Broadcom's VMware Acquisition: AT&T Exposes A Potential 1,050% Price Surge

Table of Contents

Understanding the Broadcom-VMware Merger and its Implications

The Broadcom-VMware merger represents a massive consolidation in the technology sector. Broadcom, a leading provider of semiconductor and infrastructure software solutions, aims to expand its portfolio significantly by acquiring VMware, a virtualization and cloud computing giant. This strategic move seeks to bolster Broadcom's position in the networking and infrastructure market.

- Increased market share in networking and infrastructure: The combined entity will control a substantial portion of the market, potentially impacting competition and pricing strategies.

- Potential for cost synergies and operational efficiencies: Combining operations should lead to significant cost savings through streamlined processes and resource optimization.

- Expansion into new markets and technological advancements: VMware's expertise in cloud computing and virtualization will broaden Broadcom's offerings and accelerate innovation.

- Regulatory scrutiny and potential antitrust concerns: Such a large merger will inevitably face intense scrutiny from regulators worldwide, raising concerns about potential monopolistic practices. The acquisition needs regulatory approval before completion.

AT&T's Exposure to the Broadcom-VMware Deal

AT&T's relationship with both Broadcom and VMware is indirect but significant. AT&T extensively uses VMware virtualization technologies in its vast network infrastructure. The Broadcom acquisition could thus directly influence AT&T's operational efficiency and costs.

- AT&T's reliance on VMware virtualization technologies: VMware's solutions are critical to AT&T's network operations, managing and optimizing its data centers and cloud infrastructure.

- Potential impact on pricing and service agreements: The merger could lead to changes in pricing and service agreements for AT&T, either positively or negatively depending on the integration strategy.

- Opportunities for collaboration or integration: The merger might unlock new opportunities for collaboration between AT&T and the combined Broadcom-VMware entity, leading to improvements in network efficiency and service offerings.

- Risks associated with potential changes in technology or support: There's a risk of disruptions or compatibility issues during the integration process, potentially affecting AT&T's services.

Analyzing the Factors Contributing to the Potential 1,050% Price Surge

The 1,050% price surge prediction for AT&T is highly speculative and should be treated with caution. However, several factors could contribute to a significant, albeit less dramatic, increase in AT&T's stock price.

- Increased efficiency and cost savings for AT&T due to Broadcom’s integration: Streamlined operations and improved technology could lead to reduced costs for AT&T.

- Potential for new revenue streams through collaborations: New collaborative opportunities might emerge, generating additional revenue for AT&T.

- Positive market reaction to the merger's overall success: A successful integration and positive market response to the Broadcom-VMware merger could boost investor confidence in AT&T.

- Investor speculation and market sentiment: Market speculation and investor sentiment will heavily influence AT&T’s stock price.

- Clarification that 1050% is a highly speculative figure: It's crucial to emphasize that the 1050% figure is an extreme outlier and not a realistic expectation.

Risks and Considerations

While the potential upsides are considerable, several risks and challenges need careful consideration.

- Integration challenges and potential disruptions: Integrating two large organizations is complex and carries inherent risks of disruptions and delays.

- Increased costs associated with adapting to new technologies: AT&T may face significant costs in adapting to any changes in technology or support structures resulting from the merger.

- Unforeseen market reactions or negative investor sentiment: Unexpected market reactions or negative investor sentiment could negatively impact AT&T’s stock price.

- The possibility of the 1050% figure being inaccurate: This prediction is highly improbable and shouldn't be considered a realistic forecast.

Conclusion: Navigating the Broadcom-VMware Acquisition: What it Means for AT&T's Future

The Broadcom-VMware merger presents both significant opportunities and considerable risks for AT&T. While the 1,050% price surge prediction is highly unrealistic, the acquisition could nonetheless substantially impact AT&T's financial performance. The potential for increased efficiency and new revenue streams is balanced against the challenges of integration and market uncertainty. It's crucial to monitor the situation closely and assess the long-term implications for AT&T. To stay updated on the Broadcom VMware acquisition and its impact, monitor AT&T's stock performance closely and research the implications for investors by reviewing the companies' financial reports and independent market analyses. Understanding these factors will be crucial in navigating the evolving landscape and making informed investment decisions regarding AT&T's future.

Featured Posts

-

Sierra Leone Government Fires Immigration Head

May 30, 2025

Sierra Leone Government Fires Immigration Head

May 30, 2025 -

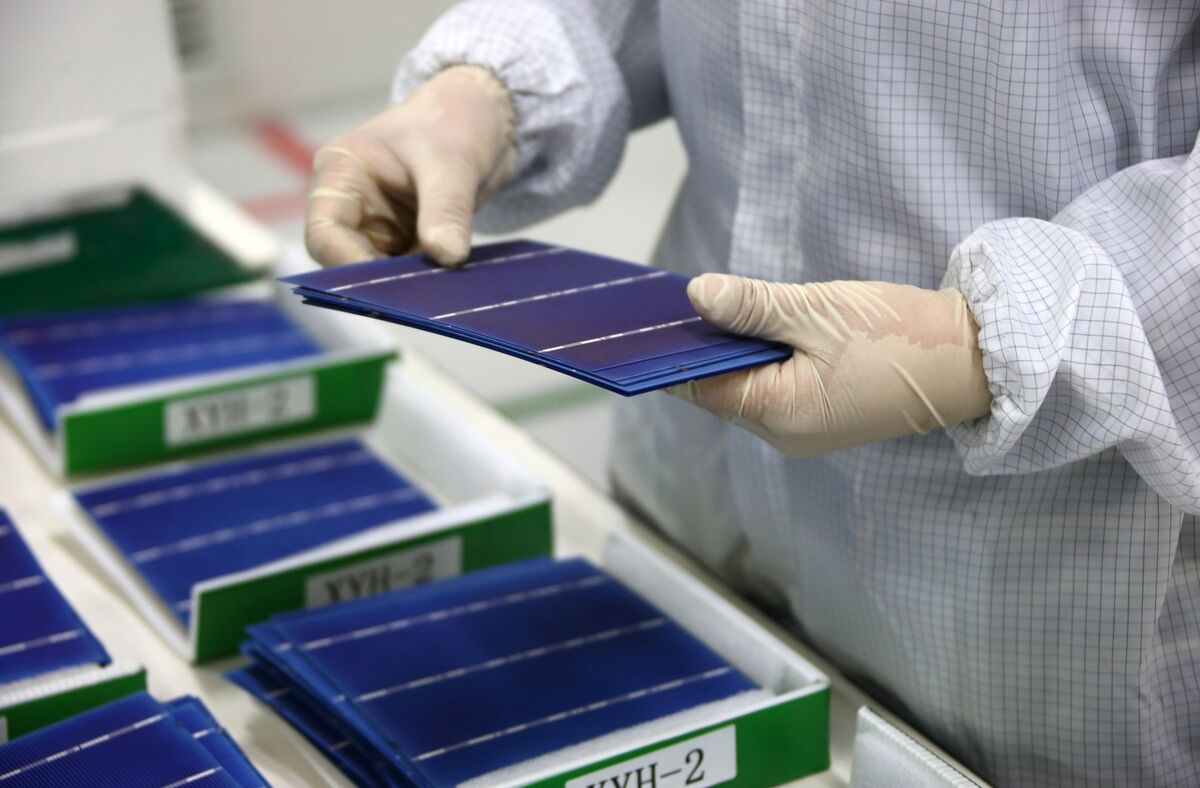

Malaysia Included In Us Solar Panel Import Duty Announcement

May 30, 2025

Malaysia Included In Us Solar Panel Import Duty Announcement

May 30, 2025 -

Roland Garros Day 1 Djokovics Strong Start Gauff And Andreevas Wins

May 30, 2025

Roland Garros Day 1 Djokovics Strong Start Gauff And Andreevas Wins

May 30, 2025 -

The 29 Million Question Will Jon Jones Return To The Ufc

May 30, 2025

The 29 Million Question Will Jon Jones Return To The Ufc

May 30, 2025 -

Are Strong Corporate Earnings Sustainable Expert Analysis

May 30, 2025

Are Strong Corporate Earnings Sustainable Expert Analysis

May 30, 2025

Latest Posts

-

Cau Long Thuy Linh Gap Doi Thu Manh O Thuy Si Mo Rong 2025

May 31, 2025

Cau Long Thuy Linh Gap Doi Thu Manh O Thuy Si Mo Rong 2025

May 31, 2025 -

Thuy Linh Doi Mat Thu Thach Lon Tai Vong 1 Thuy Si Mo Rong 2025

May 31, 2025

Thuy Linh Doi Mat Thu Thach Lon Tai Vong 1 Thuy Si Mo Rong 2025

May 31, 2025 -

May 23rd Orange County Game Results And Player Performance

May 31, 2025

May 23rd Orange County Game Results And Player Performance

May 31, 2025 -

Orange County Scores And Player Stats Friday May 23rd

May 31, 2025

Orange County Scores And Player Stats Friday May 23rd

May 31, 2025 -

Megarasaray Hotels Acik Turnuvasi Bondar Ve Waltert In Ciftler Sampiyonlugu Basarisi

May 31, 2025

Megarasaray Hotels Acik Turnuvasi Bondar Ve Waltert In Ciftler Sampiyonlugu Basarisi

May 31, 2025