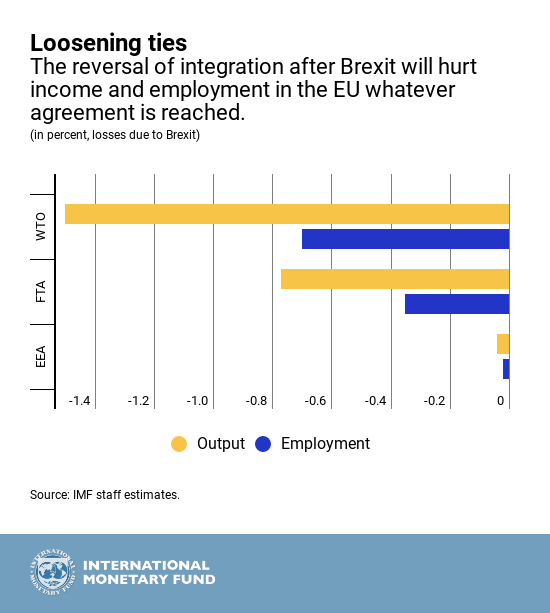

Brexit's Negative Effect On UK Luxury Exports To The EU Market

Table of Contents

Increased Tariffs and Customs Costs

One of the most immediate and significant consequences of Brexit has been the imposition of new tariffs and customs duties on UK luxury goods exported to the EU. These added costs directly reduce the profitability of exporting, making British luxury products less competitive against both EU-produced goods and global rivals.

-

Higher prices reducing competitiveness: The increased costs associated with tariffs are often passed on to the consumer, leading to higher prices for luxury items. This price increase can make British luxury goods less attractive compared to similar products from within the EU or other countries with more favorable trade agreements.

-

Increased administrative burden and associated costs: Navigating the new customs procedures is complex and time-consuming. Businesses face increased paperwork, requiring specialized knowledge and software, significantly adding to operational costs. This administrative burden disproportionately affects smaller luxury brands lacking the resources of larger corporations.

-

Examples of specific luxury items impacted: The impact spans various luxury sectors. High-end clothing, bespoke jewelry, and handcrafted goods are all affected. The additional costs eat into profit margins, forcing some businesses to reduce production or even cease exporting to the EU entirely.

-

Case studies illustrating financial losses: Several British luxury brands have publicly reported significant financial losses due to increased tariffs and customs costs. These losses illustrate the tangible and widespread impact of Brexit on the UK luxury export sector. For example, [insert example of a brand and quantify their losses if possible].

Non-Tariff Barriers and Supply Chain Disruptions

Beyond tariffs, Brexit has introduced a range of non-tariff barriers that disrupt supply chains and complicate the export process. These hurdles significantly impact the timely delivery of goods and add unexpected costs.

-

Delays at border crossings leading to damaged or spoiled goods: Increased border checks and customs inspections result in delays, potentially leading to damaged or spoiled perishable goods, resulting in significant financial losses for exporters. This is particularly problematic for time-sensitive luxury items that require careful handling and precise delivery schedules.

-

Increased paperwork and documentation requirements: The complexity of new paperwork and documentation requirements significantly slows down the export process, adding further delays and costs. This administrative burden is a major challenge for businesses already dealing with the intricacies of international trade.

-

Difficulties in accessing skilled labor for production and export processes: Brexit has also made it more challenging for UK luxury brands to access the skilled labor needed for production and export. Restrictions on worker movement and visa requirements complicate the process of employing specialized artisans and logistics personnel.

-

Impact on just-in-time inventory management strategies: The delays and uncertainties introduced by Brexit have disrupted many businesses' just-in-time inventory management strategies. The inability to predict delivery times accurately forces companies to hold larger inventories, increasing storage costs and potentially tying up capital.

Diminished Consumer Demand in the EU

Brexit has also negatively impacted consumer demand for UK luxury goods within the EU. Uncertainty surrounding trade agreements and the economic fallout from Brexit have affected consumer sentiment and purchasing power.

-

Reduced consumer confidence in British luxury brands due to Brexit uncertainty: The political and economic uncertainty surrounding Brexit has eroded consumer confidence in British brands, leading to a decrease in demand for UK luxury goods within the EU market. This diminished confidence represents a significant challenge for UK luxury brands seeking to maintain market share.

-

The impact of currency fluctuations on the pricing of luxury goods in the Eurozone: Fluctuations in the exchange rate between the pound sterling and the euro can significantly impact the pricing of luxury goods in the Eurozone, affecting their affordability and competitiveness.

-

Increased preference for EU-produced luxury goods by EU consumers: In response to Brexit-related challenges, some EU consumers have shown a preference for luxury goods produced within the EU, further impacting the market share of UK brands. This shift in consumer preference reinforces the importance of understanding the market dynamics shaped by Brexit.

-

Loss of market share to competitors within the EU: As a direct consequence of the aforementioned factors, UK luxury brands have experienced a loss of market share to competitors based within the EU. This loss of market share underscores the significant impact of Brexit on the UK luxury export sector.

The Impact on Specific Luxury Sectors

The impact of Brexit varies across specific luxury sectors. For example, Scotch Whisky exports, a cornerstone of the UK luxury market, have faced significant challenges due to increased tariffs and logistical complexities. Similarly, the high-end car industry has experienced supply chain disruptions and increased costs, affecting the competitiveness of British luxury vehicles within the EU. The high-end fashion sector also struggles with navigating new regulations and customs procedures, affecting timely deliveries and impacting overall sales. Each sector requires a tailored strategy to mitigate these Brexit-related challenges.

Conclusion

Brexit's negative effect on UK luxury exports to the EU market is undeniable. The combined impact of increased tariffs and customs costs, non-tariff barriers, and diminished consumer demand has resulted in significant economic consequences for UK businesses and the economy as a whole. Understanding the full impact of Brexit on UK luxury exports is crucial for future success. The UK government and businesses must work together to address these challenges proactively, perhaps through negotiating favorable trade agreements, streamlining customs procedures, and enhancing the overall attractiveness of British luxury goods in the EU market. Learn more about strategies to navigate these challenges and explore resources available to support UK luxury businesses in this evolving trade landscape.

Featured Posts

-

Is There A Bbc Agatha Christie Deepfake An Investigation

May 20, 2025

Is There A Bbc Agatha Christie Deepfake An Investigation

May 20, 2025 -

Man Utd Transfer News Matheus Cunha Update And Potential Alternatives

May 20, 2025

Man Utd Transfer News Matheus Cunha Update And Potential Alternatives

May 20, 2025 -

Hamilton V Leclerc Chinese Gp Contact Sparks Ferrari Drama

May 20, 2025

Hamilton V Leclerc Chinese Gp Contact Sparks Ferrari Drama

May 20, 2025 -

Learn To Write Like Agatha Christie With Bbcs Ai Classes

May 20, 2025

Learn To Write Like Agatha Christie With Bbcs Ai Classes

May 20, 2025 -

Cote D Ivoire Bruno Kone Et Le Lancement Des Plans D Urbanisme Pour Les Unites Urbaines

May 20, 2025

Cote D Ivoire Bruno Kone Et Le Lancement Des Plans D Urbanisme Pour Les Unites Urbaines

May 20, 2025

Latest Posts

-

Sofrep Evening Brief Israels Missile Intercept And Russias Amnesty International Ban

May 20, 2025

Sofrep Evening Brief Israels Missile Intercept And Russias Amnesty International Ban

May 20, 2025 -

Retired Four Star Admirals Corruption Conviction Details And Fallout

May 20, 2025

Retired Four Star Admirals Corruption Conviction Details And Fallout

May 20, 2025 -

High Ranking Admiral Found Guilty Details Of The Corruption Case

May 20, 2025

High Ranking Admiral Found Guilty Details Of The Corruption Case

May 20, 2025 -

Bribery Scandal Retired 4 Star Admiral Found Guilty On Four Counts

May 20, 2025

Bribery Scandal Retired 4 Star Admiral Found Guilty On Four Counts

May 20, 2025 -

Four Bribery Charges Against Retired 4 Star Admiral Result In Guilty Verdict

May 20, 2025

Four Bribery Charges Against Retired 4 Star Admiral Result In Guilty Verdict

May 20, 2025