Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Hike Concerns

Table of Contents

AT&T's Concerns Regarding Price Increases Post-Acquisition

AT&T's anxieties regarding the Broadcom-VMware merger are not unfounded. The telecommunications giant, a massive user of VMware's virtualization and cloud solutions, has expressed significant worry about Broadcom leveraging its newfound market power to significantly increase VMware's licensing and support costs. This translates to substantially higher operational expenditures for AT&T's extensive network infrastructure, impacting their bottom line and potentially affecting services.

-

Substantial Cost Increase: AT&T fears a dramatic increase in licensing fees for VMware's products, impacting their existing infrastructure and future projects. This could lead to millions, potentially billions, in additional annual costs.

-

Reduced Innovation & Competition: Beyond direct pricing, AT&T is concerned about reduced innovation within the virtualization market. Broadcom's acquisition could stifle competition, leading to less choice and slower technological advancements in virtualization solutions.

-

Monopoly Fears: The acquisition raises serious antitrust concerns. The combined market power of Broadcom and VMware could create a near-monopoly, potentially leading to anti-competitive practices and stifling innovation. This concern extends beyond AT&T to other major players relying on VMware.

The Potential Impact on the Broader Enterprise Market

The potential impact of a VMware price hike extends far beyond AT&T. The ripple effects could significantly impact the broader enterprise market, affecting businesses of all sizes.

-

IT Budget Strain: A substantial price increase from VMware could force businesses of all sizes to drastically reconsider their IT budgets and cloud strategies. Smaller companies may face particularly significant challenges.

-

Stifled Innovation: Increased costs could restrict innovation and limit the adoption of new technologies, particularly for smaller companies with limited resources. The market might become less dynamic and less responsive to changing technological needs.

-

Shifting Competitive Landscape: Businesses may be compelled to explore alternative virtualization and cloud solutions, potentially leading to a significant shift in the competitive landscape. This could benefit open-source solutions and alternative cloud providers.

-

Impact on Technology Spending: The overall impact on technology spending could be substantial, potentially slowing down the rate of adoption of new technologies across various sectors.

Regulatory Scrutiny and Antitrust Concerns

The Broadcom-VMware acquisition is currently under intense regulatory scrutiny from antitrust authorities worldwide. The deal faces rigorous reviews in multiple jurisdictions, focusing on potential anti-competitive practices.

-

Antitrust Investigations: Agencies like the FTC in the US are meticulously investigating the deal to determine if it violates antitrust laws, scrutinizing Broadcom's potential to control pricing and restrict competition.

-

Merger Approval Uncertainty: The outcome of these regulatory reviews remains uncertain, significantly impacting the future of VMware pricing and the overall technology market. Negative findings could lead to the deal's collapse or impose conditions to limit Broadcom's power.

-

AT&T's Influence: AT&T's publicly voiced concerns strengthen the arguments against the merger's approval. Their testimony and evidence contribute significantly to the regulatory assessment.

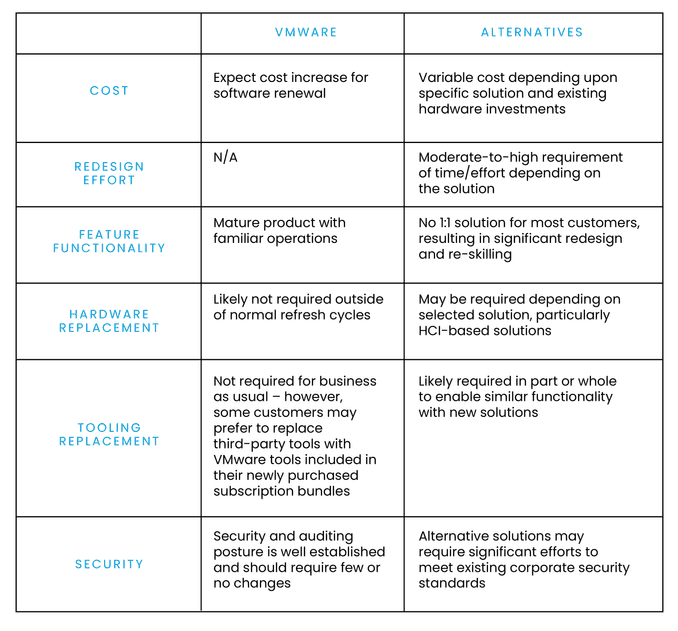

Alternative Solutions for Businesses

Facing the potential for significantly higher VMware costs, businesses are actively exploring alternative solutions to mitigate risks.

-

Open-Source Options: Open-source virtualization platforms like Proxmox VE and oVirt are gaining popularity as viable alternatives to VMware, offering cost-effective solutions.

-

Cloud Provider Diversification: Businesses are diversifying their cloud strategies, moving away from sole reliance on VMware-based solutions and exploring multi-cloud approaches.

-

Strategic Migration Planning: Careful planning for technology migration is vital. Businesses need to assess their reliance on VMware and develop a plan for transitioning to alternative solutions if necessary.

-

Cost Optimization Strategies: Implementing effective cost-optimization strategies is crucial to absorb potential price increases without dramatically impacting operations. This could include renegotiating contracts and optimizing resource utilization.

Conclusion

AT&T's expressed concerns regarding potential extreme price hikes following Broadcom's acquisition of VMware underscore a critical challenge for organizations relying on VMware's technologies. The merger's impact on the enterprise market, coupled with the ongoing regulatory scrutiny, remains a significant concern. The potential for increased costs and decreased competition necessitates a proactive and strategic response from businesses to minimize potential risks.

Call to Action: Stay informed about the ongoing developments surrounding the Broadcom-VMware acquisition. Monitor regulatory decisions closely and proactively explore alternative solutions to safeguard your business from potential price hikes associated with the Broadcom VMware deal. Understanding the implications of this merger is crucial for navigating the ever-changing landscape of enterprise software and cloud computing.

Featured Posts

-

Cavaliers 50th Win Hunters 32 Points Secure Overtime Victory Against Blazers

Apr 30, 2025

Cavaliers 50th Win Hunters 32 Points Secure Overtime Victory Against Blazers

Apr 30, 2025 -

Clase Nacional De Boxeo En El Zocalo Fotos Y Resumen Del Evento

Apr 30, 2025

Clase Nacional De Boxeo En El Zocalo Fotos Y Resumen Del Evento

Apr 30, 2025 -

Needed Changes At Parkland School Board A Measured Approach

Apr 30, 2025

Needed Changes At Parkland School Board A Measured Approach

Apr 30, 2025 -

Addressing Climate Change In Africa The Schneider Electric Climate Smart Village Approach

Apr 30, 2025

Addressing Climate Change In Africa The Schneider Electric Climate Smart Village Approach

Apr 30, 2025 -

Eurovision History Made Irishmans Unique Armenian Song

Apr 30, 2025

Eurovision History Made Irishmans Unique Armenian Song

Apr 30, 2025