Brace For More Market Pain: Investors' Risky Bids

Table of Contents

Rising Inflation and Interest Rates Fuel Risky Behavior

High inflation and aggressive interest rate hikes are forcing investors into increasingly precarious positions. The search for returns that outpace inflation is pushing many to abandon traditional, safer investment strategies in favor of riskier alternatives. This behavior, fueled by "Investors' Risky Bids," poses significant challenges to market stability.

Desperate for Returns

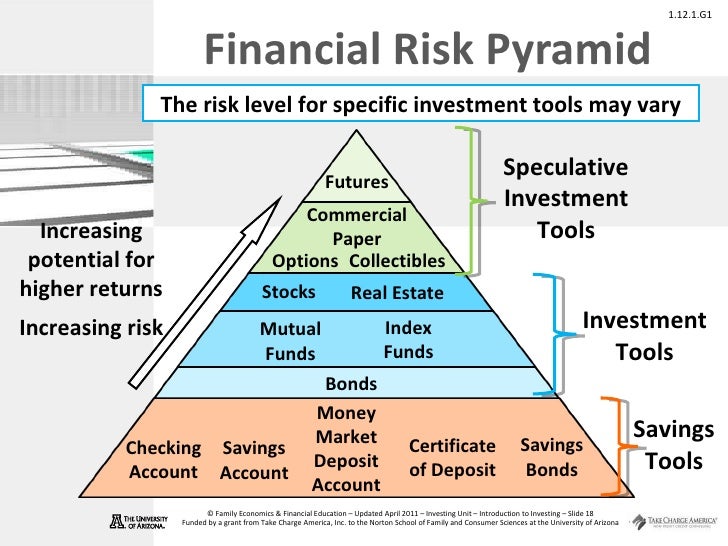

The pool of "safe" investments offering decent returns is shrinking. Traditional options like bonds and savings accounts are yielding paltry returns, failing to keep pace with inflation. This reality is pushing investors towards higher-yield, higher-risk assets.

- Shrinking Safe Havens: Low-risk investments like government bonds are offering historically low yields, leaving many feeling the pressure to seek higher returns elsewhere.

- The Allure of High-Risk, High-Reward: Speculative stocks, meme stocks, and even cryptocurrencies, notorious for their volatility, are attracting investors desperate to preserve their purchasing power.

- Examples of Risky Investments: The recent surge in popularity of certain meme stocks and the continued interest in volatile cryptocurrencies despite significant price swings exemplify this trend of investors taking on excessive risk.

Leveraged Investing on the Rise

The increased use of leverage and margin accounts is further magnifying the potential for both profits and losses. This practice, while potentially lucrative, carries immense risk.

- Mechanics of Leveraged Investing: Leveraged investing involves borrowing money to amplify investment returns. While this can lead to significant profits, it also exponentially increases losses.

- Margin Calls and Forced Liquidation: When investments decline, investors may face margin calls, requiring them to deposit more funds to maintain their positions. Failure to meet these calls can lead to forced liquidation of assets at potentially unfavorable prices.

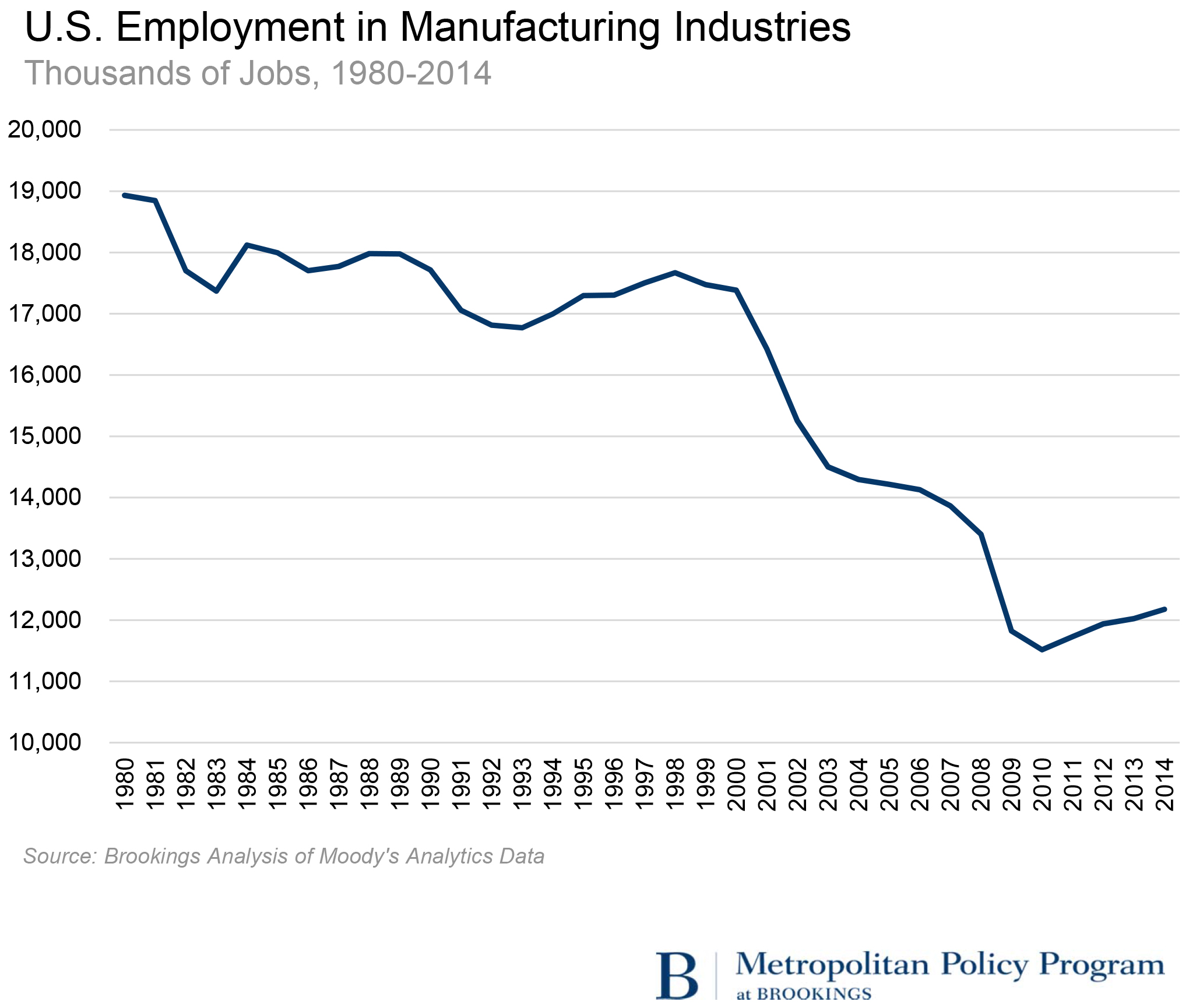

- Growth of Leveraged Investing: Data suggests a significant increase in the utilization of margin accounts in recent years, indicating a growing appetite for risk among a segment of investors.

Overvaluation and Market Bubbles

Identifying overvalued assets in a frenzied market fueled by "Investors' Risky Bids" is exceptionally challenging. The current environment, characterized by exuberance and a fear of missing out (FOMO), can easily distort valuations.

Identifying Overvalued Assets

Pinpointing overvalued assets requires careful analysis, yet even seasoned investors struggle in this climate. Several factors contribute to the difficulty:

- Overvalued Sectors: Certain sectors, such as technology and certain growth stocks, might show signs of overvaluation based on traditional valuation metrics.

- FOMO Driving Prices: The fear of missing out on potential gains can lead investors to bid up asset prices beyond their intrinsic value, creating a speculative bubble.

- Limitations of Valuation Metrics: Traditional valuation metrics like price-to-earnings ratios might not accurately reflect the true value of assets in a market distorted by speculative trading.

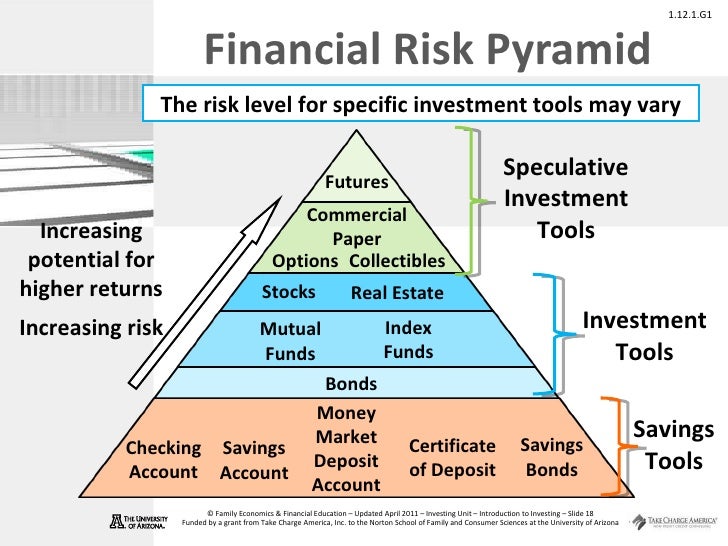

The Risk of a Market Correction

The inflated valuations driven by Investors' Risky Bids significantly increase the risk of a market correction or even a crash. This could have severe consequences:

- Impact on Asset Classes: A market correction could impact various asset classes, including stocks, bonds, and real estate, potentially causing significant losses for investors.

- Risks for Individuals and the Economy: A significant market downturn could have a ripple effect on the broader economy, impacting consumer confidence, job security, and overall economic growth.

- Historical Precedents: History is replete with examples of market bubbles that ultimately burst, leading to substantial market corrections and economic hardship.

Lack of Regulatory Oversight and Investor Education

Regulatory gaps and a lack of investor education contribute significantly to the risks associated with Investors' Risky Bids. A more robust regulatory framework and increased financial literacy are crucial to mitigate these dangers.

Regulatory Gaps

Existing regulations may not adequately address the challenges posed by the current investment landscape:

- Regulatory Shortcomings: Certain regulatory loopholes might allow for excessive risk-taking and market manipulation.

- Contributing to Instability: These gaps contribute to market instability and increase the potential for significant losses for investors.

- Increased Scrutiny Needed: Stronger regulatory oversight is needed to ensure market integrity and protect investors from excessive risk.

The Importance of Financial Literacy

Investor education plays a vital role in mitigating risks associated with risky investment strategies.

- Dangers of Market Hype: Following market hype without understanding the underlying risks can lead to devastating losses.

- Diversification and Risk Management: Diversification and effective risk management strategies are critical for protecting investments.

- Resources for Improvement: Investors should utilize reputable resources to improve their financial literacy and make informed decisions.

Conclusion

Rising inflation and interest rates are driving investors to make risky bids, leading to overvaluation and the potential for a significant market correction. A lack of regulation and investor education further exacerbates this problem. Brace yourself for potential market pain by avoiding Investors' Risky Bids. Make informed decisions based on sound financial planning and seek professional guidance to navigate these uncertain times. Consider consulting with a financial advisor to create a personalized investment strategy that aligns with your risk tolerance and financial goals.

Featured Posts

-

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

Apr 22, 2025

Stock Market Valuation Concerns Bof A Offers A Reassuring Perspective

Apr 22, 2025 -

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 22, 2025

Cassidy Hutchinsons Fall Memoir Insights From The January 6th Hearings

Apr 22, 2025 -

Assessing The Pan Nordic Military Option Strengths And Weaknesses Of Swedish Finnish Cooperation

Apr 22, 2025

Assessing The Pan Nordic Military Option Strengths And Weaknesses Of Swedish Finnish Cooperation

Apr 22, 2025 -

Technical Glitch Forces Blue Origin To Abort Rocket Launch

Apr 22, 2025

Technical Glitch Forces Blue Origin To Abort Rocket Launch

Apr 22, 2025 -

Harvard Faces 1 Billion Funding Cut Trump Administrations Anger Explained

Apr 22, 2025

Harvard Faces 1 Billion Funding Cut Trump Administrations Anger Explained

Apr 22, 2025

Latest Posts

-

The Most Emotional Rocky Movie Sylvester Stallone Reveals His Personal Pick

May 12, 2025

The Most Emotional Rocky Movie Sylvester Stallone Reveals His Personal Pick

May 12, 2025 -

One And Done Examining Sylvester Stallones Sole Non Acting Directing Project

May 12, 2025

One And Done Examining Sylvester Stallones Sole Non Acting Directing Project

May 12, 2025 -

Sylvester Stallone Picks His Top Rocky Film Why Its The Most Emotional

May 12, 2025

Sylvester Stallone Picks His Top Rocky Film Why Its The Most Emotional

May 12, 2025 -

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 12, 2025

Sylvester Stallones Favorite Rocky Movie A Deep Dive Into The Franchises Most Emotional Entry

May 12, 2025 -

Stallone Behind The Camera The Untold Story Of His One Non Acting Film

May 12, 2025

Stallone Behind The Camera The Untold Story Of His One Non Acting Film

May 12, 2025