Brexit: How It's Hampering UK Luxury Exports To The EU

Table of Contents

Increased Trade Barriers and Costs

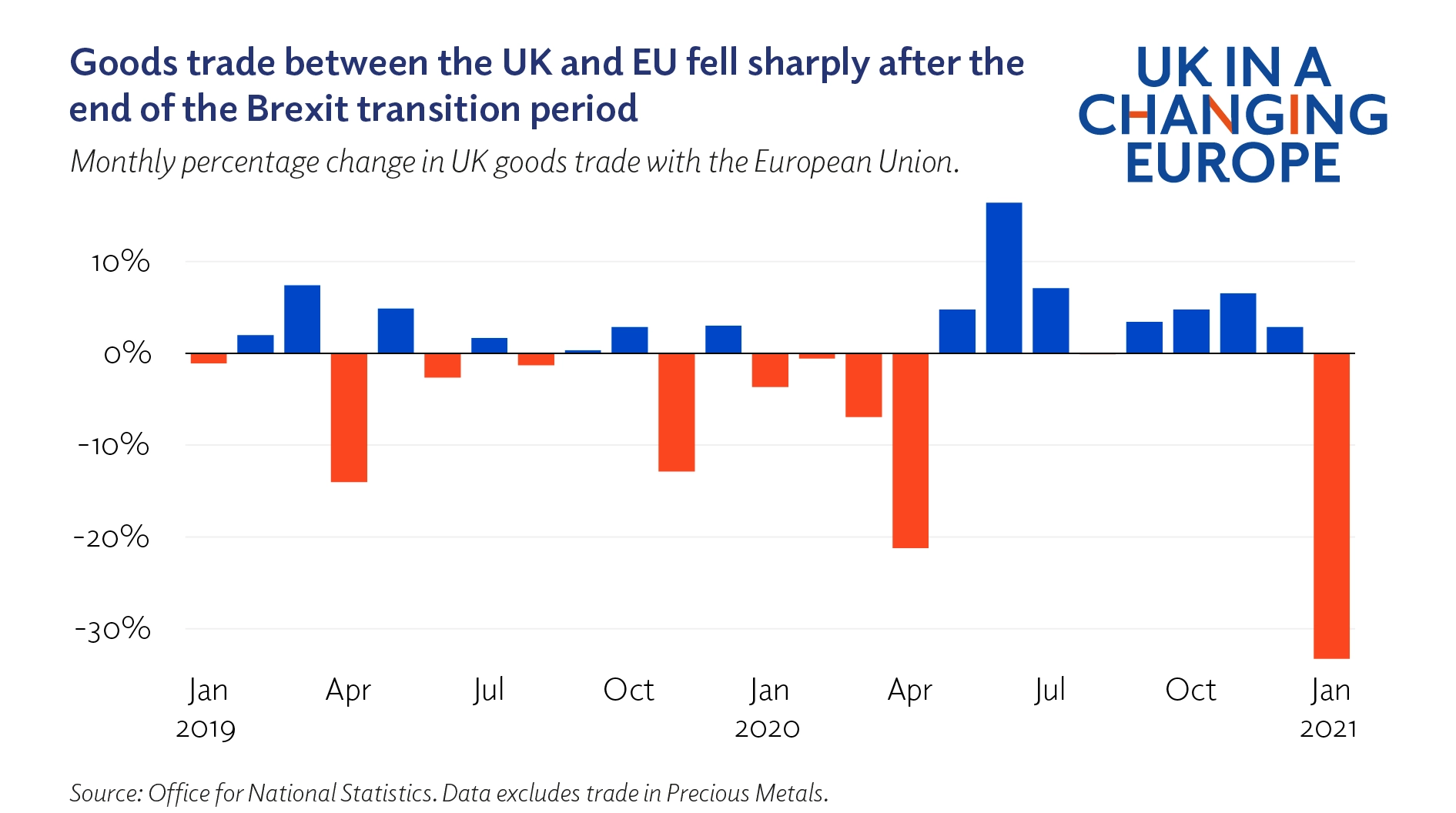

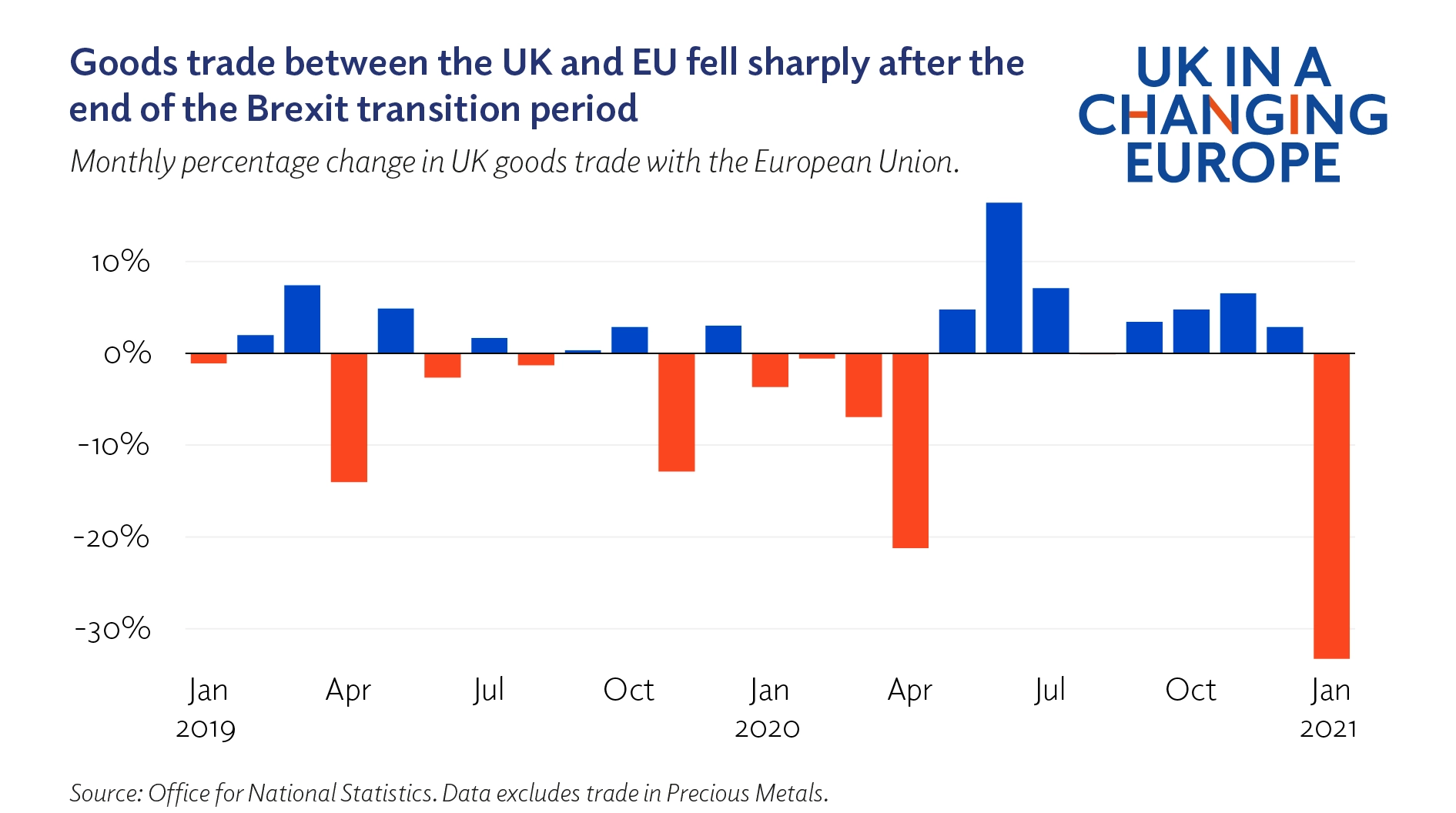

Brexit has erected significant trade barriers between the UK and the EU, dramatically increasing the cost and complexity of exporting luxury goods. These barriers manifest in both tariffs and non-tariff forms, significantly impacting the competitiveness of British brands in the EU market.

Tariffs and Duties

The imposition of tariffs and customs duties on luxury goods represents a substantial increase in the final price for EU consumers. This price hike directly reduces demand and competitiveness for UK luxury exporters.

- Examples of Increased Costs: Scotch whisky now faces tariffs, increasing its price by several percentage points in the EU. Similarly, high-end British automobiles and designer clothing experience substantial tariff-related cost increases. These added costs can range from 5% to upwards of 20% depending on the product and its specific tariff classification.

- Impact on Consumer Demand: The increased prices make UK luxury goods less attractive to EU consumers, who may opt for similar products from within the EU or from other global competitors, leading to a significant drop in sales volumes.

Non-Tariff Barriers

Beyond tariffs, Brexit has introduced a myriad of non-tariff barriers, further complicating the export process and driving up costs. These barriers encompass new customs procedures, stringent documentation requirements, and increased border checks, all adding delays and logistical headaches for exporters.

- Bureaucratic Hurdles: Exporters now face lengthy customs declarations, complex sanitary and phytosanitary checks (SPS checks), and intricate rules of origin verification. This adds significant administrative burden and delays to the shipping process.

- Impact on Supply Chains: The delays caused by these bureaucratic hurdles disrupt just-in-time supply chains, crucial for the luxury sector. Perishable luxury goods, such as fresh produce or certain high-end confectionery items, are particularly vulnerable to spoilage during these delays, resulting in significant financial losses.

Reduced Access to the EU Single Market

The UK's departure from the EU single market has dramatically altered its trading relationship with its largest export market. The once frictionless trade has been replaced by complex customs processes and regulatory compliance, significantly reducing access for UK luxury goods.

Loss of Frictionless Trade

Prior to Brexit, UK luxury goods enjoyed seamless movement across the EU's internal borders. This frictionless trade allowed for efficient and cost-effective export. Post-Brexit, however, this ease of trade has vanished, replaced by extensive customs procedures and the need for meticulous documentation.

- Pre-Brexit vs. Post-Brexit Trade: Before Brexit, goods flowed freely, with minimal paperwork and delays. Now, extensive customs declarations, inspections, and verifications are necessary, adding significant time and cost to the export process.

- Increased Time and Costs: The added time and resources required to navigate the new regulations increase the overall cost of exporting, making UK luxury goods less competitive.

Regulatory Divergence

Diverging product standards and regulations between the UK and the EU present another significant challenge for UK luxury exporters. Meeting the different requirements for the same product in multiple EU markets demands significant investment and adaptation.

- Differing Regulations: Differences in labeling requirements, ingredient regulations (for food and beverage luxury goods), and safety standards across various EU member states necessitate costly product modifications to ensure compliance.

- Costs of Adaptation: The expense of adapting products to meet various EU standards can be substantial, significantly reducing profit margins and competitiveness compared to EU-based competitors.

Impact on UK Luxury Brands and Businesses

The increased trade barriers and reduced market access resulting from Brexit have had a direct and negative impact on the profitability and competitiveness of UK luxury businesses.

Decreased Profitability

Increased costs associated with tariffs, customs, and regulatory compliance are significantly eroding profit margins for UK luxury businesses. Many are struggling to maintain their competitiveness in the EU market.

- Struggling Companies: Several UK luxury brands have reported reduced profitability and increased operational costs due to Brexit-related trade barriers. These challenges can lead to reduced investment in innovation and growth.

- Job Losses and Economic Consequences: The reduced profitability and market share can lead to job losses within the sector and a wider negative impact on the UK economy.

Loss of Market Share

The increased costs and complexities associated with exporting to the EU are enabling competitors from other regions, particularly within the EU itself (e.g., Italy, France), to gain market share.

- Market Share Data: Market research data is showing a decline in the market share of certain UK luxury goods within the EU, reflecting the difficulties faced by UK exporters.

- Competitive Disadvantage: The additional costs and complexities place UK luxury brands at a competitive disadvantage compared to their EU counterparts, hindering their ability to compete effectively.

Conclusion

Brexit has undeniably created significant obstacles for UK luxury exports to the EU, leading to increased costs, reduced market access, and a loss of competitiveness. These challenges, stemming from both tariffs and non-tariff barriers, threaten the long-term viability and prosperity of the UK luxury goods sector. Understanding Brexit's impact on UK luxury exports is crucial for businesses and policymakers alike. Continued analysis, proactive adaptation strategies, and potentially, a renegotiation of trade agreements, are needed to mitigate the negative consequences and ensure the continued success of UK luxury brands in the EU market. Further research into Brexit's impact on UK luxury goods is vital to develop effective solutions and safeguard this vital sector of the British economy.

Featured Posts

-

Flavio Cobollis Triumph Bucharest Tiriac Open Victory

May 20, 2025

Flavio Cobollis Triumph Bucharest Tiriac Open Victory

May 20, 2025 -

Fenerbahce Nin Yildizi Dusan Tadic Sueper Lig De 100 Maca Tamamladi

May 20, 2025

Fenerbahce Nin Yildizi Dusan Tadic Sueper Lig De 100 Maca Tamamladi

May 20, 2025 -

Atkinsrealis Droit Inc Assistance Et Representation Legale

May 20, 2025

Atkinsrealis Droit Inc Assistance Et Representation Legale

May 20, 2025 -

Buy Canadian Will Tariffs Hurt The Booming Local Beauty Industry

May 20, 2025

Buy Canadian Will Tariffs Hurt The Booming Local Beauty Industry

May 20, 2025 -

Familia Schumacher Prima Imagine Cu Noul Membru

May 20, 2025

Familia Schumacher Prima Imagine Cu Noul Membru

May 20, 2025

Latest Posts

-

Wayne Gretzkys Loyalty Questioned Amid Trumps Tariffs And Statehood Comments

May 20, 2025

Wayne Gretzkys Loyalty Questioned Amid Trumps Tariffs And Statehood Comments

May 20, 2025 -

Trumps Tariffs Statehood Remarks Ignite Debate Over Wayne Gretzkys Canadian Loyalty

May 20, 2025

Trumps Tariffs Statehood Remarks Ignite Debate Over Wayne Gretzkys Canadian Loyalty

May 20, 2025 -

Wayne Gretzky Fast Facts Key Moments And Milestones

May 20, 2025

Wayne Gretzky Fast Facts Key Moments And Milestones

May 20, 2025 -

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025

Wayne Gretzkys Fast Facts A Quick Look At The Great Ones Life And Career

May 20, 2025 -

Trump Tariffs And Statehood The Unlikely Debate Sparked By Wayne Gretzkys Canadian Patriotism

May 20, 2025

Trump Tariffs And Statehood The Unlikely Debate Sparked By Wayne Gretzkys Canadian Patriotism

May 20, 2025