures may vary depending on the final reporting, let's assume, for illustrative purposes, that the total compensation package for the CEO previously stood at $15 million annually. This 31% decrease would translate to a reduction of approximately $4.65 million, resulting in a new annual compensation of roughly $10.35 million. This reduction affects key C-suite executives, including the CEO, CFO, and other senior leadership members.

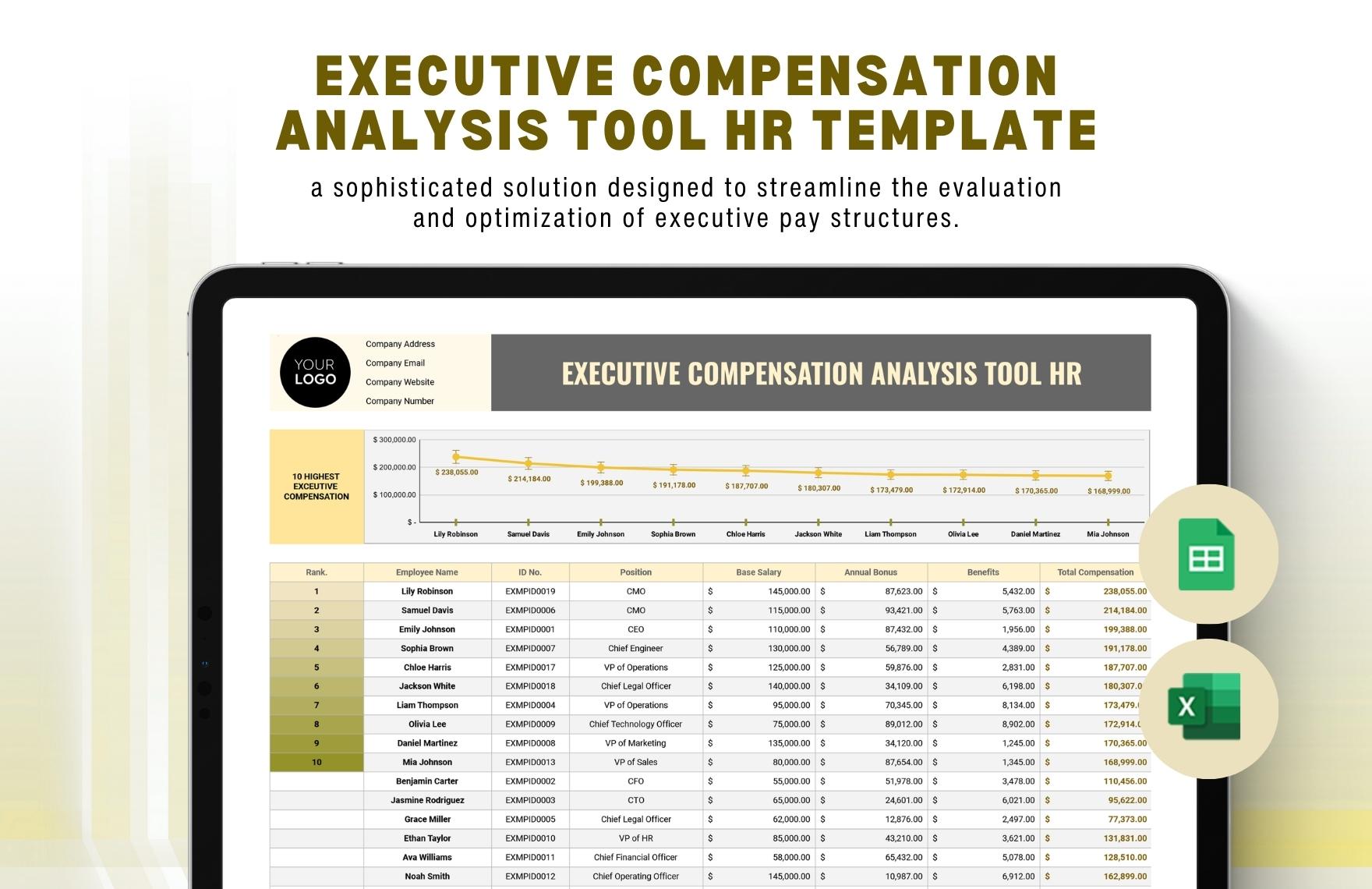

- Exact figures for previous and current total compensation packages: (Insert actual figures from official BP reports once available. Use a table for clarity).

- Breakdown of compensation components (salary, bonuses, stock options): (Provide a breakdown of the components for both previous and current compensation packages. Highlight the percentage changes in each component).

- Comparison to compensation levels in previous years: (Show a trend graph illustrating compensation levels over the past 3-5 years to contextualize the 31% decrease).

Reasons Behind the Compensation Reduction

Several factors likely contributed to this significant reduction in BP executive compensation. It's unlikely to be a single cause, but rather a confluence of contributing elements.

- Impact of fluctuating oil prices on BP's profitability: The energy sector is notoriously volatile, and fluctuating oil prices directly impact profitability. Lower oil prices likely necessitated a reassessment of executive compensation to align with the company's financial performance.

- Pressure from activist investors or shareholder resolutions regarding executive pay: Activist investors and shareholder advocacy groups often exert considerable pressure on companies to justify and moderate executive compensation, especially when perceived as excessive. Shareholder resolutions focusing on executive pay may have played a role in BP's decision.

- Company statements justifying the pay cut (if available): Review official statements released by BP regarding the compensation reduction. Analyze the justifications provided by the company.

- Alignment with broader trends in executive compensation within the energy industry: The energy sector is witnessing a growing focus on responsible and sustainable practices, impacting executive compensation policies. This reduction could align BP with broader industry trends towards more modest executive pay packages.

Implications for BP Shareholders and Investors

The 31% decrease in BP executive compensation carries several potential implications for shareholders and investors.

- Potential impact on BP's stock price: The market's reaction to this news is crucial. A positive reaction could signal improved investor confidence, potentially leading to a rise in BP's stock price. Conversely, a negative reaction might indicate concerns about the company's financial health.

- Analysis of shareholder reaction to the compensation changes: Monitor media reports and financial news outlets to assess how shareholders perceive this change. Analyze any public statements from major shareholders expressing their opinions.

- Implications for future executive compensation strategies at BP: This decision sets a precedent for future executive compensation at BP. It signals a potential shift towards a more restrained approach to executive pay, potentially influencing future negotiations and setting expectations.

- Comparison with executive compensation practices of competitor companies: A comparative analysis with competitor companies like Shell and ExxonMobil will provide a benchmark for BP's executive compensation strategy and reveal whether this reduction aligns with industry best practices.

Comparative Analysis of BP's Executive Compensation

Benchmarking BP's executive compensation against its major competitors like Shell and ExxonMobil is crucial for evaluating its competitiveness and overall corporate governance.

- Data on executive compensation for comparable roles at competitor firms: Gather data on the compensation packages of CEOs, CFOs, and other C-suite executives at Shell and ExxonMobil. (Use a table for clear comparison).

- Analysis of differences in compensation structures and philosophies: Compare the different components of compensation packages (salary, bonuses, stock options) and the overall philosophies underlying the compensation strategies of these companies.

- Discussion of the factors contributing to variations in executive pay across the sector: Identify factors such as company size, profitability, risk profiles, and corporate governance structures that contribute to differences in executive pay across the oil and gas sector.

Conclusion

The 31% decrease in BP executive compensation is a significant development with potentially far-reaching implications. The reduction reflects a complex interplay of factors, including fluctuating oil prices, shareholder pressure, and a broader trend toward more responsible executive compensation within the energy sector. While the long-term effects on BP's stock price and investor confidence remain to be seen, the move suggests an effort towards better alignment of executive incentives with shareholder interests and improved corporate governance.

Call to Action: Stay informed about future developments in BP executive compensation and the evolving landscape of corporate governance in the energy industry by regularly checking BP's investor relations page and following reputable financial news sources.

Featured Posts

-

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025

Update Ex Tory Councillors Wifes Appeal On Racial Hatred Tweet

May 22, 2025 -

Peppa Pig And Baby A 10 Episode Big Screen Adventure This May

May 22, 2025

Peppa Pig And Baby A 10 Episode Big Screen Adventure This May

May 22, 2025 -

La Salud De Javier Baez Clave Para Su Exito Futuro

May 22, 2025

La Salud De Javier Baez Clave Para Su Exito Futuro

May 22, 2025 -

Dexter Resurrection The Return Of A Popular Villain

May 22, 2025

Dexter Resurrection The Return Of A Popular Villain

May 22, 2025 -

Peppa Pigs Parents Host Gender Reveal Meet The Newest Member Of The Family

May 22, 2025

Peppa Pigs Parents Host Gender Reveal Meet The Newest Member Of The Family

May 22, 2025

Latest Posts

-

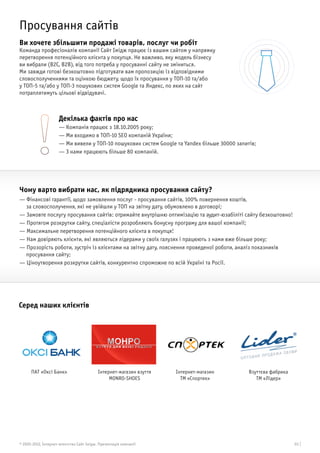

Finansovi Kompaniyi Ukrayini Reyting Za Dokhodami 2024

May 22, 2025

Finansovi Kompaniyi Ukrayini Reyting Za Dokhodami 2024

May 22, 2025 -

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku

May 22, 2025

Analiz Rinku Finansovikh Poslug Ukrayini Lideri 2024 Roku

May 22, 2025 -

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Rotsi Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 22, 2025

Naybilshi Finansovi Kompaniyi Ukrayini Za Obsyagom Poslug U 2024 Rotsi Credit Kasa Finako Ukrfinzhitlo Atlana Credit Plus

May 22, 2025 -

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 22, 2025

Top 5 Finansovikh Kompaniy Ukrayini Za Dokhodami U 2024 Rotsi

May 22, 2025 -

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 22, 2025

Reyting Finansovikh Kompaniy Ukrayini 2024 Credit Kasa Finako Ukrfinzhitlo Atlana Ta Credit Plus Lidiruyut

May 22, 2025